This is how independent asset managers start the new year

Independent asset managers in Switzerland are preparing for difficult times. They expect lower stock market prices, stagnating client assets and a recession in the USA in 2020.

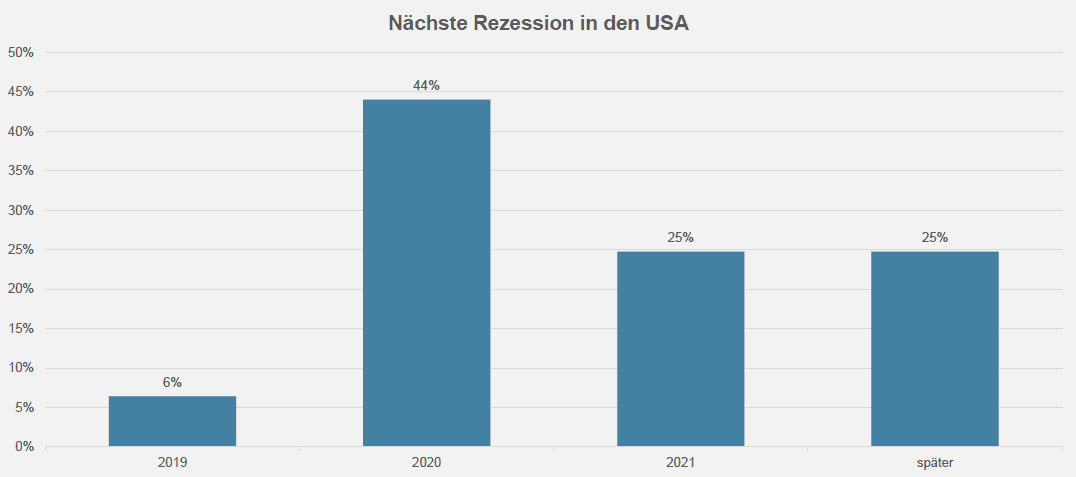

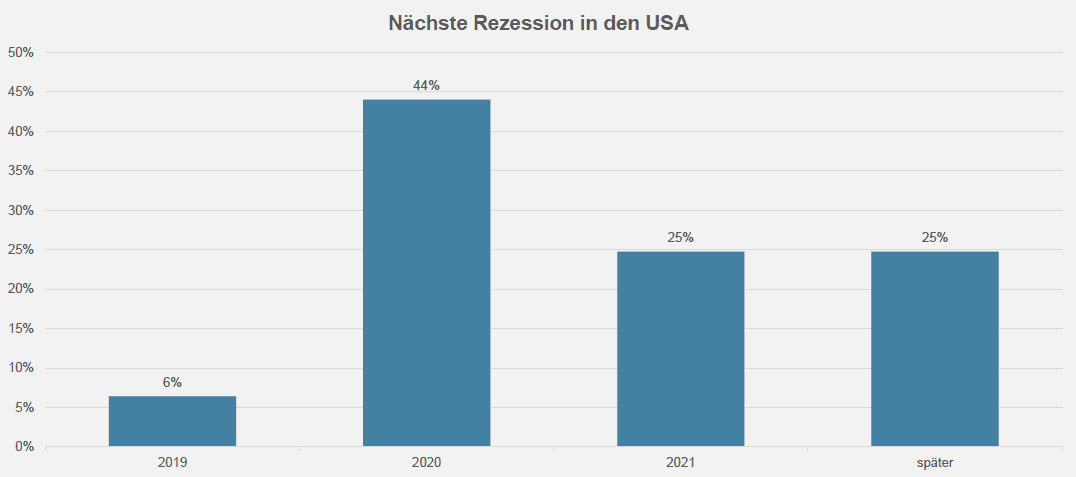

The most difficult period on the financial markets is not likely to occur until next year, i.e. 2020. 44 percent of independent asset managers in Switzerland are now convinced of this (cf. graphic below). They assume that the ongoing trade war between the U.S. and China (41 percent of respondents) will not intensify, but is likely to lead to a kind of stalemate that will have a negative impact on the stock market in the medium term.

