Executive Summary

- In view of the conflict in Ukraine we have reduced our estimate for global economic growth this year to 3.5%.

- The tragic situation in Ukraine is weighing on markets and on the mood of investors. It is impossible to forecast with any confidence how the conflict might develop.

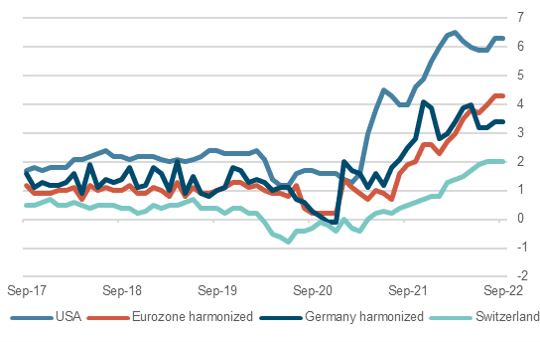

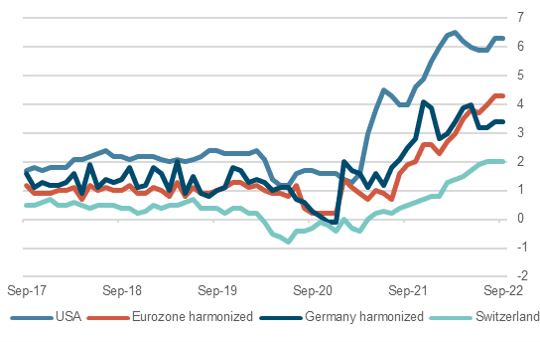

- Assuredly, one consequence will be an additional surge in inflation, which will hit Europe in particular. Consumption and living standards will suffer.

- Quarterly/annual corporate statements continue to be mostly encouraging. But inflation concerns are increasingly being highlighted.

Our macroeconomic assessment

Business cycle

- In view of the war in Ukraine and the sanctions imposed on Russia we have reduced our estimate for world economic growth this year to 3.5%. Our other key growth forecasts for 2022 are as follows – US: +3.2%, EU: +2.5%, Japan: +2.2%, China: +4.8%, UK: +2.8% and Switzerland +2.4%.

- Geopolitical risks have increased massively with Russia’s invasion of Ukraine. Security policy is experiencing an historic turnaround. The loss of the “peace dividend” and higher (unproductive) spending on armaments are weighing on business and consumer sentiment as well as on growth prospects. Frictions in global supply chains, already triggered by the Corona pandemic, have intensified due to the conflict profits and possible reduction of fuel tax) will further strain national budget finances.

- The University of Michigan’s consumer survey results for the US now show a bleaker picture.

University of Michigan consumer survey data, last 20 years  Source: Bloomberg Finance L.P.

Source: Bloomberg Finance L.P.

Monetary policy

- Despite events in Ukraine, the Fed and the Bank of England (BoE) are now in rate hike mode. The BoE raised rates for the third time. A day earlier, the Fed raised rates for the first time since late 2018. Federal Open Market Committee (FOMC) member forecasts suggest six more such moves over the balance of 2022. Commentators suggest the Fed will announce its plan for cutting its balance sheet following the next FOMC meeting on May 3 and 4.

- Current inflation rates of 7.9% and 5.5% for the US and the UK respectively provide strong justification for a further tightening of monetary policy.

- At its March 10 policy meeting the ECB opted to keep key interest rates unchanged and distanced itself from speculation that it might raise rates soon.

- In sum, central bank balance sheets are still increasing but the Fed’s upcoming decision to reduce its balance sheet may herald the turning point.

- It is questionable whether the central banks can effectively combat the current inflation problem with interest rate hikes. However, they are under pressure to act.

- The SNB decided to keep the key policy interest rate at -0.75% and reaffirmed its willing to intervene in forex markets if necessary to offset excessive strength in the Swiss franc.

Our investment policy conclusions

Bonds

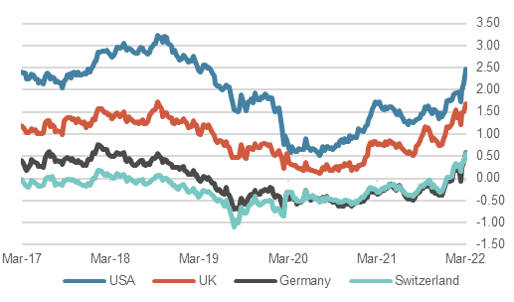

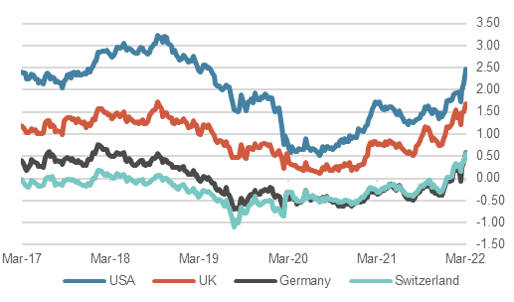

- The US yield curve is now very flat and is even inverted in some sections. As at the end of March, the yield on 2-year US government bonds is 2.1%, while that on both 5-year and 10-year equivalent paper stands at 2.35%. 30-year bonds yield only marginally higher at 2.6%. Such a flattening of the yield curve is usually followed by an economic downturn soon thereafter.

