Executive Summary

- We expect the global economy to grow around 5.0% in 2021.

- Ultra-expansionary monetary policy had little or no inflationary effect during the periods of lockdown because of the collapse in the velocity of money circulation that was induced by those lockdowns.

- Now, with the reopening of the economy, consumers can again spend on services like travel and hotels. This will tend to increase the velocity of money circulation, increasing the risks of inflation.

- The Fed has adjusted its expectations for inflation and started to discuss “tapering”. The Federal Open Market Committee now projects the first rate hike in the next interest rate cycle as early as 2023 (instead of 2024 previously).

- Stock markets are experiencing abrupt shifts in sentiment but remain resilient.

- The September FOMC monetary policy meeting and the indication that the Fed will begin tapering bond purchases later this year had only a marginal impact on the US dollar yield curve.

- The process of rotation within stock markets looks set to continue.

Our macroeconomic assessment

Business cycle

- We expect global economic growth of 5.0% in 2021. Other key 2021 growth forecasts are as follows: US:+5%, EU: +3.5%, Japan: +2.5%, China: 8%, UK: +5.5%, Switzerland: +3%.

- The $2.3bn infrastructure package proposed by President Biden in March was opposed not only by Republicans but also by some Democrat senators. A deal between the Biden Administration and a bipartisan group of senators has just been announced on a smaller package, nearly $1 trillion over 5 years and $1.2 trillion over 8 years.

- However, there are several hurdles in the way of these proposals getting passed into law.

- We fear that the economic recovery could run into trouble within 2-3 quarters.

