Executive Summary

- President-elect Donald Trump can implement his policies without restriction with the support of both chambers, which can have an inflationary effect in extremis.

- "America First" will have a positive impact on US growth. The international effects depend on the specific implementation of the measures, as well as the countermeasures - as the example of China shows.

- Western central banks are expected to cut interest rates further by 2025 to support the economy, while the BOJ is likely to move further away from its zero interest rate policy.

- Lower financing costs are also welcomed due to the high and rising national debt in some cases.

- The bond markets have calmed down following the US presidential election. Investors are keeping a close eye on the development of government debt.

- There was profit-taking on the US stock markets following the US election. In Europe, the markets have been under pressure since the end of September. We remain cautiously positive about further developments. Geopolitical risks and customs discussions could weigh on the stock markets.

- The US dollar is trending firmer after the election, while the Swiss franc is showing relative strength, especially against the euro.

- The long overdue technical correction in gold has taken place. We remain positive in our medium-term assessment.

Our macroeconomic assessment

Business cycle

- We expect moderate global economic growth in 2025. The GDP forecasts are as follows: USA: 2.1 %, Germany: 0.7 %, France: 0.9 %, Japan: 1.2 %, China: 4.5 % and Switzerland: 1.5 %.

- The global economy is proving resilient.

- Falling inflation rates allow central banks to loosen the framework conditions. Higher real incomes are boosting US consumer confidence, while Trump's second term in office should provide additional impetus and fiscal policy measures. Optimism among US small companies points to rising share indices.

- Politics in Europe remains fragile: Macron and Scholz have lost their parliamentary majorities. Necessary decisions are failing due to vested interests.

- Manufacturing is weakening, the service sector remains robust but is showing mixed signals. China must first prove that economic stimulus packages support private consumption.

- Geopolitical tensions are weighing on the outlook, and it remains uncertain whether Trump's promise to "end wars" will be implemented.

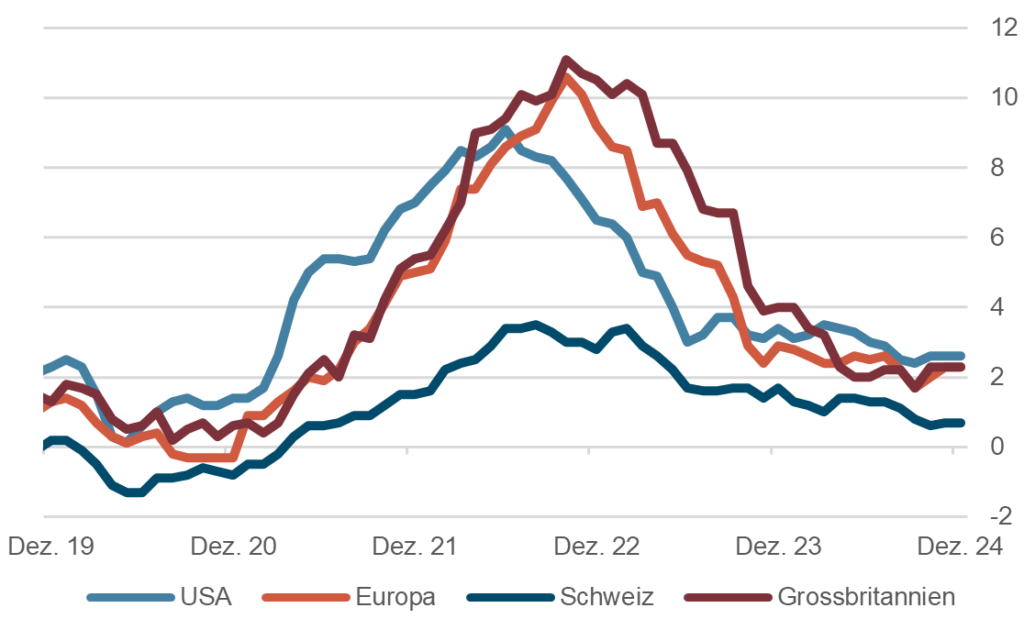

Inflation rates: Annual changes in % (5 years)

Source: Bloomberg Finance L.P.

Monetary policy

- The falling inflation figures allow the central banks to lower their key interest rates further.

- The interest rate reduction cycle initiated by the SNB back in March has lowered key interest rates from 1.75% to 0.5%. The slowdown in German industry is also having a negative impact on the Swiss economy and will probably require further stimulus from the central bank in the new year.

- The ECB has also continuously reduced the deposit facility from 4% to 3% since June, thereby counteracting weak consumer confidence.

- The US economy remains resilient. Nevertheless, a slide in key interest rates to 3.75% by the end of 2025 is priced in.

- Optimism regarding the monetary policy turnaround in China continues.

- The Japanese central bank is on the opposite path, with interest rates remaining close to all-time lows after initial increases.

- Although further interest rate cuts are generally expected, with the exception of Japan, there is a risk that a resurgence in inflation could dampen the expectations that have been priced in.