Against this backdrop, many companies have scaled back their expectations somewhat. This is evident from the latest Aquila Asset Managers Index (AVI), which the Swiss Aquila Group every three months in cooperation with finews.ch published. The index summarizes various forecasts from independent asset managers in Switzerland. A good 140 firms took part in the latest survey.

Click here for the complete overview

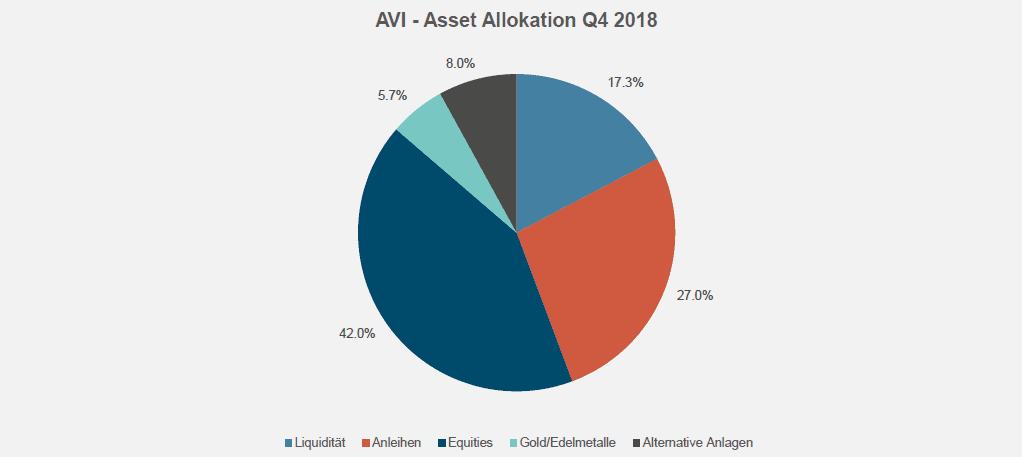

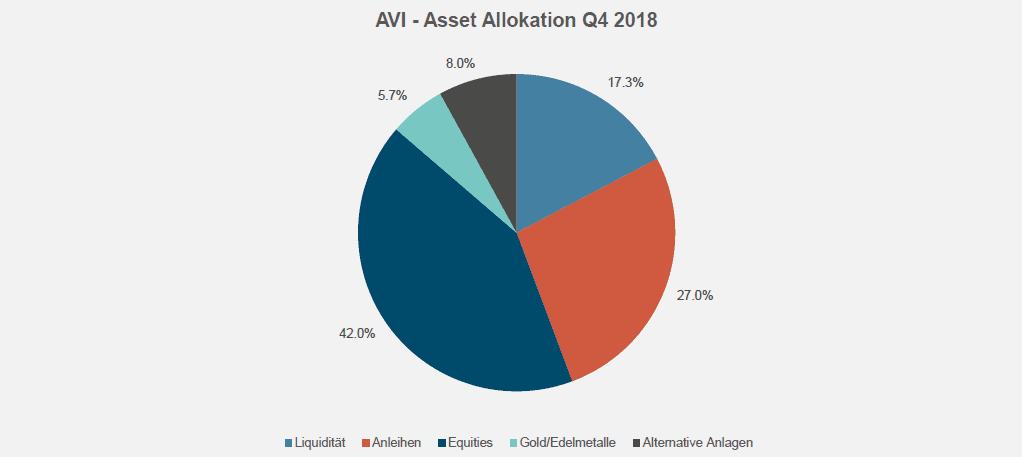

The new caution manifests itself, among other things, in the fact that many asset managers have reduced their holdings in bonds and shifted the proceeds into liquidity. They have also slightly increased their holdings in gold and other precious metals (cf. graphic below).

Specifically, asset managers reduced their bond allocation from 29.0 percent in the previous quarter to 27.0 percent; by contrast, the equity allocation remained stable at 42 percent. In contrast, liquidity rose from 13.5 percent in the previous quarter to 17.3 percent; the share of gold and other precious metals increased from 5.2 percent to 5.7 percent; the share of alternative investments fell from 10 percent to 8.0 percent.

