Executive Summary

- We expect the world economy to grow by 3.0% in 2019.

- Our key regional and country growth forecasts are as follows: US: 2.2%, Euroland: 1.0%, Switzerland: 1.3%, China: 5.9%, Japan: 1.0%, UK: 1.3%.

- The slowdown in growth reflects principally trends in the manufacturing sector. Service sectors are in general holding up.

- The ECB is not expected to raise its rates before next year.

- The US yield curve is signaling a weakening of the economy.

- If economic trends do not improve soon, equity markets will become increasingly vulnerable to a sell-off.

- But strongly oversold conditions could provide attractive tactical opportunities for equity purchases.

- Gold is now performing better due to changing expectations on the future path of US interest rates and the US dollar.

Our macroeconomic assessment

Business cycle

- The US cannot escape a cooling global economy. And we forecast lower US growth for this year – at around 2.2%. The Fed and the Trump Administration are doing all they can to extend what is already a very long period of expansion. Now nearly 10 years old, the present upswing is already close to beating the previous record of 120 months (from March 1991 to March 2001, trough to peak) as reported in NBER data.

- Parts of the Eurozone, especially the industrial sector and parts of Europe’s periphery are already in recession. But service sectors are doing better. We now forecast the Eurozone growth rate at 1% for 2019.

- The IFO Business Climate indicator, one of the most important leading indicator for the German economy, rose in March to 99.6 compared with 98.7 in the previous month. This points to some stabilization after several months of slowdown.

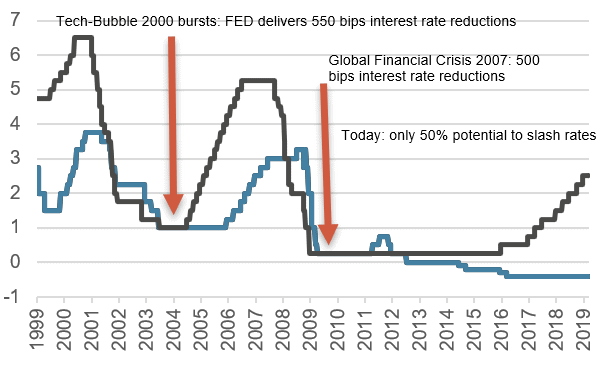

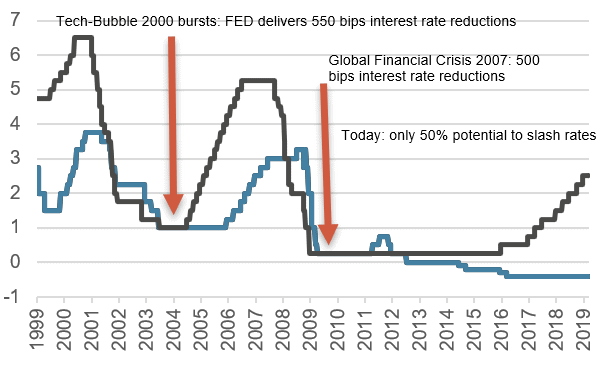

Fed and ECB policy interest rates since 1999

Source: Bloomberg Finance L.P.

Monetary policy

- Given the noticeable slowdown the Fed has shifted its monetary policy away from “normalization” and back to being “data dependent”. Probably the performance of financial markets was the key factor in this shift. The Fed does not want the US stock market to fall substantially. The message for investors is that Fed policy is indeed “data dependent” but the dependence is rather on the behavior of the financial markets. In our view, the Fed has decided to adopt an additional policy objective – namely to keep the equity markets from tumbling.

- Specifically, the Fed has communicated that its balance sheet reduction will be slowed from May and terminated from September. Meanwhile Fed guidance indicates no further interest rate rise this year.

- The Eurozone economy is so weak that the ECB has revived its long-term emergency credit scheme (TLTRO) to provide cheap finance to Europe’s banks. The ECB has said that the slowdown in the Eurozone has been steeper and more widespread than it expected. The change of view is reflected in the cut in the ECB’s 2019 growth forecast – from 1.7% to 1.1% – and the announcement that Eurozone rates will not rise until 2020 at the earliest.

Our investment policy conclusions

Bonds

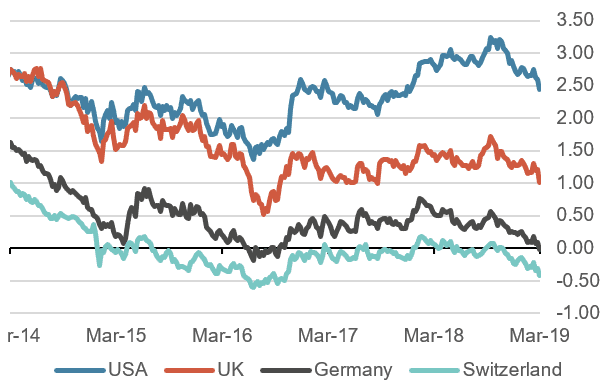

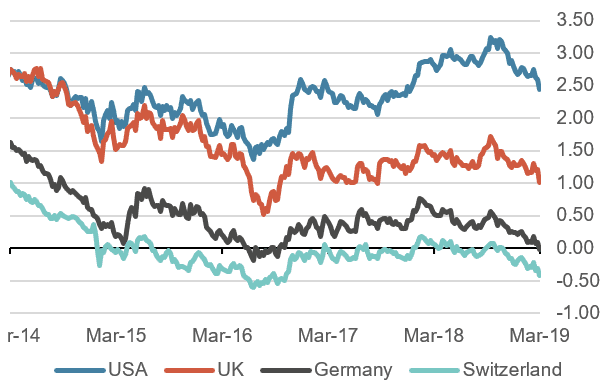

- Weakening trends in global macro data have led to a renewed flattening, and even a partial inversion, of the US yield curve. This development has been supported by very cautious statements coming out of the Fed, especially with regard to the global economy. The Fed’s emphasis on the risks to growth, and the fact that inflation continues not to accelerate, have encouraged investors to buy US Treasuries.