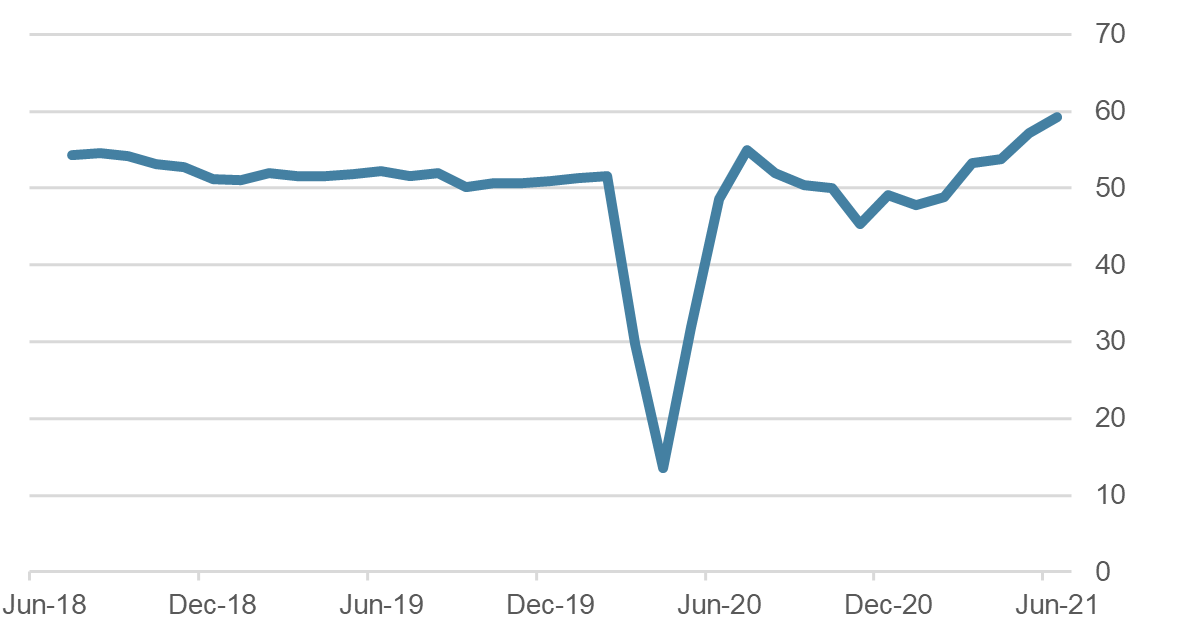

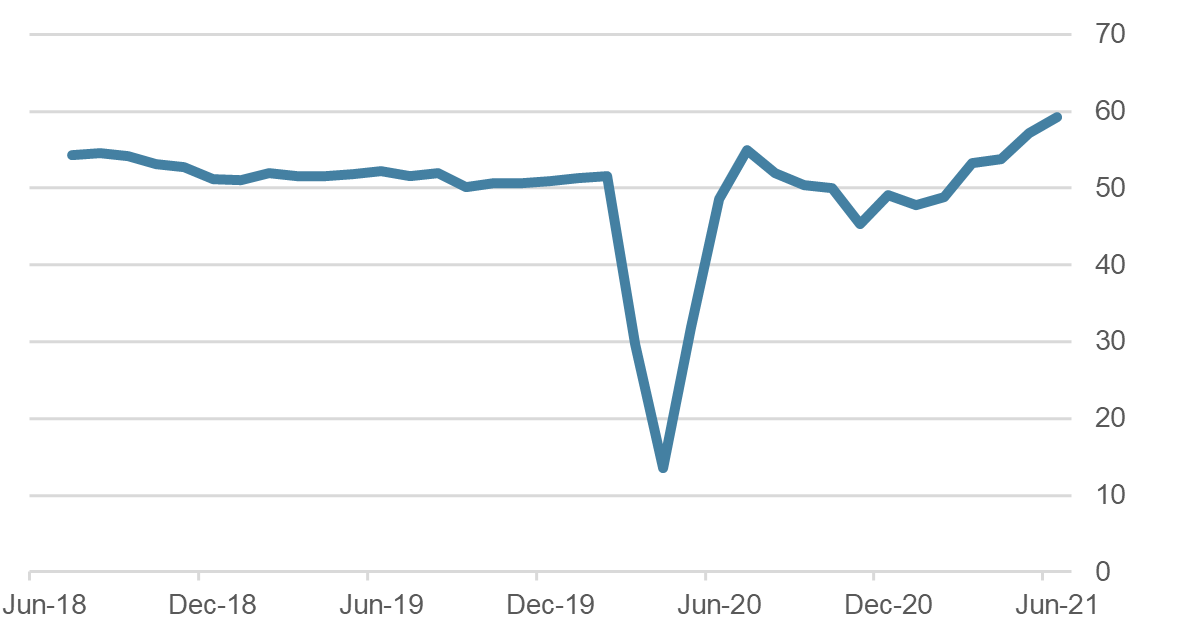

Euroland: Composite Purchasing Managers’ Index Source: Bloomberg Finance L.P.

Source: Bloomberg Finance L.P.

Monetary policy

- Inflation stayed low during the pandemic despite the rapid rise in the money supply. This is only because the velocity of money circulation collapsed during the pandemic. A large part of the newly created money flowed into financial markets and was saved rather than spent.

- Stubborn inflation is always a monetary phenomenon. Bottleneck inflation (as currently seen in microchips) is a short-term problem. Therefore, one should not be confused by central bank statements seeking to blame a higher inflation rate on factors (high oil price etc.) perceived to be not under their control.

- 11 out of 18 FOMC members now expect at least 2 rate hikes by the end of 2023.

7 FOMC members expect a rate hike already next year.

The Fed unexpectedly raised two (not so important) interest rates – the “reverse repo rate” and the “interest on excess reserves rate”.

- The Fed is slowly trying to prepare financial markets for a slightly less extreme, but still highly stimulative, monetary policy and faces an enormously difficult balancing act. The ECB and the SNB may also start discussions on a similar shift in monetary policy in the coming months.

