The rise in long-term interest rates is worrying

Large government rescue packages are straining the capacity of bond markets to finance them. Central banks have delivered a gigantic increase in the money supply which has caused a rise in inflation expectations. Nominal interest rates on longer-term bonds have risen more than inflation expectations, leading to higher real interest rates. Given that equity and bond markets are highly valued, investors must monitor developments closely. We expect central banks will soon become even more active in combatting the rise in long-term interest rates.

Enough vaccines for all Americans by end-July

President Biden promises that enough supplies will be available to vaccinate all Americans by the end of July and that lock-downs will be scaled back rapidly thereafter. The rest of the world, though not the United Kingdom, is lagging well behind with regard to Covid 19 vaccination programs. The gap is particularly large for developing countries, although China and India are important exceptions here. They have domestic vaccine alternatives and sufficient production capacity.

Many economies are set to open up in Q3

The data currently suggest a return to normality in the industrialised countries in the 3rd quarter. But for this to happen the vaccines need also to offer sufficient protection against the new, more aggressive mutations. We note that many developing countries, such as the Ukraine, have not been able to afford economically-expensive lockdowns. There are also tentative signs that herd immunity has already developed in some countries.

Largest rescue package in history

President Biden wants to sign off his US $1,900 billion bailout package by mid-March at the latest. Existing extraordinary assistance payments for the unemployed are set to expire in mid-March. But the proposed package is meeting with resistance from congressional Republicans. So Democrats are campaigning hard to sway voters and put pressure on the opposition.

It is still unclear how far the package will have to be slimmed down in order to pass. What is clear, however, is that it will have an inflationary effect, at the latest when lockdowns are eased. As the economy recovers, and the precautionary savings that have been built up start to be spent, the velocity of money in circulation will rise.

Dividing up the pie

The bailout package (notably the additional support for the jobless within it) represents “entitlements to some pie”. Indeed, the generous unemployment support even provides an incentive for low-wage earners not to work, as their income may well be higher if they don’t.

With lockdowns and the associated recession, “less pie” has been baked, i.e. less GDP has been generated.

At the same time, government support measures, such as the additional unemployment benefits, would ensure that claims on the pie do not fall as much as they otherwise would. Indeed, those claims might rise. With less pie to go round, there may not be enough for everyone. That is an allocation problem that inflation might be used to solve.

Even Democrat economists, such as Larry Summers, see the danger of a sharp rise in inflation and consider the proposed rescue package too big. So long as economic anxiety, or a desire to gamble on the stock market, pushes consumers to save rather than to spend, and so long as politicians stifle the economy with lockdowns that cause economic anxiety, the danger of inflation is not great.

But the risk of inflation will increase as life returns to normal, economies pick up speed and fears of the virus and of losing employment abate.

Bond markets are still functioning somewhat

In the last few days, longer-term interest rates and inflation expectations have risen significantly. This is an indication that bond markets are still fulfilling their pricing and capital allocation function to some extent despite the “market management practices” of the central banks. Real interest rates have also risen significantly, and US Treasury inflation-protected 30-year bonds (TIPs) are currently trading on a positive yield for the first time in months.

In fact, the Fed is already “gently” influencing the yield curve through its purchase programs and its decisions to buy longer-dated government and corporate bonds as well as mortgage bonds. Slightly higher long-term interest rates and a somewhat steeper yield curve help the banks to make profitable maturity transformations (providing long-term loans at a higher interest rate financed by short-term borrowing at a lower interest rate).

Too sharp a rise in interest rates is a fire hazard…

But if longer-term interest rates rise too fast or too high there is a danger that the gigantic “bond bubble” would burst. This would greatly complicate the financing of government debt around the world and threaten zombie companies and states. Stock and real estate markets would come under pressure and the precious metal markets would not be spared either.

..that is why market pressures will force the Fed to act so that the steepness of the yield curve is even less determined by the market

It is very likely that the bond markets will force the Fed into even more aggressive market manipulation.