Our investment policy conclusions

Bonds

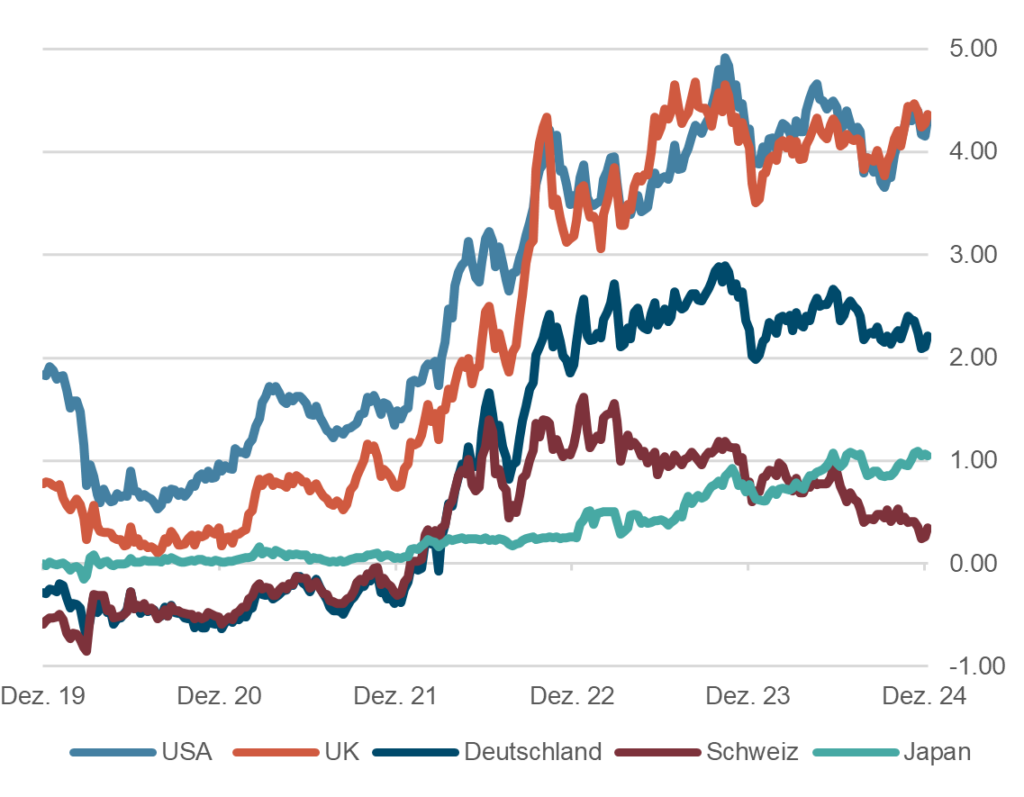

- The bond markets have calmed down further following the US presidential election. Yields on 10-year government bonds are currently at 4.3% in the USA, 2.2% in Germany and 0.3% in Switzerland.

- Rising global government debt remains on the radar of market participants, and rightly so. It will be interesting to see how central banks will behave in the dilemma of supporting the economy, minimizing debt servicing, controlling inflation and controlling the bond markets.

- The spreads on high-yield and corporate bonds have hardly changed. We continue to regard the asset class as only moderately interesting.

- We prefer securities with high credit ratings ("investment grade" and government bonds) with short to medium maturities.

Interest on 10-year government bonds, in %, 5 years

Source: Bloomberg Finance L.P.