Our investment policy conclusions

Bonds

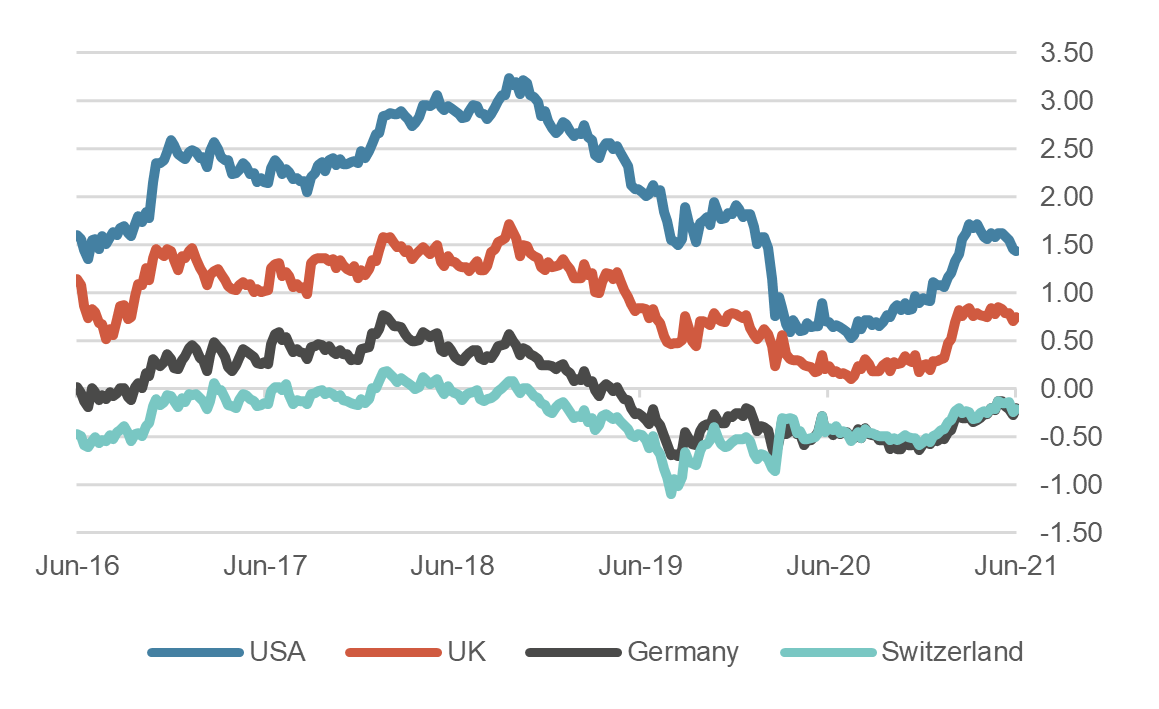

- At the FOMC committee meeting in mid-June, the tapering of the bond-buying programs was apparently discussed for the first time. In addition, and in contrast with previous Fed communication, it seems the rise in inflation has been stronger than expected. Therefore, estimates for the development of key interest rates (the dot plots) moved upwards modestly.

- In this context we saw a flattening of the yield curve, with yields rising slightly at the short end and a significant drop in yields at the long end, especially for 30-year maturities.

While the information put out by the Fed post the FOMC meeting came as a surprise to bond markets, the sharp drop further out along the yield curve suggests investors now believe that possible inflation-induced rate hikes will weaken the economy to such an extent that QE will have to be continued.

