High valuations worry asset managers

Independent asset managers in Switzerland had a good run last year. They must now be all the more vigilant in order not to squander the progress made in 2021 in the coming months. There are certainly enough risks.

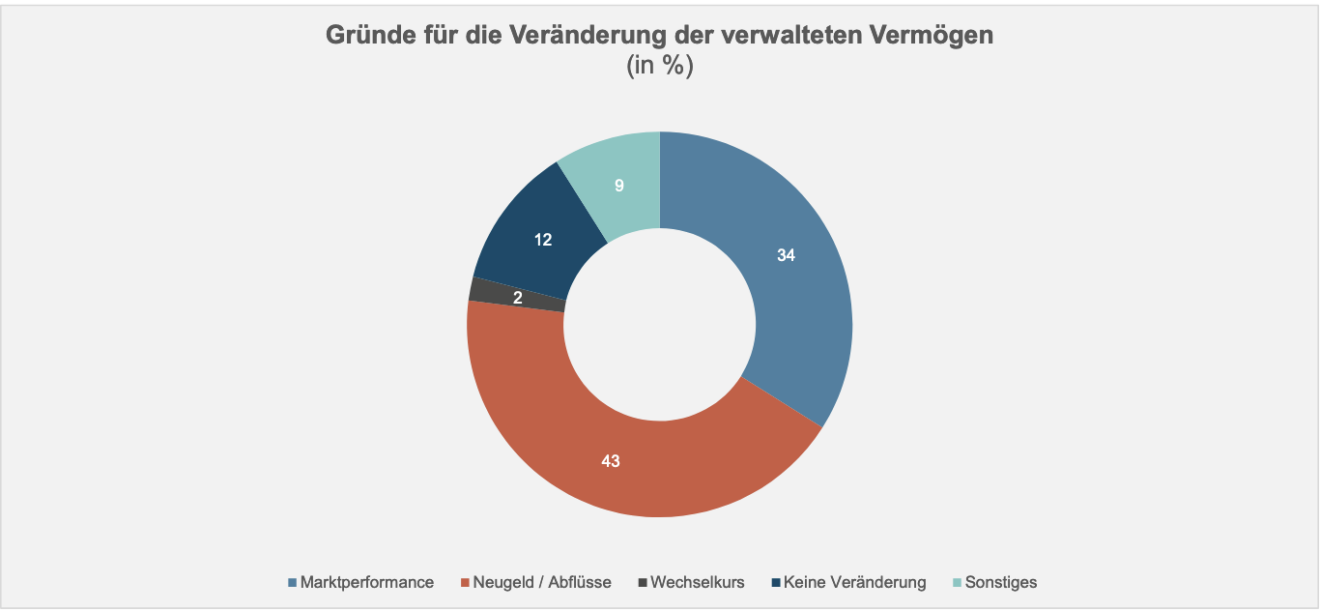

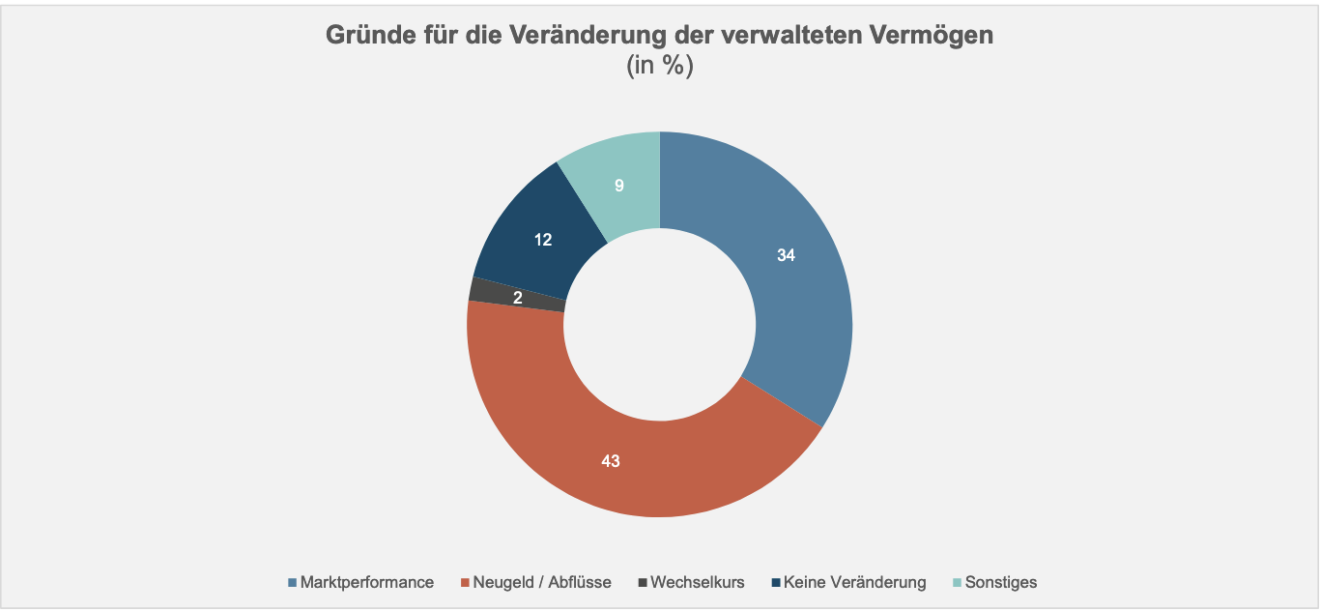

Independent asset managers in Switzerland can look back on a highly successful 2021. Not only did the good stock market provide them with significantly higher client assets, but they also received a great deal of new money (see chart below).

This is also an indication that some customers are turning away from banks and seeking advice from independent asset managers. Overall, almost 70 percent of the asset managers surveyed reported higher customer deposits at the end of 2021 than at the beginning of the year.

This is clear from the Aquila Asset Manager Index (AVI), which the Swiss Aquila Group is published every three months in cooperation with finews.ch. The index summarizes various forecasts and assessments by independent asset managers in Switzerland. 150 firms participated in the latest survey.

AVI index increased by almost 10 percent in 2021

"The year 2021 was an encouraging one for most investors. The AVI index, which is based on a balanced strategy, is implemented passively and tracks the average allocation of all asset managers participating in the survey, was up 9.3 percent," explains Nicolas Peter, Head Investments at Aquila Group (see chart below).

From a performance point of view, there was a large discrepancy between the individual asset classes, Peter continued. "In terms of bond investments, only the allocation to high-yield bonds was able to make a positive contribution to performance. All other fixed-income investments ended the year with a return of between -0.8 percent and -3.8 percent," Peter emphasizes. Accordingly, the performance of the overall portfolio was almost exclusively driven by the development of the equity markets. "The U.S. equity allocation achieved the best return with 33 percent, followed by Swiss equities with 23 percent," explains the Aquila expert.

The biggest risks in 2022

Looking ahead to 2022, the market assessment of the asset managers surveyed is highly interesting: 43 percent of respondents named high valuations as the biggest risk in the current year, and political risks were considered the second biggest risk (see chart below).

Both can be derived very well. Indeed, the shares of many technology and IT companies have reached almost astronomical valuations, which have only been possible due to the sometimes limitless flood of money from central banks; if the monetary guardians now herald a more restrictive policy - and raise interest rates - the bull market is likely to take a breather for the time being.

What makes for nervousness

If political turbulence is added to this - in addition to China and North Korea, Russia is now also causing a certain amount of nervousness in the Western world - a phase of maximum volatility is likely to return to the stock market floor. Despite these potential threat factors, independent asset managers are in good spirits for 2022.

