Asset managers expect a gold bull market in 2020

The yellow precious metal will generate a higher average return than equities in the current year. At least that is what independent asset managers in Switzerland expect.

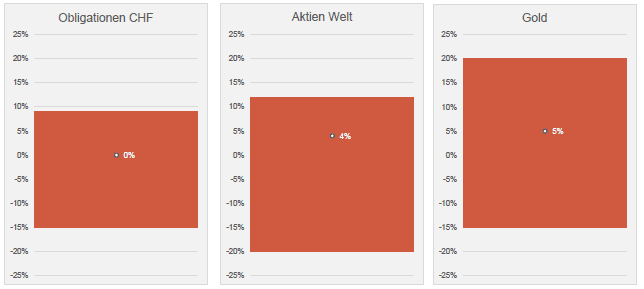

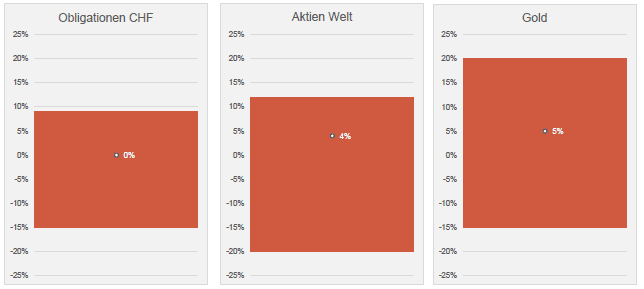

While equities have long been regarded as the traditional asset class offering the highest returns, this is no longer likely to be the case in 2020. Independent asset managers in Switzerland expect the price of gold to rise by an average of 5 percent, while they anticipate a mere 4 percent increase in the value of equities worldwide. The majority of them do not believe that bonds denominated in Swiss francs will make any great leaps (cf. graphic).

This is according to the latest Aquila Asset Managers Index (AVI), published by the Swiss Aquila Group every three months in cooperation with finews.ch published. The index summarizes various forecasts from independent asset managers in Switzerland. Almost 160 firms took part in the latest survey.

Click here for the complete overview

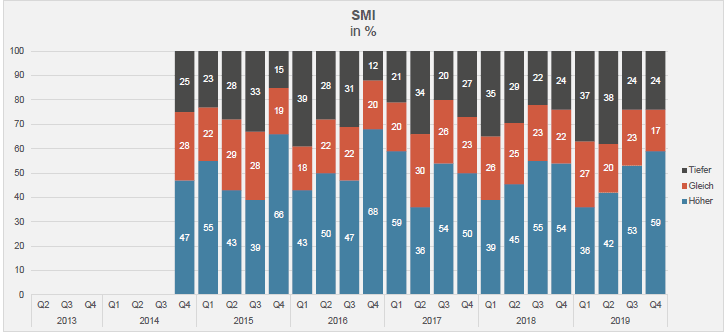

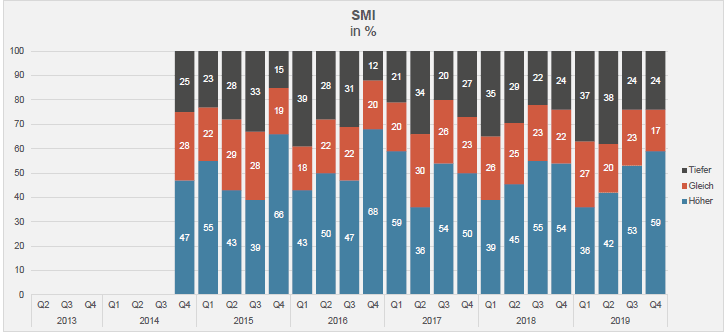

Swiss asset managers expect stock market prices to rise significantly over the next three months (59 percent of respondents in the SMI, 58 percent in the EuroStoxx50 and 57 percent in the S&P500) (cf. graphic).

