Executive Summary

- We expect global economic growth of -1.0% in 2020.

- Due to the COVID 19 coronavirus outbreak in all parts of the world and large-scale quarantine measures, we had to revise growth forecasts sharply downward.

- It is already clear that economic growth will suffer a slump, particularly in the first half of the year. However, we must also assume that full-year growth will also be negative in many regions.

- All over the world, attempts are being made to prevent insolvencies with huge rescue packages. When the long road to normality begins in hopefully 2-3 months, the companies must be solvent!

- The huge rescue packages have to be financed. Central banks and private investors will have to step in. This is likely to push up bond yields.

- We continue to keep the equity quota slightly underweighted and remain patient for the time being. We would use further setbacks to make additional purchases.

Our macroeconomic assessment

Business cycle

- We expect global economic growth of -1.0% in 2020. The COVID-19 coronavirus has led to a partial standstill in economic activity in large parts of the world. It is a combined supply and demand shock. A sharp recession can no longer be prevented in most countries. The decisive factor for further development will be how quickly the numbers of new infections can be reduced and the quarantine measures can be lifted.

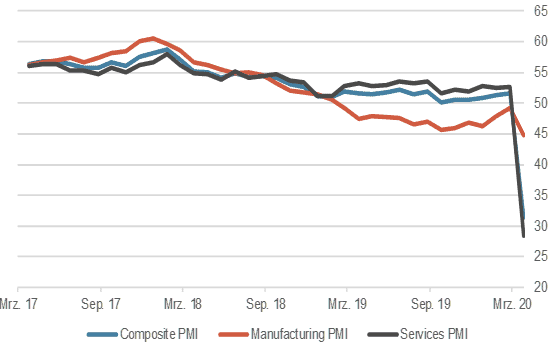

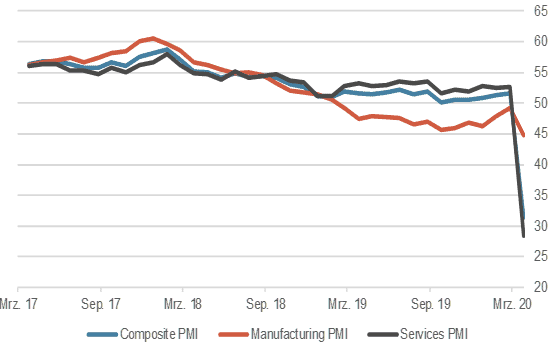

- The Purchasing Managers' Index for the euro zone collapsed to 31.4, the lowest level since July 1998. In the UK, the Purchasing Managers' Index fell to 37.1, a more dramatic drop than during the global financial crisis. In the USA, the overall index fell to 40.5 (February: 49.6), consensus: 44.

Eurozone Purchasing Managers' Index, 3 years

Source: Bloomberg Finance L.P.

Monetary policy

- The coronavirus represents the biggest supply shock in living memory, as an ever increasing proportion of the working population cannot work productively, but is in isolation / quarantine, worldwide. Unfortunately, the central banks are completely powerless against this.

- But they can help prevent an unprecedented wave of insolvencies by providing support to prevent a credit crunch. This can buy valuable time until the rescue packages that fiscal policymakers are putting together can be implemented and take effect.

- Central banks can react immediately; fiscal policy rescue packages take time. In this sense, central banks are still very powerful, even when the key interest rate is already "zero" and balance sheet expansion programs have been initiated. It is wrong to think that central banks can do nothing more. They must act as lender of last resort to prevent a system crash by collaborating on huge bailout packages. This goal can be achieved!

- The ECB will buy bonds worth €750 billion by the end of the year and offer banks extremely favorable financing conditions. The FED bought almost $600 billion worth of U.S. bonds (3% of U.S. GDP).

Our investment policy conclusions

Bonds

- The government bond markets have been subject to wild ups and downs in recent days. The shifts in correlations between asset classes triggered by the crash also affected government bonds. Thus, at one point, investors simply sold them to create liquidity.

- Following the resumption of massive government bond buying programs by central banks, the scale of which has never been seen before, there is somewhat less of a flurry of activity. The FED has now already inflated its balance sheet to USD 4,600 bn, and a further significant increase is certain.

- On the other hand, government fiscal programs of colossal size will be financed via the bond markets, leading to a gigantic supply of bonds.

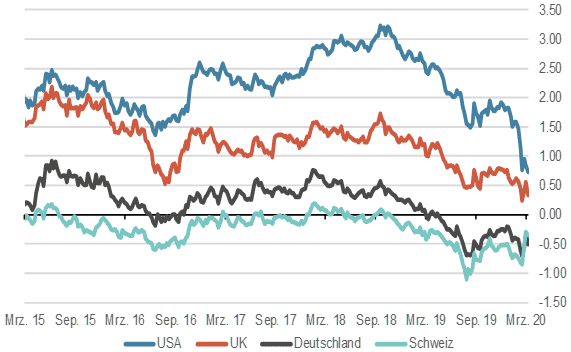

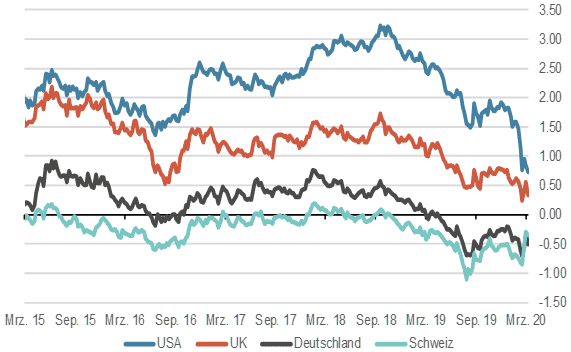

10 year government bond yields last 4 years, in %

Source: Bloomberg Finance L.P.

