Executive Summary

- We are sticking to our forecast for global economic growth of around 5.0% for this year. However, the growth rate has already passed its peak. For 2022, we expect growth of 4.0%.

- China is also facing weakening economic growth. Moreover, there are problems in the real estate sector.

- The Biden Administration is having difficulty finding Congressional majorities for its ambitious $3,500 billion spending package.

- The Fed wants to start reducing (“tapering”) its bond-buying programs in November.

- Federal Open Market Committee (FOMC) member interest rate forecasts (the “dot plots“) are consistent with one rate hike next year followed by three rate hikes in each of the following two years.

- The September FOMC monetary policy meeting and the indication that the Fed will begin tapering bond purchases later this year had only a marginal impact on the US dollar yield curve.

- The quiet sideways trend in the US dollar continues.

Our macroeconomic assessment

Business cycle

- Our key 2021 economic growth forecasts (with those for 2022 in brackets) are as follows: World: +5.0% (+4.0%), US: +6% (+4.5%), EU: +4.5% (+4.0%), Japan: +2.5% (+2.5%), China: +8% (+5.5%), UK: +5.5% (+4.0%), Switzerland +3.5% (+2.8%).

- The Chinese economy is experiencing a real estate crisis while being impacted by policies designed to combat moral hazard. Credit impulse, a measure of the extent to which credit is impacting economic growth, is currently rather low. We expect Chinese fiscal policy soon to become more expansionary again and credit reins to be loosened. Faced with a choice between “good governance with social unrest” or “stimulus and false incentives”, Beijing is likely to choose the latter. The potential consequences of the Evergrande crisis suggest swift action is essential to combat contagion to other property developers and Chinese banks. We expect this to happen. A (partial) nationalization of Evergrande is also possible.

