Executive Summary

- We expect the global economy to grow by -5% (+3.5%) in 2020 (2021). USA: -8% (+4%), EU: -9% (5.5%), Japan: -6% (2.5%), UK: -10% (+6%).

- Although the opening measures after the lock-downs lead to high growth rates in the short term, a V-shaped economic recovery is still unlikely.

- A significant rise in insolvencies cannot be prevented despite rescue packages and aggressive balance sheet expansion by central banks.

- The FED may introduce a control of the entire yield curve ("yield curve control").

- The development on the stock markets is at odds with the development of the macro indicators.

- Expectations of a rapid, "V-shaped" growth recovery have led to very high valuations in some cases.

- There is currently a period of calm on the foreign exchange markets.

- We continue to expect a positive scenario for gold.

Our macroeconomic assessment

Business cycle

- SECO expects a decline in sports event-adjusted GDP of -6.7% for 2020. The Federal Council has decided on an aid package of CHF 40 billion, which corresponds to around 6% of GDP. The Swiss national budget is solid thanks to the debt brake introduced in 2003, so there is no threat of a debt crisis. Switzerland is one of the countries with the best credit rating in the world.

- The US labor market came up with one of the biggest positive surprises in years in the latest releases: While the consensus expected the U.S. unemployment rate to rise from 14.7% to 19%, it fell to 13.3%. Nonfarm payroll jobs did not fall by 7.5 million jobs as expected. Instead, 2.5 million jobs were created. The financial markets celebrated this positive surprise with price fireworks.

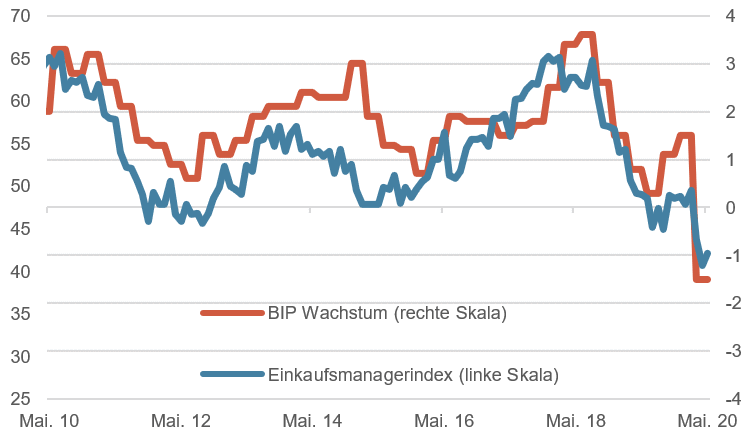

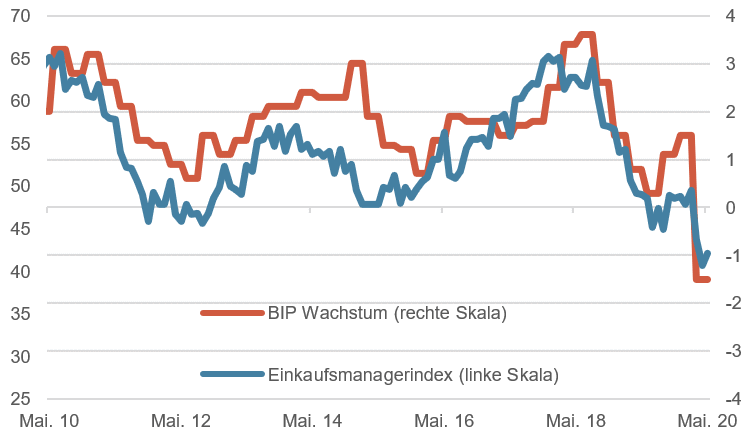

Switzerland Purchasing Managers' Index & GDP Growth, 10 years

Source: Bloomberg Finance L.P.

Monetary policy

- Many market participants expect the FED to fight a bear market in equities more aggressively than ever before. This expectation, together with the extremely aggressive expansion of the balance sheet and the creation of excess liquidity, explains why equities have risen so strongly despite what is expected to be the sharpest recession since the "Great Depression".

- U.S. short-term (T-bill) interest rates have never been as low as they are now, neither during the "Great Depression" nor during World War 2, when the FED simply dictated short-term rates.

- For the first time in months, the Fed's balance sheet shrank very slightly. The reason was that U.S. dollar swaps with other central banks decreased. This is a positive sign that the U.S. dollar funding squeeze is coming to an end.

- The European Central Bank has decided to expand its Pandemic Purchase Program (PEPP) by EUR 600 billion. The ECB is thus promising to buy bonds worth a total of EUR 1,350 billion. It was also decided to let the program run until mid-2021.

