Executive Summary

- In 2022, economic growth is expected to slow slightly to around 3.9%.

- The inflation problem will remain an issue in 2022. The high money growth rates of the last two years mean that the inflation potential is high, even if the central banks were to "tap" faster.

- To break inflation expectations, the FED has announced it will "tapering" twice as fast, with the prospect of three rate hikes.

- However, the FED will only be able to normalize its monetary policy tentatively. The financial markets will play a key role in determining the pace.

- The USD yield curve implies a "policy error" by the FED. Investors assume that growth will come under pressure after a series of interest rate hikes and that policy will be reversed again in two to three years.

- The stock markets are trending friendly, albeit with decreasing market breadth.

- The gold price consolidates around the level of 1,800 US dollars.

Our macroeconomic assessment

Business cycle

- We expect the global economy to grow by +3.9% in 2022. USA: +4.5%, EU: +4.0%, Japan: +2.5%, China: +5.0%, UK: +4.0%, Switzerland +2.7%.

- The year 2022 begins with strong global economic growth, record high inflation rates and an overheated U.S. labor market, as evidenced in part by the fact that there are more job openings than job seekers. Initial jobless claims also indicate overheating. At "only" 184,000, these fell to the lowest level since 1969. As there are fewer and fewer available suitable personnel, wage cost pressures are increasing. On the one hand, more must be paid to fill vacancies. On the other hand, more and more "less suitable candidates" are hired because they are the only ones available, leading to declining labor productivity. Rising wage costs and falling labor productivity drive inflation.

Consumer Price Inflation USA (in%), since 1973  Source: Bloomberg Finance L.P.

Source: Bloomberg Finance L.P.

Monetary policy

- Jerome Powell remains FED Chairman. This continuity was "celebrated in the form of a Christmas rally" by the financial markets.

- Inflation expectations play an important role in future inflation. High or rising inflation expectations lead consumers to bring forward purchases in order not to have to pay even more later. Purchasing resistance to price increases decreases, for the same reason. These behavioral changes increase inflationary pressures. For this reason, the FED tries to reduce inflation expectations as far as possible.

down" as possible.

- The FED has so far denied any responsibility for the highest inflation rates in over 40 years. Money creation in the four-digit billion range is not analyzed as a contributory cause. Instead, problems in the supply chain and high energy prices are put forward as reasons. According to surveys, more and more US consumers assume that the Fed will not succeed in getting inflation under control.

- The FED is trying to break high inflation expectations by announcing twice as fast "tapering" (30 billion per month) and by holding out the prospect of three rate hikes this year.

Our investment policy conclusions

Bonds

- In the "dots" (expected path of key interest rates), the members of the FOMC Committee foresee an increase in key interest rates of 0.75% for both 2022 and 2023. However, the market assumes that these expected key interest rate hikes in the USA will stall the economy before then and represent a so-called "policy error". This can be seen, for example, in the euro-dollar forward rates (short-term USD offshore interest rates) for 2025, which imply a clear reversal on the interest rate path.

- The same message is coming from the USD yield curve, where the spread (difference) between 2- and 30-year Treasuries has also narrowed sharply, which is usually a sign of an economic slowdown that is more likely to require interest rate cuts.

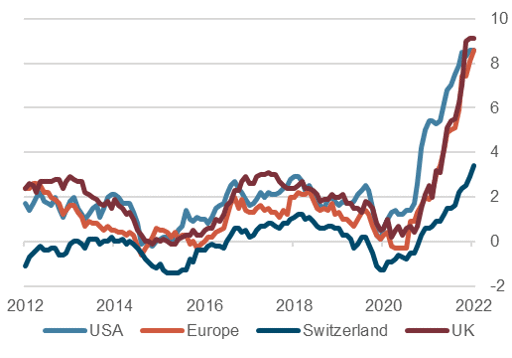

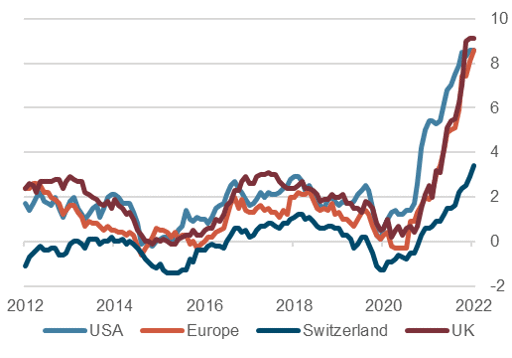

10 year government bond yields last 4 years, in %

Source: Bloomberg Finance L.P.