Equities

- The crash on the stock markets was intensified by the forced reduction of leveraged positions (so-called "margin calls" were triggered). Analysts estimate that up to USD 12,000 billion in margin calls had to be raised for such positions, leading to the sale of assets in all asset classes. In addition, the market is of course reacting to the dramatically deteriorating macro situation. Uncertainty is huge, as no one is able to predict how the shutdown will affect corporate balance sheets and profits in large parts of the global economy.

- We will slowly start to increase our underweight in the equity quota again somewhat. Our focus is on companies in the US and Switzerland. We consider the technology, pharma/health and consumer staples sectors to be interesting.

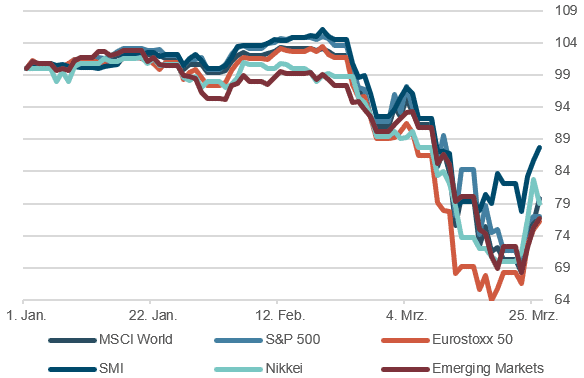

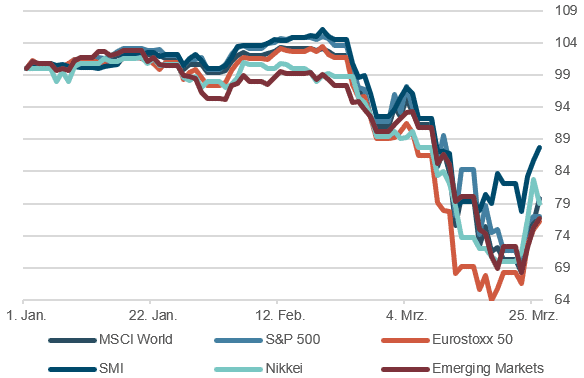

Equity markets, perfomance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

- In line with the huge dislocations in all asset classes, major currencies have also been more volatile. The U.S. dollar initially came under pressure, but was then in strong demand as a result of the huge demand for USD liquidity to service margin calls. The swap lines with all major currencies now made available by the FED without limit have eased the problem somewhat. In the crisis, the USD is emperor, this was confirmed again this time.

- However, the discussion about currencies may have to go in a different direction due to astronomically increasing national debts. How far is the system of fiat currencies at all resilient before they are finally called into question? A decline in confidence could have disastrous consequences. Credit default swaps for the U.S. have risen from 15 to 25 basis points over the last few days.

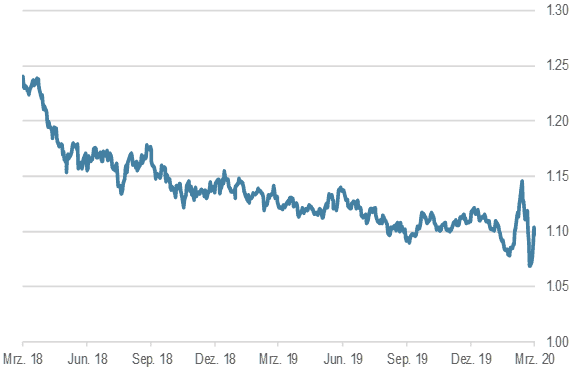

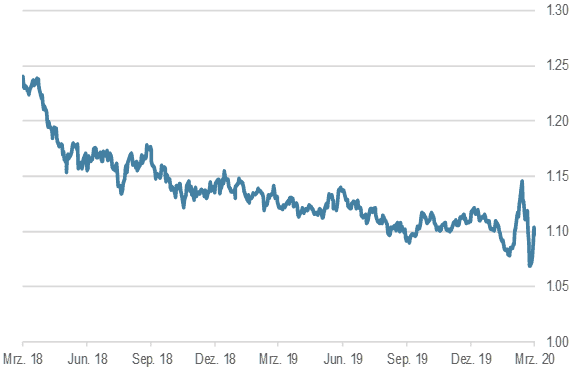

EUR/USD, last two years

Source: Bloomberg Finance L.P.

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.