FocusIn 2023, numerous geopolitical risks came to the fore, supplemented by interest rate hikes by central banks in the fight against inflation. The conflict in Ukraine will soon last two years. In addition, the situation in the Middle East has worsened, particularly between Israel and Hamas. An escalation of the conflict to neighboring Arab countries has been prevented so far. Economic weaknesses are also evident in two of Switzerland's key trading partners: China and Germany. These developments are leading to a lack of important impetus from foreign trade. Geopolitical issues will continue to play an important role in the coming year. However, the past has shown that the impact of such events on the global financial markets is often short-lived.

Global economy

Declining inflation, but still above the central banks' 2% target in many countries

The central banks of the USA, Europe and Switzerland have continuously tightened their monetary policy to combat inflation and have repeatedly disappointed market participants' hopes of an imminent end to the cycle of interest rate hikes. The interest rate hikes have reduced the imbalances on the goods side and in the labor market and successfully lowered price pressure. A favorable base effect, particularly in energy costs, has contributed to a significant reduction in inflation. The central banks are likely to be reluctant to cut interest rates prematurely due to the experience of the 1970s, when inflation spiked again. We therefore do not expect the first interest rate cuts until the second half of 2024.

Resilient US economy

The US economy was surprisingly robust in the face of unusually high inflation and a sharp rise in key and market interest rates. Annualized growth of 5.2% was even recorded in the third quarter. Consumption was supported by reserves from the pandemic and fiscal as well as other stimulus packages. A shortage of skilled workers and record-low unemployment increased job security and thus consumer sentiment - although higher wages also contributed to inflation. The tightening of monetary policy is now showing signs of slowing down, both in terms of growth and the labor market. The sharp rise in key interest rates and the Fed's subsequent pause have raised hopes that the cycle of interest rate hikes is now complete.

The German economy weakens Title

Germany has slipped into recession due to inflation and reduced purchasing power. In view of an extremely difficult budget debate, a sustained upturn is hardly to be expected. As the largest economy in the currency area, this is also having a negative impact on the entire eurozone and Switzerland as an important trading partner. Relatively high inflation, higher interest rates and consequently higher financing costs are having a major impact on the economy and, above all, the real estate sector. Leading indicators continue to point to little growth momentum. The expected growth for 2023 for the eurozone is disappointing at around 0.5% and will only recover slightly in 2024.

Switzerland

Two of Switzerland's major trading partners, China and Germany, are weakening. As a result, there is a lack of important impetus from foreign trade. Leading indicators from industry and services point to a continuing slowdown. Private consumption remains a pillar of support, buoyed by encouraging developments on the labor market. However, sharply rising health insurance premiums and another round of rent increases are weighing on purchasing power and the outlook. However, there are also signs of a slight acceleration in growth in Switzerland in 2024.

