Executive Summary

- The economy in the USA is still surprisingly robust. The flip side is that inflationary pressures remain elevated. However, there are increasing signs of a slowdown. Loan arrears and bankruptcies are rising.

- In the Eurozone there is a marked loss of momentum. The services sector is now also coming under pressure.

- Central banks take such developments into account in setting their mone-tary policies. They have stepped back from a commitment to rapid rate rises and have shifted to “fine-tuning”. This might involve modest rate changes and substantial pauses when it comes to changing rates.

- Yields on 10-year US government bonds have risen to 4.5%, reaching a 16-year high. Meanwhile, European and Swiss government bond yields have trended sideways.

- Equity markets are unsettled and are currently trading around 5% below their highs for the year (depending on the region).

- The US dollar is benefit-ing from the rise in US yields and looks set to make further gains. The Swiss franc is trending weaker.

- Gold has lately been rather stable despite rising US real interest rates. Oil prices have risen, reaching a high for the year around $95 a barrel.

Our macroeconomic assessment

Business cycle

- Most macro data from the US point to a continuing robust economy. This is driven in part by high government spending, which is keeping unem-ployment low and positively influencing consumer sentiment. Government spending has risen by US$ 1.58 trillion since the Federal debt ceiling was lifted at the beginning of June, bringing the national debt to over USD 33 trillion.

- But the USA is also showing the first signs of a slowdown. For example, industrial orders and the labor market, for which rising “underemployment” is reported, are weakening.

- The outlook for the Eurozone remains weak and is strongly influenced by developments in Germany. The composite purchasing managers' indices for Germany are falling. The correlation between the PMI and GDP growth has been high and points to negative growth for the third quarter

- As Germany is Switzerland’s largest trading partner, with a total annual trade volume around US$ 125 billion, the Swiss economy is impacted by the weakness of its northern neighbor.

