Conflicting signals on the world economy and a sharp rise in the price of oil. But equity markets are booming.

April saw further strong gains in the price of oil and in global stock markets. Meanwhile there have been conflicting signals on the global economy. Whereas the US continues to grow at a decent pace and China’s economy has stabilized, the Eurozone has been unable to break out of its sluggish growth trend. Various equity indices are at all-time highs. So far, the corporate earnings season has been well-received, helped by low expectations. And the Fed remains supportive for markets. But this year’s strong stock market gains reflect the unattractiveness of non-equity assets in a very low interest rate world. We are sticking with our neutral weighting in equities.

The hardening of sanctions against Iran has boosted the price of oil

During the Easter holidays the US tightened its sanctions regime against Iran. Whereas certain countries had previously enjoyed an exemption from the Iranian oil import ban, the ban will be extended to all countries from May 2. Brent crude futures have risen sharply as a result. The Trump Administration wants to reduce Iranian oil exports to zero so as to force Iran to the negotiating table on its atomic energy expansion program. Turkey is highly dependent on Iranian oil and stands to be hard hit by the new US policy. The already weak Turkish lira has fallen further in recent weeks. It will be interesting to see what happens in respect of India and China, hitherto the largest importers of Iranian oil.

But oil markets have been tightening for some time

In fact, oil markets have been tightening for some time. Libyan output has been hit by a rebellion centered round the capital. And Venezuela (which has the world’s largest oil reserves) is in crisis with energy blackouts frequently hitting production. Meanwhile, OPEC has extended its voluntary production cutbacks. This is the background to the near 40% rise in some crude prices since the start of the year. Seasonal factors are also expected to tighten markets in coming months as the demand for oil in the northern hemisphere tends to peak in the summer, and not only in the US.

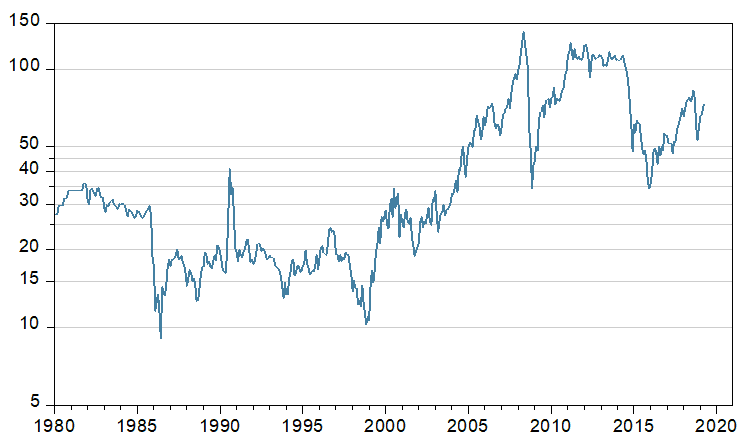

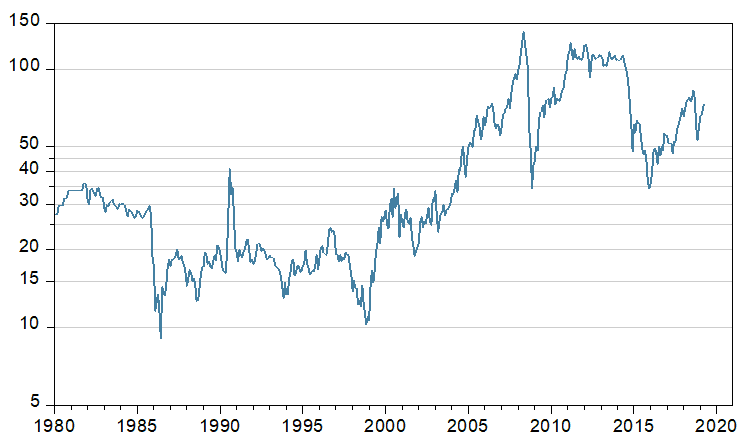

Graph 1. Putting this year’s sharp rise in oil prices into historical context.

