Executive Summary

- Global growth was robust in the first quarter and the European economy is gaining momentum. The recovery is also likely to continue for the rest of the year - supported by the looser monetary policy, among other things.

- We expect global economic growth of 3% for 2024.

- The fall in inflation since the coronavirus pandemic is generally welcomed, but has not yet reached the target value of 2% in most regions.

- Nevertheless, the first central banks are easing their monetary policy framework and providing growth impetus.

- Central banks remain data-dependent in their decisions.

- Yields on government bonds in the most important markets are moving sideways.

- The stock markets in the most important regions are behaving heterogeneously: new highs in the USA, setbacks in Europe. We remain cautiously constructive for the equity markets.

- The US dollar has consolidated its gains since the beginning of the year, while the Swiss franc weakened briefly following the SNB's renewed interest rate cut.

- The price of gold is currently trading in a range of USD 2,300 to 2,400 per ounce, and we remain positive in our assessment.

Our macroeconomic assessment

Business cycle

- Global growth was robust in the first quarter and the European economy is gaining momentum. The recovery is also likely to continue in the second quarter and for the rest of the year.

- The service sector is experiencing strong growth globally, which is also leading to a sustained surge in prices. The manufacturing industry, on the other hand, continues to develop below potential - including in Switzerland.

- The economic recovery in the eurozone and Switzerland should also be seen in the context of the already slightly lower key interest rates of the two central banks, which are favoring investment, consumer spending and construction activity.

- In the longer term, however, we expect growth prospects to deteriorate in view of the emerging structural changes. The numerous geopolitical problems are unlikely to ease in the foreseeable future.

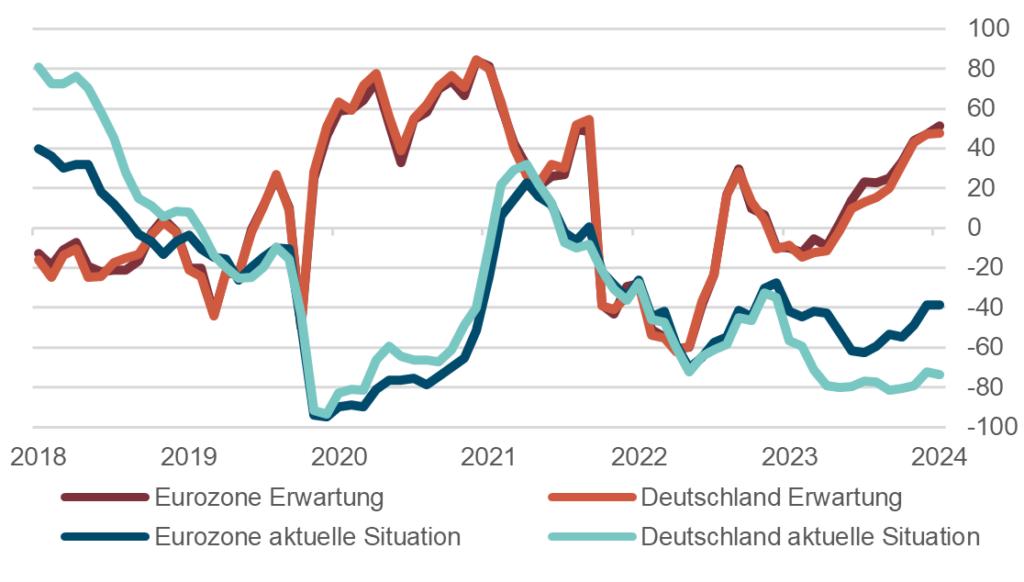

ZEW: Expectation vs. current situation in the eurozone and in Germany (5 years)

Source: Bloomberg Finance L.P.

Monetary policy

- The fall in inflation since the coronavirus pandemic is generally welcomed. However, it seems premature to declare it defeated. The recent rise in price pressure in some countries is causing uncertainty and is reminiscent of the 1970s, when interest rates were cut too early and inflation flared up again.

- For the foreseeable future, this price pressure is unlikely to bring inflation in the EU and the US down to the target level of 2%. As the Fed has committed itself to the data situation, a rate cut is not expected until the fourth quarter at the earliest.

- The members of the Fed have raised their estimates of interest rate developments summarized in the "dot plot" compared to the March forecasts, which consequently also suggests higher inflation expectations. However, long-term USD interest rates are now negating this assessment.

- The SNB has eased its monetary policy conditions for a second time in response to the rather modest economic growth in the first quarter, but can also justify its decisions on the basis of low inflation.

- The ECB's reduction in key interest rates is more likely to be motivated by the growth stimulus. Inflation remains above the propagated target of 2% and the committee is also raising its inflation estimate for 2024 and 2025.