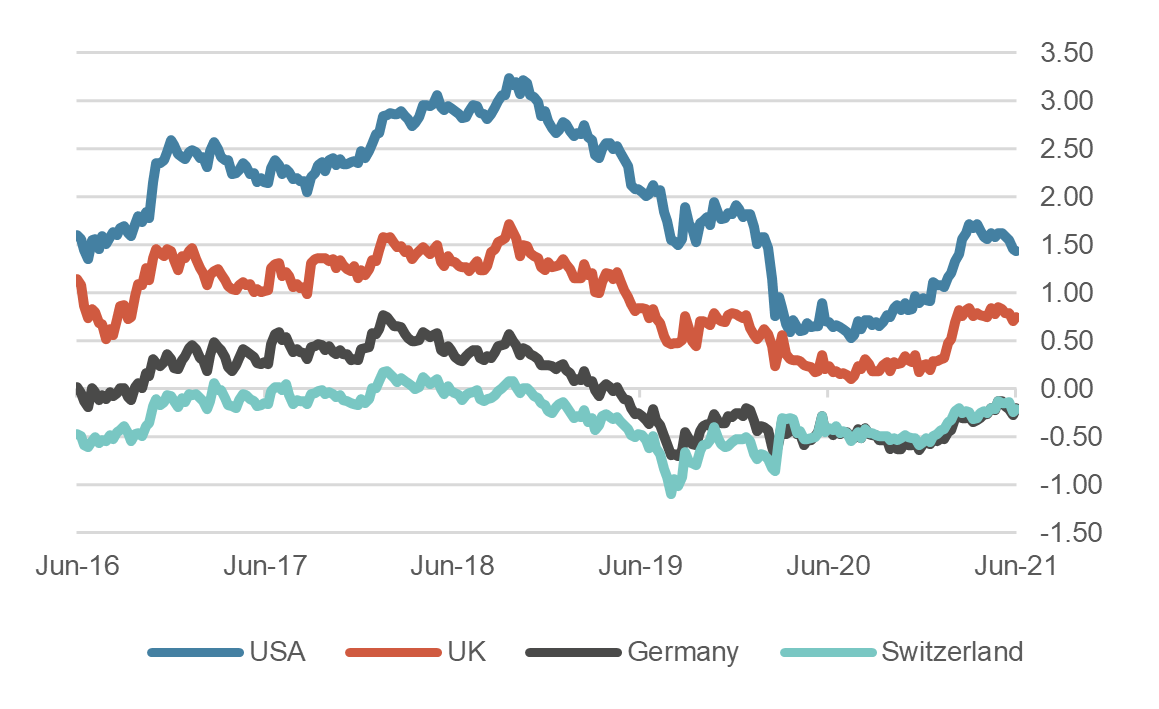

10 year government bond yields last 4 years, in %

Source: Bloomberg Finance L.P.

Equities

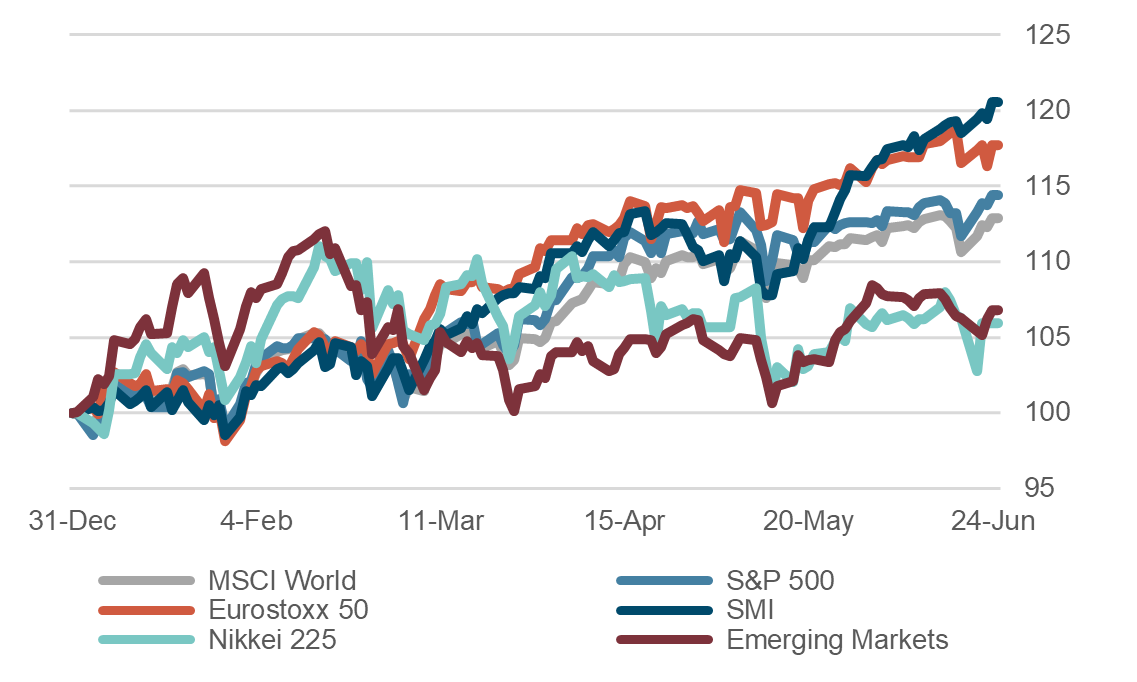

- The results of the FOMC meeting also led to a flare-up of volatility in stock markets although the performance of the major indices indicates that the situation soon calmed down again.

- Beneath the surface we see certain shifts. Cyclicals, commodities and banks (the reflation trade and the outperformers in recent months), have been trimmed. By contrast, stocks with a “long duration”, e.g., large caps in the tech/communications sector or utilities, have profited.

- We remain positive on equities, as their attractiveness as real assets and as a source of income (dividends) remains unbroken in the medium term. Consequently, we view setbacks on the stock markets as opportunities for additional purchases.

