Executive Summary

- Central bank decisions have been the focus of investors' attention in recent days. The Fed surprised participants with a bold rate cut of 50 basis points. The far-reaching sweeping move by the PBOC was unexpected. The measures were positively received by the stock markets. The ECB and SNB also eased their monetary policy in line with expectations.

- The global economy appears to be cooling down and is now also affecting the service sector to some extent. The figures remain contradictory.

- The USA is surprising on the upside and monetary easing continues to allow for a soft landing.

- In Europe, economic concerns are weighing heavier.

- The global bond markets have calmed down. The Fed's interest rate cut is leading to a normalization of the yield curve.

- On the stock markets, the significant swings "downwards" were corrected surprisingly quickly. However, this recovery was not equally strong everywhere.

- The US dollar could remain under pressure. In addition to the expectation of further interest rate cuts, rising debt in the US is also weighing on the greenback.

- Gold rises to over USD 2,700 per ounce and reaches a new all-time high.

Our macroeconomic assessment

Business cycle

- Following the rather disappointing labour market data from the US and the downward revision of the number of newly created jobs, the labour market and the economy are increasingly becoming the focus of analysts and the Fed.

- The expectation of a more pronounced slowdown in the US economy prompted the Federal Reserve to significantly ease its monetary policy and support the economy and the labor market.

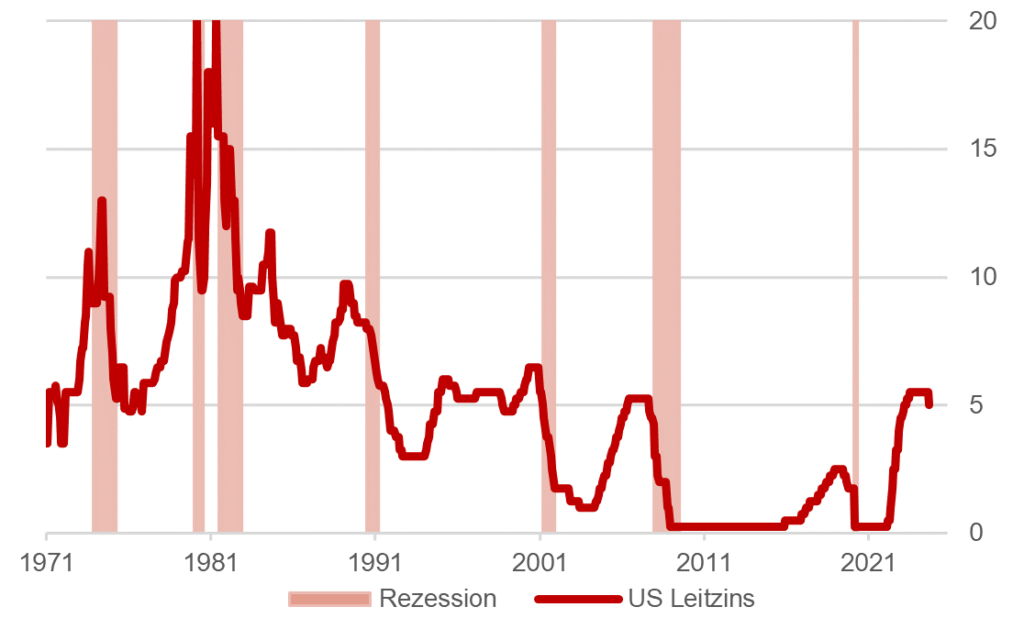

- Normally, a cycle of interest rate cuts that is not associated with a recession is "bullish" (positive) for the equity markets. However, the past has shown that a soft landing is not the rule, but the exception.

- In Europe, the manufacturing industry has been shrinking for some time and now the weakness is also affecting the service sector. At 47.2 and 48.3 points respectively, growth in the two major economic areas of Germany and France is below the 50-point threshold.

- German industry is in crisis. The ifo data is disappointing and increases the likelihood of recession.

