Executive Summary

- Central bank interest rate hikes will slow economic growth significantly in coming months.

- While the world economy is still in decent shape, with labor markets robust, various sentiment indicators are becoming gloomier.

- Russia’s territorial losses in eastern Ukraine increase the pressure on Vladimir Putin. Russia’s recently announced partial mobilization will undermine support within Russia for its war in Ukraine.

- Sharp hikes in key interest rates and the process of central bank balance sheet reduction point to an economic slowdown.

Central banks aim to bring current unacceptably high rates of inflation back to target levels around 2%.

- Government bond yields continue to rise, and the US yield curve has become more inverted.

- Equity markets are due for another reality check. Valuations have come down significantly, but earnings estimates for coming quarters are probably still too high.

- The US dollar continues to trend higher. The euro, on the other hand, is suffering from the Eurozone’s multiple problems.

- Gold has come under pressure due to higher yields and the strong US dollar.

Our macroeconomic assessment

Business cycle

- We have adjusted our growth forecasts for 2022 as follows: World 2.7% (previously 2.9%), US 1.9% (2.1%), EU 2.3%, Japan 1.9% (2.2%), China 3.7%, UK 2.8%, Switzerland 1.9%. (2.0%). For 2023 we expect the following growth rates: World 2.5%, US 0.9%, EU 0.3%, Japan 1.5%, China 4.9%, UK 0.2%, Switzerland 1.0%.

- High and persistent inflation is forcing central banks to raise policy interest rates sharply. A change of course by the central banks in this regard is not in sight. Our revised growth estimates for 2023 imply a recession in many regions.

- The ZEW’s September survey of the current economic situation in Germany reported a fall to minus 60.5 points (-12.9). The last three major corrections (2003, 2009 and 2020) were associated with eventual lows in this metric around minus 95 points.

- None of the major economies is currently in recession in any meaningful sense despite the US marginally meeting the technical definition of one. America’s “technical recession” should be considered alongside her strong labor market and high rate of industrial capacity utilization (around 80%).

- The increasing burden on households and companies has to be addressed by fiscal policy and other government measures.

Monetary policy

- The more important central banks raised their key interest rates by 50 to 75 basis points. Inflation has to return to the target level of 2%. The Bank of Japan has left interest rates unchanged.

- Further tightening is expected and a recession would be accepted.

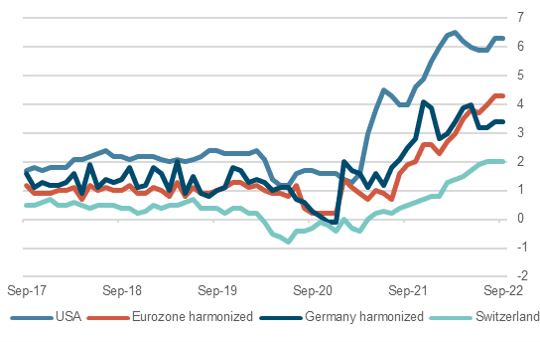

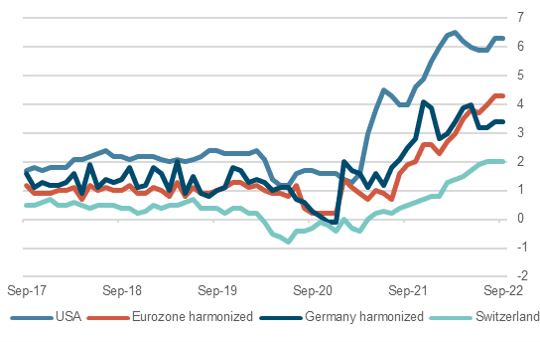

Core inflation, last 5 years

Source: Bloomberg Finance L.P.

- While headline inflation is declining in the US, it continues to rise in Europe. The persistent price rises in certain sectors (for example rents) contribute particularly to the core inflation rate and puts upward pressure to it. This rose in the US another 0.4% to 6.3% year-on year in August.

- Interest rate hikes only have an indirect effect on inflation in that they produce an economic slowdown. But reducing the size of central bank balance sheets has a more direct effect in that it will slow the rate of growth of the money supply. The balance sheet total of the G4 group of central banks will now fall significantly as a result of quantitative tightening in the US and the UK. And the ECB is scheduled to discuss reducing its balance sheet in October.

Our investment policy conclusions

Bonds

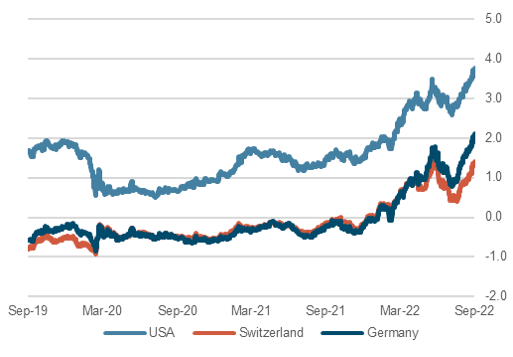

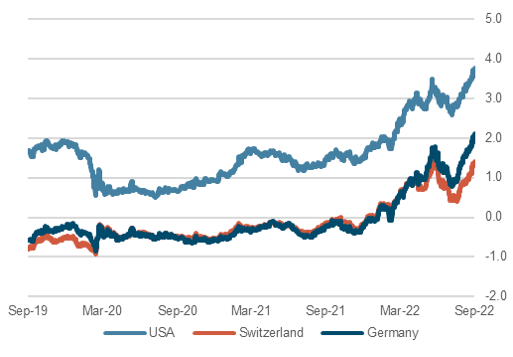

- At its most recent meeting, the Fed confirmed its tightening course with a further large increase in policy rates and indications that further interest rises are in prospect. Moreover, as of September the rate of quantitative tightening (whereby maturing bonds will no longer be reinvested) has doubled to $95 bn a month. The Fed is thus steadily reducing its presence as a buyer of government bonds and mortgage-backed securities.