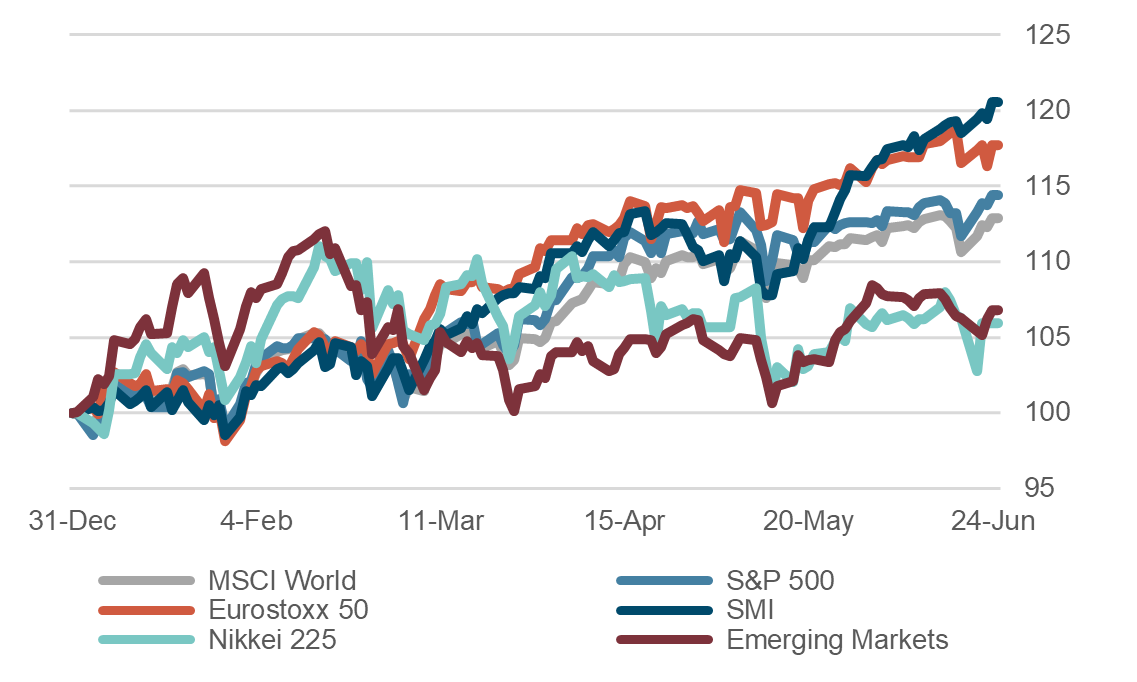

Equity markets, perfomance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

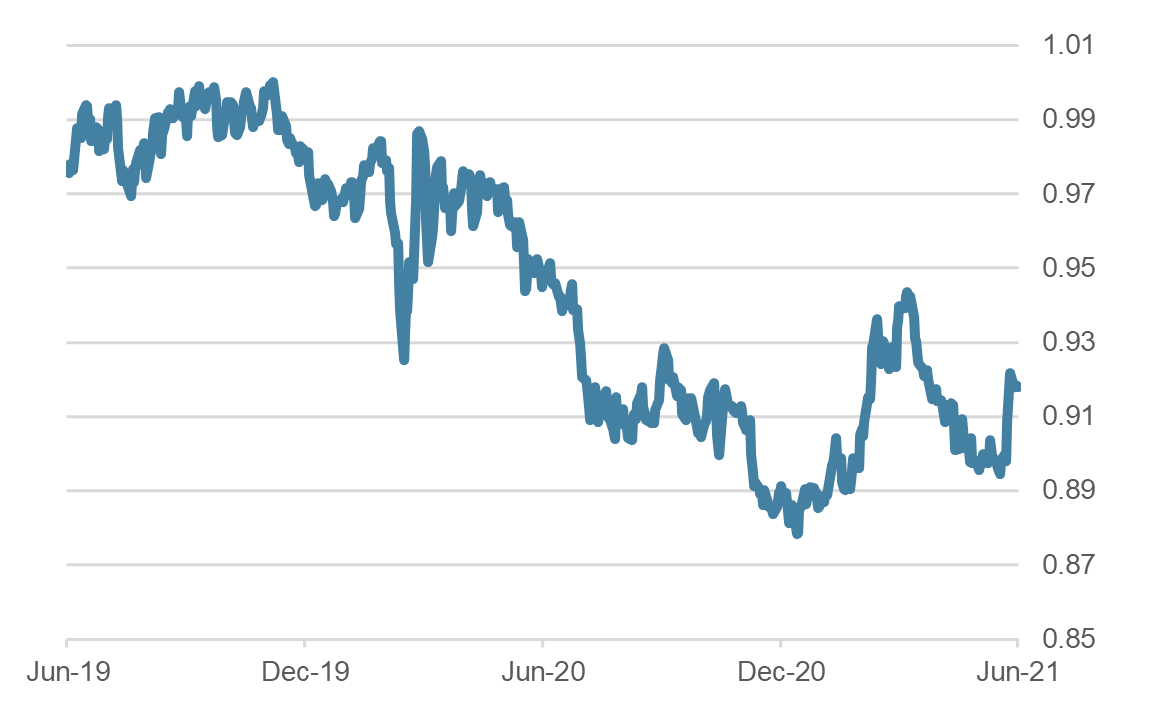

- The US dollar has reacted in a classic fashion to the statements from the June FOMC meeting. The shift to a flatter yield curve with somewhat higher yields at the short end has helped the US currency to gain around 2%. This would not normally be anything special but may be worth noting given recent rather stable currency markets.

