Monetary stimulus propels stocks further into exceis more attractive than paper currencies

The initially V-shaped economic recovery has lost momentum due to the reimposition of lockdowns. A wave of insolvencies, especially affecting small companies, still lies ahead. Meanwhile, monetary policy is driving the equity markets to unprecedented heights.

The fiscal threshold in the US must be raised

In order to offset the effects of Covid-related shutdowns and to stabilize consumption, unemployed persons in the US have been receiving an additional $600 benefit each week. In this way, around $72 billion has been pumped into the economy each month. Also, those with an annual income of less than $75,000 have received a one-off $1,200 stimulus check. But many Republicans are opposed to an extension of such benefits. In June, the US reported a sad record-busting monthly deficit of $864.1 bn. Indeed, government expenditure tripled last month versus June 2019! The “income” of US households would probably decrease by 25% if the government were to stop all such exceptional direct payments. So far, four Corona aid packages worth $3,000 bn. in total have been implemented. A fifth is being planned. The Republicans want to limit this fifth package to $1000 bn. but the Democrats want “more”. We assume that further rescue packages will be launched and that, as US government finances are already out of control, the Fed will have to finance an increasing share of the resulting US government debt. With its spiraling debts and increasing debt monetization the US is following the path of Japan.

Small businesses in the US are now more optimistic

Small businesses represent over 40% of the US economy and the NFIB Small Business Optimism index rose 6.2 points to 100.6 in June. Eight of the ten components improved with many companies saying they expect the economic downturn to be short-lived.

A wave of insolvencies lies ahead

But US developments in July look problematic as many previous easing measures have had to be reversed due to increasing rates of infection. Smaller companies stand to be more affected by these measures, as they often rely on walk-in customers and usually had low profit margins even before the Corona crisis. We think many of these businesses will be forced to close permanently, especially in the catering, hotel, retail and tourism sectors. Despite the $3000 bn. in bail-out packages so far, the wave of bankruptcies is still largely yet to happen. We note most smaller companies can’t access capital markets directly, relying instead on bank loans for financing.

Manufacturing in Euroland is recovering

Eurozone industrial production rose by 12.4% in May compared to the previous month. Thus the year-on year “shrinkage rate” fell from -29.7% in April to -20.9%.

Set against this, Germany’s ZEW economic sentiment index fell against expectations in July by 4.1 points to 59.3.

The hitherto V-shaped recovery is threatened by increasing infections

Overall, the data currently suggest that most economies initially experienced a V-shaped recovery but that this recovery has flattened rapidly in July due to Covid-related developments, with some areas already contracting again. Although death rates are generally decreasing, new infections are again increasing, though mostly with falling growth rates. An exception is India, where the virus seems to be exploding.

Cold war enters the investment arena?

Even before the Corona pandemic, Chinese stocks and bonds were gaining ever larger shares in international indices and portfolios; a source of irritation to the US Administration.

US Federal pension funds are not allowed to base their investment strategy on indices containing Chinese stocks, a rule designed to hinder outflows of investment funds from the US to China. Demands that all US State pension funds be similarly prevented from investing in Chinese securities are getting louder.

Chinese purchases from US high-tech companies are also to be largely prohibited.

Meanwhile, barriers are being placed in the path of Chinese companies trying to access US capital markets.

Where is all this leading? Might a future US law prevent the US private sector from investing in China altogether?

And cold war in the South China Sea

The US has firmly rejected most of China’s territorial claims in the South China Sea – at over 3 million square kilometers, the lion’s share. US Secretary of State Mike Pompeo has said that Chinese claims are absolutely against applicable law. And the US and many others are determined that Beijing will not be allowed to control the South China Sea. But American “strong words” and current exercises of the US Navy in the area claimed by China risk escalating the conflict.

President Trump also wants to end Hong Kong’s special status quickly and to apply sanctions to Chinese politicians who act against “freedom activists” in Hong Kong.

On the other hand, the US wants to continue to work constructively with China on a fresh trade agreement. Right now, financial markets seem determined to take an optimistic view but we are concerned that the ideological-strategic confrontation between the US and China will become more acute.

Why do stock markets continue to rise?