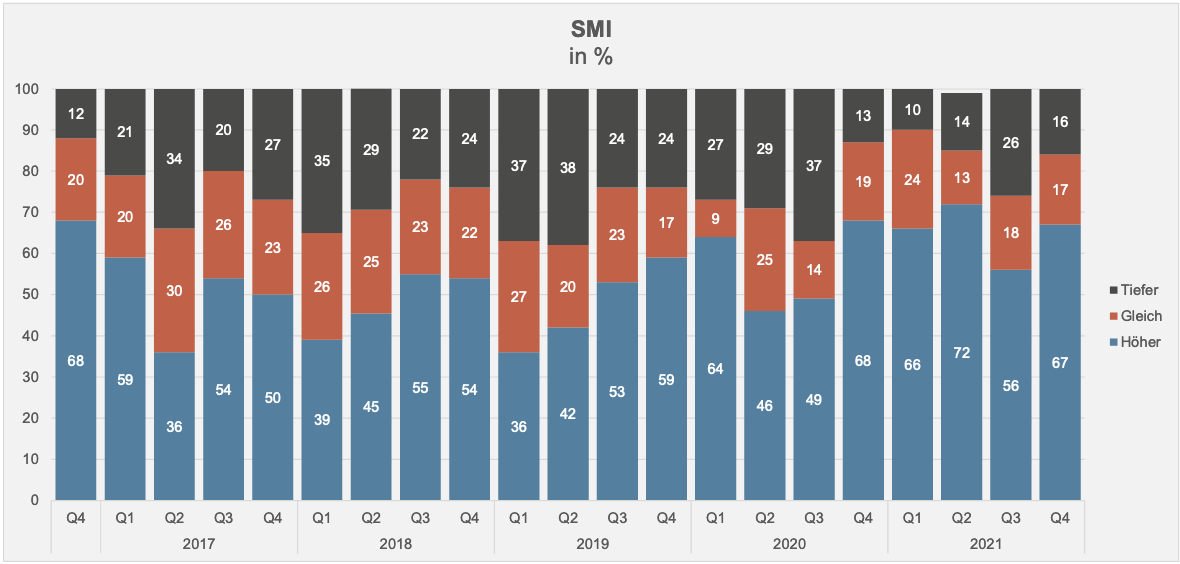

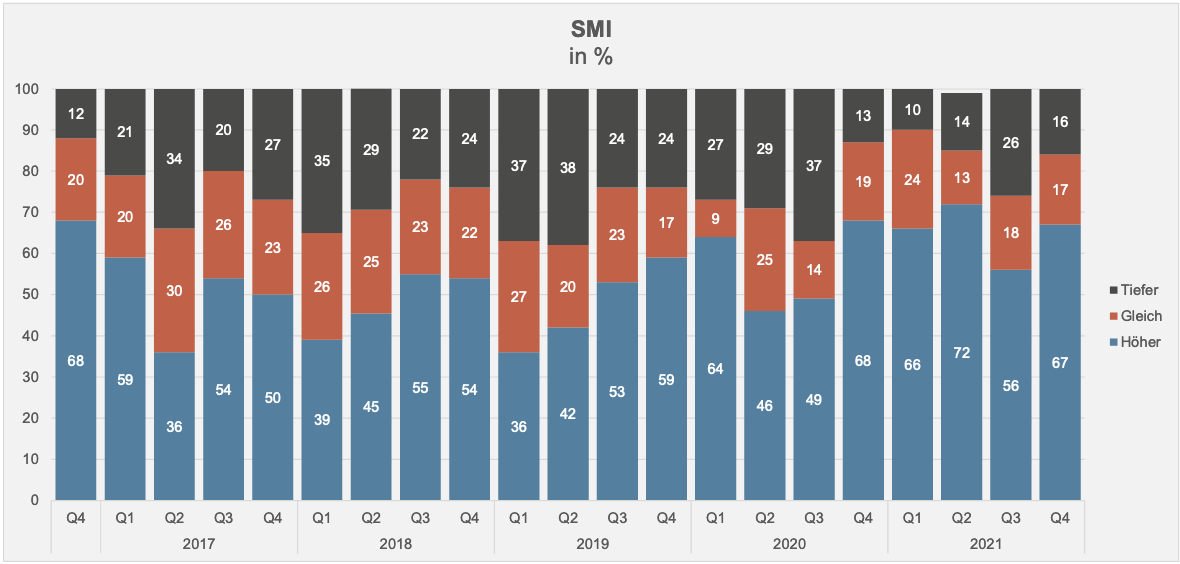

A full 67 percent (previous quarter: 56 percent) of respondents expect prices on the Swiss Market Index (SMI) to rise overall over the next twelve months, while only 16 percent (previous quarter: 26 percent) expect prices to fall (see chart below).

