Executive Summary

- We expect the world economy to contract some 4.5% in 2020 but forecast the recovery will produce 3.5% growth in 2021.

- Right now, the global economic recovery is losing some momentum because Covid-19 infections are rising again.

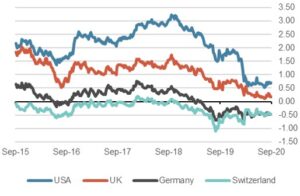

- The economic effects of the Covid-19 pandemic have forced practically all central banks to push their policy interest rates close to zero. These central banks are now following the path already taken by the ECB and the Bank of Japan.

- Yields on government bonds continue their consolidation phase. The Fed is buying around $120bn worth of government and other bonds per month.

- Through its purchases of corporate bonds the Fed is pushing down yields in the secondary market.

- Equity markets have started to correct with technology shares leading the declines. Markets are closing in on technical support levels.

Our macroeconomic assessment

Business cycle

- Our growth forecasts for 2020 (and 2021 in brackets) are as follows – World economy: -4.5% (+3.5%), US: -6.5% (+4%), EU: -7% (+5.5%), Japan: -5% (+2.5%), UK: -8% (+6%), Switzerland: -5% (+3%).

The economic recovery is continuing at a slower pace due to an impending second wave of the Covid-19 virus and statistical “base effects”.

- The US economy urgently needs another rescue package. Since July 31, nearly 30 million unemployed Americans have no longer been receiving their additional weekly benefit of $600 a head. Democrats and Republicans are fighting over the necessary size of a further package as well as aiming for votes in the US elections on November 3rd. Given the political strife in Washington it is becoming ever more likely that a new rescue package will only be agreed after the upcoming Presidential election.

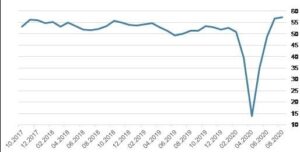

Purchasing Managers' Index for Russia

Source: Bloomberg Finance L.P.

Monetary policy

- The Fed has clearly communicated to the market the conditions that must be met for an initial rate hike: full or overemployment, inflation of at least 2% and the prospect of a moderate overshoot of the inflation target for some time.

- Interestingly, the markets were largely left in the dark about the other main tool in the Fed’s armory, the securities purchase and balance sheet expansion programs. However, it was communicated that securities purchases are going to be continued, at the current or a higher rate, for some time to come.

- The expansion of central bank balance sheets has led to a sharp rise in the supply of money and a collapse of spreads on riskier bonds. This has “forced” investors to increase portfolio risk, including through investment in stocks. Low credit spreads and high stock prices have helped companies to access much-needed capital and liquidity during the lockdowns.

- The purchase programs of the Fed and the ECB mean that real interest rates out to 10 years are zero or even negative for corporates, even though companies and governments have been issuing new debt at a record pace. Thus, fundamentally poor credits are being kept on life-support at the expense of economic efficiency.

Our investment policy conclusions

Bonds

- Central banks are still buying government bonds but demand for them is also coming from institutional investors again looking for “safe havens” as stock markets suffer another bout of profit-taking.

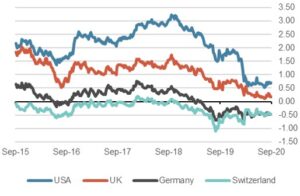

- But real yields in all currencies are now clearly in the negative range, making the entire asset class fundamentally unattractive.

The supply side is set to increase massively in coming months as the various fiscal support packages need to be financed. Moreover, the most important central banks have recently signaled that they are not currently planning an immediate expansion of their security purchase programs.

10 year government bond yields last 4 years, in %

Source: Bloomberg Finance L.P.

Equities

- After a massive rally in August and the first half of September, which was mainly driven by a few large technology groups and characterized by some unhealthy developments, disillusion has now set in. In recent weeks, various indicators had already pointed to the risk of a correction. The trigger was probably the rather cautious communication of the Fed regarding “support” for the economy from the monetary side.

- Fed Chairman Powell’s demand that politicians must now take further fiscal measures collided with the fact that Republicans and Democrats have been unable to agree on the scope of the CARES 2.0 package.

We are assuming markets will now have to go through a difficult phase. The longer the impasse, the less certainty as to whether and how there will be a result in the US Presidential election.

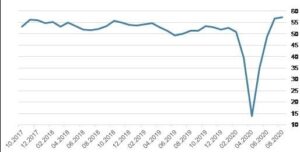

Equity markets, perfomance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

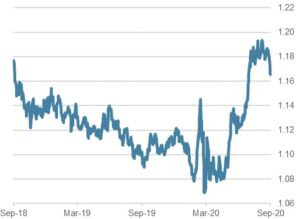

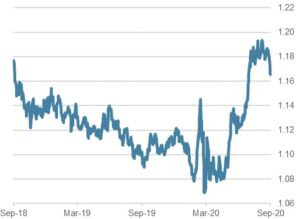

- Outstanding futures contracts betting on a falling US dollar reached record levels in September. So, with hindsight it is not surprising that a countermovement has now occurred, with the dollar rising in recent trading. One trigger for this could have been the communication from the ECB, which tried to weaken the euro after it rose above 1.20 on the EUR/USD. On the other hand, dollar purchases could be linked to the correction in stock markets. Both tendencies can be considered as part of a move to “risk-off”. Stocks are clearly risk assets and the dollar is often perceived as a haven when investor uncertainty rises.

- All central banks face a dilemma when their currencies appreciate. Currency appreciation is not welcomed in an economic world that can only generate growth via competitive devaluation.

- The EUR/CHF currency pair is now just below 1.08. Europe is currently not in focus as a source of headlines, so demand for the Swiss franc is only moderate.

EUR/USD, last two years

Source: Bloomberg Finance L.P.

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.