Equities

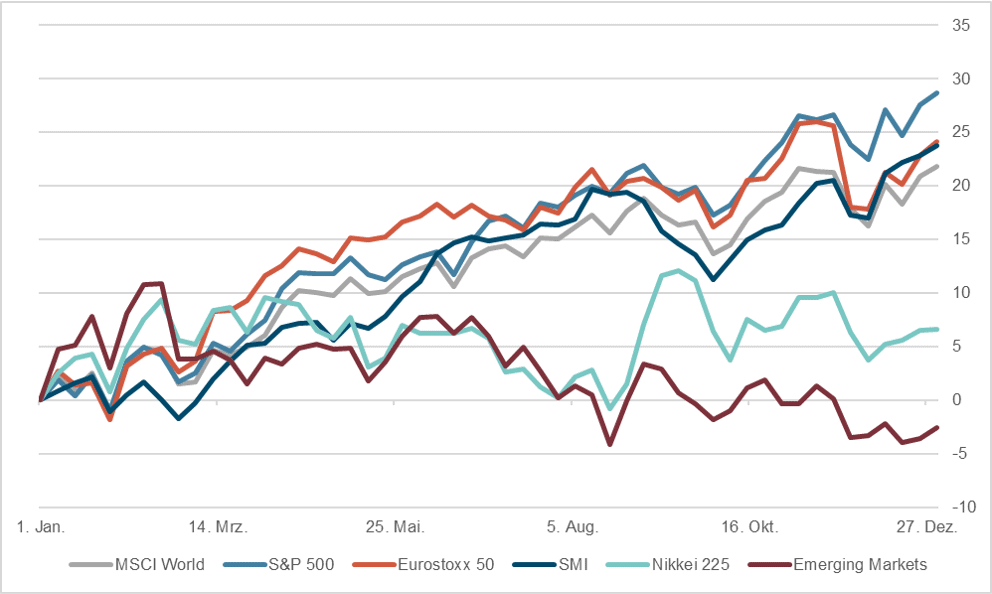

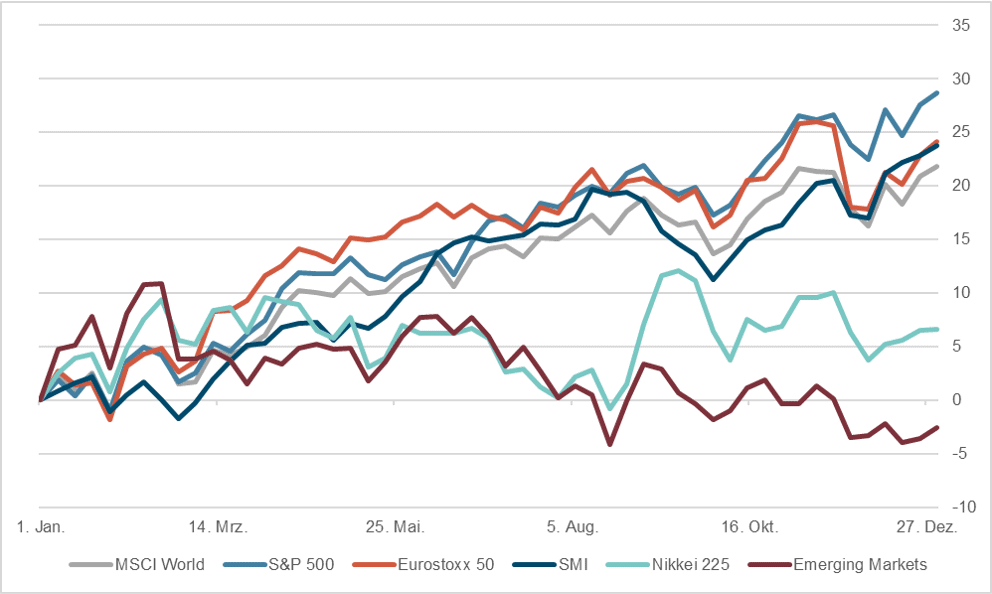

- Since the setback in the fall, global stock markets have entered a volatile phase. On the one hand, this is manifested by short, rapidly alternating phases with sharp ups and downs in the indices. On the other hand, it is noticeable that the market breadth has decreased, i.e. only a few heavyweight stocks are still supporting rising indices. The reasons for this are, besides the decreasing liquidity at the end of the year, the emergence of Omikron, but also the uncertainty about the future course of the central banks.

- Nevertheless, in retrospect, there is a clear positive correlation between the growth of central bank balance sheets and the performance of the stock markets. A decline in balance sheet growth is likely to have a dampening effect.

Equity markets, perfomance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

- The upward trend of the US dollar against most currencies has stopped for the time being. Against the Swiss franc, the strength of the USD is not as pronounced, which is why the currency pair continues to move in a narrow range. The strength of the Swiss franc is also evident against the euro, so the EUR/CHF currency pair is trading below 1.04. The reason for this could be the much lower course of inflation in Switzerland, which is only slightly above 1%. Furthermore, the ECB chief Lagarde has spoken out very decisively against key interest rate increases, which has put additional pressure on the euro.

- The FOMC's surprise-free communication had no impact on the course of the U.S. dollar.

USD/CHF, last two years

Source: Bloomberg Finance L.P.

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.