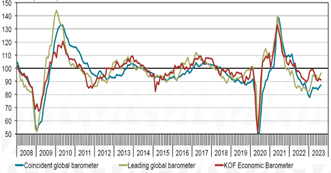

The KOF Swiss Economic Institute at ETH Zurich examines economic development in Switzerland as well as worldwide. The leading indicator for the global economic barometer already indicated in the second half of 2022 that economic growth will cool down in the coming months and is likely to bottom out in the first quarter of 2023. This currently indicates a clear recovery in growth. This is also the case in Switzerland, where the leading KOF indicator appears to be stabilizing and has bottomed out.

Economic barometer global and Switzerland

Source: KOF

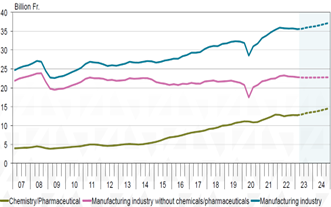

Growth in Switzerland is also likely to stagnate in the third quarter and show a black zero (as is also the case for Germany). The chemical and pharmaceutical sector remains the prominent growth driver. The manufacturing sector, and in particular the export-oriented areas, are weighing on the figures.

Growth contribution by sector

Source: SECO, KOF (15.6.2023)

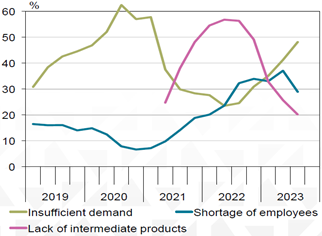

The pandemic has led to massive distortions in many areas. These include raw materials, semi-finished and finished products and the labor market. Russia's attack on Ukraine has also caused energy prices to rise sharply, while the opening after the lockdowns led to a recovery in demand. The subsequent increase in inventories as part of the shortening of supply chains also contributed to the shifts. This resulted in a sharp rise in inflation. However, the latest data shows that the various distortions are increasingly normalizing.

The latest KOF surveys of companies show that the situation on the labor market and in terms of supply bottlenecks is easing, while final demand has also been weakening for the first time in recent weeks. The influence of Germany, Switzerland's second-largest trading partner, on the Swiss economy plays a key role here, as the development of the two economic areas is highly correlated. As the survey's expectations are better than the assessment of the current situation, the "worst" (in terms of a slowdown in growth) is probably already behind us according to the surveys.

Obstacles to production in the Swiss industry

Source: KOF

Our assessment of the economy is somewhat less optimistic. We expect the German economy to deteriorate further before the recovery sets in, supported by an easing of the central banks' monetary policy. In view of the high historical correlation, the Swiss economy is likely to develop in step, albeit at a slightly slower pace. The defensive character is working in Switzerland's favor here. In the USA, the expansion of infrastructure should provide a new boost to growth over the coming months.

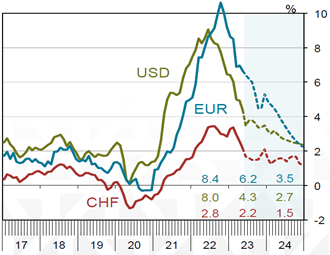

The KOF expects overall inflation in the USA and Europe to fall back towards 2% by the end of 2024, which is in line with the expectations of central bankers. In the short term, however, inflation is expected to rise again slightly as healthcare costs, rents and energy prices increase. This means that a further rise in key and market interest rates cannot be ruled out. Finally, the discussion about a further key interest rate hike is increasingly receding into the background. What will be important is how long interest rates can be kept at their current levels. We are currently assuming that interest rates will remain high for longer than the market currently expects. Interest rate cuts currently only seem realistic if there are major distortions.

Inflation rates (actual and expected)

Source: BLS, Eurostat, FSO, KOF (15.6.2023)

In the short term, we expect the equity markets to move sideways within the ranges of recent months. We prefer defensive investments such as large-cap companies, quality and value stocks.

Contact: Christoph Sieger, Portfolio Manager

Telephone: +41 58 680 60 56

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.