How did the Silicon Valley Bank mess come about?

After Silvergate, SVB is the 16th largest bank in the U.S. and the next financial company to run into trouble last week. The Silicon Valley-domiciled bank is also primarily a link between venture capitalists and startups. The institution has grown rapidly since the liquidity glut in the wake of the pandemic. Some of its capital has been invested in default-proof long-term U.S. government bonds, which have yielded low but safe interest rates in recent years. As a result of the Fed's tighter monetary policy to combat inflation, yields on these bonds have risen and, accordingly, their value has fallen significantly. To avoid having to show this as a price loss on the balance sheet, a banking institution can carry its bonds at nominal value. As a rule, the bonds are held until maturity and repaid accordingly at 100%.

As rumors were doing the rounds around SVB on Thursday that the financial institution had run into difficulties, customers (savers) had withdrawn their deposits out of fear for their assets, causing the bank to sell part of its long-term bonds at market prices, i.e. at a loss, in order to secure the claims. This loss is said to have amounted to $1.8 billion. The company's share price plunged by around 60% on Thursday due to the rush. After-hours, it added another roughly 20%. On Friday, trading on the title was suspended and over the weekend, solutions were sought to rescue.

Other financial institutions, including Signature Bank, have been affected. Soon, the first questions also arose as to whether this was a systematic risk and whether investors were in for another financial crisis.

Securing of uninsured customer deposits

Over the weekend, the Fed, the Treasury Department and the Federal Deposit Insurance Corporation (FDIC) decided to guarantee all deposits (including balances above the statutory deposit protection of $250,000). In addition, a new instrument, the Bank Term Funding Program (BTFP), was created under which banks can sell government bonds and mortgage securities at nominal value and thus do not have to realize balance sheet losses in value.

How is the bond market reacting?

Interest rates on 2-year U.S. government securities fell by a full percentage point within a few hours. Interest rates on 10-year paper fell by 60 basis points. These historic swings calmed the situation. Bond portfolios were able to recover noticeably.

Turnaround at the Fed?

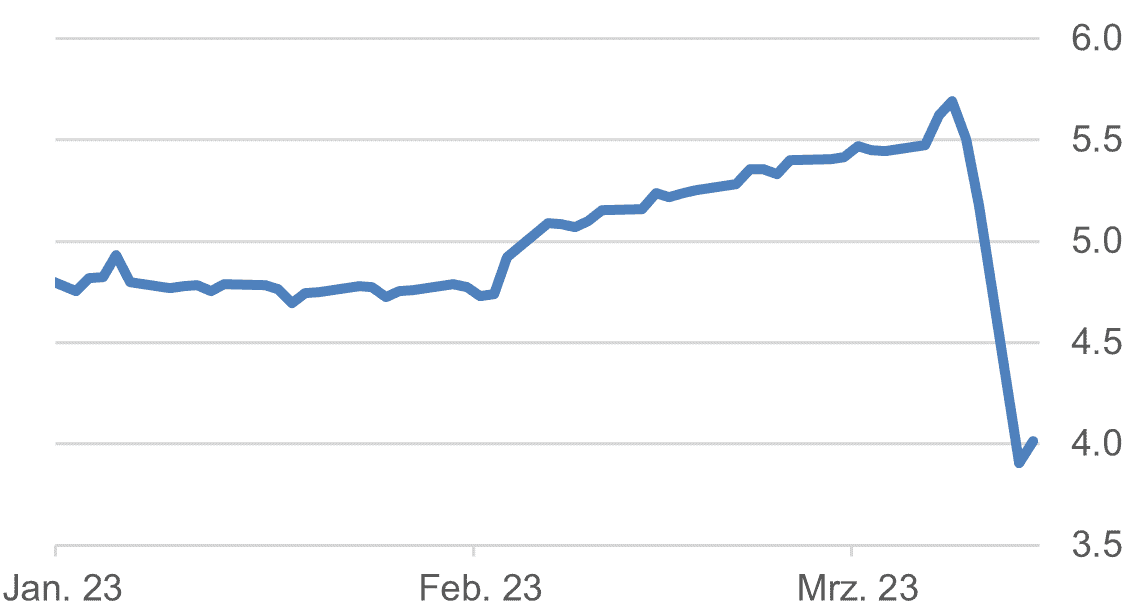

Jerome Powell reiterated to the Banking Committee last Wednesday that inflation is too high and the economy is too robust. The expected interest rate peak could be higher than previously priced in. Further monetary policy, he said, will be a function of inflation and the economy - and now, arguably, recent developments in the financial sector that are likely to affect the economy. The interest rate peak for the Fed's September meeting has fallen from 5.65% to below 4% due to the recent turmoil. Further monetary tightening appears to be off the table based on Fed Fund Futures and as many as two Fed rate cuts are now priced in by the end of the year.

A dual-track approach by the Fed and the U.S. Treasury is conceivable, with the Fed continuing to pursue a tight monetary policy to combat inflation while at the same time providing sufficient liquidity to the financial sector. The easing base effect of energy commodities for the coming months promises falling inflation data, which suits the Fed in the current environment.

Fed Fund Futures Interest Rate Expectation with Expiration September 2023, Last Data Point 3/14/2023

Source: Bloomberg Finance L.P.

Impact on the technology sector

The difficulties in the startup market represent both risks and opportunities for the large technology companies. The tech giants thus have a vested interest in a healthy, functioning startup market. Not least, they have been able to buy new forward-looking technologies from this segment in the past. The valuations of these startups have multiplied in recent years. With the recent valuation correction, there are again attractive buying opportunities for the cash-rich mega-caps in the technology sector.

Conclusion

Where there is smoke, there is fire. There is a risk that it will spread to other segments and regions in the financial sector. More bank shares are being sold off on the stock market and some are even being suspended from trading. However, the government is ready to provide unlimited funds for the rescue. In the short term, the Fed will probably also be given leeway to step back from quantitative tightening and support the capital markets. However, the road will be bumpy and will again bring increased volatility.

In the short term, quality and large-cap companies should be favored accordingly, before growth stocks will then be favored in a second step. Interest rates cannot actually rise further in this environment. The substantial drop in interest rates will probably have to be "processed" first, and policymakers will have to work through the day's events.

Contact: Christoph Sieger, Portfolio Manager

Telephone: +41 58 680 60 56

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.