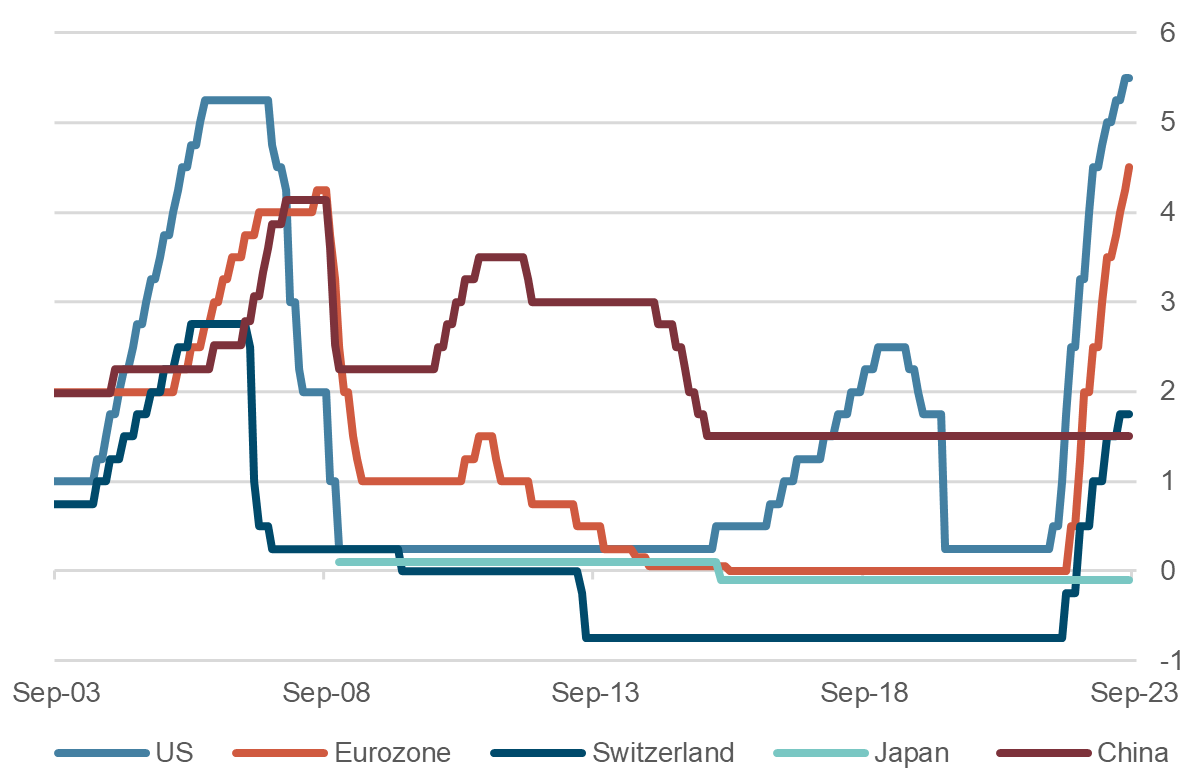

Monetary policy

- At its September meeting, the ECB was probably only just able to push through a 25-basis point increase in its key interest rates. The ECB’s move could be categorized as a "dovish hike“, perhaps signaling a pause with no further policy tightening for the foreseeable future. Meanwhile, mar-kets are now pricing in a first ECB rate cut by mid-2024. Given still high Eurozone inflation at 5.2%, this reflects a pessimistic assessment of Eu-rope’s economy.

Central bank policy interest rates, last 20 years

Source: Bloomberg Finance L.P.

- As had been expected, the Fed kept its key rate in a range of 5.25 to 5.50% at its September meeting. Commentators have called this a “hawkish pause“ as a further rate hike by year-end is not ruled out. The Fed has significantly raised its growth forecasts.

- The SNB and the Bank of England also decided to leave key interest rates unchanged. Because a rate hike had been expected in both cases, mar-kets gained short-term following these decisions. The SNB remains pre-pared to intervene in forex markets to steer the value of the Swiss franc.

- The Bank of Japan kept its key interest rate at -0.1%, putting further pres-sure on the already weak yen. However, the yield on 10-year Japanese government bonds has continued to climb and now stands at 0.75%.

