Rise in long-term interest rates must be curbed by central banks!

Long-term interest rates have risen sharply in recent weeks. There are 3 reasons for this: 1. due to the strongly rising government deficits, more and more bonds have to be placed with investors 2. the prospect of an end to the quarantine measures and a strong economic upswing reduce the demand for government bonds 3. rising inflation expectations. Due to the enormous debt and highly valued equities and real estate, the rise in interest rates must be slowed down. We expect the FED to take further measures soon.

Prospect of pandemic ending drives interest rate rise…

Higher interest rates are driven by the improving economic outlook in the coming quarters, but unfortunately not only!

…along with an exploding supply of US government bonds….

The Biden administration has passed a 1.9 billion bailout package. The administration’s 900 billion bailout package, passed in December, is “in the process of being disbursed”. The two packages together are equivalent to about 14% of the US gross domestic product. Such “special budgets” or high government deficits have never been seen in peacetime!

Net borrowing will skyrocket in the coming months, and old debt will also have to be refinanced. This will put the absorption capacity of bond markets worldwide (not only in the USA) to a severe test.

…and rising inflation expectations due to destroyed production chains…

The lockdowns destroyed some production and supply chains. As a result, there are sometimes supply problems, for example with microchips, which can lead to long delivery times and price increases

…and due to bottleneck inflation…

There is a threat of so-called “bottleneck inflation”. The easiest way to visualise this is with an example: Due to travel restrictions, huge capacities have been cut in the tourism sector. When demand picks up again after the abolition of travel restrictions, many consumers will have a “pent-up demand”. A high demand for tourism services meets a greatly reduced supply, suppliers can and will raise prices.

Development of the velocity of money in circulation could also pose a risk

Due to the lockdowns, many consumers were often not able to spend their money wisely at all, as a visit to the cinema or a restaurant or a trip was not even possible. Instead, the money was saved or invested. Therefore, the velocity of money in circulation decreased and the newly created money did not trigger inflation. If consumers can spend their money sensibly again after the lockdowns have ended, the velocity of money in circulation and inflation will rise again.

Fair interest rate on 10-year US government bonds in the past: around 4%.

A rule of thumb said that the interest rate on 10-year government bonds should roughly correspond to the trend real growth of the economy plus “normal” inflation, i.e. nominal growth. Assuming a trend growth of 2% and an inflation of 2%, the interest rate should be this would result in a fair interest rate of 4%. For the US budget, however, these financing costs would be far too high.

Next step of central bank intervention will have to be on the long end of the yield curve

So far, the central banks have pushed the intervention interest rate and thus the short end of the yield curve down. In most countries, interest rates are close to zero, in Euroland and Switzerland even negative. However, a state does not only issue short-dated bonds.

Long-term interest rates must not rise too much or too fast

If long-term interest rates were to reach too high a level, the case could arise that the financeability of government debt is no longer guaranteed, which would lead to a wave of selling and further rising interest rates. Then there would be a threat of a bursting of the debt bubble, an end to the stock market boom and an end to the upswing. The FED and all other central banks will not and cannot allow this.

Logical next step: yield curve control

Therefore, the central banks will probably soon introduce the already discussed and thus “actually already announced” yield curve control. Another “Operation Twist” is likely. The aim is to turn the yield curve downwards, hence the name “twist”.

This operation has already been carried out twice by the FED

1961 and the so-called Operation Twist 2.0, which lasted from September 2011 to December 2012. At that time, it succeeded in reducing long-term interest rates from 3.75% to 1.44%. After the end of the programme, interest rates rose again towards the end of 2013 to 3.0%. If the operation is credibly announced, the FED should again succeed in pushing down long-term interest rates. Thus, fears that the Fed could lose control over long-term interest rates are wrong. However, it is likely that the FED will only start Twist 3.0 when it looks like the FED is losing control. Thus, a rapid, sharp rise in interest rates and a sharp equity correction a clear communication from the market to the FED “do something, protect us from a too high long term interest rate”.

We expect the FED to start Operation Twist 3.0 soon

The market will soon force the FED to expand the bond-buying programmes and buy much more long-dated bonds. However, at what “suffering pressure” (falling share prices and bond prices) this will be the case is unclear.

