Executive Summary

- We expect the world economy to grow by 3.0% in 2019.

- Our key regional and country growth forecasts are as follows: US: 2.2%, Euroland: 1.0%, Switzerland: 1.1%, China: 5.9%, Japan: 1.0%, UK: 1.0%.

- The US trade conflict with China has intensified, a peaceful resolution is not in sight.

- The ECB and the Fed have announced that they will switch to a more expansionary policy stance if inflation targets are not met.

- The face value of outstanding government debt posting negative yields stands at $12.5 trillion.

- Corporate bonds have become expensive and therefore less atractive.

- We are staying slightly underweight in equities for the time being.

- Gold has breached important technical levels to the upside. Looking forward, it should be in demand given the now lower interest rate expectations of investors and rising geo-political tensions.

Our macroeconomic assessment

Business cycle

- The global economy has continued to lose momentum. While service sectors have managed keep afloat and construction has grown in most countries, manufacturing has continued to suffer. We expect 3% growth for the world economy in 2019.

- The Eurozone‘s manufacturing sector continues to weaken. This and the intensification of trade hostilities between the US and China cause particular problems for Germany (on account of the high export share in its GDP) and for Italy (whose industrial sector accounts for a large portion of the economy in value added terms). The latest business cycle indicators, for example the ZEW index for Germany show no improvement.

- The May reading for China’s business confidence index was a disappointing 49.4.

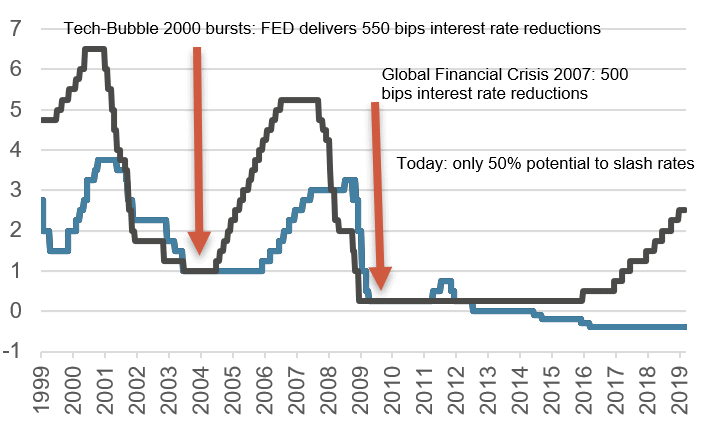

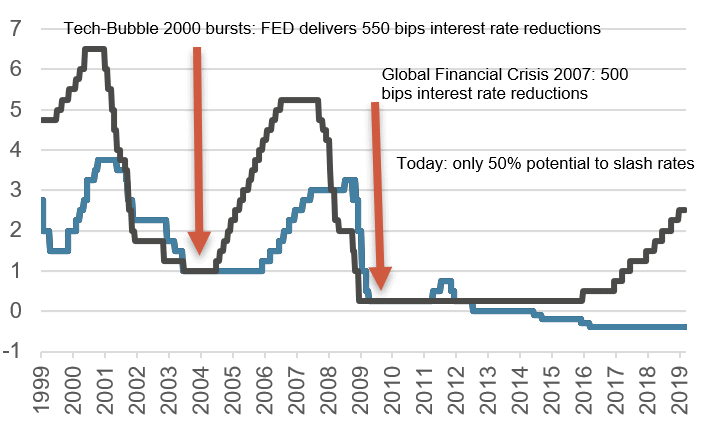

Fed and ECB policy interest rates since 1999

Source: Bloomberg Finance L.P.

Monetary policy

- The Fed‘s Open Market Committee (FOMC) met over June 18 and 19 but produced little in the way of surprise. Already, in early June, Fed sources had suggested that US interest rates were likely to fall. Markets are now pricing in an interest rate cut following the July FOMC meeting with a further one or two cuts before the end of the year. As it did in January, the Fed has reacted to a marked fall in expected inflation rates. It seems that the Fed will do all it can to avoid what has happened in Japan and in parts of Europe – namely falling inflation rates triggering falling inflation expectations.

