The U.S. Federal Reserve raised the key interest rate by 25 basis points on Wednesday and held out the prospect of six more interest rate steps this year.

For the first time since 2018, the U.S. Federal Reserve raised interest rates by 25 basis points. In addition, the key interest rate is also to be raised by a further 25 basis points at each of the next six meetings. From the remarks of Federal Reserve Chairman Jerome Powell it could also be inferred that already at the next meeting further details on the reduction of the balance sheet total will be announced.

Neutral reaction of the financial markets

The reaction on the financial markets was restrained, as the announcements were already largely expected. After initially reacting negatively to the decision, U.S. equity markets recovered in the course of the day and closed significantly higher. While yields on short-term U.S. government bonds continued to rise, there was little movement in longer maturities.

As a result of this movement on the bond markets, parts of the U.S. yield curve are now inverted, i.e. the yield on short-term bonds is higher than on long-term paper. For example, the difference between the 5-year and 10-year maturities was negative at times. An inversion of the yield curve is often seen as a harbinger of a possible recession. Past experience shows that not every cycle of interest rate hikes has led to a recession, but when the yield curve inverts at the same time, the risk of recession increases significantly for the next 12 to 36 months.

Will the Fed stay the course?

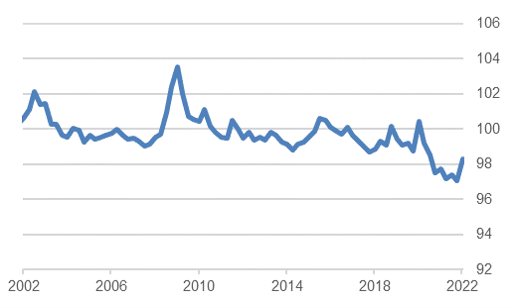

The big question, however, remains whether the Fed will stay true to its plan. The interest rate hikes are justified by the stubbornly high inflation rates and solid growth. In the U.S., "financial conditions" have already deteriorated significantly over the past few weeks and the corresponding index is slowly rising towards 2018 levels. Also at that time, the Fed began to gradually raise interest rates and reduce the size of the balance sheet. However, after only a few months, the Fed was "forced" by the financial markets to deviate from its plan and thus the first interest rate cuts followed in 2019.

Goldman Sachs US Financial Conditions Index

Source: Bloomberg Finance L.P.

Corporate bonds more interesting again

In addition to the higher yields on government bonds, credit spreads on corporate bonds have also risen significantly and are slightly above the historical average. Accordingly, the asset class has regained its attractiveness. However, it is important to be selective.

Contact: Nicolas Peter, Head of Investments

Telephone: +41 58 680 60 42

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.