Executive Summary

- The pleasing growth of the global economy in the third quarter - especially in the USA - will be severely dampened in the fourth quarter, which is usually a seasonally strong quarter. The restrictive monetary policy is having an inhibiting effect.

- The outlook for the second half of 2024 is brightening and is experiencing positive momentum, not least thanks to an expected looser monetary policy and "presidential cycle".

- Some countries are likely to have already slipped into recession. However, this is mild in most of the countries affected.

- The US Federal Reserve and the European Central Bank (ECB)

- could open the round of interest rate cuts and cushion a possible downturn.

- Yields on government bonds in the most important regions virtually collapsed after the Fed meeting. The announcement of three potential interest rate cuts took many by surprise.

- The stock markets responded positively to Fed Chairman Powell's comments and falling interest rates and continued their rally.

- Gold consolidates after reaching a new all-time high.

Our macroeconomic assessment

Business cycle

- Annualized GDP growth in the US has been revised to 4.9% for the third quarter. Global economic growth also exceeded expectations. By contrast, growth in Switzerland was only "moderate" (+0.3%) and in the eurozone even declined slightly (-0.1%). In general, the service sector is expanding and economic output in industry is stagnating.

- The growth prospects for the global economy in the coming quarters remain subdued. The restrictive monetary policy of most central banks is having a dampening effect. The Fed sees the neutral interest rate at 2.5%.

- Based on the recently published preliminary survey results of purchasing managers, this economic slowdown is confirmed and is also increasingly affecting the services sector.

- We expect growth in the USA to slow in the coming year and therefore a challenging global environment. However, whether a recession can be avoided in the US remains to be seen.

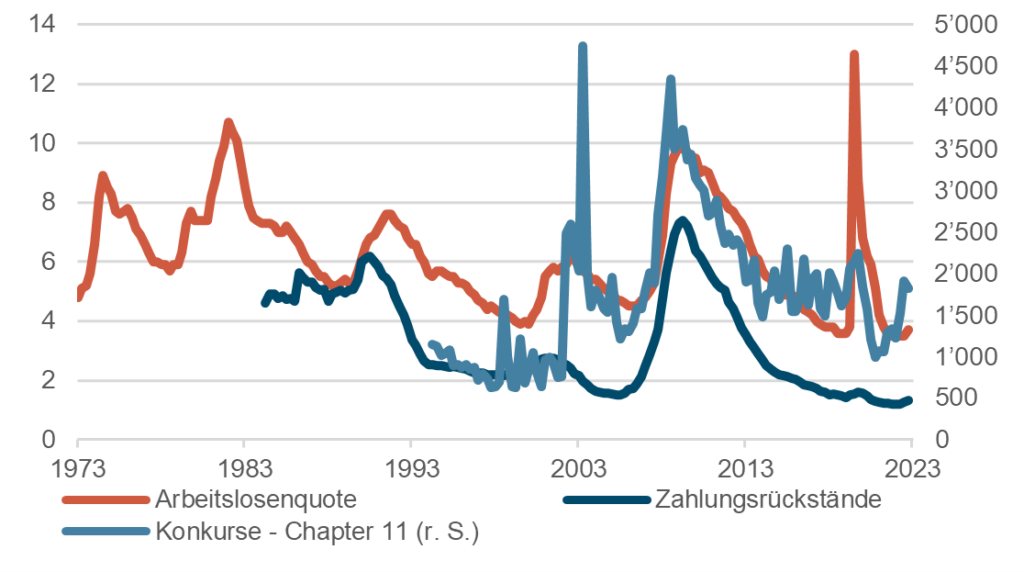

USA: Bankruptcies, unemployment rate and arrears (50 years)

Source: Bloomberg Finance L.P.

Monetary policy

- At their December meetings, the central banks in focus left key interest rates unchanged in light of falling inflation and a cooling economy. The Fed has signaled that it will cut key interest rates by 75 basis points in 2024 if the economy continues to normalize. Based on interest rate futures, the financial markets even expect six rate cuts. This harbors the potential for disappointment.

- Following the zero decision and the Fed's press conference, market yields fell by over 30 basis points for maturities of two years or more.