Expectations are similar for other countries. For the EuroStoxx50, 60 percent of respondents (previous quarter: 45 percent) expect prices to rise, while 16 percent (previous quarter: 29 percent) anticipate lower prices. Looking at the USA, 64 percent of respondents (previous quarter: 40 percent) expect higher prices for the S&P500, while 17 percent (previous quarter: 29 percent) expect prices to fall.

Coveted gold

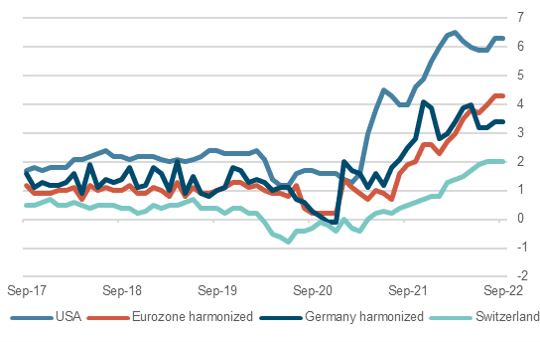

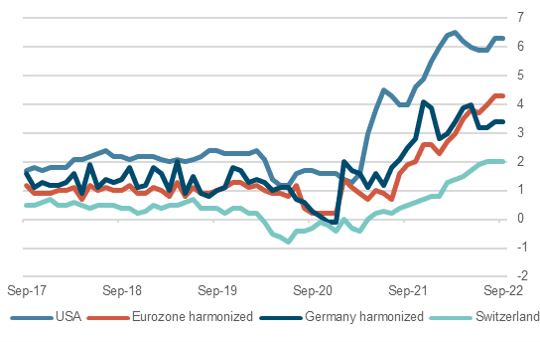

Finally, it is clear to the independent asset managers that the Swiss National Bank will leave interest rates unchanged despite possible inflation abroad. This is the assumption of 93 percent of those surveyed. In the U.S., the experts expect inflation to be in the range of 2 to 4 percent over the year as a whole.