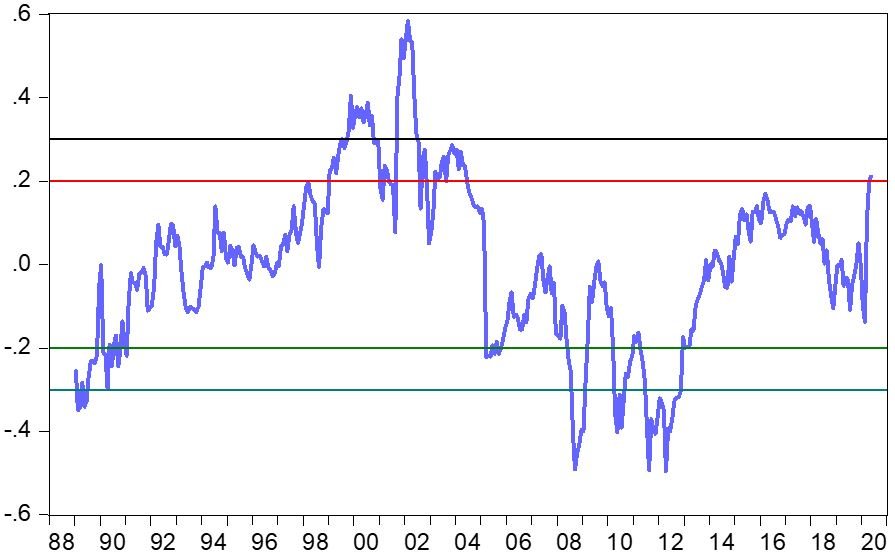

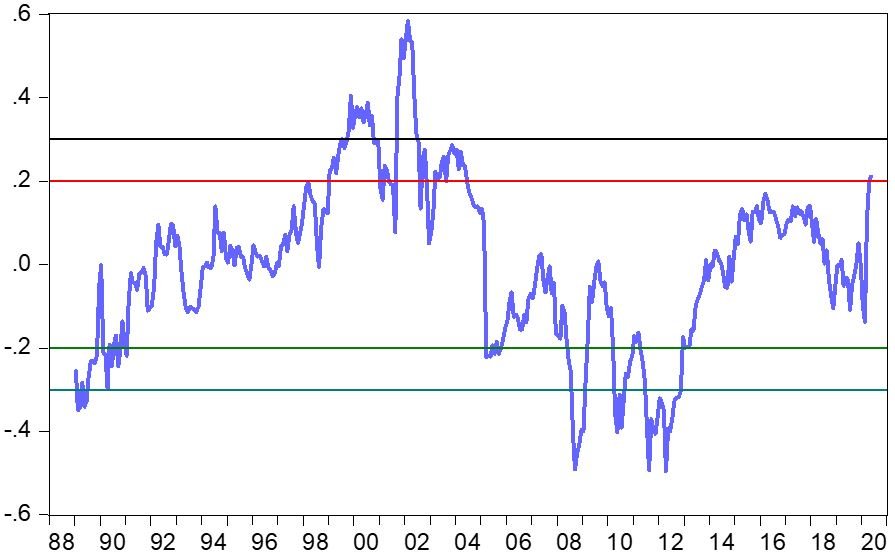

The initially V-shaped economic recovery is looking ever more limp following the re-imposition of lock-downs. And a wave of bankruptcies, hitting smaller companies especially, is still to come. Meanwhile, the geopolitical situation is increasingly tense. Despite all this, stocks are highly valued relative to historic norms (see the co-integration valuation model in the chart below). Why are stock markets continuing to set new records?

Monetary policy is waging total war against the risks of depression

Once again the well-known (and therefore probably boring) answer must be that enormously expansionary monetary policies are driving up the prices of risky stock investments despite imploding profits. Expressed in a more differentiated way, it is not only the ultra-expansive measures already implemented, but also expectations of the yet more expansionary measures to come, that are driving equity markets upwards and the interest rates on massively expanding government debt downwards. The fact is that monetary policy is no longer driven by the central banks, but rather by myopic politicians who, regardless of the cost, aim for re-election. The current Fed chairman is not Mr. Powell, but rather the performance of the US stock market and the system has become highly self-referential. This much is clear from the following (satirical) financial statement which we expect to be made in the “near future”: Fed Chairman, Standard & Poors announced on Monday that it would introduce negative interest rates and buy stock-ETFs without limits because the S&P 500 had slumped 15% in the previous week. The S&P 500 acknowledged this announcement with a significant price jump”.

Estimated over/undervaluation of the S&P500 in %

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.