Our investment policy conclusions

Bonds

- At the moment, the discussion in the U.S. bond markets mainly revolves around the question of how the dramatically increasing supply of bonds due to the U.S. Treasury's fiscal programs can be absorbed. The FED is in principle a buyer of bonds (due to QE), but to a lesser extent. The rise in interest rates that is to be feared as a result of the oversupply must be prevented. The easiest way to do this would be with the so-called "yield curve control (YCC)", with which the FED imposes yields on the yield curve. Thus, there is no longer a market for price discovery.

- This strategy was already implemented in the USA in the 1940s. The aim was to "inflate away" the astronomical war expenditures via a phase of negative real interest rates.

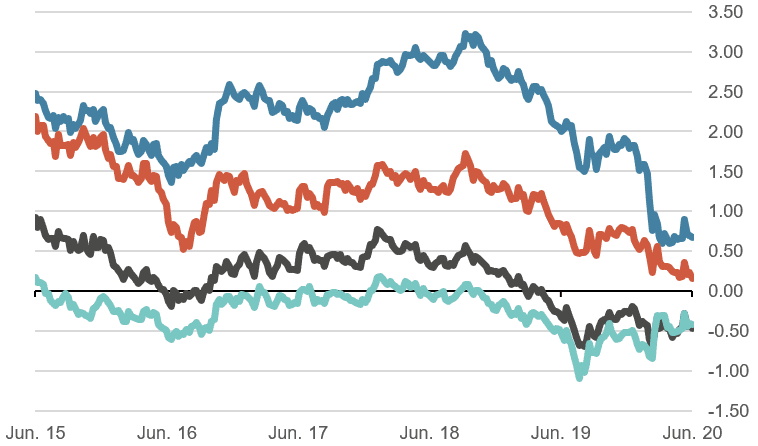

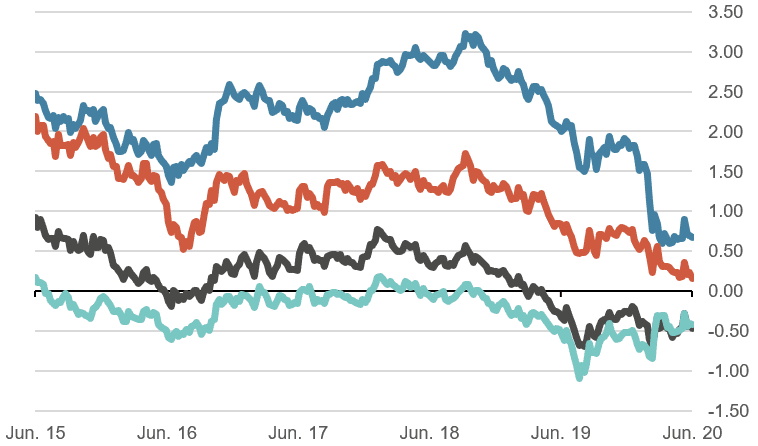

10 year government bond yields last 4 years, in %

Source: Bloomberg Finance L.P.

Equities

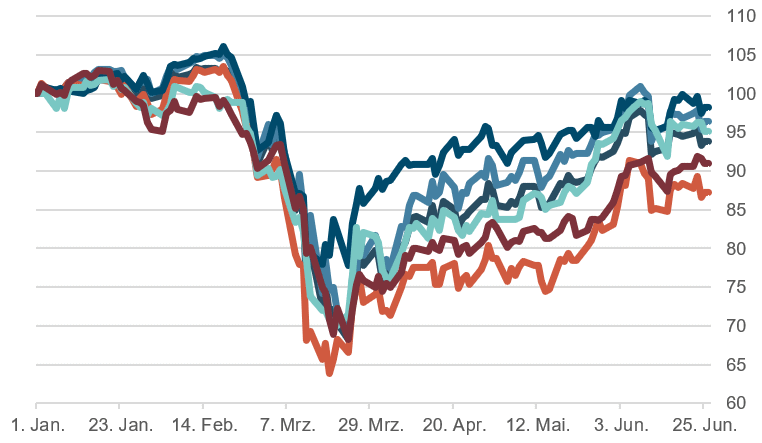

- Since the lows in mid-March, the world equity index has recovered by around 35%. This development is at odds with the economic outlook, as a large number of macro indicators are now signaling that there will not be a V-shaped recovery.

