Asset managers expect further surge in inflation

Independent asset managers in Switzerland are facing difficult times. Some of their portfolios are showing high losses due to market conditions. At the same time, a large number of players are assuming a further surge in inflation. What are the most recommendable asset classes now?

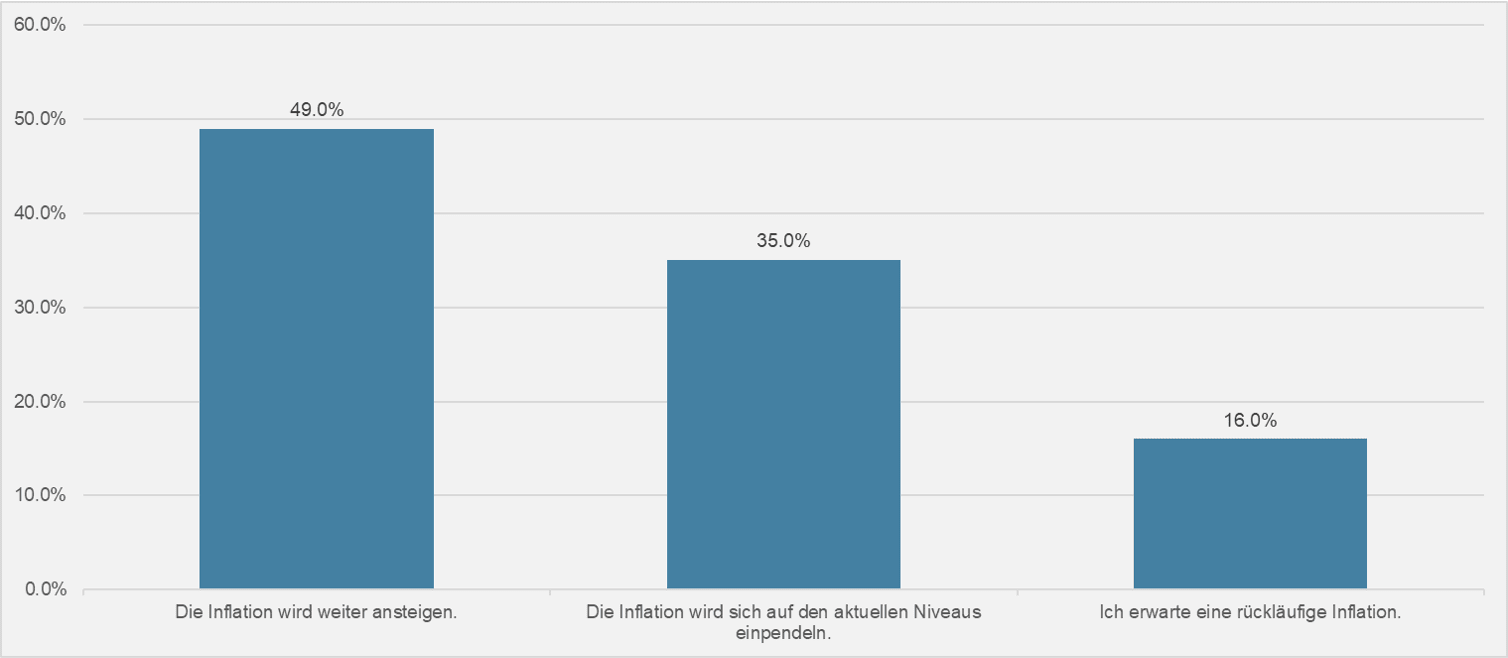

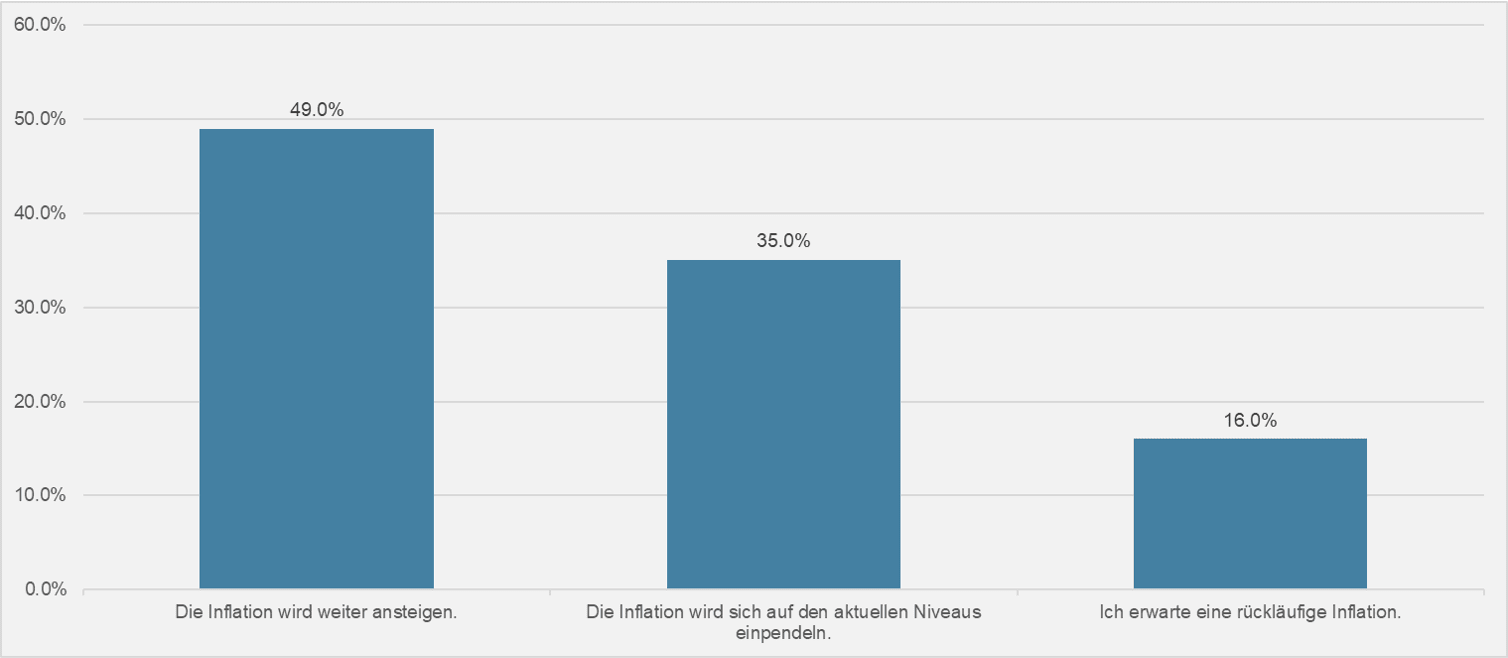

Just under half of independent asset managers in Switzerland expect inflation to continue rising. One-third of respondents, on the other hand, believe that inflation will settle at the current level (see chart below).

Although the proportion of players who expect stock market prices to rise in the next three months still tends to predominate, i.e. 45 percent compared with 48 percent just three months ago, the proportion of independent asset managers who expect prices to fall has also increased. This is now 3o percent of respondents, compared with 24 percent at the end of June 2022.

"We expect inflation to decline only slightly. It will lead to wage demands by employees in the fourth quarter of 2022. The unions are demanding full inflation compensation and another real wage increase, which will lead to a wage-price spiral. Inflation will therefore continue in 2023, which does not seem to be priced in on the stock markets at the moment," said Bruno Schneller, Managing Director at the Zurich-based company Invico Asset Management.

Shares from industrialized countries favored

This information is derived from the Aquila Asset Manager Index (AVI) which the Swiss Aquila Group is published every three months in cooperation with finews.ch. The index summarizes various forecasts and assessments by independent asset managers in Switzerland. 150 firms participated in the latest survey.