- We forecast two 25 basis point US interest rate cuts before the year end. Should this happen, the US dollar could well come under pressure as the ECB would probably not fully match the Fed’s rate cuts. The dollar is in any event somewhat overvalued, and a declining US interest rate differential would support a correction.

- ECB Chairman Mario Draghi surprised markets on 18 June with his announcement that stimulus would be increased were the ECB´s inflation target to be missed in the future. This suggests an increased likelihood of a rate cut and a resumption of balance sheet expansion in the coming quarters.

Our investment policy conclusions

Bonds

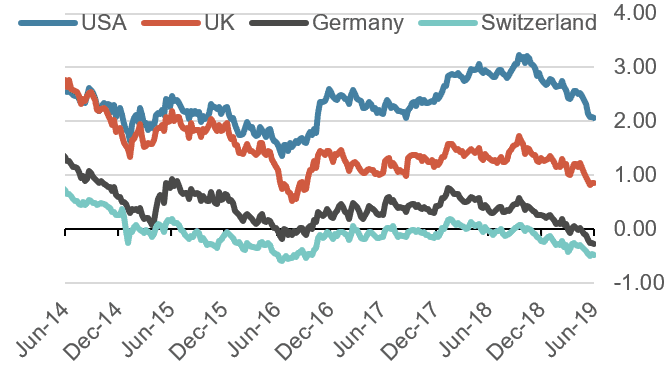

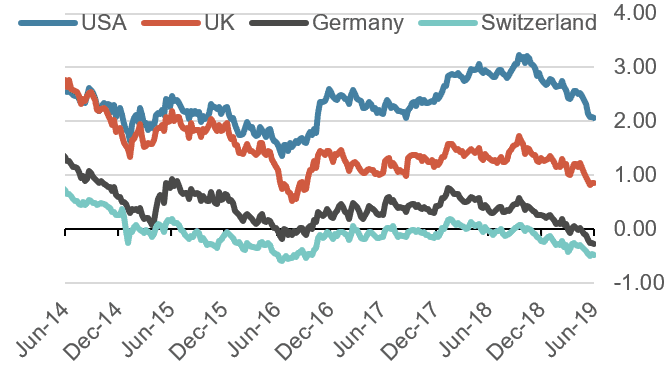

- The decline in bond yields since the start of the year has continued and has even accelerated following recent remarks from the Fed and the ECB. Markets seem in the grip of a general tendency to even lower yields. “Core” European bond markets are now even more substantially in negative yield territory, something that has made bond investment extremely difficult.

- Worldwide, the face value of outstanding government bonds that are currently posting negative yields is around $12.5 trillion. This greatly favors governments at the expense of investors. (Often grossly) indebted states can refinance and service their debts on extremely favorable terms while investors, above all in the benchmark institutional sector, are deprived of income as a result of the negative yields they are obliged to accept for top quality bonds.

10 year government bond yields last 4 years, in %

Source: Bloomberg Finance L.P.