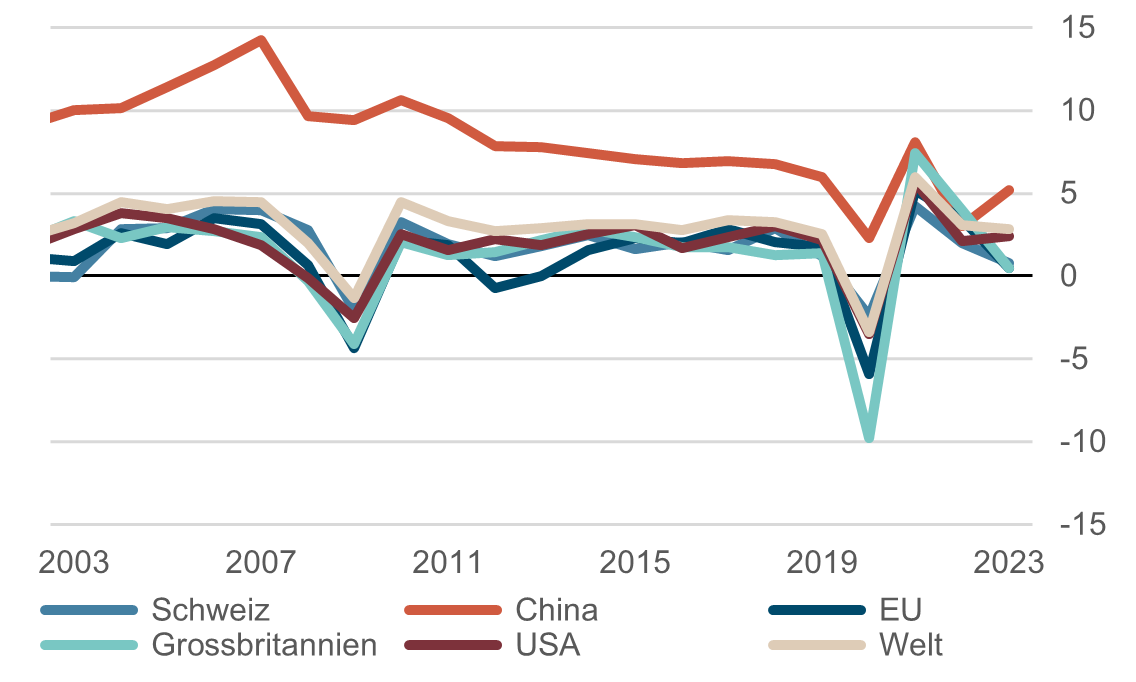

China is struggling with several problems at the same time

Record-high youth unemployment, the collapse of the overheated real estate market, a rapidly advancing ageing population and a disappointing restart after the pandemic have clearly dashed hopes of an economic upturn and also held back global growth. The government and central bank are expected to take substantial measures in 2024.

Annual growth in gross domestic product

Source: Bloomberg Finance L.P.

Equity and commodity markets

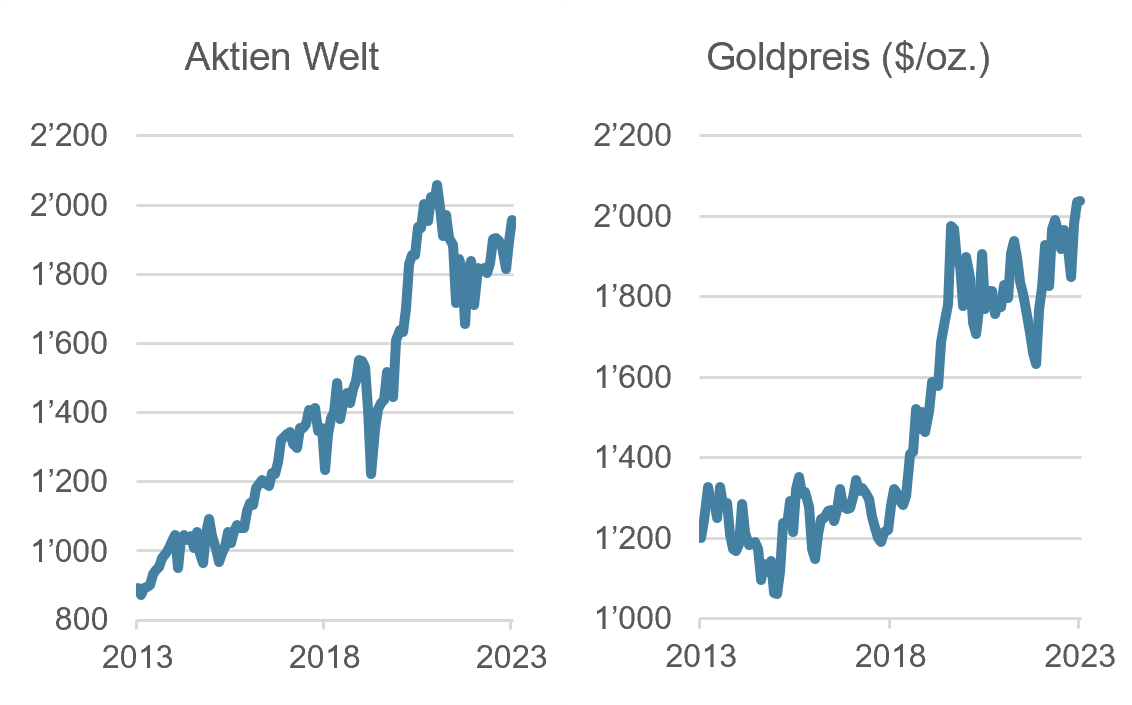

Different development of the stock markets After a very poor 2022, the outlook for 2023 was positive. Most equity markets are likely to end the year with a positive performance, albeit with significant differences by country, region and sector. Large-cap growth stocks were in favour with investors, while defensive value stocks received little attention. Prices fell in the third quarter as hopes of an imminent fall in interest rates faded. The Fed's pause in the rate hike cycle triggered a year-end rally, but this lost momentum. As the economic situation

As little impetus is to be expected, investor focus has shifted back to corporate earnings growth and valuations, in addition to the development of key interest rates. We recommend keeping the equity allocation close to the strategic quota and prefer defensive stocks. This also includes the attractively valued Swiss market.