Our investment policy conclusions

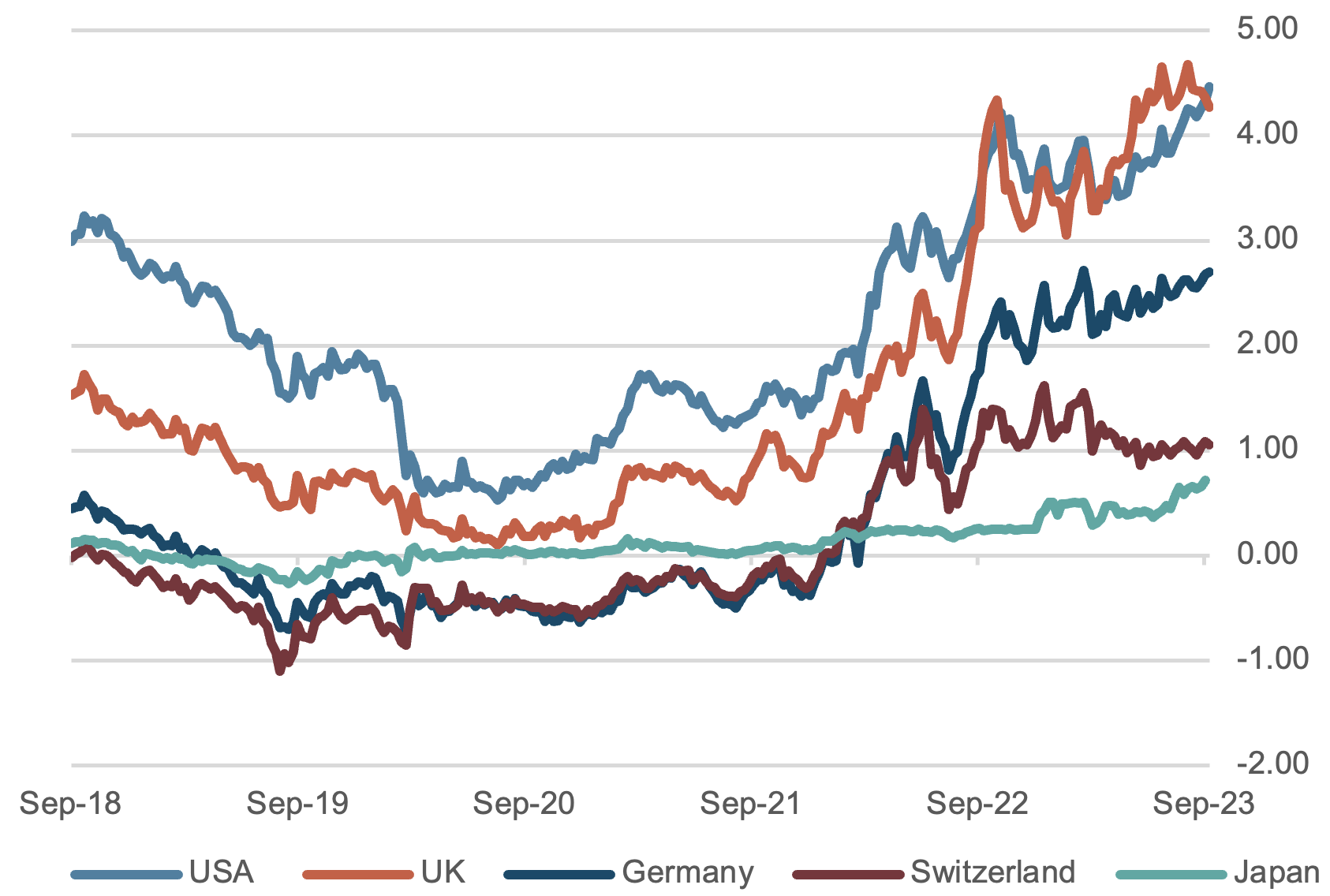

Bonds

- Yields on US government bonds continue to trend upwards. Currently, the yield on 10-year Treasuries is at 4.5%, a 16-year high. In Germany (2.7%) and Switzerland (1.0%), 10-year yields have been more stable. Broadly, the surprisingly "hawkish" statements by Fed Chair Powell after the last FOMC meeting have led to further declines in bond markets. Meanwhile, chart technicians are still looking for a break-out of yields to the upside, while the US yields have already managed to break out.

- Ever-increasing levels of US debt - in the government sector, the private sector and among consumers - are also viewed critically by investors. Moreover, the simmering dispute on Capitol Hill over the US budget is sending negative signals.

- In corporate bond markets, spreads have tightened slightly. Within corpo-rate bonds, we continue to favor the short to medium maturity range for new commitments due to the higher yields on offer.

10 year government bond yields in %, last 5 years

Source: Bloomberg Finance L.P.