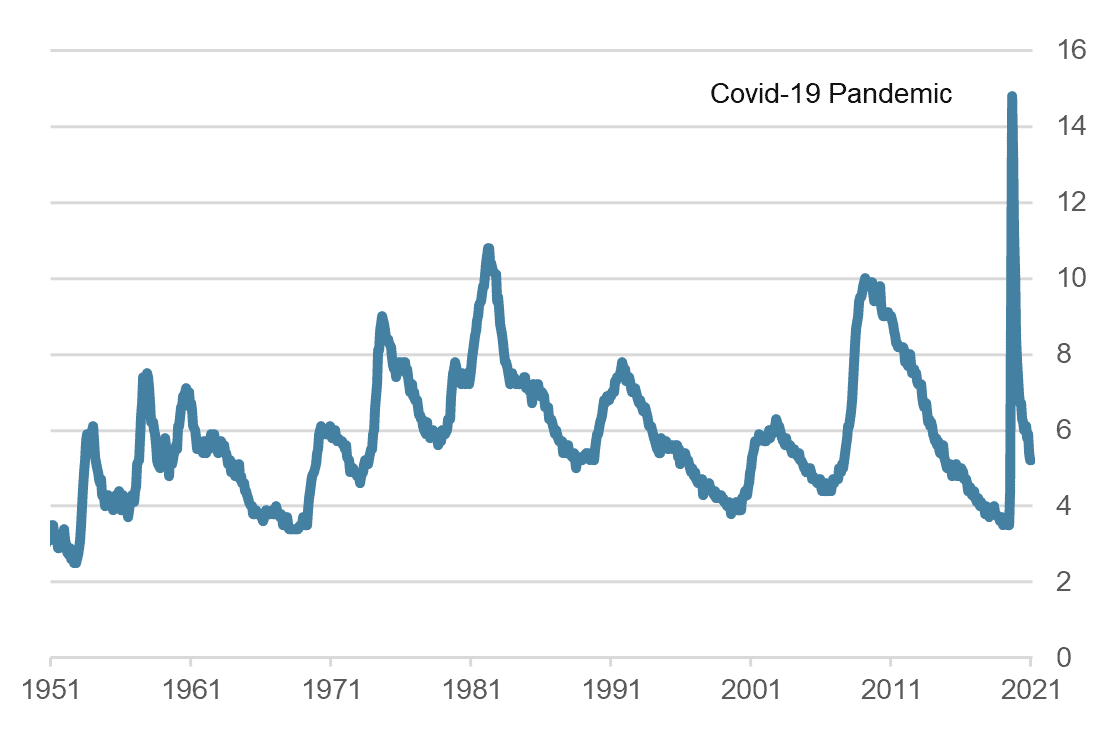

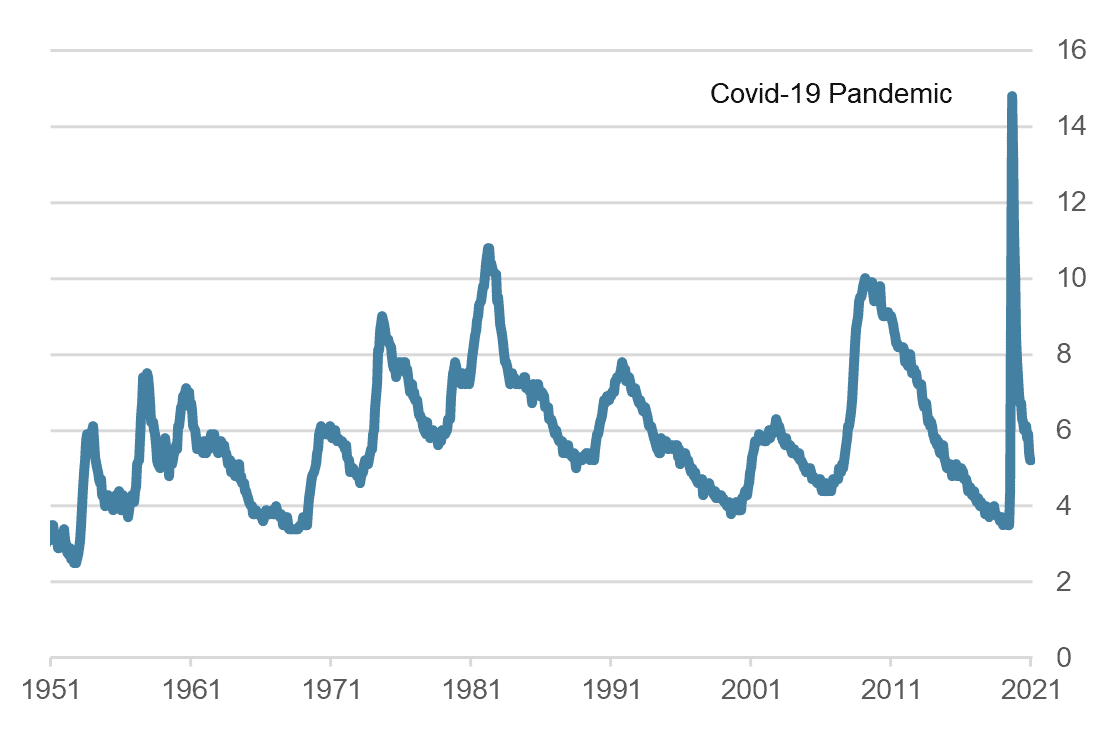

US unemployment rate, % since 1951 Source: Bloomberg Finance L.P.

Source: Bloomberg Finance L.P.

Monetary policy

- Fed Chairman Powell has indicated that the Fed’s bond buying programs might start to be scaled back in November and might be terminated around mid-2022. Half of FOMC members also expect a rate hike next year, with the other half only projecting rate hikes from 2023. FOMC member “dot plots” suggest three rate hikes in both 2023 and 2024.

- The financial markets are currently not assuming the Fed will achieve its tapering and rate hike targets. If the bond market really believed recent Fed announcements the yield curve would shift substantially. This has not happened so far.

- We side with the financial markets: The Fed’s plans for policy normalization are unrealistic and likely to fail sooner or later.

- In the short term, inflation rates are likely to approach or even exceed recent highs. But we note that economic growth has already slowed. Thus, less aggressive price increases are to be expected from now on in industries previously but no longer operating above capacity. A slowdown in inflation will also be helped by the expiry of base effects, especially in fuels and second-hand goods responsible for much of the recent rise in inflation. In the medium term, however, the threat of inflation will continue as central banks continue to expand their balance sheets and already swollen monetary aggregates continue to grow strongly.

