Turkey: Should you be concerned

The collapse of the Turkish lira is dramatic..

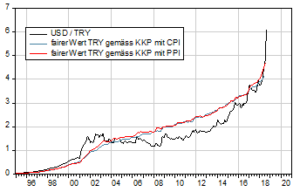

The graph shows in black the exchange rate for Turkish lira against one US dollar since 1995 and, in red and blue, the purchasing power parity (PPP) estimates for this exchange rate over the same period using, respectively, producer price and consumer price indices. These PPP estimates suggest the lira is undervalued by some 30% according to producer price indices and by some 45% according to consumer price indices.

It’s likely that the Turkish economy will go into recession, with a Turkish banking crisis now a possibility. With a chronic current account deficit, currently around 6% of her GDP, Turkey is highly dependent on external capital inflows and therefore vulnerable.

Turkey has been living beyond her means for a long time and monetary policy is too accommodating. Moreover, the Turkish central bank is now in reality no longer independent. Against this background, international investors have withdrawn their backing for President Erdogan and for Turkish institutions. The direct links between Turkey and other emerging market economies are in fact rather tenuous. Developing economy exports to Turkey amount in total to just 0.3% of all developing economy GDP. Probably Bulgaria, with exports to Turkey amounting to some 5% of her GDP, is the most exposed. While Turkish GDP accounts for just 1% of world GDP, the Spanish banks, and in particular BBVA, are heavily exposed. Spanish bank credits to Turkey amount to some 6% of Spanish GDP.

While the direct economic effects of Turkey’s situation are not particularly significant, there is a risk of sentiment-led contagion to other developing economy financial markets. We note that financial markets in those developing economies with high current account deficits – especially South Africa and Argentina – seem already to have “caught a cold“.

We continue to advise caution to our clients, especially concerning Emerging Markets.

Turkish Lira per USD since 1995 and the respective purchasing power parity (PPP) estimates.

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.