Record low US unemployment is a poor omen for US stocks. The trade war is troubling markets. Stay underweight in equities.

The trade war has intensified. We recommend investors stay underweight in equities.

US unemployment rate at a 50-year low

The US unemployment rate is stuck at around 3.6% and America’s labor participation rate has risen for the 104th consecutive month. In some industries there is now a shortage of specialist labor. Despite this situation of “over-employment”, wage growth remains rather low. The main reason is that very low inflation expectations are influencing the negotiations that help determine real wages. With increasing trade hostilities between the US and China, there is now a good chance that inflation expectations will tend to increase at a time when the business cycle is weakening.

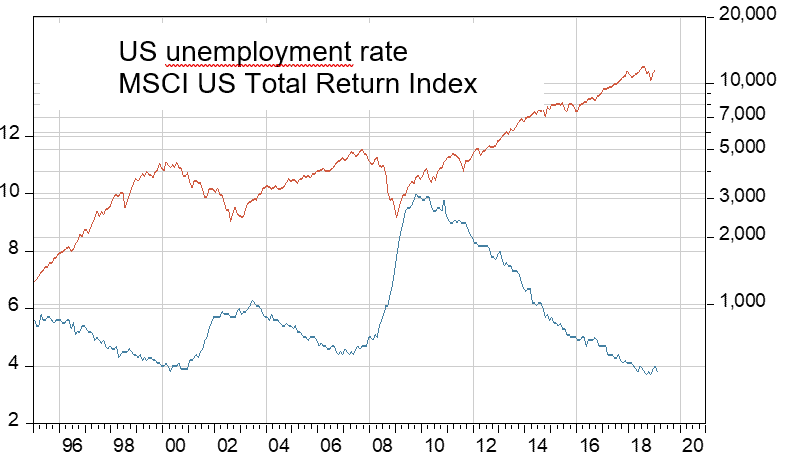

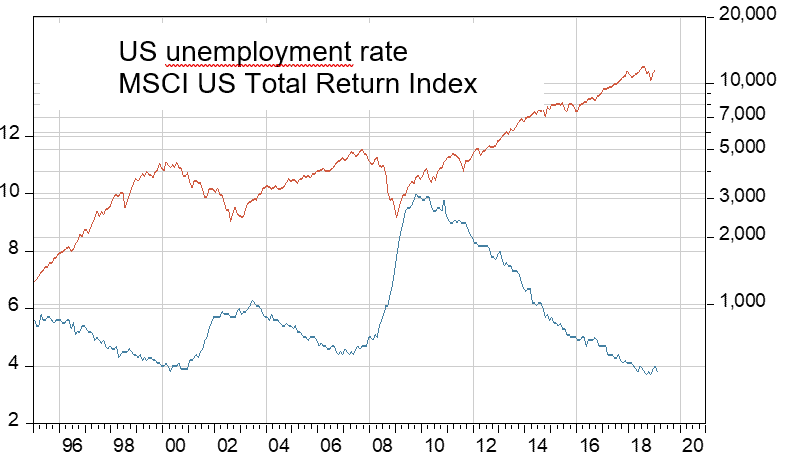

In general US stock market performance is inversely related to the US unemployment rate, something shown clearly in the graph below.

Trade conflict between USA and China came to a head

Contrary to the expectations of the financial markets, no "grand bargain" was reached last week. According to statements by the US president, China wanted to renegotiate and reverse what had already been agreed. In response, the U.S. increased tariffs on imports from China worth 200 billion U.S. dollars from 10 to 25%.

US unemployment rate, (in %, left scale) and MSCI US Total Return index, (right scale, in logs)

One can show that at times of low but rising unemployment equity investment is particularly risky and tends to produce relatively poor returns.

Clearly, the unemployment rate is only one indicator among many that should be considered when deciding the appropriate commitment to stocks in a portfolio.

