The combination of a tighter monetary policy by the U.S. Federal Reserve and sales in U.S. government bonds from Japan are increasing the pressure on U.S. interest rates. Effects on the stock markets cannot be ruled out.

Fed raises interest rates and reduces balance sheet total

The Fed has raised key interest rates by 50 basis points (0.5%) and announced further rate hikes of this magnitude. An increase of 75 basis points is currently not an issue. The Fed is reducing its balance sheet by $47.5 billion a month from June 1 and by $95 billion from September 1, withdrawing liquidity from the system. This is double the volume of the last adjustment between October 2017 and August 2019, but how long this balance sheet reduction combined with interest rate hikes will last is uncertain. For now, the Fed is focusing on fighting inflation. However, if the U.S. economy and labor market weaken significantly, the Fed is likely to quickly return to this decision and hold out the prospect of easing measures. Currently, based on Fed fund futures, this is not expected until 2023.

Japan sells US government securities

Balance sheet reduction in the USA is receiving unwanted support from an unexpected source. Historically, Japan has been one of the largest buyers and investors in U.S. government securities. Japan holds around 1.3 trillion US dollars in US Treasuries. According to various sources, about $60 billion of this was sold in early May. The rising interest rate differential (yen vs. USD) and high demand for dollars have led to a sharp increase in hedging costs. This has made yen-denominated bonds much more attractive for Japanese investors compared with U.S. bonds, net of hedging costs. There is a risk of continued selling by Japanese investors.

High correlation between total assets of G4 central banks and share prices

Since 2015, the correlation between the money supply of the G4 central banks (Fed, BOE, ECB and BOJ) and the S&P 500 has been high. While the massive expansion of the balance sheet total to combat the effects of the Corona pandemic in particular had led to a corresponding price increase in equities, the reduction of the balance sheet total should now lead to the opposite effect.

Total assets G4 central banks vs. S&P 500

Source: Bloomberg Finance L.P.

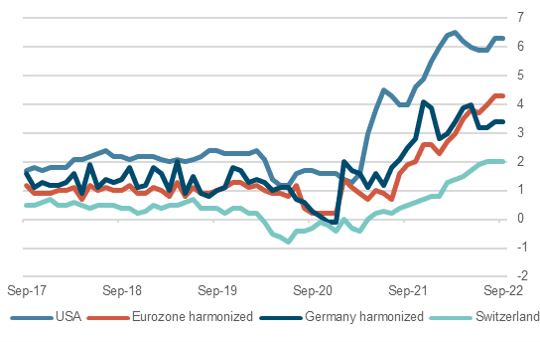

However, the rise in interest rates in the USA, the UK and Europe (excluding Japan) is also weighing on the stock markets. The volume of bonds with negative yields has fallen significantly, and US bonds superficially offer attractive nominal interest rates. Adjusted for inflation, however, bonds remain unattractive. However, higher interest rates are weighing on growth-oriented sectors in particular via multiplier contraction (e.g. price-earnings ratio). In addition, supply chain bottlenecks and the war in Ukraine are weighing.

Bank of Japan and People's Bank of China

While the Fed is vigorously tightening its monetary policy, the central banks in Japan and China remain expansionary. China, in particular, will have to provide monetary stimulus due to the real estate crisis and the large-scale lockdowns resulting from the zero-covid strategy.

At best, these measures can counteract the tighter US monetary policy, but they can hardly offset it. On balance, the balance sheet totals of the major central banks will probably decline and continue to weigh on share prices.

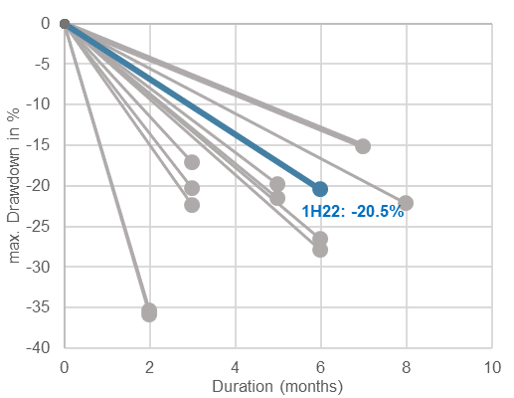

Stock market recovery possible in the short term

The stock markets are currently heavily oversold and, in the case of the S&P 500 and NASDAQ 100, at support levels, which is why a short-term price recovery is possible. However, we do not expect a sustained recovery.

In the medium term, the reduction in total assets will be reflected in share prices. High inflation and rising key interest rates, as well as the economic slowdown to be expected as a result, are also unlikely to permit a prolonged recovery in share prices.

Performance indexed, 5 years

Source: Bloomberg Finance L.P.

Contact: Christoph Sieger, Portfolio Manager

Telephone: +41 58 680 60 56

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.