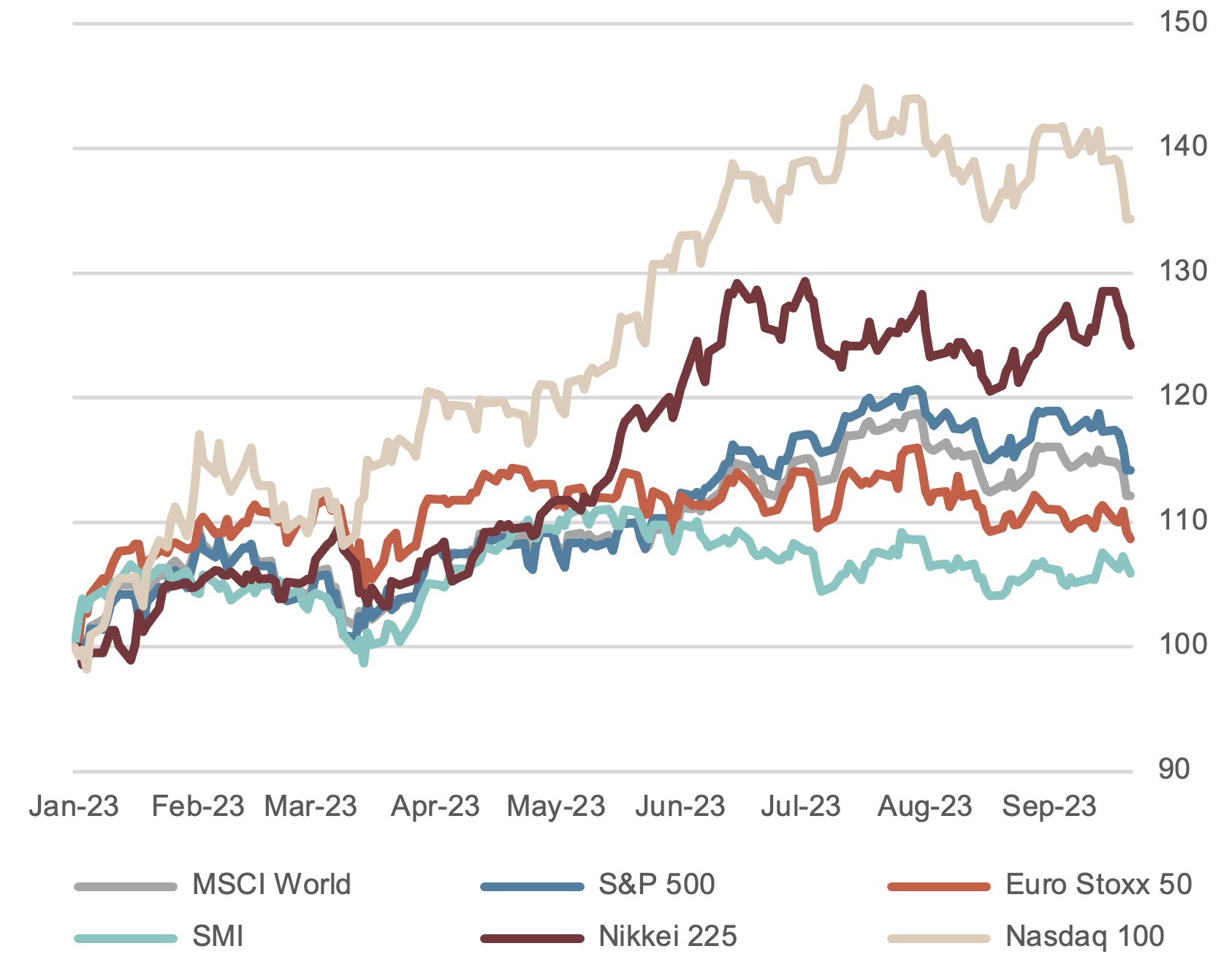

Equities

- Since the beginning of the year, stock markets have largely shown a positive trend, albeit with clear divergences between value and growth stocks. Overall, this good performance is surprising given the many uncer-tainties that could continue to weigh on markets.

- In the aftermath of the recent FOMC meeting, investors seem less posi-tive, something which manifests itself not only in weaker prices but also in increased volatility. Rising bond yields are weighing on already elevated valuations for “long-duration”, growth stocks. Also contributing to current uncertainty is Washington’s argument about the US budget, which should be settled by the end of September, otherwise a government shutdown looms.

- The Q3 corporate reporting season is eagerly awaited. Having underestimating the quality of earnings in the previous quarter, especially in the tech sector, the market now appears to have higher expectations for earnings this time round.

- We remain cautiously constructive on the equity markets and assume they will remain within the range that has existed for some time.

Equity markets, performance year to date, indexed

Source: Bloomberg Finance L.P.