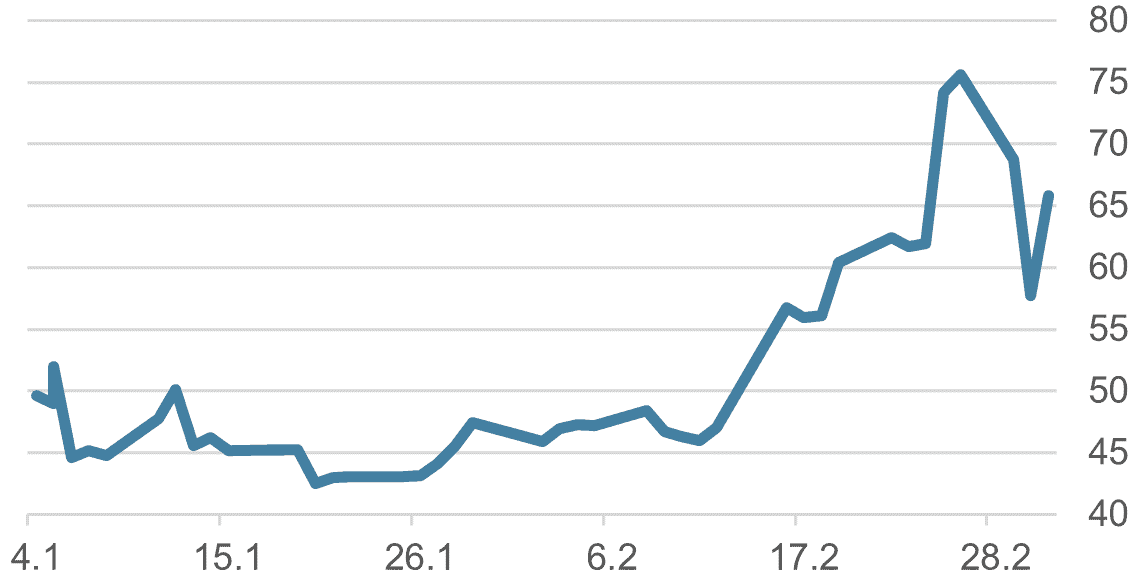

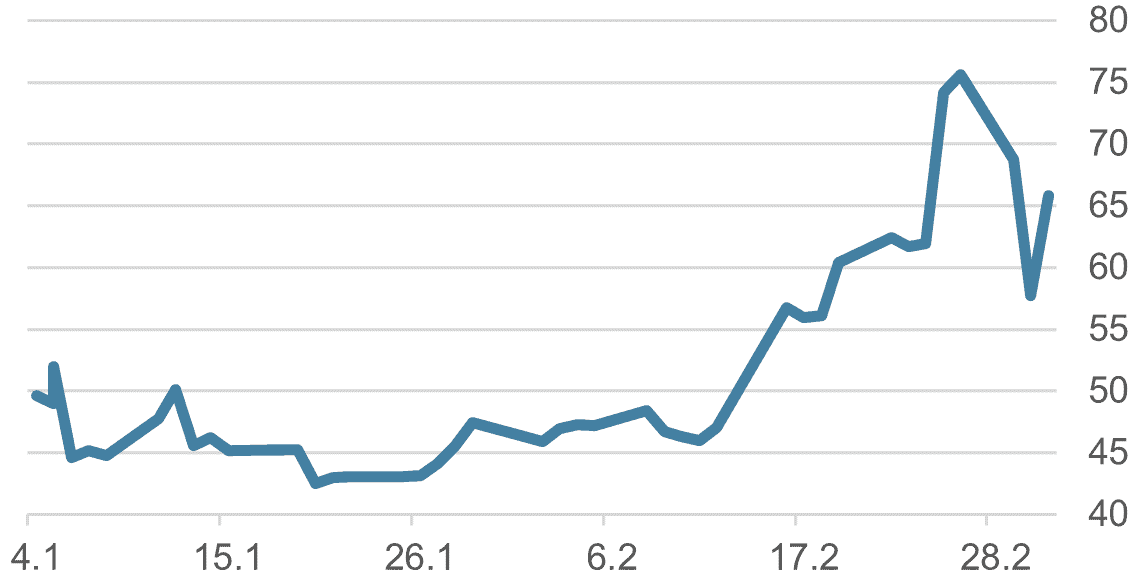

The Move index is the VIX index of the bond market

The so-called VIX index measures the expected volatility, the expected range of fluctuation of American shares. This index is often called a “sentiment barometer” because investors’ emotions, fears and hopes are reflected in the index. A high value indicates unsettled markets and high fears, a low value indicates calm performance and investors tend to be less concerned.

The Move index measures the expected volatility of bonds. If the Fed is successful in calming the bond markets, this can best be recognised by a falling value for the Move bond volatility index. At present, however, it continues to indicate a certain nervousness and anxiety.

Chart 1: Move index since the beginning of the year

Source: Bloomberg

Source: Bloomberg

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.