Executive Summary

- Donald Trump and Joe Biden face off again for the presidency in the USA.

- The robust US economy is showing signs of a slight slowdown.

- Overall, economic output from industry is weak and is being boosted by the service sector.

- The BOJ raises key interest rates for the first time in 17 years, but otherwise remains supportive.

- The SNB cuts its key interest rate and leads the way among the major central banks. ECB, BOE and Fed wait with interest rate cuts.

- Yields on government bonds in the most important regions are consolidating at the upper end of the ranges that have existed since the beginning of the year.

- The stock markets in the most important regions have for the most part continued to perform very well since the beginning of the year.

- The US dollar is well supported and the Swiss franc came under pressure following the latest inflation figures and the SNB's interest rate cut.

- Gold reaches new highs, we are sticking to our positioning.

Our macroeconomic assessment

Business cycle

- The stable development of the labor market, higher wages, the wealth effect from increased asset values and a lower tax burden are among the reasons for the positive consumer sentiment in the US.

- The core inflation rate of 3.8% and the price increase in personal spending of 2.8% give the Fed little scope to meet the market's rate cut fantasies.

- European industry appears to be weakening again based on the latest survey of purchasing managers. By contrast, consumer sentiment in the eurozone improved slightly in March.

- In China, the consumer price index rose by 0.7% in February, leaving deflation behind. This development is to be welcomed and could continue in view of rising producer prices.

- In Switzerland, the economy is growing moderately and is being driven by the service sector, while value creation in industry is declining. Positive impetus is expected from the looser monetary policy.

Monetary policy

- The Bank of Japan raised its key interest rate for the first time in 17 years. However, the move from just 0.1% to a range of 0.0 to 0.1% disappointed market participants' expectations. And although the upper band for 10-year interest rates on government bonds of 1% has been abandoned, interest rates are falling because the volume of government bond purchases is being maintained and may even be increased. On the other hand, purchases of ETFs and REITs are being halted.

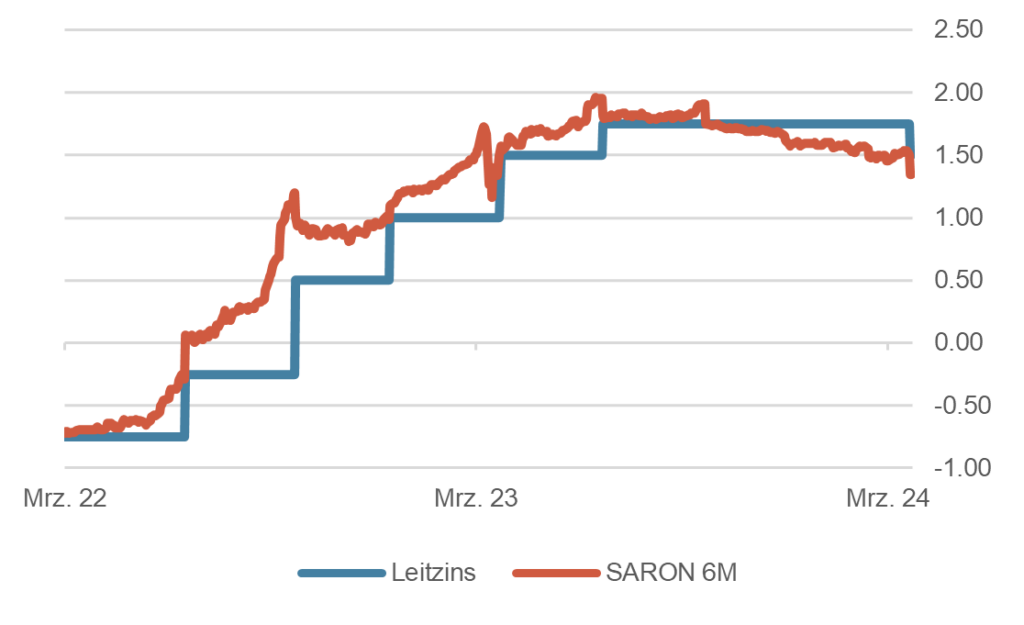

SNB key interest rate vs. SARON 6M (2 years)

Source: Bloomberg Finance L.P.

- The Fed is leaving interest rates unchanged at 5.25-5.5%, but is becoming much more accommodative verbally and is signaling three possible rate cuts of 25 basis points each for this year. These could be implemented in individual steps from June 2024, with an interruption to be expected before the presidential elections. A further interest rate cut would be possible at the December meeting.

- The SNB rounded off the central bank round-up with a bold and unexpected key interest rate cut. Many market participants were surprised by this monetary easing, although the low inflation and the continuing downward outlook certainly justify this move. The 6-month SARON has once again correctly anticipated the decision and is already indicating a further interest rate cut in June.