- An interesting criterion for the valuation of shares is the so-called Buffett indicator. Here, the total market capitalization is put in relation to the GDP. This ratio is again at levels as in the days of the "tech bubble". The valuations of the market are far advanced. Warren Buffet has also commented on this, emphasizing that there are currently no cheaply valued companies to buy.

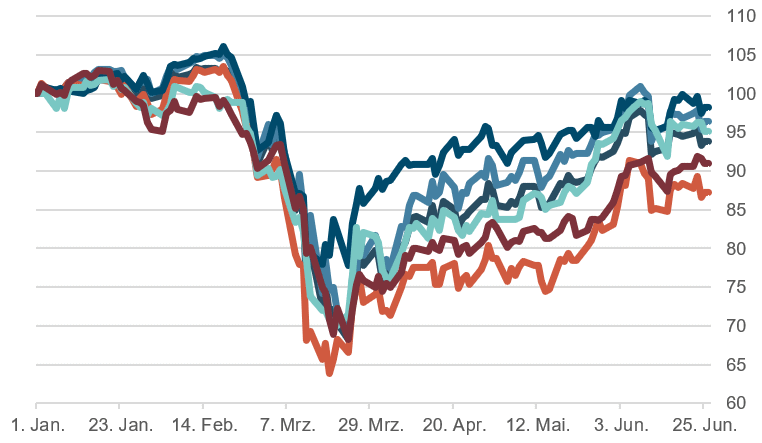

Equity markets, perfomance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

- The Swiss franc remains in demand in the current environment of increasing uncertainty in Europe. The SNB is again clearly more active in intervening, as shown by the latest statistics.

- The US dollar was only marginally changed against the other major currencies. Now that the "financing stress" in the eurodollar area has receded, there has been a clear easing. With its USD swap lines, the FED has taken over this task for very many central banks globally. The price for this is an even stronger dependence of these countries on the USD area. There are those who see this as a preparation for the introduction of the U.S. dollar as the "world currency.

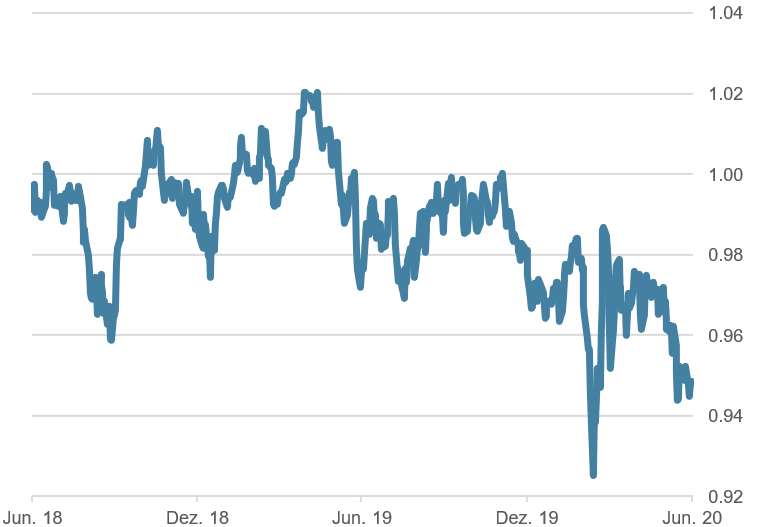

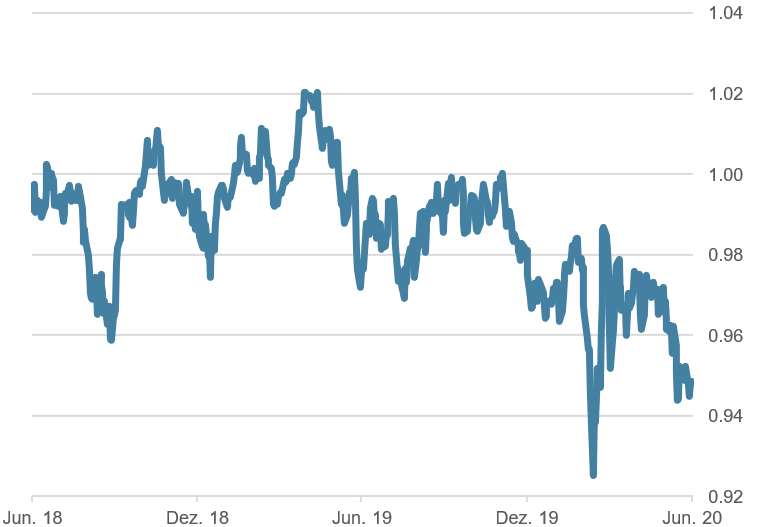

EUR/USD, last 2 years

Source: Bloomberg Finance L.P.

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.