Our investment policy conclusions

Bonds

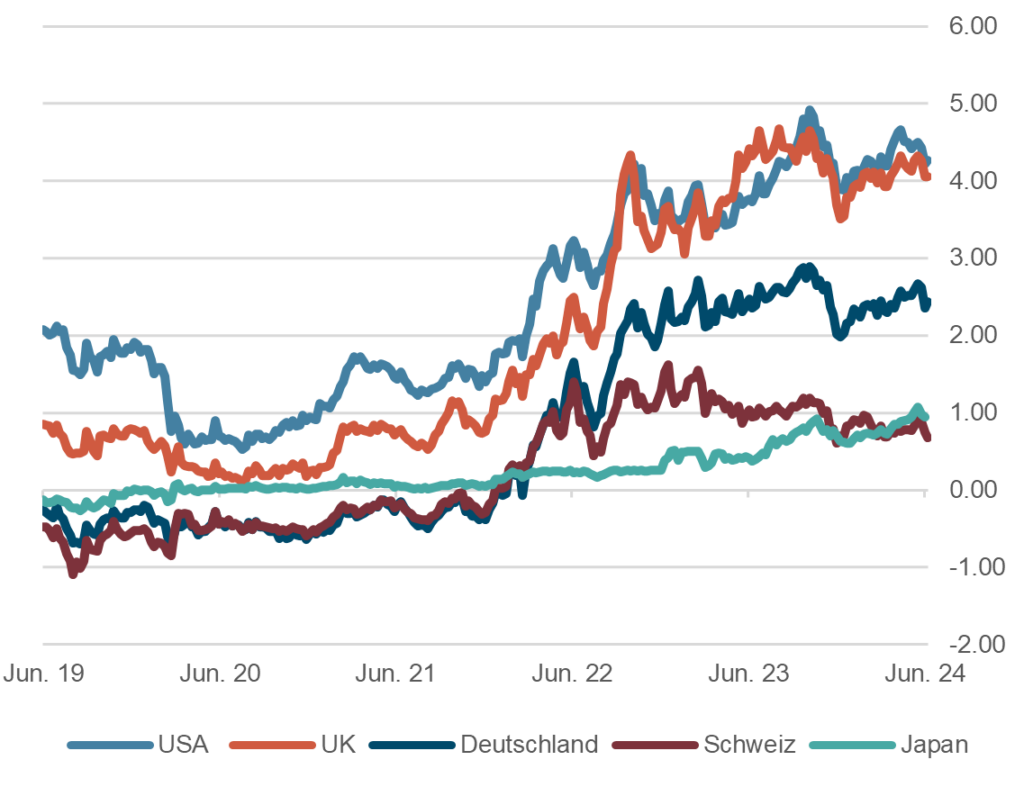

- Yields on the most important government bonds continue to move sideways within a narrow range. Currently, 10-year government bonds in the USA are yielding 4.3%, in Germany 2.4% and in Switzerland 0.6%.

- The opposing forces of economically appealing macro figures, particularly in the US, and inflation figures, which remain well above the target values, continue to have an impact. With this starting position, the markets are unable to receive any new impetus. Yield levels and the inversion of yield curves are therefore likely to continue to level off.

- For investors in the euro and US dollar area, this means that yields on medium-term government bonds remain attractive. In view of the easing of monetary policy by the central banks, a slight increase in duration is even an option.

- In the area of corporate bonds, interest rate premiums are at very moderate levels and do not indicate any economic weakness.

10 year government bond yields in %, last 5 years

Source: Bloomberg Finance L.P.

