Peking’s policies of debt containment have left skid marks on Chinese economy, and they are hurting China’s property market.

Slowing economic momentum in China

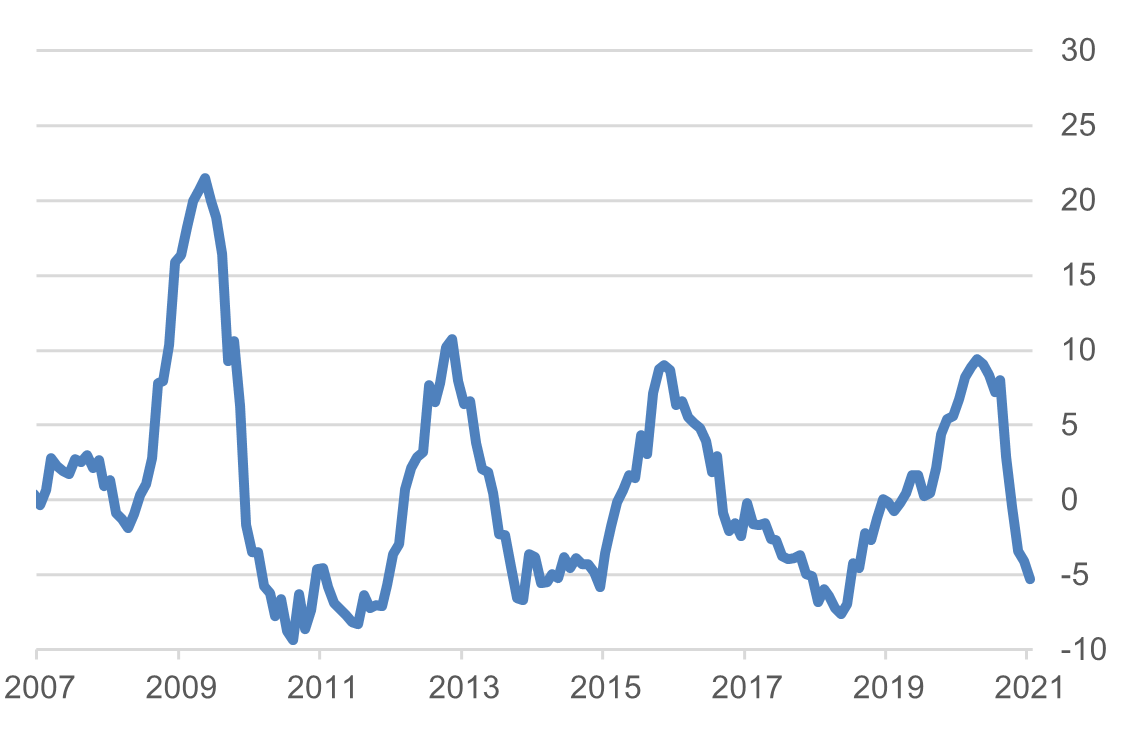

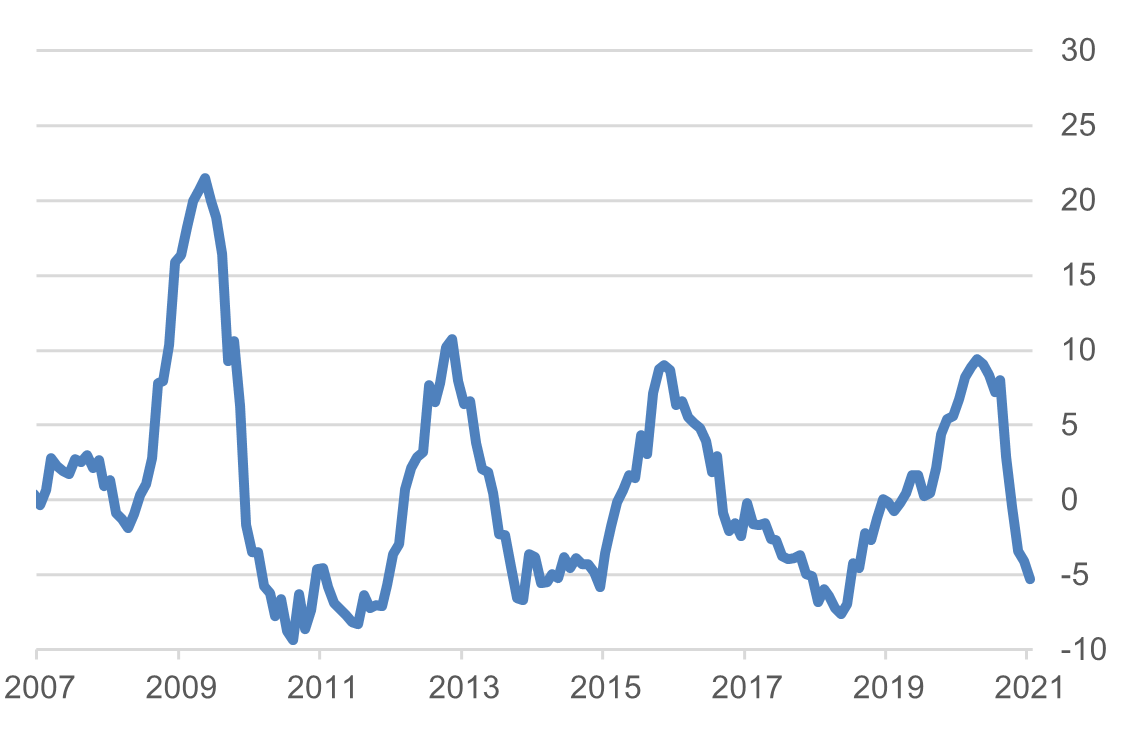

The economic upswing has lost momentum on a worldwide basis and latest data from China have been disappointing. “Credit impulse” measures the extent to which credit expansion is driving or slowing economic growth, the decisive factor being the rate of change in new debts. In China’s case, the credit impulse has now reached such low levels that a turning point seems likely in coming months (see chart).

China’s credit impulse

Not only low credit growth, but also the stricter regulation of Chinese internet companies and the Covid restrictions imposed in August to contain Delta variant outbreaks are weighing on growth in China. The credit impulse metric normally leads the real economy by around half a year.

Real estate crisis in China

Structurally, China’s residential and working populations are growing less rapidly. In less than a decade, China’s overall population is expected to stagnate.

In China, the rate of growth of residential construction has exceeded population growth for years and many apartments are bought speculatively rather than to rent out. Already in 2017, President Xi Jinping warned at the Party Congress that houses should be built to be lived in and not for speculation. Even so, vacancy rates are high. Indeed, China has one of the highest housing vacancy rates in the world.

The state budget depends on a real estate boom

It is estimated that more than 50% of government revenue comes from the granting of land rights and land sales. Thus, a bursting of China’s real estate bubble would entail significant revenue losses for the central, as well as provincial, governments. China has tightened access to mortgage credit in recent quarters and we note that in August, China’s government sector generated substantially less revenue from land sales.

High indebtedness of Chinese real estate developers

The total debt of listed real estate developers is more than 1000 billion US dollars. Of this total, over US$ 350 billion is debt that must be repaid in US dollars.

The largest asset class in the world

In 2019, Goldman Sachs calculated the value of all Chinese real estate at about 64% of global Gross National Product, or 52’000 billion US dollars. Thus, together with the country itself, the asset class “real estate China” is probably the largest asset class in the world.

Evergrande – is it an isolated case?

Evergrande, China’s second largest real estate developer in terms of sales, is currently close to collapse. The company’s outstanding debts total around 300 billion US dollars. But allowing Evergrande to collapse would probably be far more expensive for the Chinese authorities than a quick rescue. This is because of the impact a collapse would have on property prices and hence on other developers due to numerous collateral provisions/credit links. A further complicating factor is the threat of social unrest, as many small investors could lose their savings.