- At 95.9 points, the KOF Swiss Economic Institute's economic barometer remained below the long-term average in September.

Fed interest rate decisions and recession periods (1971-)

Source: Bloomberg Finance L.P.

Monetary policy

- The Fed surprised market participants with an aggressive interest rate cut of half a percentage point. At the press conference, Jerome Powell was keen to emphasize the strength of the US economy and allay fears of an economic slowdown. The labor market also remains robust, but now needs some support to achieve a soft landing.

- The ISM Purchasing Managers' Index has repeatedly been below the 48-point mark over the last 20 months - a value that has historically prompted the Fed to cut interest rates and is now being followed.

- The European Central Bank (ECB) has lowered the deposit rate by 25 basis points to 3.5% and the main financing rate and the marginal lending rate by 60 basis points each to 3.65% and 3.9% respectively.

- The SNB also intervenes with a cut of 0.25 percentage points to 1.0%. Inflation falls to 1.1% and allows further interest rate cuts.

- Finally, the Chinese PBOC announced comprehensive measures to stimulate the economy and support the real estate and stock markets.

Our investment policy conclusions

Bonds

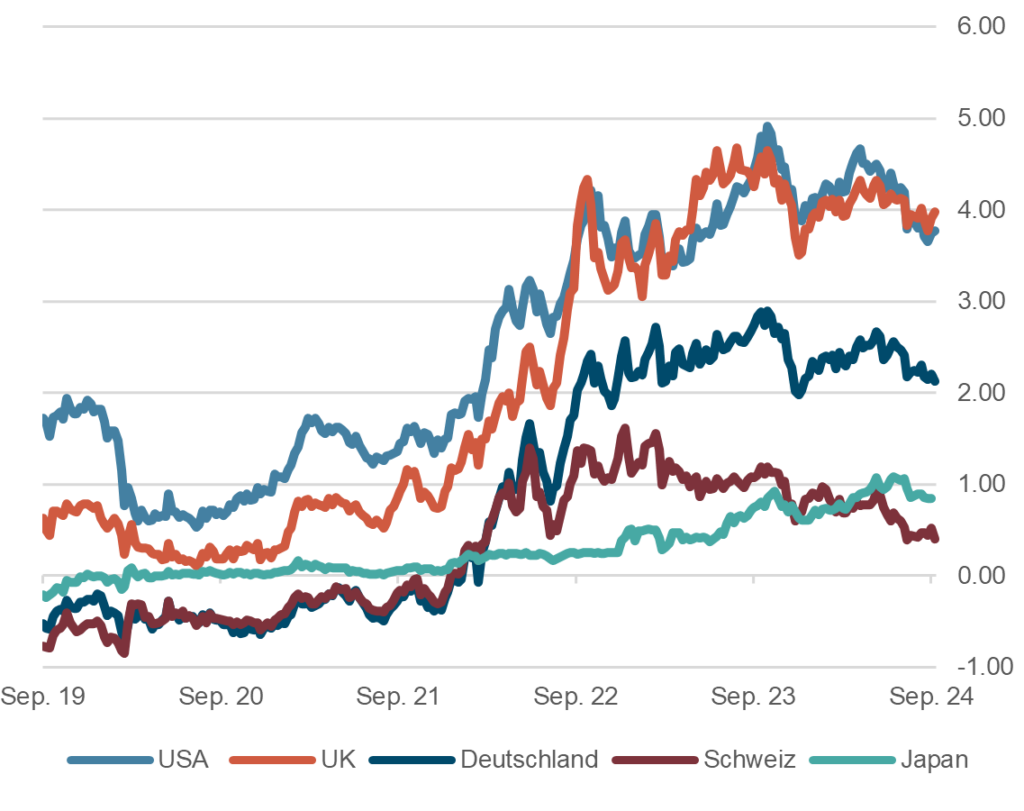

- After the sharp correction at the beginning of August, which was also accompanied by significantly increased volatility on the bond markets, the situation has calmed down again. Yields on 10-year government bonds are currently at 3.8% in the USA, 2.2% in Germany and 0.4% in Switzerland.