- The USD yield curve reacted to the Fed’s announcements, especially at the “short end”. The yield on 2-year paper rose again significantly and is currently trading around 4.1%. Even at the “long end” yields rose (10-year maturity at 3.75%). It seems as if the Fed will ultimately be successful in fighting inflation.

- The ECB not only has to control the level of the EUR yield curve, but also the yield differentials between individual countries. We therefore assume that the ECB's Transmission Protection Instrument (TPI) will soon be activated at some point, which will further distort the European bond markets.

10 year government bond yields in %, last 3 years

Source: Bloomberg Finance L.P.

Equities

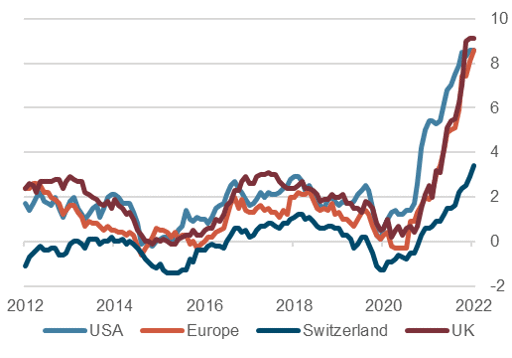

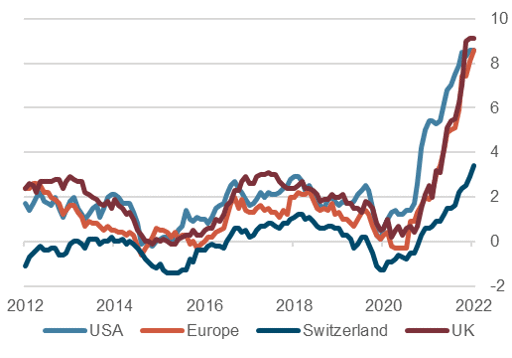

- Central bank commitments to further tighten policy in the fight against inflation have so far only been partially anticipated of the stock markets which have so far seemed to resist the increasing headwinds.

- Stock market optimism had previously been supported by the “narrative” of an imminent reversal of course (in 2023) on the part of the Fed to a renewed “friendlier mode” with interest rates falling again. The Fed’s last policy meeting shattered any remaining belief in that narrative and stock markets came under renewed pressure.

- Stock markets now face a reality

check: Are the expected profits for 2023/2024 realistic and is the valuation of these profits (via the price-earnings ratio) appropriate? Rising real interest rates are negatively correlated with P/E ratios and could put them under further pressure.

- Geopolitical risks pose an additional threat to the equity markets. We therefore remain cautious and neutrally positioned in the equity quota. We recommend underweighting European equities due to the various uncertainties (politics, the euro, energy supply.

Equity markets, perfomance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

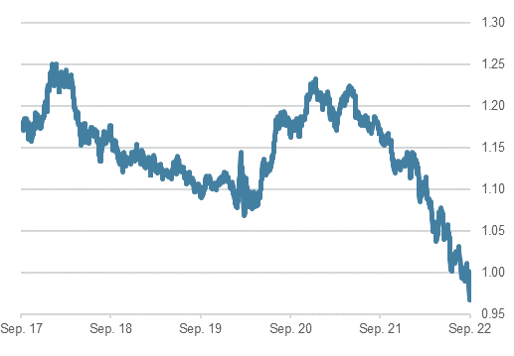

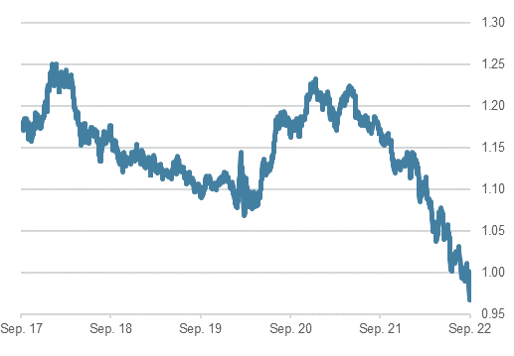

- The US dollar has been one of the big winners since the beginning of the year as it generally benefits from rising uncertainty. Other reasons for the increased flow of capital back to the US are a (relatively) strong US economy, America’s distance from the war in Ukraine and high and rising interest rate differentials in favor of the dollar, especially against the euro and the yen. The recent interest rate cut by the Chinese central bank only intensified the dollar’s general upward trend.

- In the meantime, however, there is increasing discontent with the dollar’s strength. The Bank of Japan, for example, has already envisaged interventions in FX markets to support the yen, although it is sticking to its policy of controlling the Japanese yield curve.

- A further weakening of the euro is also evident on the foreign exchange markets. This has recently been accentuated by the partial mobilization of Russian armed forces. The looming energy crisis is also weighing heavily on the outlook for Europe.

EUR/USD, last two years

Source: Bloomberg Finance L.P.

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.