How will China react?

Will the party open the bailout parachute given that China’s bankruptcy law has just recently been tightened? In all likelihood, no! But, if Evergrande is simply allowed to go bust a major housing crisis and social unrest would threaten. Also, the government budget would be severely affected. The Chinese leadership is fully aware of the potential implications given the catastrophic consequences of the Lehman default.

Managed default

It is therefore likely that a default by Evergrande will be heavily cushioned by state intervention, although it won’t be completely prevented. There is the threat of a “bail-in”, i.e., an orderly recapitalization as part of a restructuring process whereby most lenders and investors would find themselves taking losses or being called on to contribute. A sort of middle-of-the-road scenario. It is inconceivable that the Chinese leadership would allow a Lehman-type disaster to happen as long as they have the means to prevent this. International investors are unlikely to escape unscathed. The distribution of losses is at the discretion of the Chinese state. Part of the outstanding debt of USD 300 billion is likely to be converted into equity.

More expansionary economic policy in prospect

As China’s second largest real estate developer, Evergrande is highly “system-relevant”. Asian banks in general, and not just Chinese ones, are likely to have to take a substantial hit and refinancing the debt of other developers will probably become much more difficult. We expect financing resistance to be high. Therefore, China’s central bank, the People’s Bank of China, will soon adjust its monetary policy in an expansionary direction to try to “manage” the collateral damage. As a result, we predict that following its recent decline China’s credit impulse will soon return to positive territory.

Chinese banks and construction stocks are unattractive

We view Chinese property developers and banks as unattractive investments at present. The volume of non-performing loans is set to rise sharply. There will be a time to invest in stressed Chinese developers trading well below book value. But that time is not today, nor in the immediate future. First, the numerous contagion processes following events at Evergrande will have to be digested, as was the case after the Lehman default. In contrast to the Great Financial Crisis of 2007/8, international investors are likely to be less affected this time, as they have been rather reluctant to invest in Chinese real estate and financial stocks. While the crisis may spread to the rest of the world its epicenter will remain in China. Thus, we see little chance of a catastrophic contagion impact in Europe such as happened during the Great Financial Crisis.

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.