- Looking at the US yield curve, we can see that it has normalized further following the Fed's latest decision. Interest rates have fallen at the short end and risen slightly at the long end. The inversion persists up to a maturity of two years and the curve rises slightly above that. The normalization is likely to continue once the interest rate cuts priced in at the short end occur.

- The yield on 10-year Swiss government bonds has settled in a range between 0.35% and 0.50% and is likely to trend sideways in the foreseeable future.

- The spreads on high-yield and corporate bonds have hardly changed. We continue to regard the asset class as only moderately interesting.

Interest on 10-year government bonds, in %, 5 years

Source: Bloomberg Finance L.P.

Equities

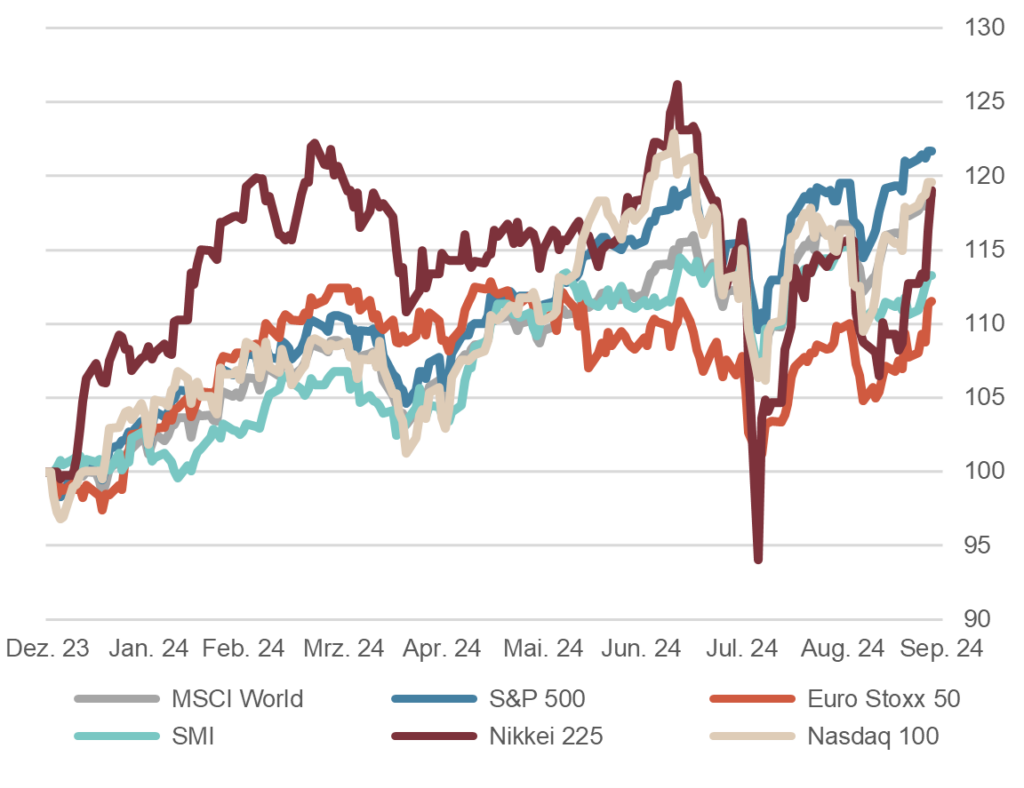

- The significant "downward" swings on the stock markets were corrected surprisingly quickly. However, this recovery was not equally strong everywhere. The S&P 500 and the Dow Jones Index are now trading at new highs, while the SMI has not yet reached this hurdle.

- Clear divergences can also be seen when comparing sectors. For example, the leading chip stocks until the end of July (artificial intelligence theme) are still below their previous highs. By contrast, new records were set in some defensive sectors, such as utilities.