- The current shape of the yield curve coupled with the aggressive path of interest rate hikes now being communicated by the US Fed suggests it will tighten financing and interest rate conditions into a flattening economy. After downplaying inflation last year, the Fed making every effort to highlight measures designed to fight an inflation rate that is now “getting out of hand”.

- Global corporate bonds of good debtors (investment grade) are currently showing credit spreads of around +70 basis points. This is slightly above the long-term average and indicates the strains within the global economy that result from the sanctions against Russia.

10 year government bond yields last 4 years, in %

Source: Bloomberg Finance L.P.

Equities

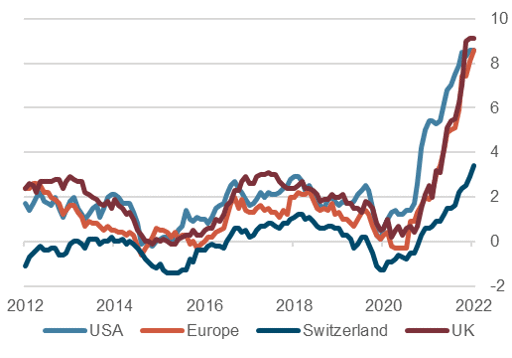

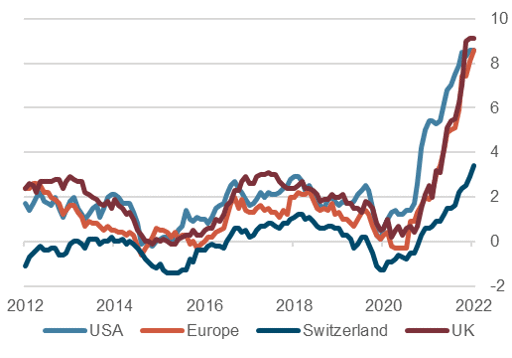

- In the first half of March stock markets came under significant pressure but they have subsequently staged a noteworthy “interim rally”. The interest rate fears already latent at the beginning of the year have been exacerbated by events in Ukraine. As a mirror image, volatility has increased significantly.

- The coming corporate earnings reports will be very revealing. If the commentary refers increasingly to inflationary pressure, it may indicate that higher prices are triggering a faster rate of wage increases, which would be interpreted negatively.

- The indications from the interest rate markets can only mean that central bank room for maneuver is limited. Should the Fed roll back even slightly on its recent communication to the markets, we would expect a significant rally in equities.

- We continue to recommend a neutral positioning in the equity allocation and to use setbacks to buy high-quality stocks, with balance sheet quality and dividend continuity being particularly important criteria in the selection of stocks.

Equity markets, perfomance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

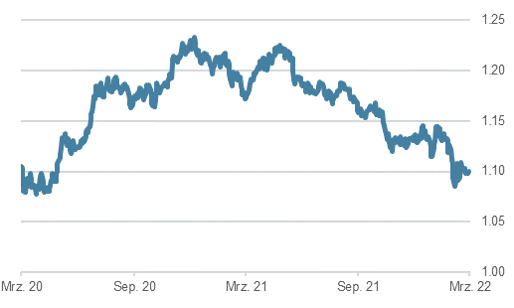

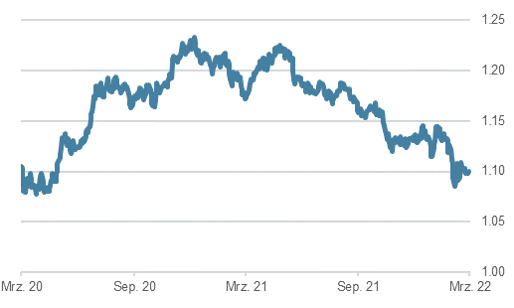

- The combination of sharply rising US interest rate expectations and the escalating conflict in Ukraine has increased demand for US dollars. But the rise of the dollar against the Swiss franc has been only moderate, as the latter also has a “safe haven” character. In the medium term, we do not see the US dollar going much higher. The euro remains under pressure.

- The impact of a strong Swiss franc on Swiss competitiveness is partly compensated by the higher inflation rates, relative to Switzerland, in the Eurozone and the US. The SNB is now intervening in forex markets on a far smaller scale than before.

- The ECB finds itself in a delicate situation. The hint of a somewhat more restrictive monetary policy has led to a widening of spreads within the Eurozone. Thus, the European South now has again to pay over 2% on 10-year government bonds – a problematic rate of interest given the extent of the indebtedness of these countries.

USD/CHF, last two years

Source: Bloomberg Finance L.P.

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.