"In our view, the correction in the equity markets is not over yet," says Reinhard Styger. "After a brief recovery in January, the U.S./China trade conflict, the political arenas of Brexit, Italy, France, Germany, and questionable U.S. Federal Reserve policy are likely to take the markets back to 2016 levels (SMI at 7,600, S&P 500 at 2,040/1,860, and DAX at 8,970) in the worst case," Styger added. Against this background, he recommends further reducing equity positions in any recovery phases.

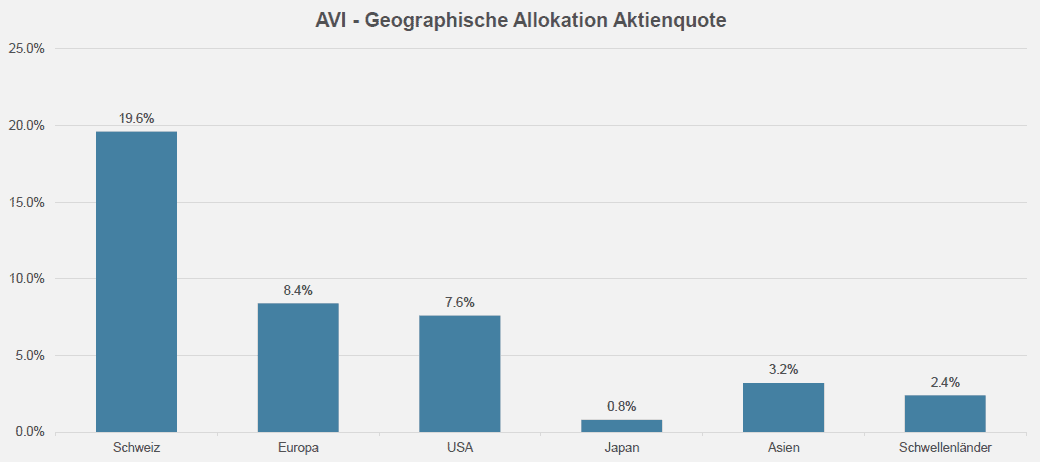

Swiss shares in demand

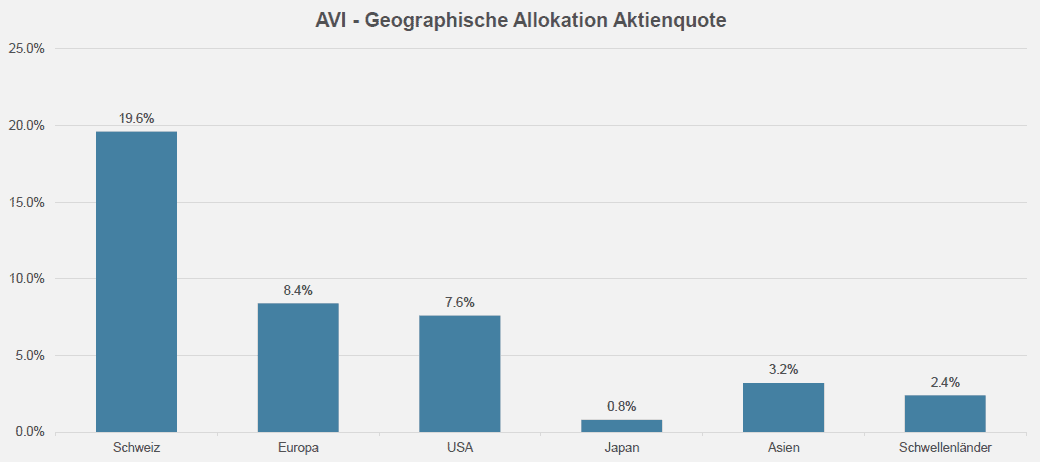

It is also interesting to note that the asset managers surveyed have increased the proportion of Swiss equities in their equity allocation (from an average of 42 percent) from 17.5 percent in the previous quarter to 19.6 percent now. In contrast, they have clearly reduced their holdings of European and Asian stocks as well as emerging markets. US equities are now also less in the players' favor (cf. graphic below).