Commodities in the rollercoaster of economic and geopolitical cycles

The prices of energy commodities quickly normalized after the energy crisis failed to materialize. The war in the Middle East threatens to destabilize the energy supply and OPEC+ (Organization of the Petroleum Exporting Countries) wants to expand its influence by accepting new producer countries (Brazil).

Despite higher real interest rates, gold was able to cushion price losses due to the numerous geopolitical uncertainties. Finally, a price recovery set in during the fourth quarter, taking the precious metal back to its previous highs - supported by the probable end of interest rate hikes.

We expect energy prices to remain stable or rise slightly in 2024. We expect gold to reach new highs as key interest rates fall.

Performance of the equity and commodity markets

Source: Bloomberg Finance L.P.

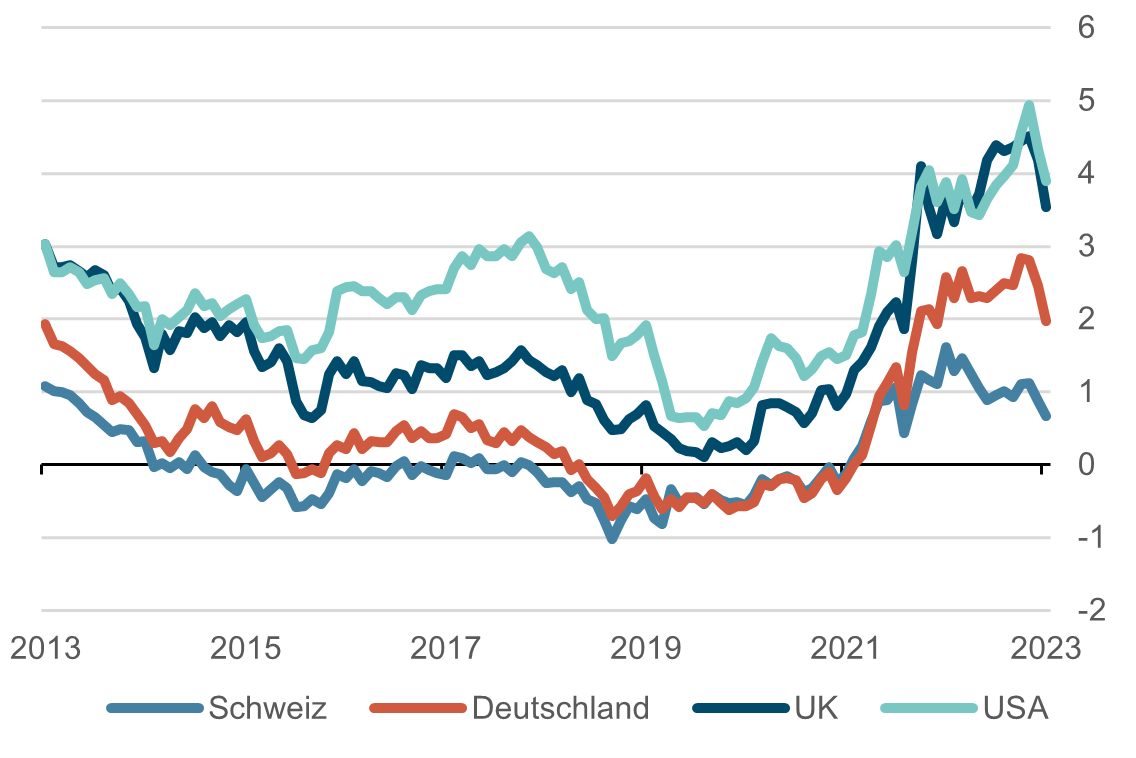

Foreign exchange and capital markets

Monetary policy is being eased Following the interest rate hikes, bonds have once again become a viable asset class - even if their attractiveness has declined somewhat due to the fall in long-term interest rates. The yield on corporate bonds in Swiss francs, for example, is around 1.3%. The situation is quite different for US dollar investments, where yields of over 5% can still be achieved. For Swiss investors, however, we do not recommend taking any foreign currency risks with bonds and prefer corporate bonds with medium and government bonds with longer maturities.

Yield on 10-year government bonds

Source: Bloomberg Finance L.P.

Refuge in safe havens

The Swiss franc is and remains the crisis currency par excellence. This trend is particularly evident in the EUR/CHF exchange rate. While the franc is sought after in connection with geopolitical uncertainties, the euro is weakening due to the challenging conditions in the eurozone and the US dollar has also depreciated significantly. The Swiss franc is therefore likely to remain strong.

Contact: Christoph Sieger, Portfolio Manager

Telephone: +41 58 680 60 56

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.