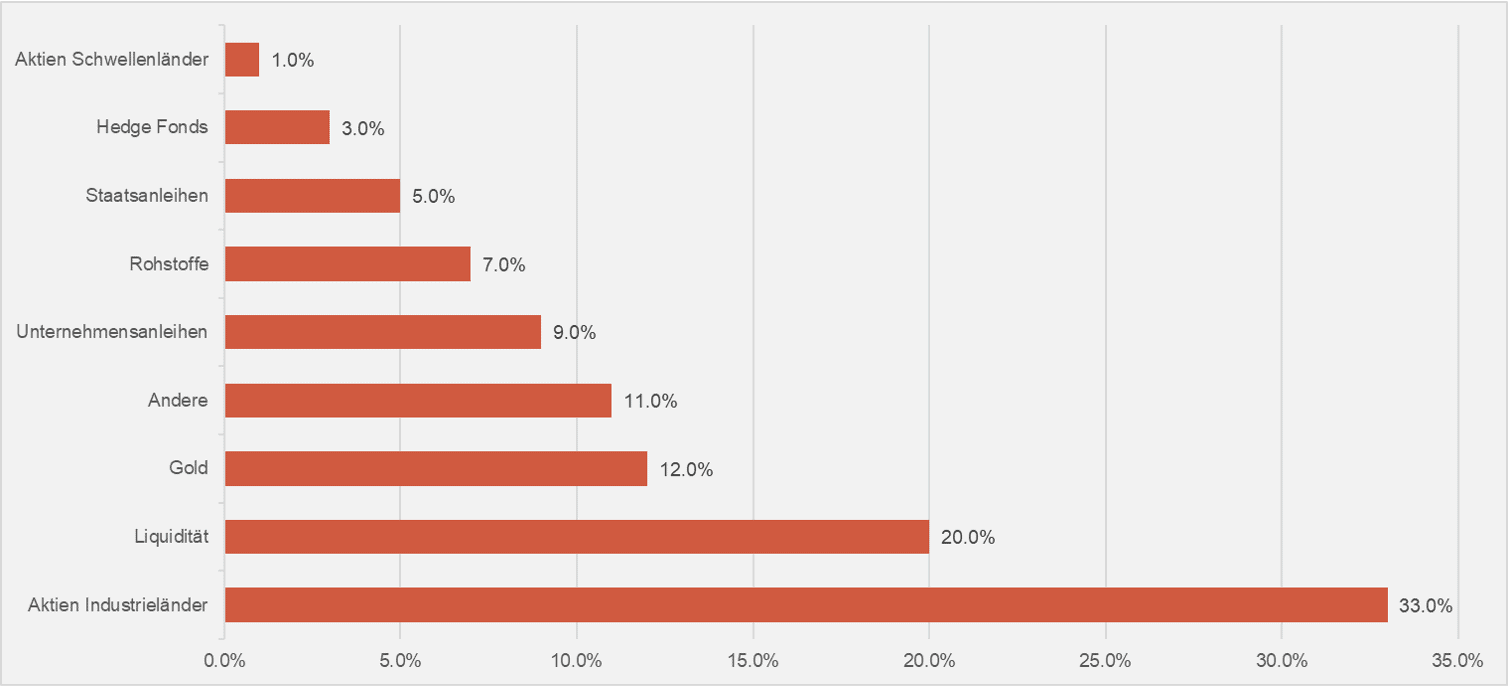

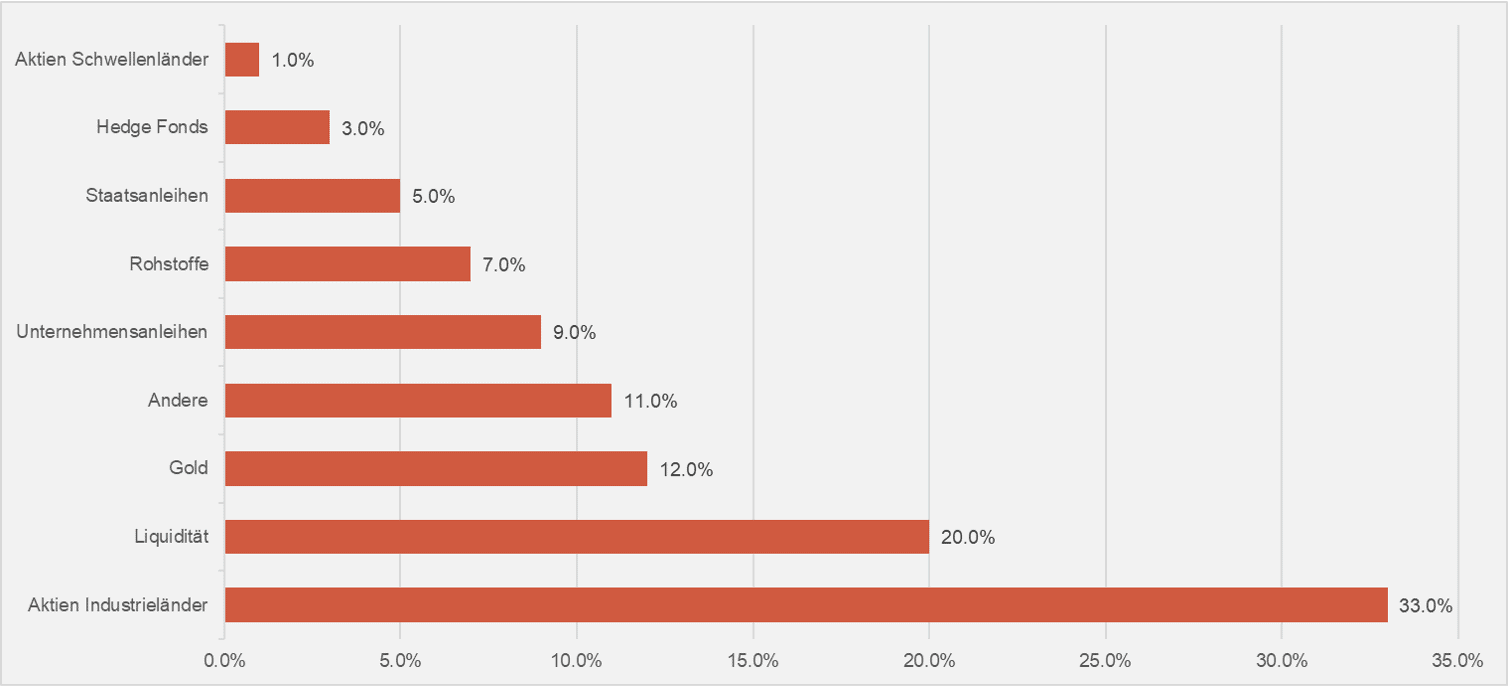

In this context, it is also interesting to see which asset classes the survey participants now favor. In first place are equities from industrialized countries (33 percent of respondents), exactly one fifth of independent asset managers are now focusing on liquidity - in order to be ready for action when a sustained trend reversal becomes foreseeable on the market; gold, on the other hand, is now recommended by 12 percent of players.