- There is also a clear trend in European bond markets. In both core and peripheral markets, yields have declined significantly. Here too, the central bank has played a key part in influencing markets. The ECB has clearly pointed out the trend to weaker growth and has insisted that its policy tool kit contains further instruments to support Europe’s economy.

10 year government bond yields last 4 years, in %

Source: Bloomberg Finance L.P.

Equities

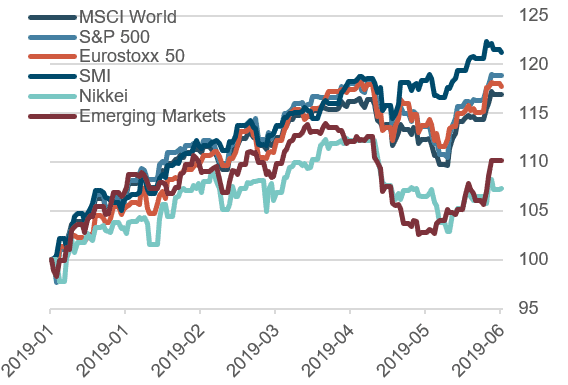

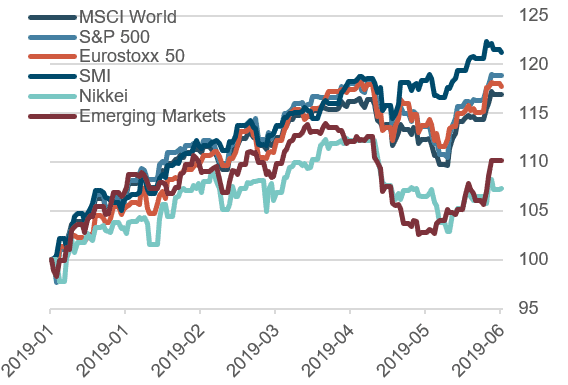

- Currently we have a neutral allocation to equities but have started to take some profits. For us, the explosive gains of the latest stock market rally raise a question as to its sustainability. Given that trends in macro data and also in corporate earnings are now weaker, we have concerns as to the direction markets have taken in recent weeks.

- Fund flows tell us something as to whether markets are firmly-based or vulnerable. Hedge funds and CTAs were prompt to shift positions from “short” to “long” in early January. But retail investors, steady sellers over the first 10 weeks of this year, have latterly moved to become net-buyers. We note the common belief that retail investors are poor market-timers.

Equity markets, perfomance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

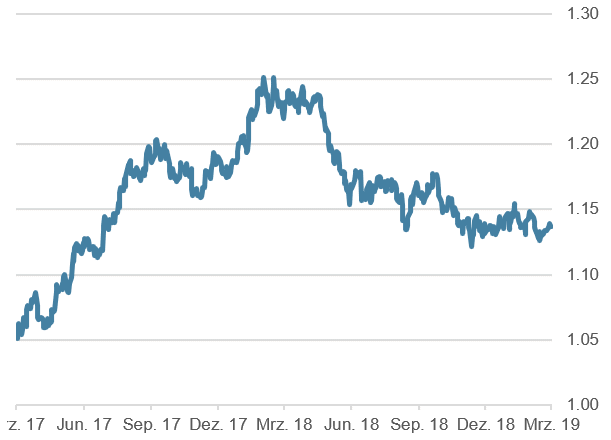

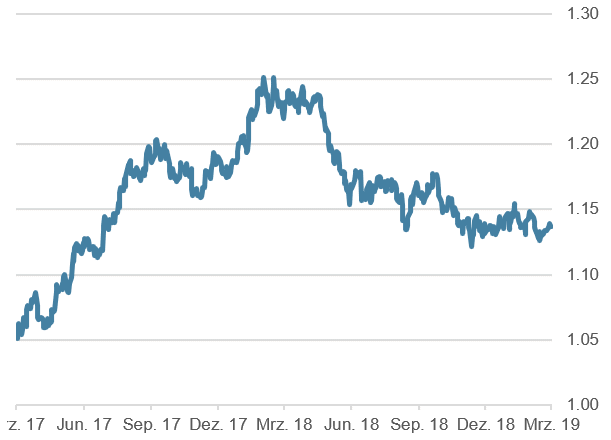

- Communications from the Fed and the ECB seem to have had little impact on forex markets of late. But recent disappointing figures for Europe’s Purchasing Managers’ indices did put the euro under pressure. We believe the EUR/USD will continue to move within the 1.12 to 1.16 channel for the time being.

- It is a similar range-bound story for the USD/CHF. Both currencies are widely regarded as safe havens and they have hardly moved against one another in recent months. We expect this trend to continue. On the one hand, US deficits suggest that the US dollar should be weaker. On the other, the interest rate differential in favor of the US is still substantial. That fact, and the relatively low level of “investor uncertainty” will probably prevent a substantial investor push into the Swiss franc.

- The British pound stabilized as a postponement of the original Brexit deadline became a serious prospect. Right now, there are many potential pathways as to how the Brexit affair will develop. While we accept the pound could weaken further in the near term, its fundamental cheapness points to a longer-term attraction.

EUR/USD, last two years

Source: Bloomberg Finance L.P.

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.