China unveils retaliatory tariffs. At Jackson Hole, FED chair Powell stopped short of mapping out a clear-cut path for policy rates.

On Friday China announced that it will impose new tariffs on a range of U.S. goods and resume auto tariffs in response to the newly announced measures by President Trump. Jerome Powell kept future interest rate cuts squarely on the table.

US/China trade war escalates further

China has already announced in mid-August that they will respond to the latest round of tariff implementations by the U.S. administration. On Friday, China has released the full list of goods that will be taxed shortly. The new taxes ranging between five and ten percent on American goods worth 75 billion US Dollars will be implemented as of 1 September and 15 December respectively. Amongst the most prominent products being taxed with a five percent charge going forward are U.S. soybeans and crude oil. Also worth noting is the resumption of a suspended extra 25 percent duty on U.S. cars that will resume in December.

Regional FED Chairs express their views

Several regional FED Chairs have expressed their views on the state of the economy and interest rates on national television before FED President Jerome Powell released his statement at the Jackson Hole conference in Wyoming.

Esther George, Kansas City FED President said on Bloomberg TV: “As I look at where the economy is, it’s not yet time, I’m not ready to provide more accommodation to the economy without seeing an outlook that suggests the economy is getting weaker.”

Loretta Mester, Clevelands FED President said that she still forecasts the US economy to grow in line with its long-run potential this year, with inflation rising to the Fed’s 2%-a-year goal, but risks to that outlook are serious and weighted to the downside”. For her there is currently no clear case for another rate cut but job data in the coming weeks will be important.

St. Louis FED President James Bullard said lower interest rates would help to hit the inflation target and “the Fed should cut rates because an inverted yield curve is not a good place to be”. He thinks that there will be a robust debate about a 50 basis point rate cut at the next FED meeting in September but he wasn’t ready yet to commit to further cuts.

FED will act appropriately, Trump less so

In his remarks at the Jackson Hole Conference FED President Jerome Powell pledged to act as appropriate to sustain the economic expansion without saying explicitly where he thinks rates should go. Powell painted a mostly positive picture of the U.S. economy but also pointed out downside risks – most of them directly linked to the escalating trade war between the US and China.

US President Donald Trump responded immediately on Twitter asking the question: “who is our bigger enemy, Jay Powell or Chairman Xi?”. Over the weekend he revealed again new tariff measures: (i) the 25 percent tax on 250 billion US dollar on goods and products from China will increase to 30 percent as of October 01 and (ii) the remaining 300 billion US dollar of goods, initially planned to be taxed at 10% from September, will be taxed at 15%.

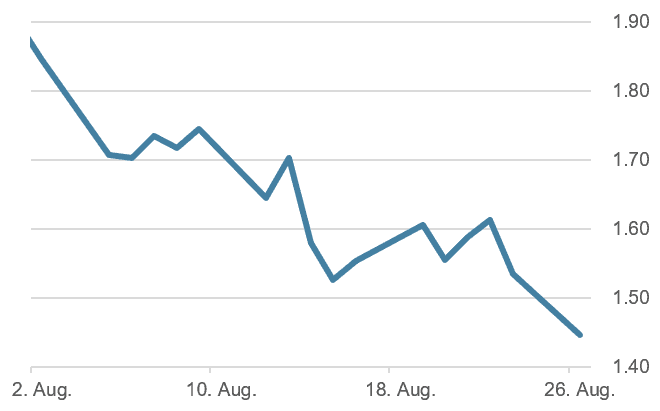

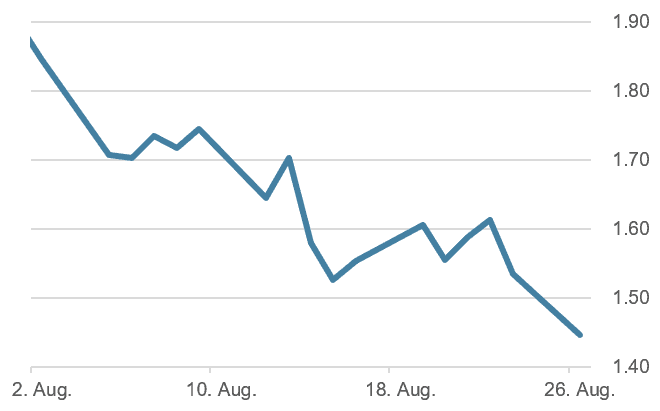

10-Year US Treasury Yield below 1.5%

The 10-Year US Treasury yield managed to climb above 1.6% on Friday but has fallen substantially since the new tariff announcement – falling below 1.5%.

Development 10-Year US Treasury Yield

Source: Bloomberg Finance L.P.

Expectations regarding rate cuts haven’t changed substantially since last week. A 25 basis point rate cut in September seems certain. Market participants still expect the benchmark rate to be 50 basis points lower by the end of the year. The question remains whether the FED will reduce rates by 0.5 percent at the September meeting or follow a two-step approach – with one cut in September and a second towards the end of the year.

US equity markets turned negative in reaction to President Trumps newly announced measures. It proves again that investors shouldn’t believe in any of the headlines about positive progress in the trade negotiations between the U.S. and China.

Positioning unchanged

In our view it is too early to buy equities again and we therefore maintain our current positioning – remaining slightly underweight in our allocation to stocks. The S&P 500 Index is approaching a first, technical support level at around 2’822 points. Should the market fail to hold this level further downside towards the June-lows can be expected (approx. 5% below current levels).

Contact: Nicolas Peter, Head Investments

Telephone: +41 58 680 60 42

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.