- Uncertainty remains high with regard to inflation. The experience of the 1970s and 80s certainly plays a role here. It is true that inflation has fallen significantly in recent months due to massive base effects. However, this positive trend is likely to come to an end in the coming quarters. In addition, special effects (discontinuation of subsidies, VAT increase or rising rental and ancillary costs) may contribute to a renewed boost. Globally, strategic factors such as increased debt, the ageing population, the energy transition, de-globalization and, finally, armed conflicts are providing the basis for inflationary pressure that cannot be ignored.

Our investment policy conclusions

Bonds

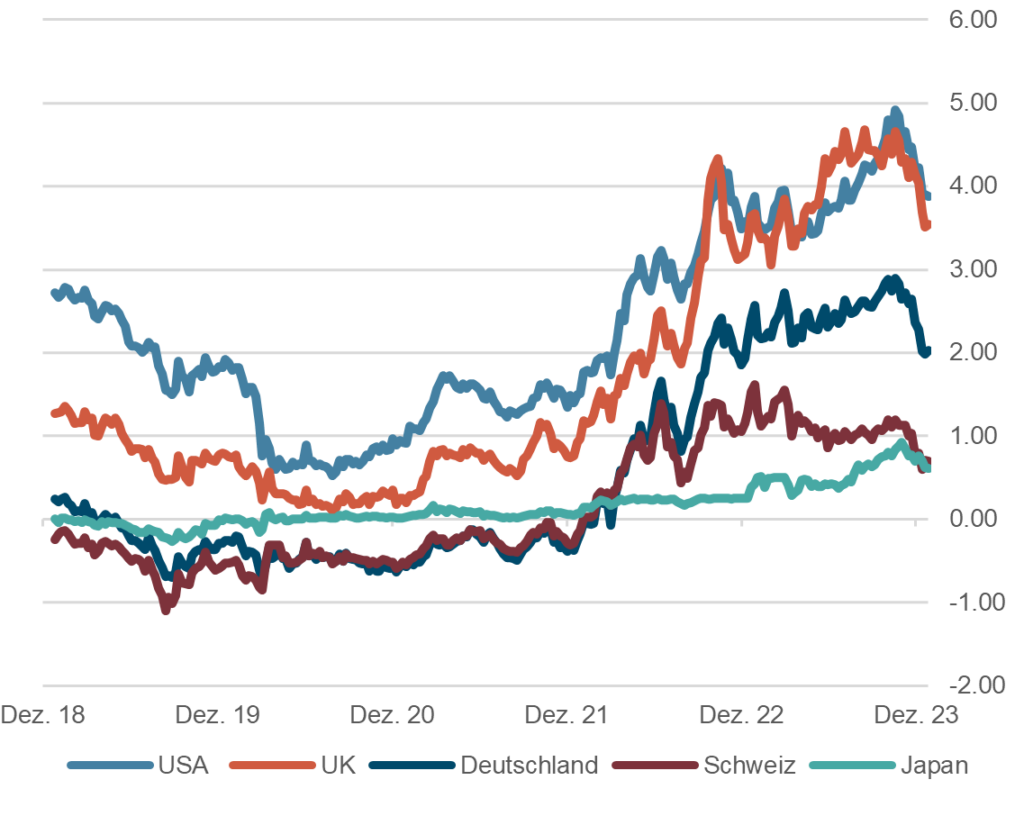

- Yields on government bonds in the most important regions have continued their decline following the US Federal Reserve meeting. The yield on 10-year government bonds is currently 3.9% in the USA, 2.0% in Germany and 0.6% in Switzerland.

- The "standstill" of the Fed and other central banks has confirmed to investors that the peak of the interest rate cycle has probably been reached and that interest rate cuts can be expected in the coming year. This optimism has also spread to the long end of the yield curves, especially as inflation is also expected to fall further.

- Whether this will actually happen is uncertain. What is certain is that inflation has fallen recently, mainly due to falling energy prices.

- Spreads have narrowed again in the corporate bond segment. We continue to regard the short to medium maturity range as more attractive for new investments due to the higher yields.

10 year government bond yields in %, last 5 years

Source: Bloomberg Finance L.P.