Equities

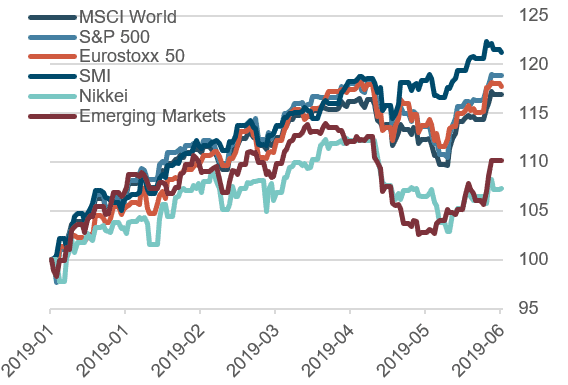

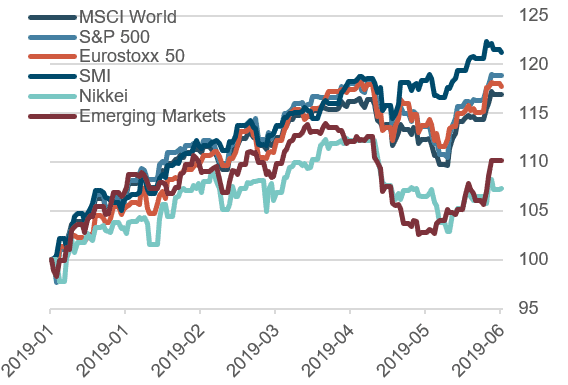

- The major equity markets, with year to date performances between 15% and 20%, are now strongly in positive territory. But there are exceptions – notably Japan and emerging markets, which have taken a hit as the US-China trade conflict has intensified. The speed of some recent falls among emerging markets does catch the eye. But we note that Germany’s DAX index has been able to stay among the best performers despite Germany’s export orientation. And the performance of the Swiss SMI, which has been boosted by the strong showing of some defensive heavyweights, is very encouraging

- We think markets will continue to be impacted by trade hostilities. And President Trump’s Twitter feed is not helping in this respect. Probably a sustained further rise in equities needs better trends in macro data as well as more confidence in the earnings power of companies.

Equity markets, perfomance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

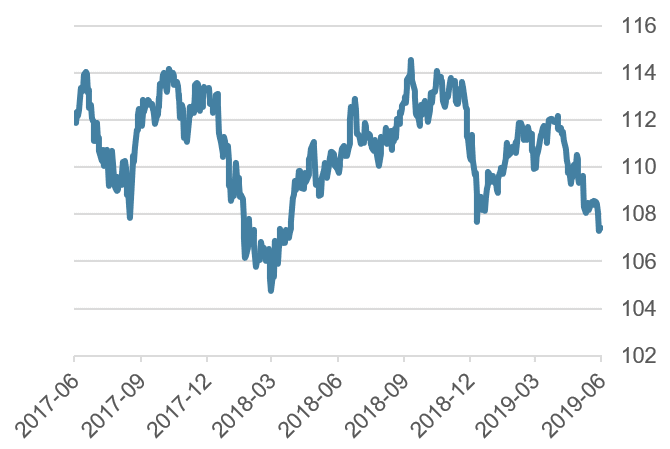

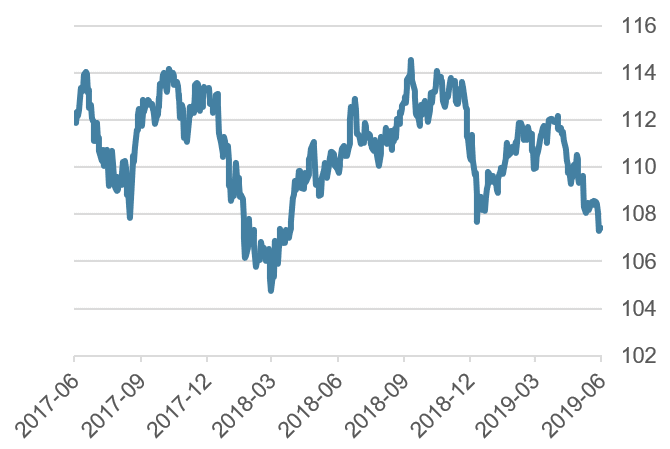

- On the whole we continue to think that the US dollar will move sideways, even though it has come under pressure following the Fed’s FOMC meeting on June 18 and 19. The surprisingly “dovish” tone of recent Fed communication has left its mark on forex markets. Especially against the yen a marked weakening of the US currency has occurred. The weaker dollar is very welcome in Mr. Trump’s White House.

- The Chinese yuan has appreciated of late. This can be seen as a reward from China to Washington for reacting positively to suggestions of a resumption in trade negotiations.

- The EUR/CHF has come under modest pressure recently, partly in the context of greater Brexit uncertainty and the sense that a “hard Brexit” has become more likely. But developments in Italy (the possible introduction of Treasury mini bills, or mini bots, which some think could create a parallel currency to the euro, as well as the threatened resignation of Deputy Prime Minister Salvini) mean an increase in investor uncertainty, which almost always favors the Swiss franc.

USD/JPY, last two years

Source: Bloomberg Finance L.P.

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.