Equities

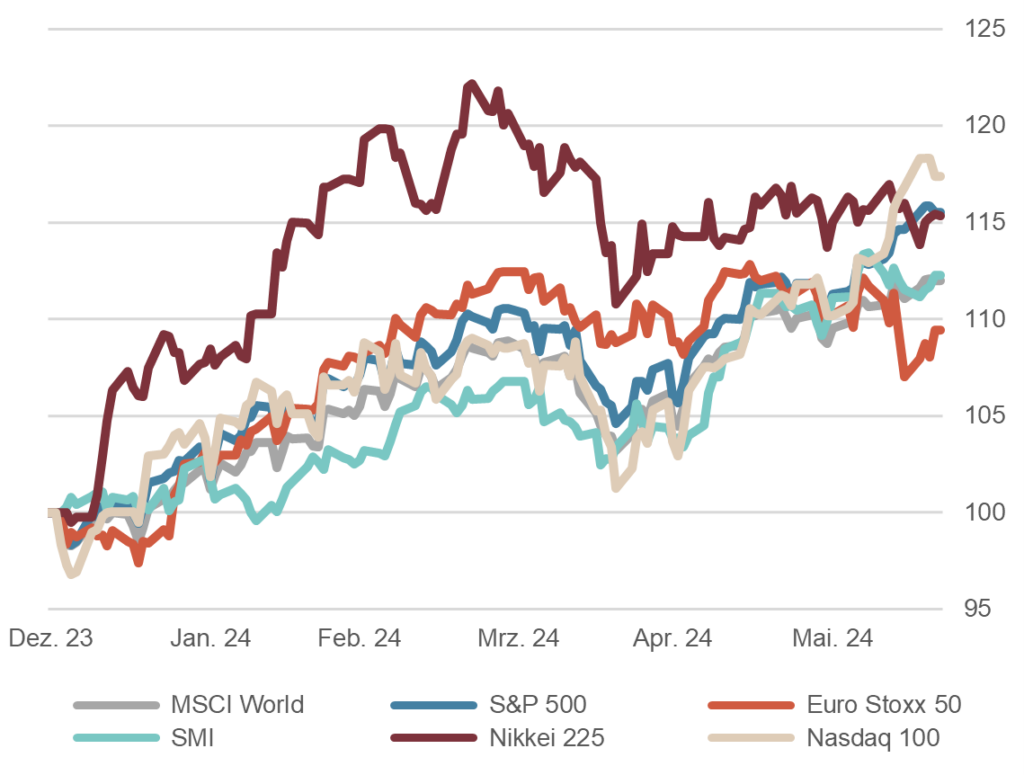

- The equity markets in the most important regions continue to trend positively, but have performed unevenly in recent weeks. The leadership of growth stocks (AI, semiconductors) has once again become clearer, resulting in an outperformance of the Nasdaq and the S&P 500. On the other hand, the results of the European elections have raised concerns about political stability on the old continent. The share indices responded to this with falls.

- The geopolitical trouble spots have only calmed down superficially. An escalation that would change the "local" nature of the conflicts could put pressure on the stock markets.

- However, we remain cautiously constructive in our assessment and assume that the most important stock markets will develop positively over the course of the year due to the abundant liquidity in the system.

Equity markets, performance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

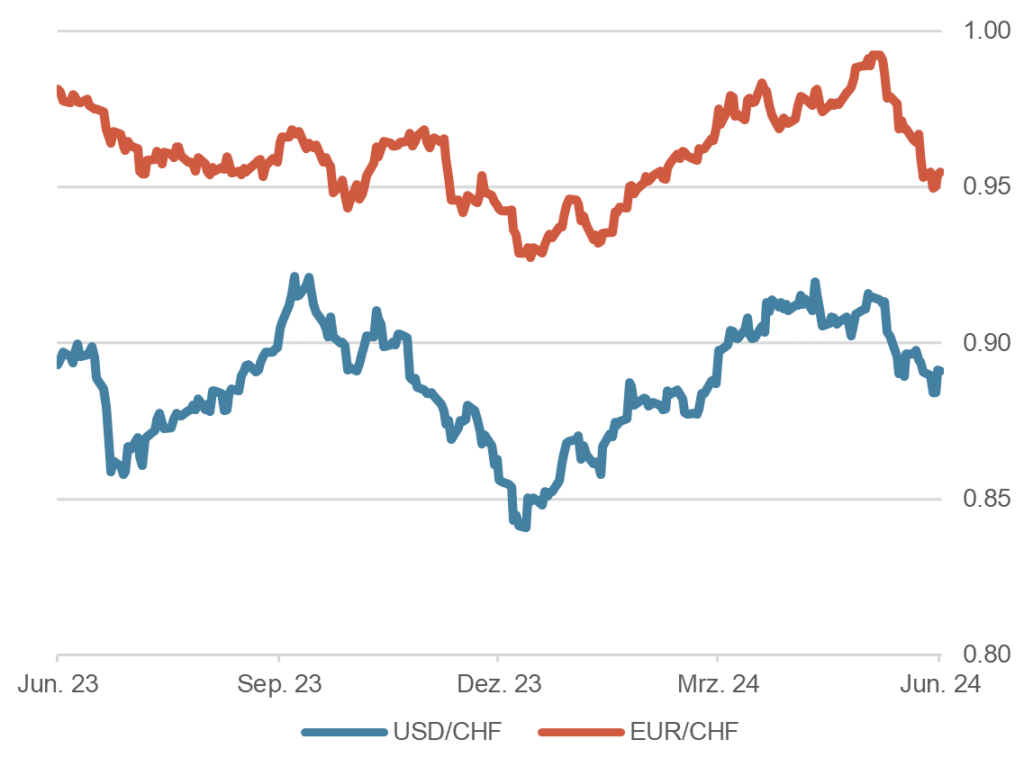

- The trade-weighted dollar index is consolidating and is currently 4% higher than at the start of the year. This reflects the change in interest rate expectations in the US and a possible geopolitical risk premium for the US dollar.

- The EUR/CHF exchange rate depreciated by around 4% in June and is currently back at 0.9550. After some pressure had built up on the Swiss franc in the run-up to the European elections, this has now given way to political realities and has led to a renewed significant strengthening of the franc. The exchange rate is also subject to the central banks' interest rate decisions and the interest rate differential.

- Irrespective of this, we continue to assume that the Swiss franc will appreciate in the long term due to its structural advantages over the euro. Any kind of political crisis in the EU is likely to put even more pressure on the single currency.

Dollar and euro against franc, 1 year

Source: Bloomberg Finance L.P.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.