- Overall, the rotation already observed over the course of the year appears to be continuing. Investors are realizing gains in growth sectors and shifting into more defensive areas of the market.

- We remain cautiously positive about the further development of the equity markets. The US elections are just around the corner and liquidity is still abundant. Nevertheless, it should be noted that some growth stocks are sporty in terms of valuation.

Equity markets, performance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

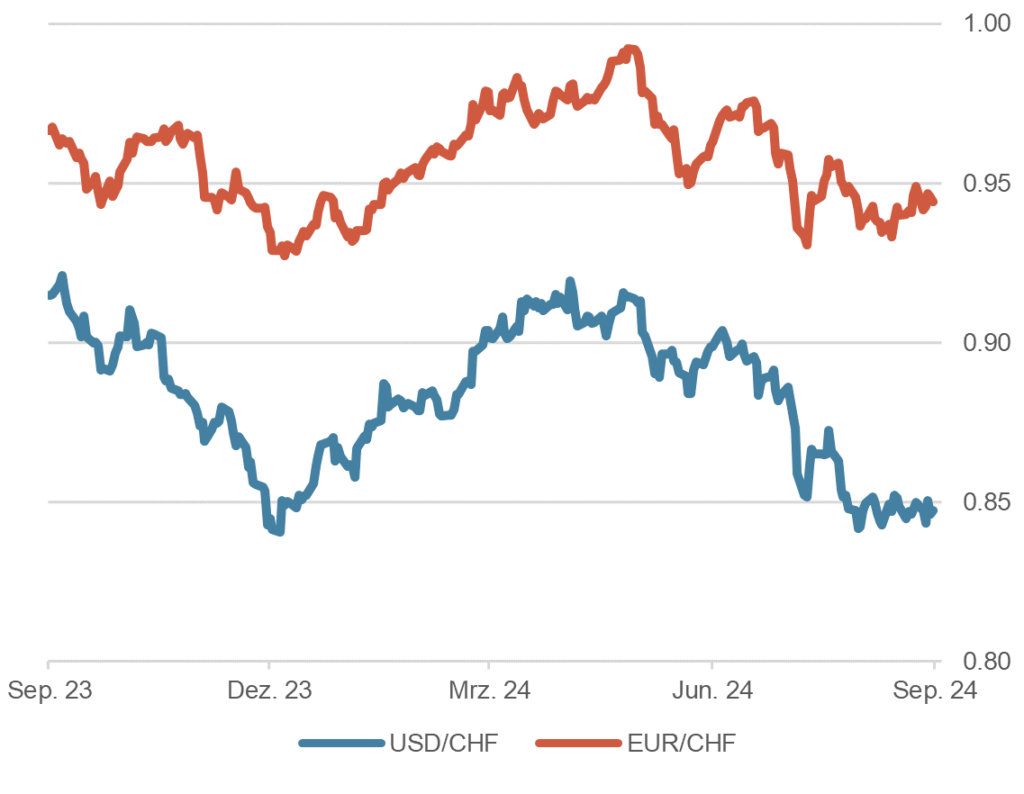

- The US dollar has weakened continuously against the Swiss franc and the euro since the middle of the year and is virtually unchanged compared to the start of the year.

- The interest rate hike by the Japanese central bank has reduced the interest rate differential against the dollar, led to a noticeable appreciation of the yen and triggered a massive liquidation of carry trades. The yen fell below 140 against the dollar and is now trading slightly weaker. It remains to be seen whether and when the yen will be able to resume its traditional role as a funding currency.

- The EUR/CHF exchange rate currently stands at around 0.94. The SNB's interest rate cut of 0.25% was already largely priced in and caused little volatility.

- Due to the interest rate constellations and the different paths of interest rate cuts, we assume that the US dollar will tend to remain under pressure.

Dollar and euro against franc, 1 year

Source: Bloomberg Finance L.P.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.