Our investment policy conclusions

Bonds

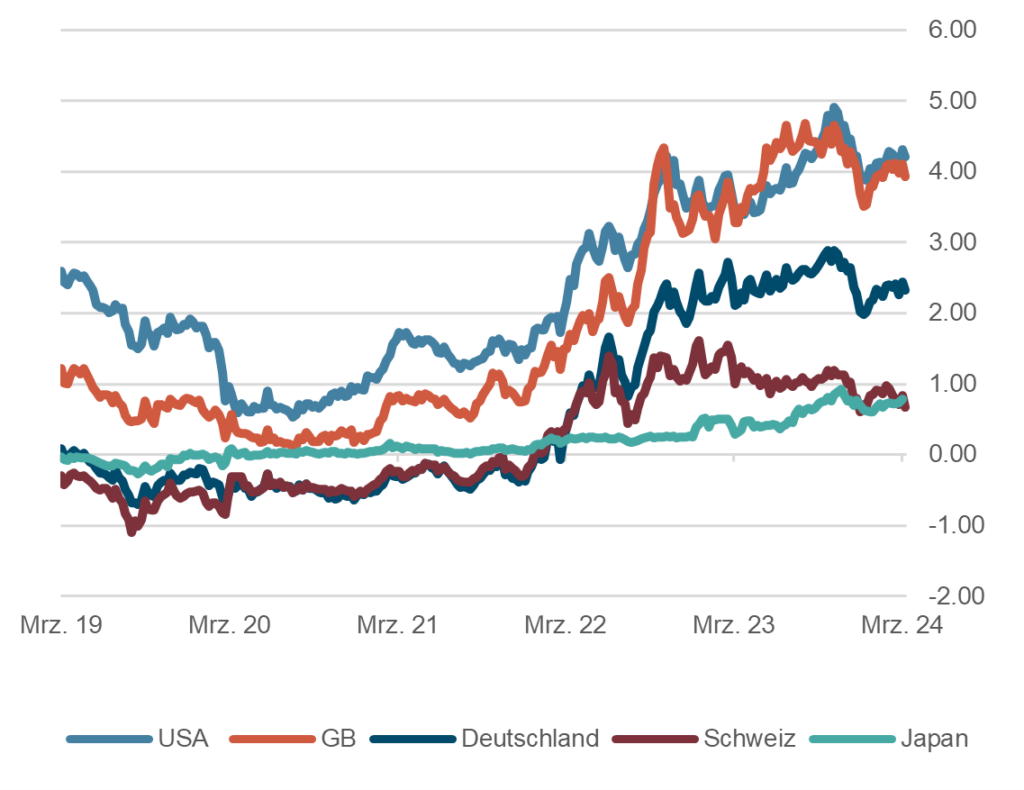

- Yields on government bonds in the most important markets remain at their current levels and thus at the upper end of the ranges established since the beginning of the year.

- In contrast to the optimistic scenarios for key interest rate cuts that were bandied about at the beginning of the year, reduced expectations have now worked their way into the bond markets. This is probably due to the fact that inflation figures are no longer falling. This can also be clearly seen in the rising inflation expectations. This has led to a flattening of the yield curves, although they are still inverted.

- Spreads on corporate bonds remain at very narrow levels, indicating that a recession is not expected here. For new investments, we continue to regard the short to medium maturity range as more attractive due to the higher yields (inverted yield curves).

10 year government bond yields in %, last 5 years

Source: Bloomberg Finance L.P.

