The gold price is already discounting a further expansion in the money supply. But gold mining shares are attractive medium-term

Gold is now slightly overvalued and already discounts further monetary expansion. Indeed, excessive debt and related insolvency risks mean that a further increase in the money supply is likely. The gold price should continue to rise in the medium- term and gold mining stocks remain attractive.

The gold price has risen sharply in recent months, but has come under pressure in recent days. Therefore the question arises as to whether gold is still priced above its “fair value” or, following the correction, again attractively valued?

In the long term, the main influence on the gold price is the development of liquidity. The basic idea is that paper money can be increased at will and the more paper money is produced, the higher the equilibrium gold price is likely to be. The following text in small print is only for interested readers with a taste for financial satire. It can simply be skipped if desired.

This “thought experiment” should clarify the mechanics of the gold price in paper currencies. Imagine two planets.

On the “Responsible” planet, the amount of money will remain the same for 100 years at 2,000 billion “Paul dollars” (the official currency of this planet, named in honor of Fed Chairman Paul Volcker). On the “Crazy Experiments” planet, the currency is the “Jerojanebenalan dollar” (named in honour of the central bank governors of this planet) and the money supply, starting at 2,000 billion, is increased by 10% every year, so that after 100 years each “Paul dollar” is worth around (1.10) ^ 100 = 13,781 “Jerojanebenalan dollars”. The two planets are completely identical in all other respects, including their gold reserves. Let us assume that an ounce of gold costs 1 “Paul dollar” on planet “Responsible”, and consider its equilibrium price on planet “Crazy Experiments” after 100 years. The answer is 13,781 “Jerojanebenalan dollars “. In the long term, if the money supply expands, the gold price must also rise accordingly compared to a reference world where the money supply remains constant. Since the planets started with the same amount of money and are otherwise identical, an ounce of gold costs the same amount of monetary units on both planets in the starting year and an interplanetary currency trade is settled at 1:1. After a hundred years, the currency of the planet “Crazy Experiments” has devalued by 1,378,000%, and the interplanetary exchange rate will be 13,781 “Jerojanebenalan dollars” per 1 “Paul dollar”.

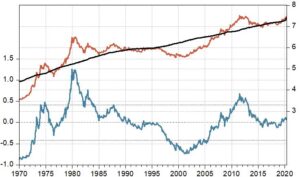

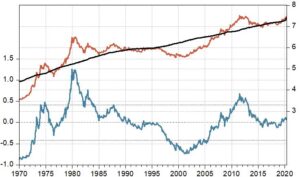

Our gold valuation model, which aims to assess the “fair value” of gold is shown in Graph 1.

Graph 1: Gold price, US$per ounce, logarithmic scale; Estimated fair value and % deviation from «fair value» (LHS)

Our estimated “fair value” for gold is currently around $1,750 per ounce. Thus gold is now slightly overvalued. But this degree of overvaluation is well within past fluctuations and thus we do not have a clear “sell” signal.

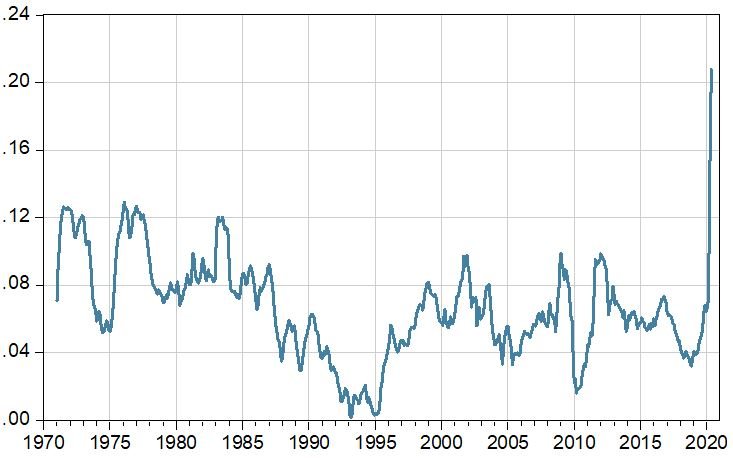

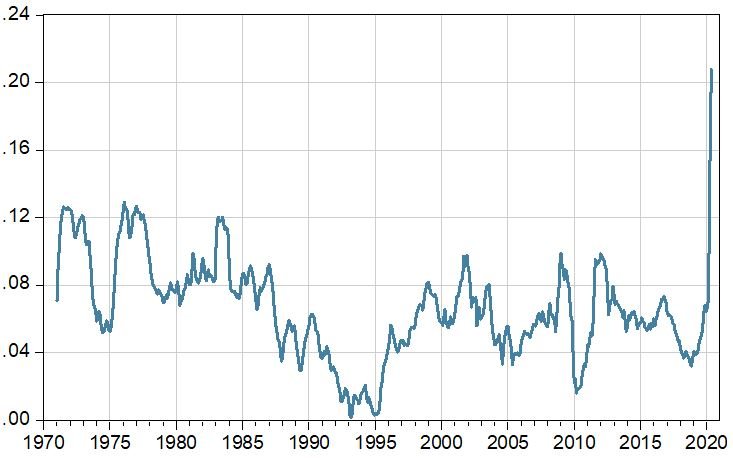

The fair valuation line is increasing at roughly the same rate as the US monetary aggregate M2. With M2 now growing over 20% p.a., US money supply is “exploding” (see chart 2). With an estimated overvaluation of 9%, the gold price now appears to incorporate around 6 months of future growth in the US money supply at its current 20% rate.