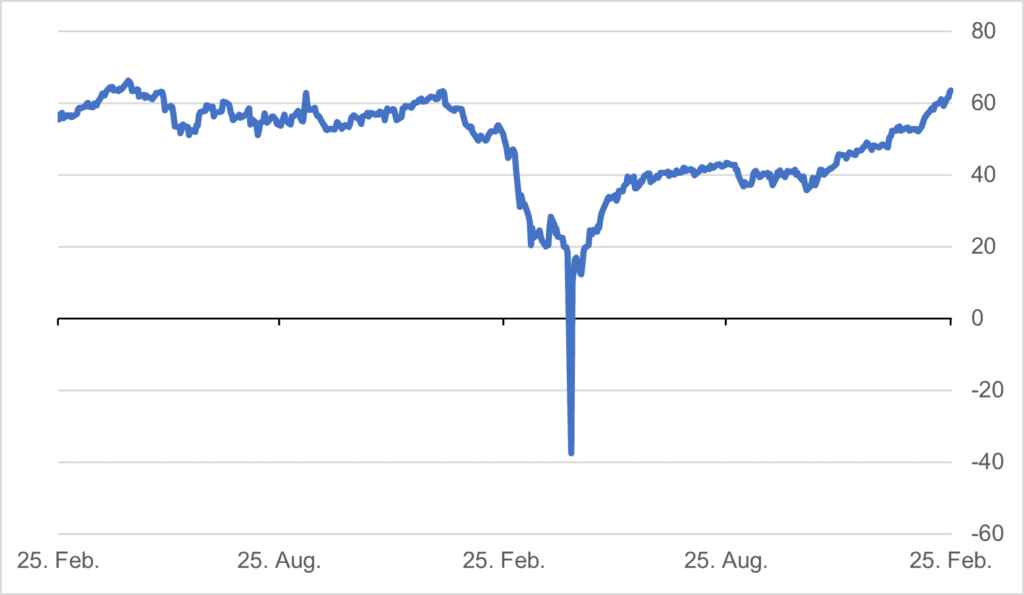

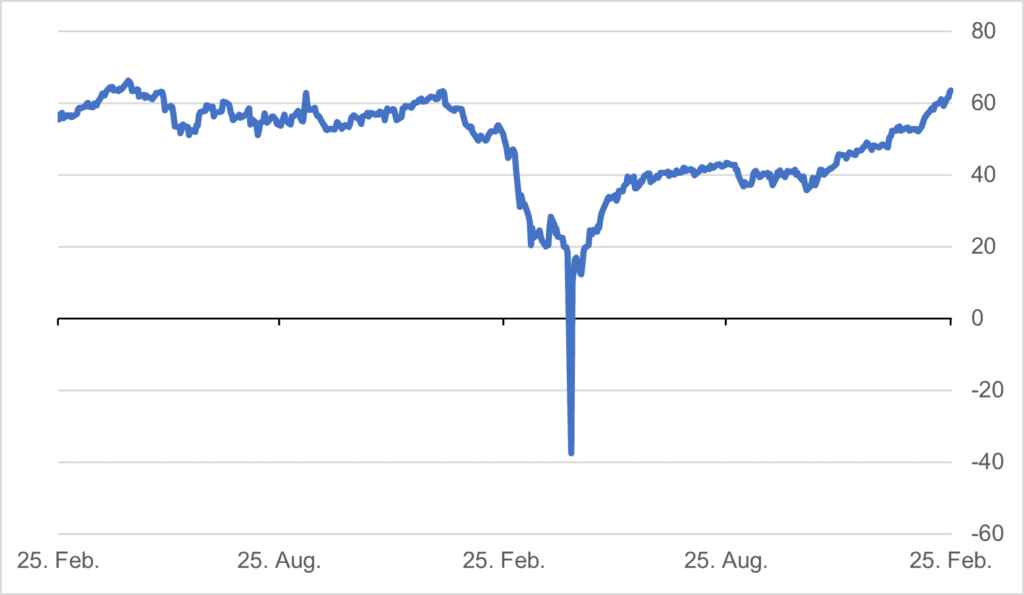

Oil

The oil price turned negative in April 2020 when on spot markets a barrel “cost” almost minus 40 US dollars! For some time now, oil prices have been rising and key benchmarks breached the $60 a barrel mark this February.

Chart 1: Development of the crude oil price

Source: Bloomberg

Source: Bloomberg

While the strong oil price increase of recent months will further boost inflation, it is also likely to induce OPEC to reverse its voluntary production cuts. The next OPEC meeting will take place on March 4th and we do not expect further big gains in the oil price in the immediate future.

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.