Relative to gold, gold mining shares look attractive

Ever larger bailouts and aggressive balance sheet expansions increase over-indebtedness risks. Gold is an attractive alternative currency as supply cannot be artificially increased. Gold mining stocks are attractive compared to gold.

Economic indicators make dire reading

With over 36 million Americans having lost their jobs in the past two months, the US unemployment rate is now likely above 15%. But if one includes the underemployed and those not currently looking for work, the (real) unemployment rate is probably around 23%.

Putting the Covid-19 shock in its long-term context

An assessment of the really long-term context requires data availability. The UK’s “Office for Budget Responsibility” assumes in its baseline scenario a decline in UK GDP of 35% in Q2, and of 13% for 2020 as a whole, while the annual 2020 forecast from the Bank of England (BoE) is for a contraction of 14%. On BoE data, this would be the biggest annual decline since 1706!

Avalanches of stimulus aim at preventing a collapse

Central banks and governments around the world are trying to prevent the economy and the financial system from collapsing. Indeed, central banks are signalling to investors a commitment, if necessary, to buy up virtually all asset classes without limit.

Stocks jump despite, or because of, grim economic data

Bad economic news is currently good news for stocks. The strategy of buying what central banks are buying, or what they might soon be buying, is currently profitable.

That is why some argue that the value of stocks is less influenced by investor assessments of future profits than by central bank behavior – their buying programs, balance sheet expansion and policies of ultra low interest rates.

The strategy “Don’t fight the Fed” might pay for some while yet….

In Japan, an investment strategy based following the activities of the Bank of Japan did very well for investors “on average” until the late 1980s.

…but it is proving difficult for the economy to gain traction

Despite record bailout packages and extremely expansionary monetary policies, it may be difficult to get economic activity back to pre-crisis levels. Many consumers are likely to be more cautious when it comes to spending and the determination to save is increasing.

Table 1 shows the results of a recent CBS survey.

Table 1: If stay-at-home restrictions were lifted would you feel comfortable going to…?

Source: CBS News Poll

Ask yourself if you are likely to spend less in future, what spending you might cut and whether you are likely to increase your savings.

Central banks have to feed the debt monster by buying up more and more debt

Balance sheet expansion and the policy of low, or even negative, interest rates encourage and reward taking investment risk, leverage and loan-financed share buyback programs.

The market capitalization of all stock markets is now around $ 100 trillion. In comparison, the global value of all outstanding listed debt and of all real estate are both put at around $ 300 trillion.

Declines in the value of these investments jeopardize outstanding loans as they imply declines in the worth of debt collateral.

Central banks have to buy ever-more assets to prevent the financial system from collapsing and a negative wealth effect from weighing on consumption. The Fed, whose balance sheet was around $6.7 trillion on May 7, wants to create a positive wealth effect to support the economy in the post-Covid-19 era . We expect it and the other central banks to continue with massive asset purchase programs in order to prevent debt levels from fatally infecting the global financial system, the global economy and ultimately civil order. It is unclear whether this central bank activity will succeed in the medium term. As long as consumer price inflation is under control, central banks can buy anything they want. Only when the “paper money” they create becomes toxic, as it is seen to be quickly losing its purchasing power, will this “Ponzi game” come to an end. When this will happen is almost impossible to predict. What is clear, however, is that each incremental billion of central bank asset purchases has an ever smaller effect on economic activity.

“Fed prints $50 trillion worth of gold to nationalize the US stock market”…….(fake news, folks)

Because this is not possible gold is once again “Public enemy No. 1” as it provides the best protection against government manipulation. Gold provides protection not only against hyperinflation, but also against “hyper-deflation” (i.e. the collapse of the financial system).

We therefore stick to our strategy of tactically underweighting stocks and overweighting gold. As a “safe haven”, gold could benefit from the prospective sharp rise in indebtedness, possible instabilities in the financial system which may result from this, as well as the risks of “currency debasement”. Elsewhere, we believe convertible bonds offer an attractive ratio of risk to reward.