Source: Thomson Reuters / Datastream

Saudi Arabia has an interest in a higher oil price

It’s questionable whether Saudi and the UAE are prepared to make good the supply shortfall. Saudi Arabia has an interest in a higher oil price partly because even balancing its Budget would need a price around $80 per barrel. Secondly, the Saudis plan a massive offering of bonds and equities in Aramco. Issue prices and therefore sale revenues are likely to be higher in a high oil price environment than in a low one.

E-mobility and climate change: sources of downward pressure on oil prices over the longer-term?

Longer-term, downward pressure on oil prices could develop as a result of a slowing of the world economy, or a structural demand shift due to increased electricity-fuelled transportation or other efforts to combat global warming and climate change. In the much nearer-term, President Trump is always keen to see lower oil prices and has no qualms about using his “bully pulpit” in pressing for this. Chart 1 puts the recent rise in oil prices in a long-term historical context. We note that the last two financial crises – 2000 and 2007/8 – were both preceded by sharp gains in the oil price, something which may have contributed to economic fall-out from those crises. But the rise in oil prices so far this year does not seem to pose a broader threat to financial markets and the global economy.

President Trump wants low oil prices

Contrary to Saudi Arabia the US Administration has a strong interest in low oil prices. And President Trump is always trying to cajole and pressure OPEC into boosting supply. Meanwhile, he does what he can to ease regulations on US domestic energy production and to “talk prices down”. All this may be part of the reason why this year’s rise in oil prices has not been reflected in sharp gains for oil company equities.

The outlook for the world economy seems more than usually uncertain

he latest data out of South Korea and Germany have been bad. This is concerning because both countries are cyclical bellwethers, with Korea tied more to the technology cycle and Germany more to the industrial one. Korea’s economy has a reputation for (more or less continuous) rapid growth. So the recent quarterly decline in GDP (-0.3%) is concerning. Indeed, it is the weakest quarterly report in around 10 years.

Meanwhile, Bloomberg calculates a 1.9% decline year on year in global trade flows over the three months to February. If accurate, this is the worst result since May 2009 and points to the urgency of a trade agreement between China and the US.

Encouraging business cycle data from the US …

First quarter US GDP data show a 3.2% annualized growth rate, a stronger than expected result. (The consensus estimate was just 2.3%). At the same time, US inflationary pressures are significantly lower than expected. But further analysis points to a less encouraging picture than implied by the headline GDP number. A good part (0.65%) of the overall growth reported reflected stock-building. A further chunk (0.4%) was accounted for by the government sector where spending rose 2.4% (and but for the government shutdown GDP might have been 0.3% higher). We note that the largest GDP component – consumer spending – rose just 1.2%. On the more positive side, March retail sales data were reasonably good and trends in investment remain positive. Meanwhile constructive reports on Chinese-American trade negotiations have boosted markets. The Mid-April figure for initial jobless claims (196,000) was considerably better than the 210000 expected. So the US labor market is still in pretty good shape. Thus, recent data confirm that the US is still rather buoyant and, apart from China whose economy is stabilizing, the rest of the world is rather weak. The latest IMF world economic growth forecast for 2019 is just 3.3%, lower than any growth outturn since 2009.

… and China

The recent report for China’s Purchasing Manager’s index for manufacturing was 50.8, slightly above the 50 mark which separates expansion from contraction. We view this as a sign that the government stimulus program is working.

Economic stabilization in Euroland

With the US economy still doing fairly well, a recovery in China and a relatively weak euro, the chances are good that the Eurozone economy will get a boost from its international trade sector.

Equity markets continue to boom

Various equity indices are now trading at all-time highs. The first quarter earnings season has so far been well-received, helped by moderate investor expectations. And the Fed’s policy stance has been supportive for the markets. But we think the main reason why equities are performing so strongly is that, in a very low interest rate world, any assets that are not equities are unattractive. We caution that the markets are getting too optimistic and stick with our neutral weighting in equities.

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.