Earnings per share of US companies are now at all-time highs due to corporate equity buy-backs, and low interest rate and tax policies

Earnings per share of S&P 500 companies are now at record levels. But investors should remember that this metric has been boosted by US companies buying back their own shares. As a result, external capital has been used to substitute for own capital, something which increases the corporate leverage (borrowing) ratio. Meanwhile, the low interest rate policies of the central banks have the effect of reducing interest expenses in profit and loss accounts. Given the escalating US Budget deficit (nearly 4% of US GDP, and that in peacetime with an economy at overemployment), today’s abnormally low US corporate tax rates are unlikely to prove sustainable. Current excellent US corporate earnings owe much to abnormally low corporate interest and tax charges and should be viewed with caution.

Recent EU Parliamentary elections produced results which did not surprise the financial markets. In fact, the extremists won fewer votes than had been feared.

The European economy has weakened further, although European unemployment has fallen slightly

The Euroland Purchasing Managers’ index (PMI) for Manufacturing reported just 47.7 in May ( slightly below the previous month’s 47.9).

Germany had a particularly weak reading for its Manufacturing PMI at 44.3 but Italy’s figure – at 49.7, up from 49.1 in the previous month – was slightly better than the expected 48.5. Core inflation in Euroland fell to 0.8% year on year, and inflation expectations in Euroland are now at their lowest level since 2016. Perhaps reflecting this, the yield on 10-year German Federal bonds is now minus 0.2%, a record low.

On June 6, the ECB made, as expected, a market-supportive announcement, namely that it now expects to keep policy rates on hold until at least mid-2020 (which compares the previous “end-2019” indication). It is good news that unemployment in the Eurozone fell to 7.6% in April, the lowest level since August 2008.

Brexit anxiety is hurting the UK economy despite the weak pound

The Brexit process has clearly depressed the British economy. The UK PMI for Construction reported just 48.6 in May compared to an expected 50.6 and the previous month’s 50.5. Meanwhile the comparable index for UK Manufacturing was just 49.4, compared with an expected 52.2 and April’s 53.1. The pound fell sharply after the May UK PMI data releases. Markets fear a Labour government led by unreconstructed leftist, Jeremy Corbyn.

We note that the Japan PMI for Manufacturing also disappointed in May with a reading of just 49.8.

The US manufacturing sector is not immune from international trends towards economic weakness

The US PMI for Manufacturing was just 50.5 in May, compared with 50.6 expected and 52.6 in April, and is thus close to the 50 mark which separates expansion from contraction. We rather expect further deterioration from here as the full impact of America’s trade war with China has yet to be felt. Thus, the “industrial recession” now obvious elsewhere is likely to reach the US as well.

There is no end in sight to the recession in global manufacturing, partly because recession anxieties

are nowhere near a peak level. We think it almost certain that the US manufacturing PMI will fall well below 50 in coming months and that any stabilization of global economic growth will not come about before autumn, or even winter, at the earliest. The Fed seems to share this view and has indicated it could soon be cutting US interest rates, something which should boost global equity markets, at least in the short term.

Mr. Trump’s tweets are a function of the financial markets. Should equities fall further, those tweets will aim to raise expectations about a “big deal” between the US and China. Here, we are skeptics. The rivalry between the US and China will last for decades and no deal will prevent the US from doing all it can to preserve its status as the world’s Number 1 power, nor prevent the Chinese doing all they can to seize that crown. Thus far, hostilities have been restricted to trade wars. China has reacted to higher US tariffs by raising non-tariff trade barriers to US goods. These get less publicity as they operate at the specific institutional or business concern level. For example, the bureaucracy for customs clearance or permits can easily be tuned to process applications more slowly.

US “Antitrust Enforcement Agencies” ( the Department of Justice and the Federal Trade Commission) are reported to be investigating whether Alphabet, Facebook, Apple and Amazon have abused their dominant, partly monopolistic market positions. In theory, a finding of serious malpractice could result in these technology giants being forced to relinquish some of their businesses. While Republicans, and especially President Trump, complain that social media “discriminate against conservative values”, many Democrats also would like to see these behemoths have their wings clipped, as we believe would America’s voting public.

Once reports of the investigation circulated, on June 3rd, technology stocks, and especially Facebook, Alphabet and Amazon, reported significant losses for the day.

Stay underweight in equities

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.