- The Chinese central bank (PBoC) is not unhappy with this dollar rise as it removes pressure that had arisen due to the rising renminbi. However, the PBoC remains on balance restrictive and will probably continue to play its role in the Fed/PBoC “tandem”. This in turn gives the Fed leeway should it wish at some stage to move in the direction of tightening.

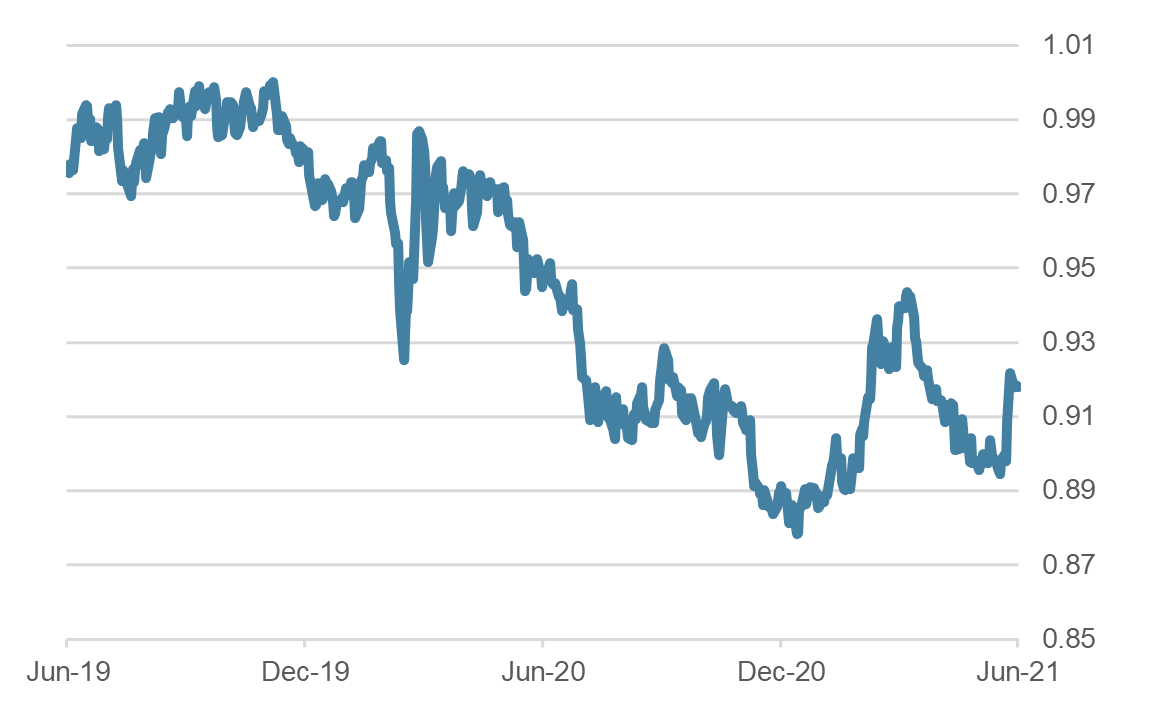

- We do not expect the USD to move substantially out of its downtrend. And we expect the price channel against the CHF (0.88/0.94) to continue.

EUR/USD, last 2 years

Source: Bloomberg Finance L.P.

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.