US equities are expensive but bonds are even more so. Geo-political risks in the Middle East ratchet up. Gold is in demand.

US stocks are highly priced and technically overbought, but the bond markets are probably even more expensive than equities. Geo-political tensions have ratcheted up following the US drone strike in Baghdad which killed a key member of the Iranian regime as well as the commander and other members of the pro-Iranian, Iraqi Shiite group, Kata´ib Hezbollah. We remain overweight in gold. Following a slack phase around the start of the year we expect the US economy to pick up some steam in coming months due to the combination of very expansionary fiscal and monetary policies. But our predicted acceleration in growth assumes some easing of geo-political tensions

2019 was a good year for all assets except cash

Despite US-China trade hostilities, Brexit worries and a weaker global economy “risk assets” in general made strong gains in 2019.

One of the main reasons for last year’s strong showing in the markets was the unexpected shift towards monetary expansion. Some 50 central banks lowered their key policy interest rates, while the Fed and the ECB resumed balance sheet expansion programs. Unlike the ECB, the Bank of Japan and the Swiss National Bank, many emerging market central banks had plenty of room to lower interest rates, and that’s what they did last year.

Outlook for 2020

Wall Street has an important role in setting equity risk premiums around the world. This is reflected in the saying, “when Wall Street sneezes the rest of the world catches a cold”. And history suggests this is true even when non-US stock markets are cheap. Given the currently very high weighting of the US in world stock markets we expect the influence of Wall Street on markets elsewhere to be even more powerful than usual.

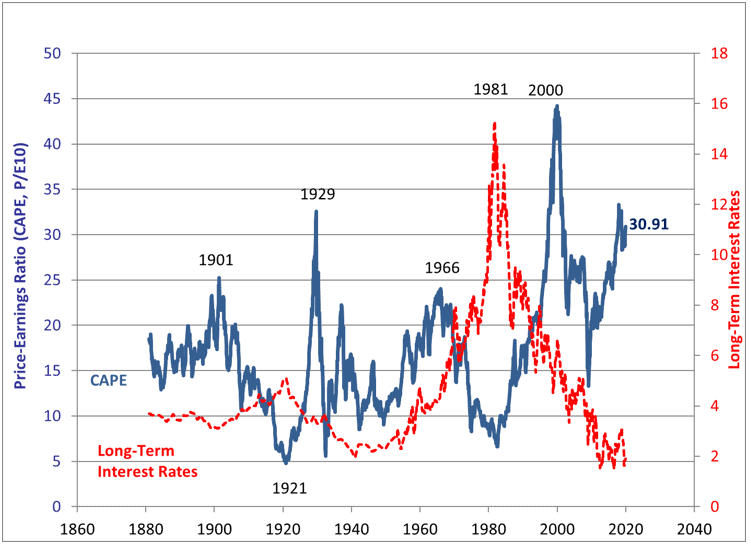

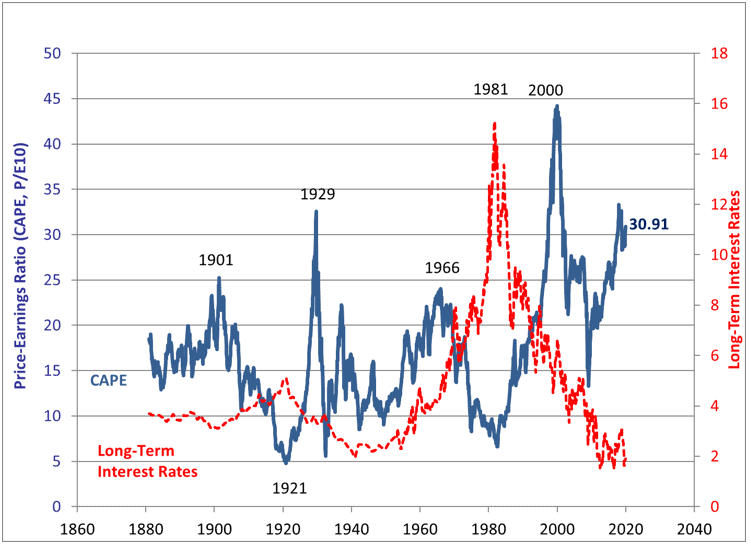

US stocks are highly valued relative to their history

The graph below shows the Shiller cyclically adjusted price to earnings ratio for the US S&P 500 equity index. Currently near 31, the index looks dear relative to its own history. But this needs to be considered in the context of the extreme shortage of attractive non-equity assets.

Shiller cyclically adjusted PE ratio for the S&P 500

Source: http://www.econ.yale.edu/~shiller/data.htm

It’s problematic that bonds are also very expensive

When considered against world bond markets, equities look less bad. Probably, bonds are even more heavily over-priced than stocks.

For this reason our strategic view is that equities should only be slightly underweighted.

Geo-political tensions escalate

A US drone attack in Baghdad killed two key military commanders, from the Iranian Revolutionary Guard and the Iraqi, pro-Iran Kata´ib Hezbollah. Iran has promised vengeance. Her nuclear program is to be stepped up and the centrifuges that produce enriched uranium should soon be running at full steam.

In a counter-offensive, President Trump announced that the US had identified 52 Iranian targets, including key places in Iranian culture, for attack should Iran attack US institutions or US citizens. The threat to cultural locations is odd and noteworthy as, if carried out, it would contravene the Geneva conventions on warfare, as many Democrat politicians have been quick to point out.

Iraq, arguably Iran’s second most important traditional enemy after the US, does not want to be drawn into another war. And the Iraqi parliament has approved a resolution demanding that all foreign troops (and especially American troops) leave Iraqi territory.

The likely shorter-term investment implications

The US-Iran conflict has erupted at a time when, following a strong year-end rally, many “risk assets” are overbought. Thus, the conflict has probably increased the chances that any technical correction could be sharp.

Oil and gold make gains

Oil and gold have already made strong gains and we are sticking with our overweight recommendation on gold. Should geo-political tensions escalate, gold will make further gains.

It is also worth pointing out that, should the economy weaken, perhaps as a result of higher oil prices, central banks can be expected to step in with stimulative measures, which in turn would also probably push gold higher.

Trade agreement set for signing by January 15

A Chinese delegation is expected to travel to Washington on January 13, and this should allow the US-China Phase 1 trade deal to be signed by January 15 at the latest. This is what the financial markets now expect and has therefore probably been “priced in”. We don’t expect markets to make further gains simply on account of the deal being signed.

The next – Phase 2 – deal is what’s important now

After the Phase 1 deal is signed President Trump will focus on managing expectations with respect to Phase 2. 2020 is a Presidential election year and President Trump will do all he can to prolong the (already record) US expansion and to keep the mood in the financial markets positive. The sharper any technical correction in the

near-term (that is, if there is a correction at all), the more the President will try to ensure that financial markets remain buoyant.

A stabilization of US economic growth may take some time

The US ISM Manufacturing purchasing manager index for December was a disappointing 47.2 (versus an expected 49). Offsetting this, data from the construction industry has tended to be better than expected.

After a period of slackness at the start of 2020, and thanks to very expansionary monetary and fiscal policies, the US economy is likely to accelerate, thus continuing what is already its longest upswing ever.

On the other hand, were the geo-political situation to deteriorate and the oil price to rise sharply, the economic upturn could be jeopardized. Therefore, President Trump, who has his eyes on the forthcoming election, is probably not interested in ratcheting up tensions in the Middle East.

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.