Equities

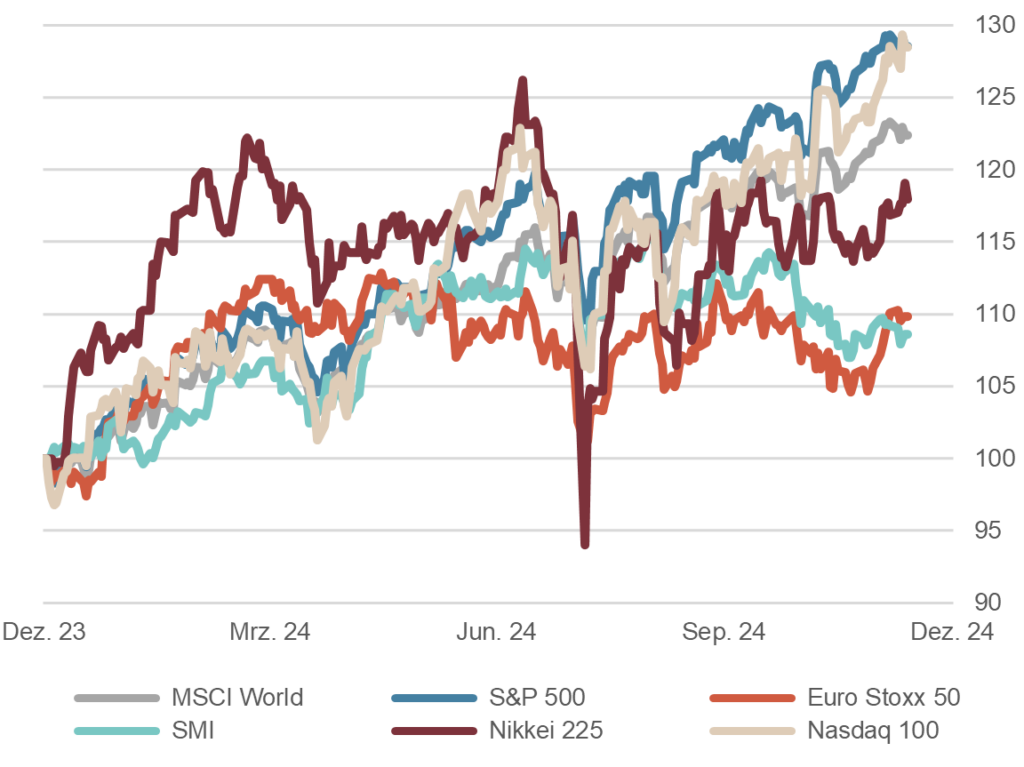

- After the US share indices were already trending positively before the presidential election, many Americans and Wall Street see a new "golden age" with the US under Trump as the engine of the global economy. The US markets are reaching new highs and confidence is high.

- The picture in Europe is different: the markets have been under pressure since the end of the third quarter. Persistent weaknesses in the manufacturing sector in Germany and Italy as well as political stalemates are slowing development.

- We remain cautiously positive about the further development of the equity markets. It should also be noted that growth stocks are valued at a sporty level in some cases.

- Geopolitical tensions (Ukraine, Middle East, Taiwan) could weigh on the markets.

Equity markets, performance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

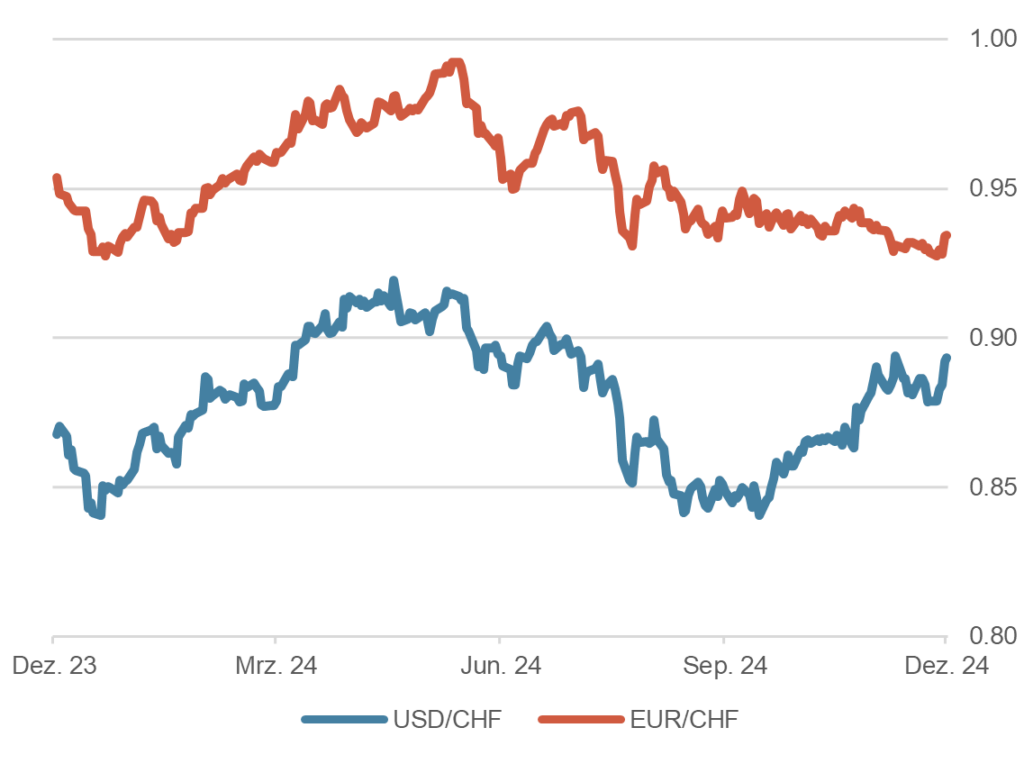

- Following the clear election result in the US (Trump trade), the US dollar has appreciated. This movement is now taking a breather. Over the year as a whole, the trade-weighted dollar has thus appreciated by just under 6%.

- The EUR/CHF exchange rate has been quoted at around 0.93 for several weeks. The relative strength of the Swiss franc is understandable given European tensions and geopolitical uncertainties. The SNB's significant interest rate cut was therefore largely priced in.

- We do not expect any major fluctuations among the western currency pairs.

Dollar and euro against franc, 1 year

Source: Bloomberg Finance L.P.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.