Our investment policy conclusions

Bonds

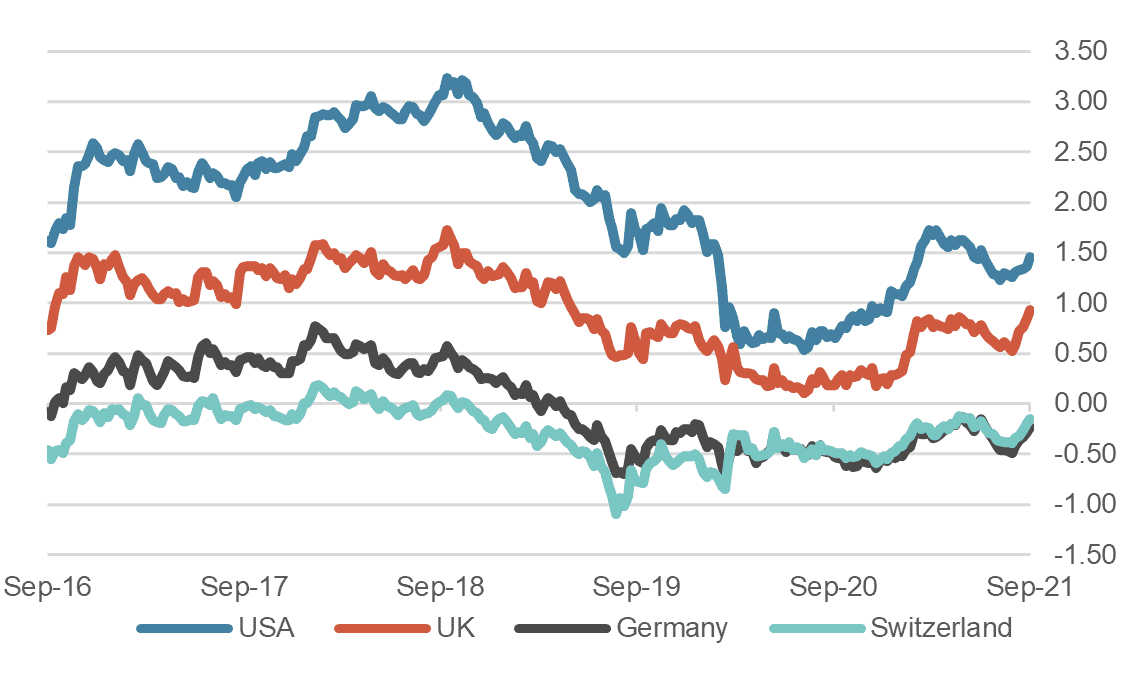

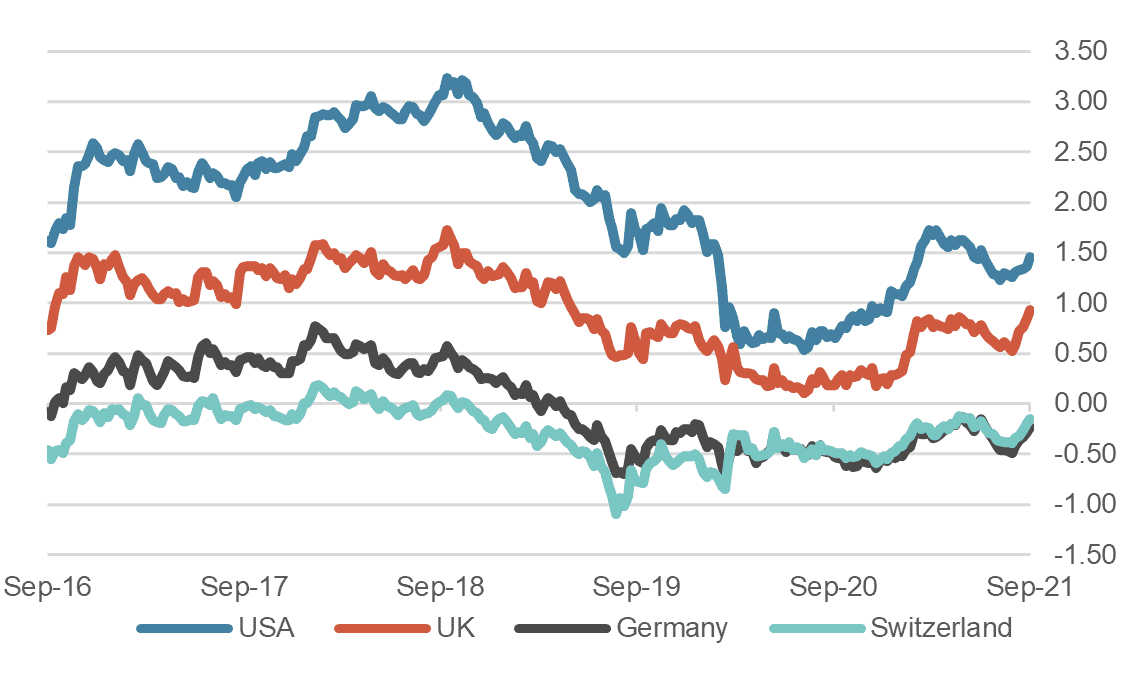

- The FOMC meeting and the indication of a start to tapering bond purchases being made this year had only a marginal impact on the US dollar yield curve. Contrary to widespread comment, the long end of the curve (long maturities) fell slightly initially, resulting in further curve flattening. In the meantime, yields started to rise again resulting in a steepening of the curve. For international investors from currency areas with negative interest rates, US government bonds are still a good alternative to their domestic fixed-income investments.

- In the long term, central banks in conjunction with finance ministries are still interested in issuing more freshly printed money and at the same time “inflating away” immense national debt burdens. For this reason, a scaling back of security purchasing programs will only take place in very tentative steps and will be liable to interruptions.

10 year government bond yields last 4 years, in %

Source: Bloomberg Finance L.P.