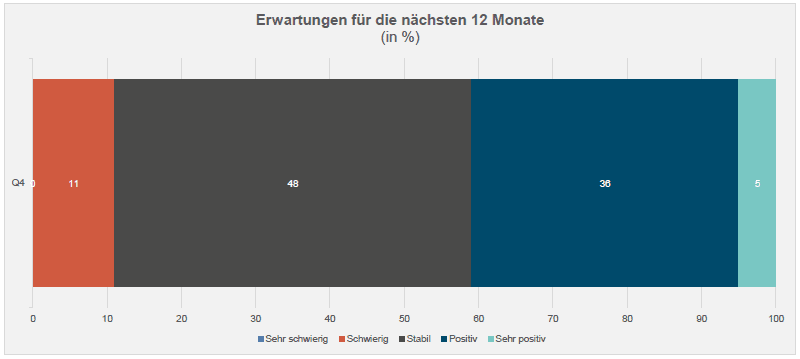

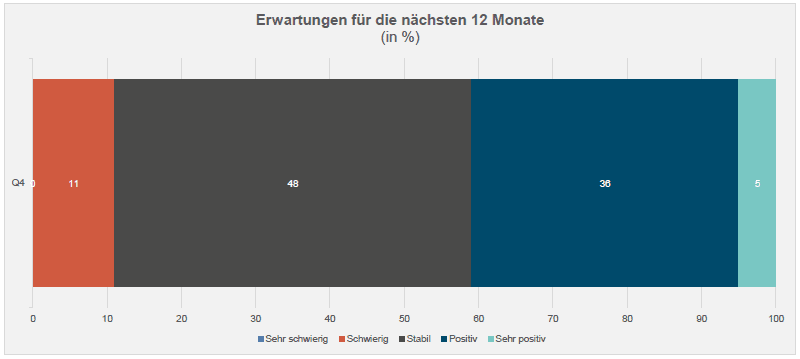

These expectations make asset managers generally optimistic. A total of 41 percent of survey participants expect business to develop positively or even very positively over the next twelve months; 48 percent anticipate stable development.

Under these premises, a quarter of the asset managers surveyed intend to hire additional staff, as the current survey further reveals (cf. graphic).

More new money

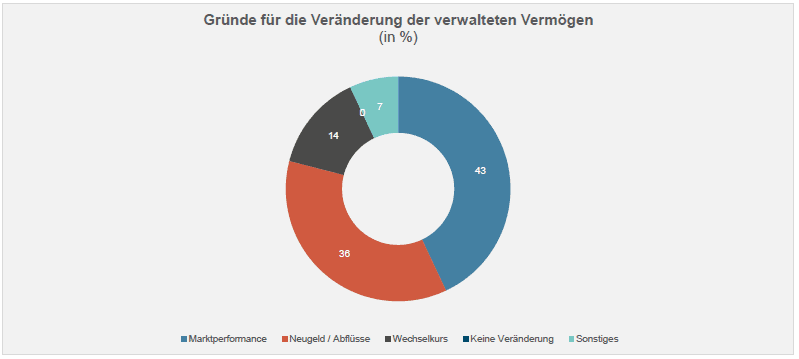

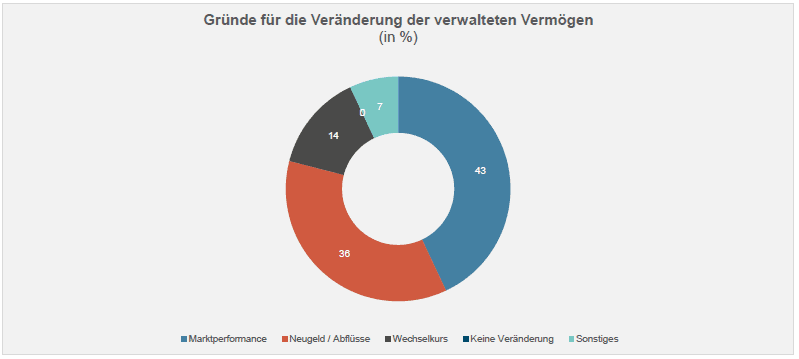

A look back shows that 2019 has already left a positive mark on the books of independent asset managers. The encouraging price performance on the financial markets not only led to an increase in assets under management for 65 percent of respondents, but also to a significant increase in new money for 36 percent of survey participants. Good market performance was also important for growth for 43 percent of asset managers (cf. graphic).

Rising SMI

In three months, Swiss asset managers see the SMI averaging 10,606 (previous quarter: 10,017), gold at a good 1,505 (previous quarter's expectation: 1,538) dollars an ounce and the euro at 1.09 (previous quarter: 1.08) francs.

The next AVI Index will be published in April 2020.

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.