Graph 2: Percentage year on year growth in US monetary aggregate, M2

With an overvaluation of 9%, the gold price has thus anticipated future monetary growth of about 6 months.

Paper money is the legal tender to pay off debts. That’s why the following chain of argument applies: the bigger the problem of over-indebtedness, the more elevated the risk of future waves of insolvency, the faster the central banks will expand their balance sheets and the faster the money printing machines will rotate to prevent bankruptcies and the collapse of the debt pyramids. Therefore, high debt ratios (e.g. gross debt as a % of gross domestic product) predict high future liquidity creation by the central banks and thus high future growth rates of the money supply and thus further increases in the price of gold.

This argument encourages us to believe that gold will also provide good protection against a possible second Covid-19 wave in the medium term. The more the economy is adversely affected by Covid-19, the more “willing to experiment” central banks will be.

We therefore expect a further sharp rise in the price of gold over the medium-term.

The Research Center for Trade Management at the University of St. Gallen has carried out a Swiss-wide study on physical precious metals on behalf of the gold dealer philoro Schweiz AG. In the following we present some findings of this study: The SNB holds around 1,040 tons of gold and it is estimated that Swiss private individuals hold around 920 tons of gold. According to this study, Swiss individuals hold around 131 grams of gold (equivalent to 4.2 ounces) per capita. This suggests the Swiss hold the most gold per capita, worldwide. The estimated gold share of savings is particularly interesting. On average, respondents said they had “invested” almost 12% of their savings in gold in the past year.

We stick to our view that gold should be viewed as an “alternative currency” rather than an “investment”. Gold thus has a firm place in an optimal currency allocation, but should not be regarded as a productive asset that can generate long-term income.

Gold mining stocks are different. They can usually generate an income return over the long-term.

Gold mining stocks also benefit disproportionately from a rise in the gold price.

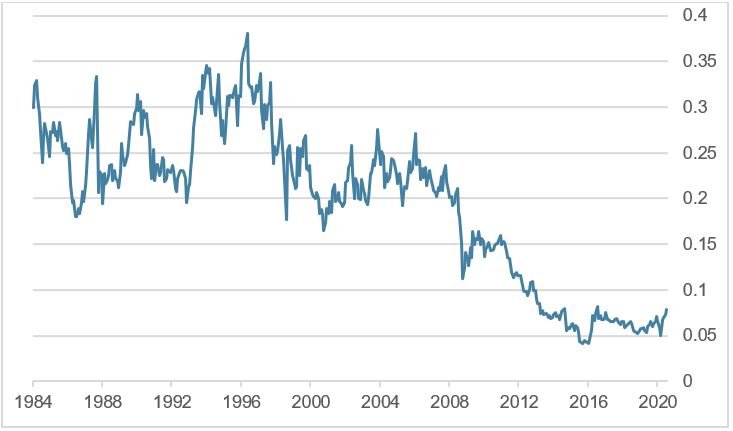

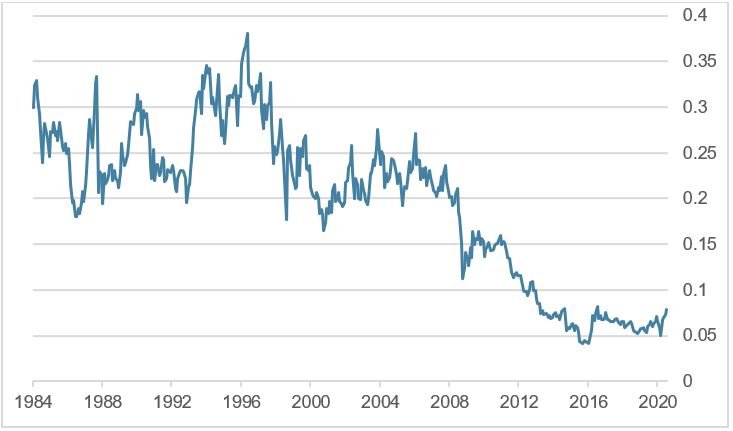

Chart 3 shows the ratio of the Philadelphia Stock Exchange Gold and Silver index to the gold price over time. Compared to physical gold, gold mining stocks are still attractively valued.

Graph 3: Ratio of gold mining stocks index to the gold price

In the short term, gold is technically overbought and gold mining stocks are at risk of a correction. But on a medium term basis gold mining stocks are still attractive.

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.