Equities

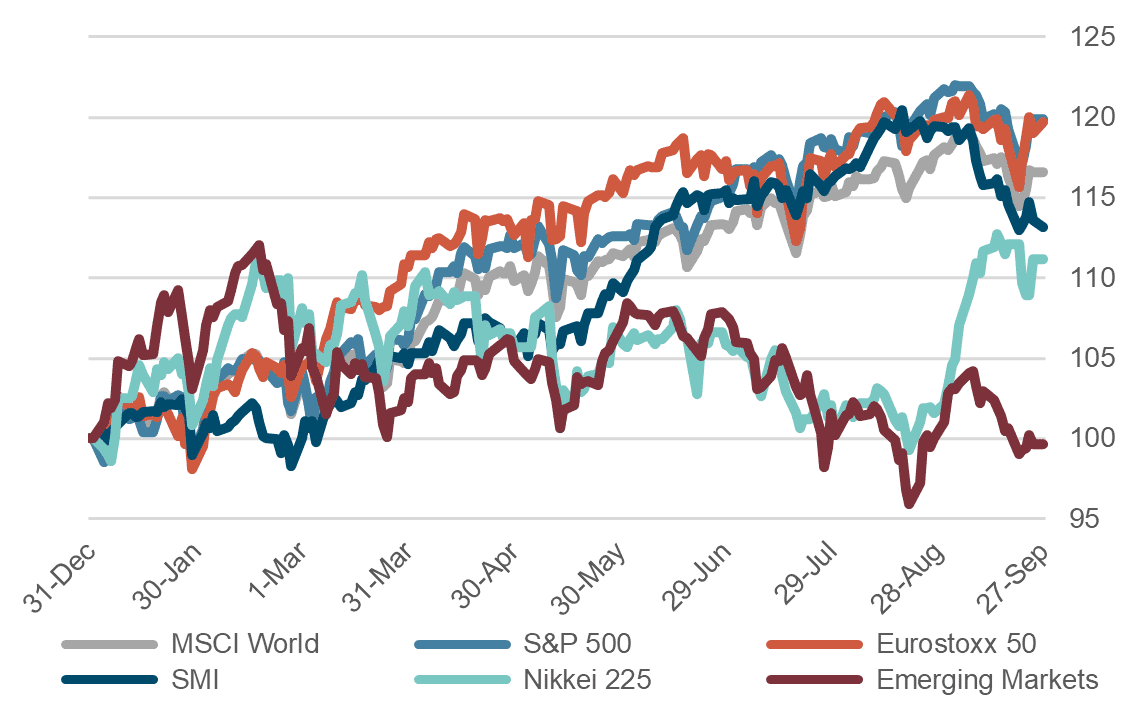

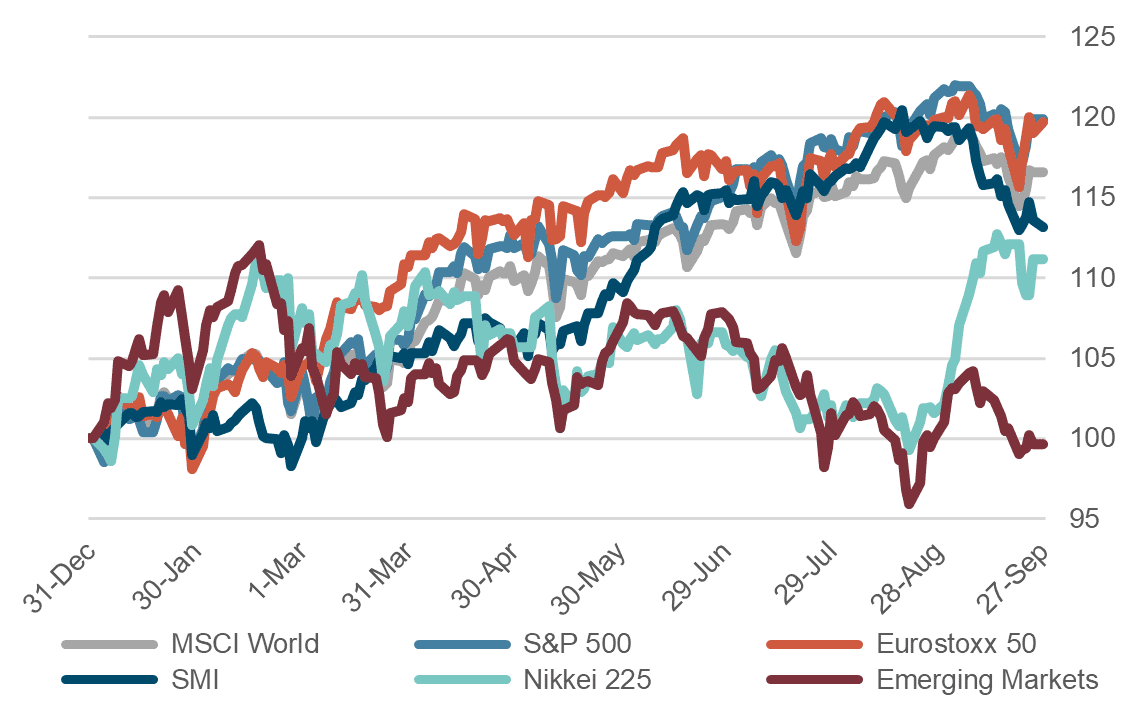

- The unease surrounding the giant Chinese real estate developer, Evergrande is justified although we do not envisage a “Lehman scenario” as is perhaps feared in some quarters. However, the Chinese government’s orchestrated liquidation of the illiquid conglomerate will shed light on how international investors are likely to be treated in future crises The first consequences of a paradigm shift in China, in the direction of a “turn inwards”, may already be visible. China no longer sees itself as a junior partner, rather an important “grown up”.

- Insgesamt befinden wir uns an den Aktienmärkten in einem weit fortgeschrittenen Zyklus. Das Wachstum der Zentralbankbilanzen ist einer der wichtigsten Treiber der Märkte geworden, Fundamentaldaten und Bewertungen spielen im Moment eine untergeordnete Rolle.