Equities

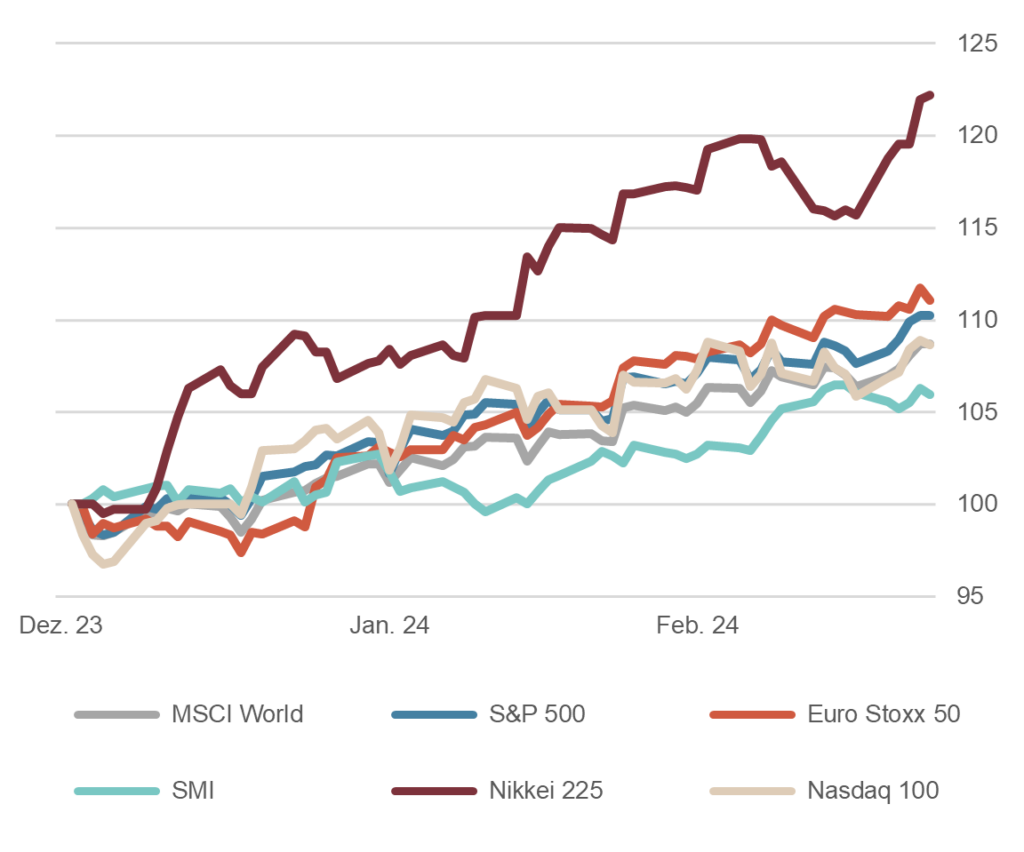

- The stock markets in the most important regions have largely continued to perform very well since the start of the year. The US stock market is still at the top end of the table. However, the Swiss market is now also well "in the green" and has caught up.

- After the narrative of rapid interest rate cuts dominated the stock markets at the beginning of the year, the "soft landing" scenario is currently favored. According to this interpretation, which can also be interpreted from the last FOMC meeting, a recession can be avoided.

- The geopolitical trouble spots have by no means calmed down. However, the markets do not seem to be interested at the moment. This is also evidenced by the fact that volatility on the stock markets is settling at record low levels.

- Overall, we remain cautiously constructive in our assessment and assume that the most important stock markets will develop positively over the course of the year due to the abundant liquidity in the system.

Equity markets, performance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

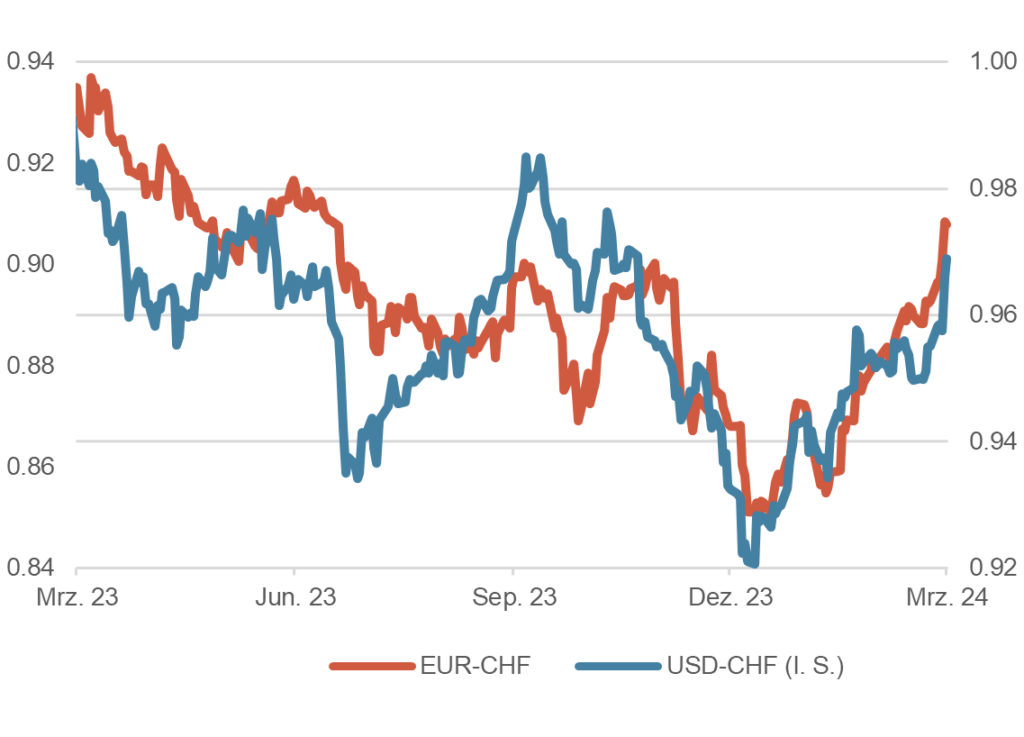

- The US dollar has managed to break away from the lows recorded at the end of 2023 against all major currencies and is currently around 3.5% higher.

- The recovery of the US dollar against the Japanese yen is striking. It has depreciated again by around 7% since the beginning of the year. Perhaps somewhat surprisingly, the BOJ has only raised key interest rates homeopathically by 0.1% (to 0%) and has indicated that it will only slowly deviate from its low interest rate policy.

- The euro has continued to recover against the franc and is at just under 0.98. In particular, the lower than expected inflation figures in Switzerland led to a weakening of the CHF and an interest rate cut by the SNB. We continue to assume that the franc will appreciate in the long term due to its structural advantages against the euro.

Euro and dollar against franc, 1 year

Source: Bloomberg Finance L.P.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.