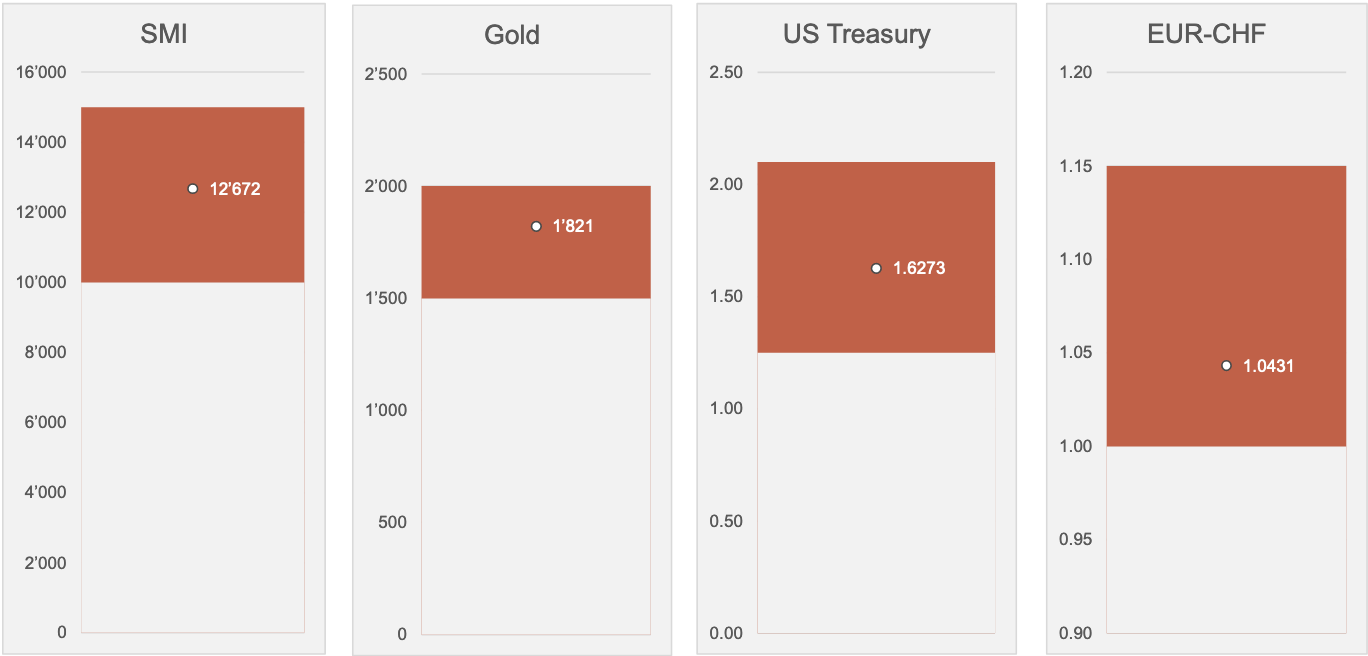

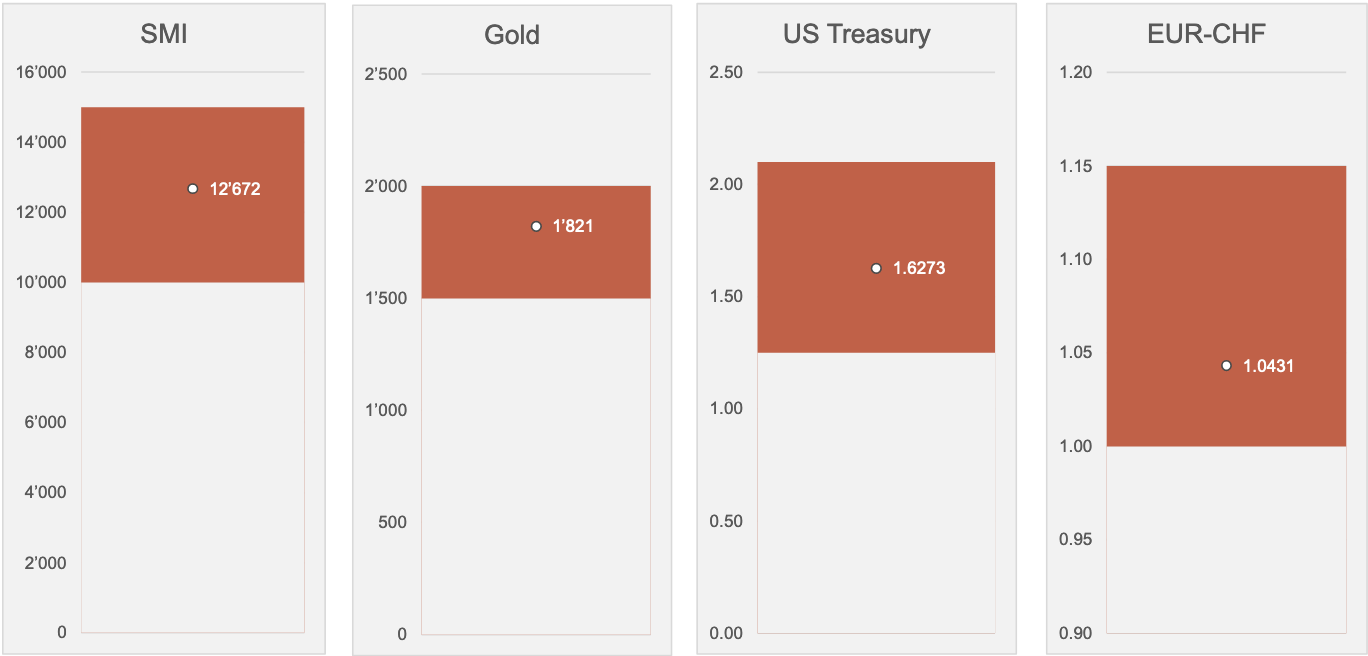

In three months, the independent asset managers see the SMI at 12,672 (current: 12,714); the troy ounce of gold at $1,821 (current: 1,813); the yield on the 10-year U.S. Treasury at 1.627 percent (current: 1.769); and the euro-franc exchange rate at 1.0431 (current: 1.0494).

The next AVI Index will be published in April 2022.

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.