Equity markets, perfomance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

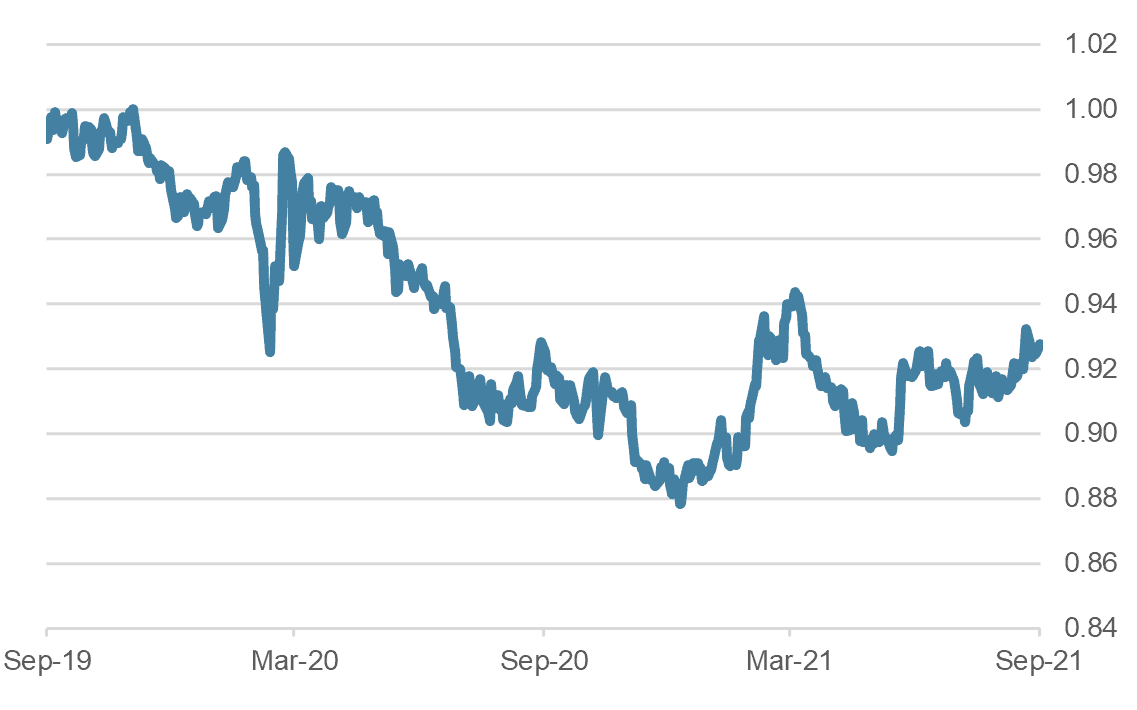

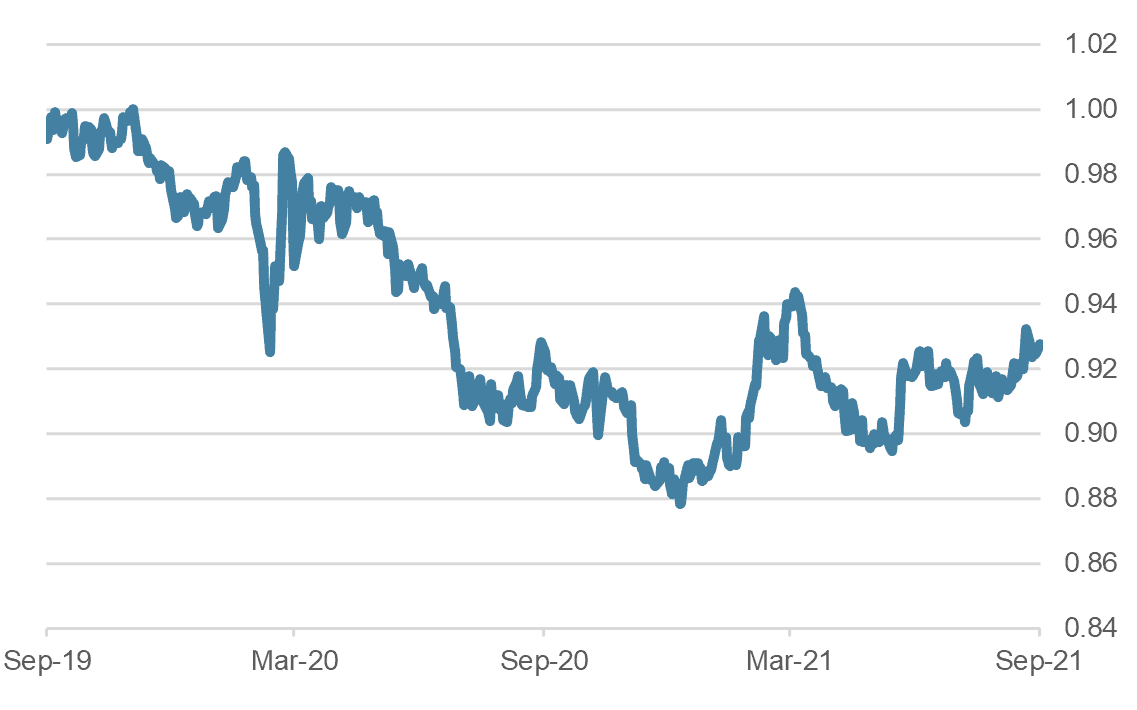

- The quiet sideways trend in the US dollar continues, accompanied by exceptionally low volatility. Although some members of the FOMC moved their interest rate forecasts upwards and more details on a “tapering roadmap” have become known, the impact on the greenback was small.

- This is mirrored by the ranges for the other currency pairs, which are very narrow. For the moment, we assume that the USD will continue to move in a sideways channel between 90 and 93 centimes against the CHF.

EUR/USD, last 2 years

Source: Bloomberg Finance L.P.

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.