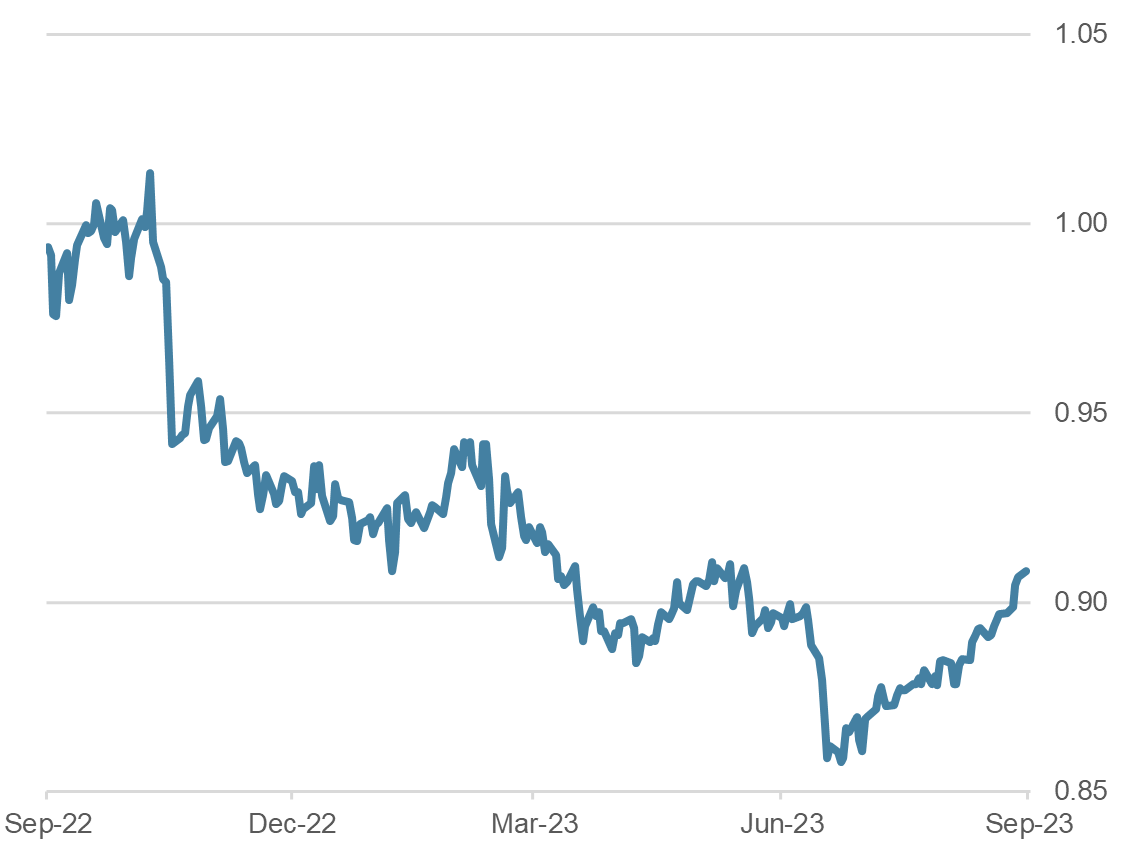

Forex

- The US dollar has appreciated by around 5% since the middle of the year, with a notable rise against the Chinese yuan. This is a consequence of the still-deteriorating situation in China and the series of interest rate cuts there. In contrast, the US economy continues robust, attracting capital flows and thus boosting the currency.

- At their meeting, BRICs countries were unable to agree on a new basis of trade, one which would not be financed via the US dollar.

- The Swiss franc remains in strong demand against most currencies. The EUR/CHF is currently trading at 0.9650, having gained just around 1% due to the SNB’s decision to leave its key interest rate unchanged.

- We continue to assume that the franc will appreciate in the long term due to its structural advantages over the euro.

Dollar vs Swiss franc, last 12 months

Source: Bloomberg Finance L.P.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.