Equities

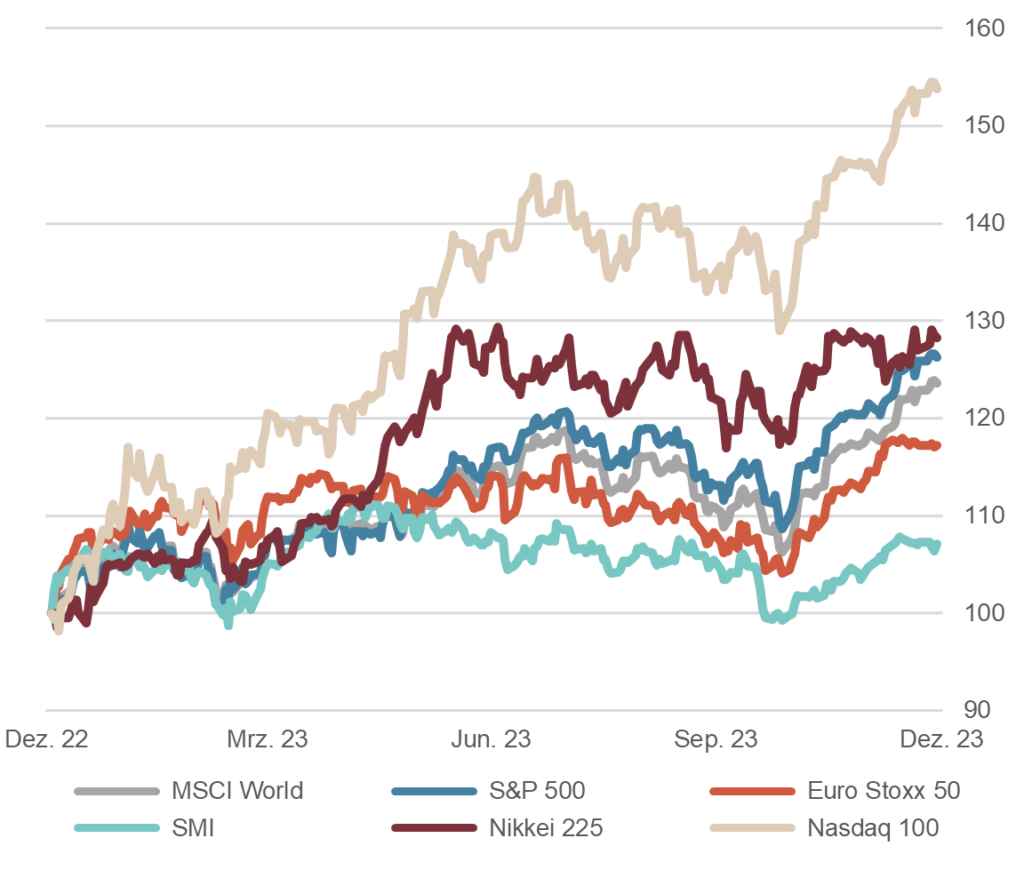

- The interest rate optimism dominating the stock markets was given a further boost by Fed Chairman Powell's statements after the FOMC meeting.

- The stock markets in the most important regions continued their positive trend, even reaching new all-time highs here and there (Dow Jones, Dax, EuroStoxx 50). Certain markets gained in breadth. Cyclical stocks and small capitalized companies in particular have recently made strong gains. In the USA, the rotation was clearly noticeable, with the equally weighted S&P 500 Index outperforming the market-weighted index in recent days.

- The crisis in the Middle East is by no means over, but the markets no longer seem to be interested at the moment.

- We remain cautiously constructive in our assessment and assume that the most important equity markets will remain within the range that has existed for some time. We are currently refraining from chasing this rally.

Equity markets, performance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

- In line with the falling yields on US Treasuries, the US dollar index has lost around 5% since the end of October. After the FOMC meeting, the movement gained further momentum.

- Due to the apparent calm in the Middle East, the US dollar has lost some of its function as a safe haven, which is also putting pressure on the greenback. The recovery in the yen is striking. It has appreciated by almost 10% in just a few weeks. If the Japanese central bank really does abandon its current interest rate policy, further appreciation gains can be expected.

- The euro has depreciated again against the franc and is back below 0.95. We continue to assume that the franc will appreciate in the long term due to its structural advantages against the euro. A possible government crisis in Germany is likely to put pressure on the euro.

Dollar vs Swiss franc, last 12 months

Source: Bloomberg Finance L.P.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.