The so-called “Trading with the Enemy Act of 1917” provided the (il) legal basis for this. But in strong civil societies such as Switzerland, gold is unlikely to be expropriated, as a referendum would be required.

Gold likely in a bull market

Gold offers protection against central bank policies aimed at debasing legal currency but it is not a productive asset. Therefore gold should be viewed as a currency replacement within a currency allocation perspective and not as an investment. We recommend investors hold part of their currency exposure in gold as an alternative to cash.

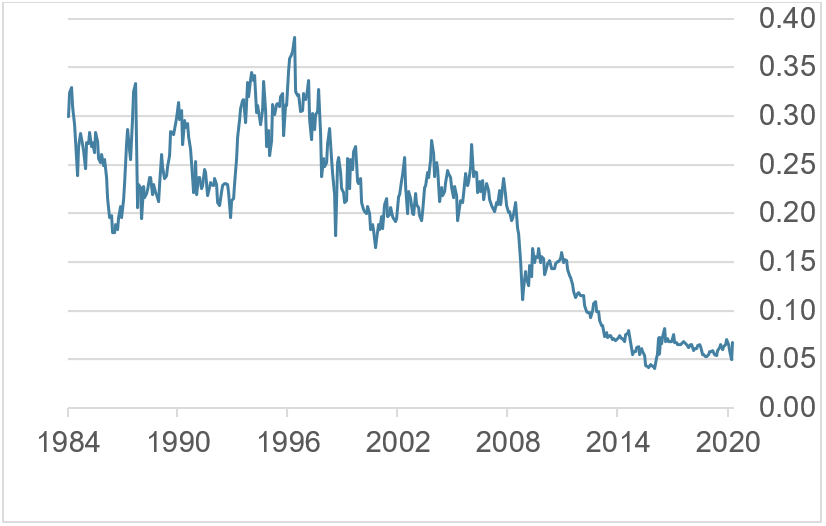

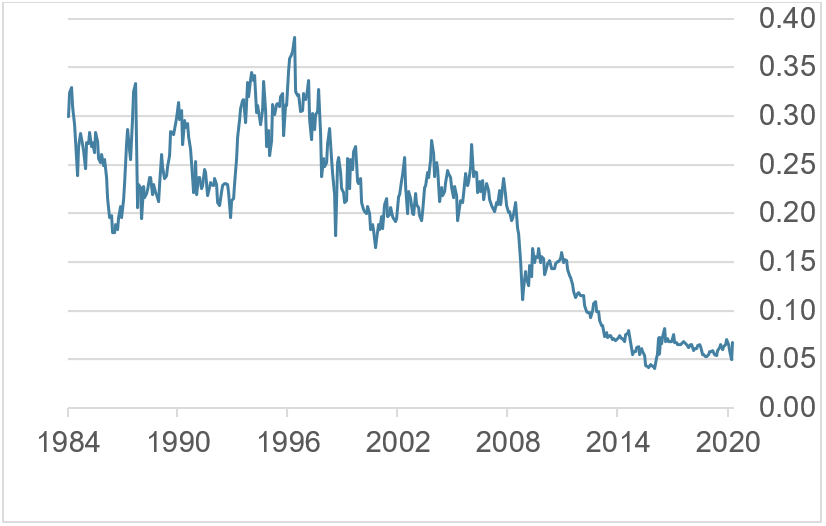

Gold stocks – an attractive alternative to gold

Gold producers have been hit hard by Covid-19, with production at least partially discontinued and skyrocketing transportation costs due to the cessation of air traffic. In the medium term, these problems will be resolved. Chart 1 shows that gold stocks are currently attractively valued compared to gold.

Graph 1: Comparison of Philadelphia Stock Exchange Gold and Silver index to gold bullion

Source: Bloomberg

Even were the gold price simply to stay where it is, gold mining stocks could still rise in the medium term. The potential resumption of gold production and the cost relief that comes from low oil prices both argue for an exposure to gold stocks.

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.