"Anyone can speculate. Doing it at the right time - that's the art," says Urs Lüscher, founder and partner of the company Sinvest Finance, quoting a bon mot of the legendary stock market guru André Kostolany. "Equity valuations have moderated. Stock markets have anticipated slowing growth, and volatility will remain high in 2019," he continues, concluding, "The key is to take advantage of this volatility with targeted transactions."

Technically, the markets are still oversold and sentiment indicators are at a very low level. This is an attractive time to build up equity positions with good dividends and growth over the long term, says Lüscher.

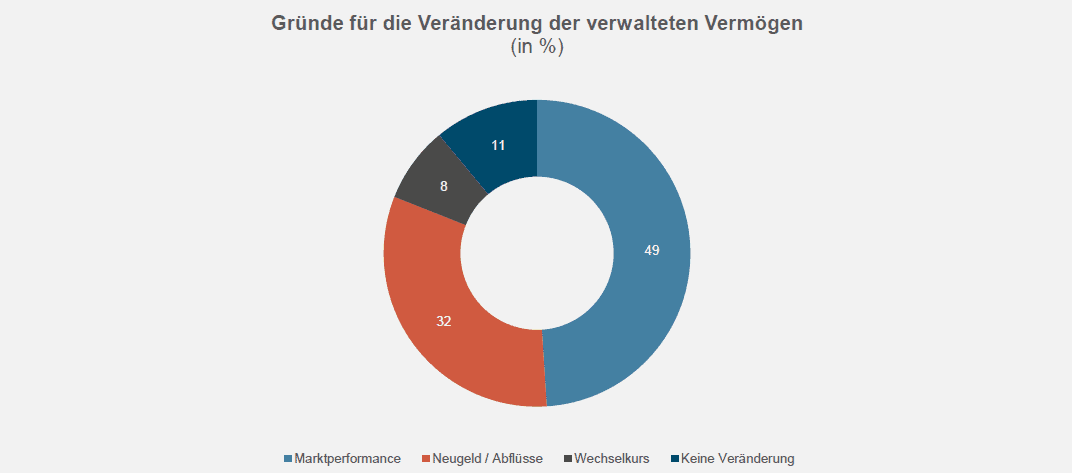

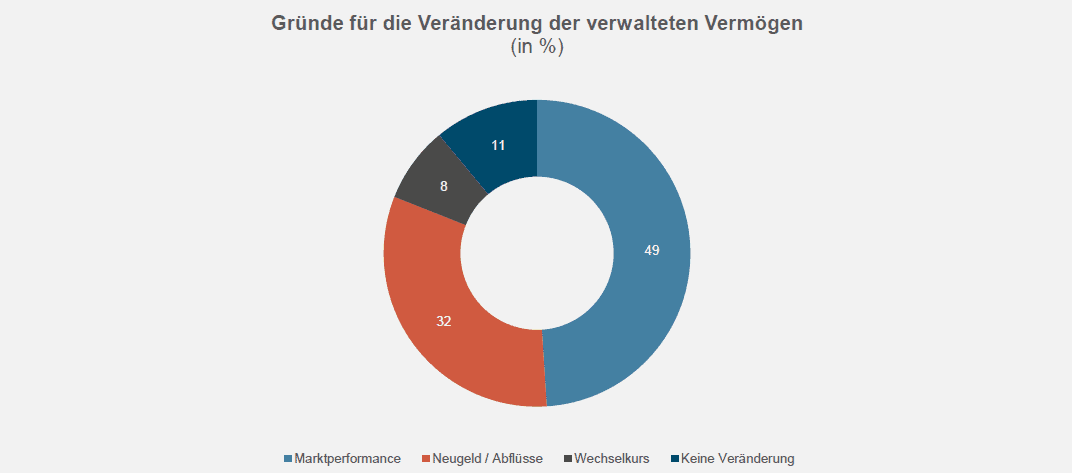

With regard to their own companies, the asset managers surveyed are relatively confident about the next three months despite the gloomy outlook. Almost half (49 percent) of the independent asset managers expect to be able to maintain the level of client assets under management, but no longer to increase it substantially (cf. graphic below).

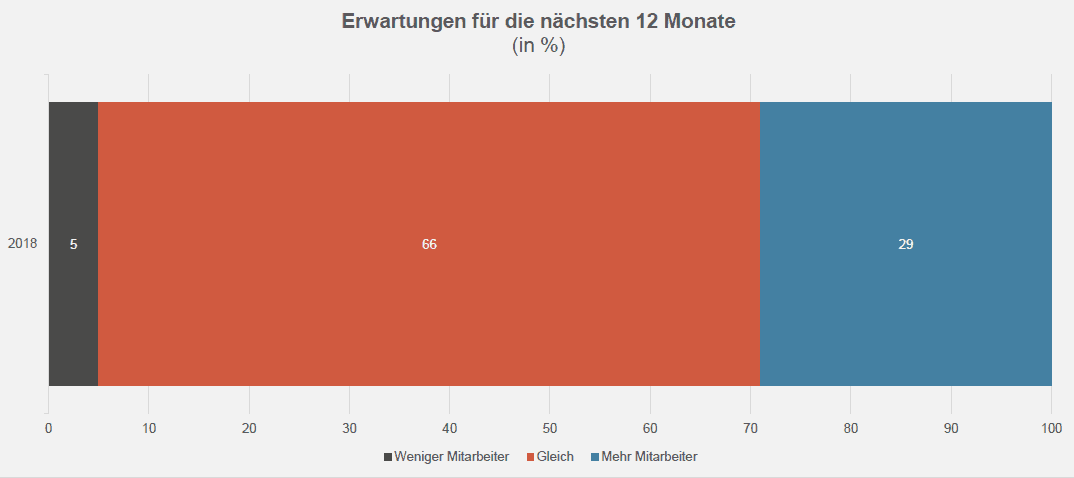

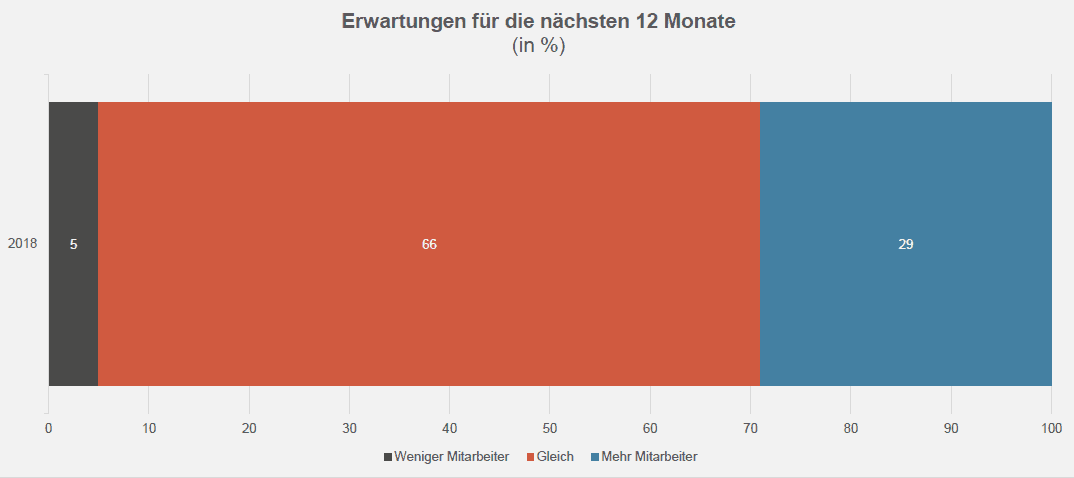

However, despite this somewhat subdued assessment, a third of the survey participants still rate business development in the next twelve months as positive. It is particularly noteworthy that 29 percent still want to hire additional employees. Only 5 percent of the asset managers surveyed intend to cut jobs.

Looking ahead over the next three months, the independent asset managers see the Swiss Market Index (SMI) at a level of around 9,000. By comparison, the SMI is currently trading at around 8,738. Gold, in turn, which used to be a good indicator in difficult stock market times, is seen by the survey participants at a level of around 1,300 dollars an ounce next April, slightly above the current level of 1,294 dollars.

The next AVI Index will be published in April 2019.

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.