By contrast, independent asset managers now steer clear of emerging market equities and hedge funds (see chart below).

Investments at the front end of the yield curve

"For cyclically sensitive equities in particular, a possible recession means lower profits. Especially in the dollar area, real interest rates have risen sharply in recent months, not least thanks to inflation expectations falling again. Thus, holding cash in dollars is yielding a higher real return than at any time in the last decade. This is accompanied by higher discount rates, which also make growth stocks or companies with high leverage look unattractive," said Andreas Schwyn, Chief Investment Officer at Zurich-based firm Nimar Asset Management.

"So for the time being, safe investments at the front end of the yield curve seem to be the better alternative versus many parts of the equity market," Schwyn concludes.

Potential for the SMI

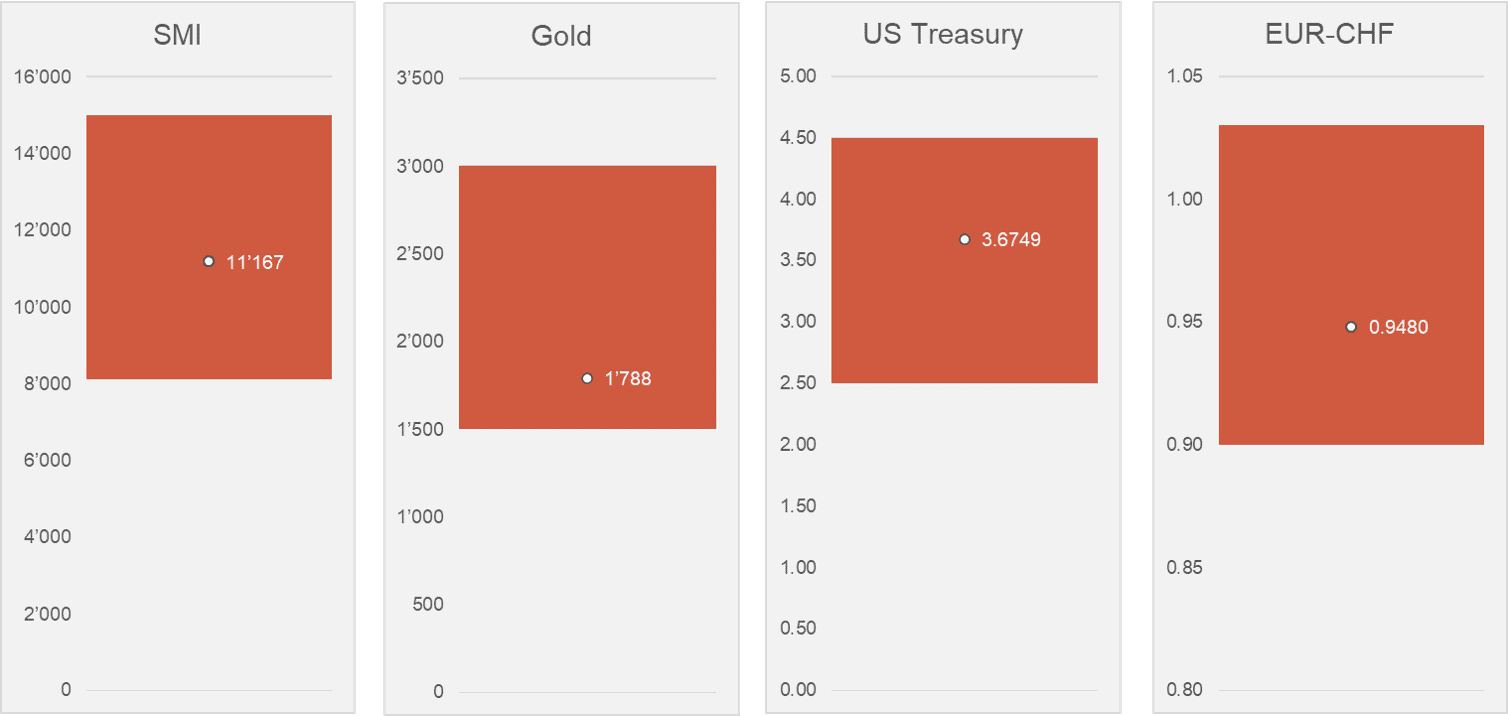

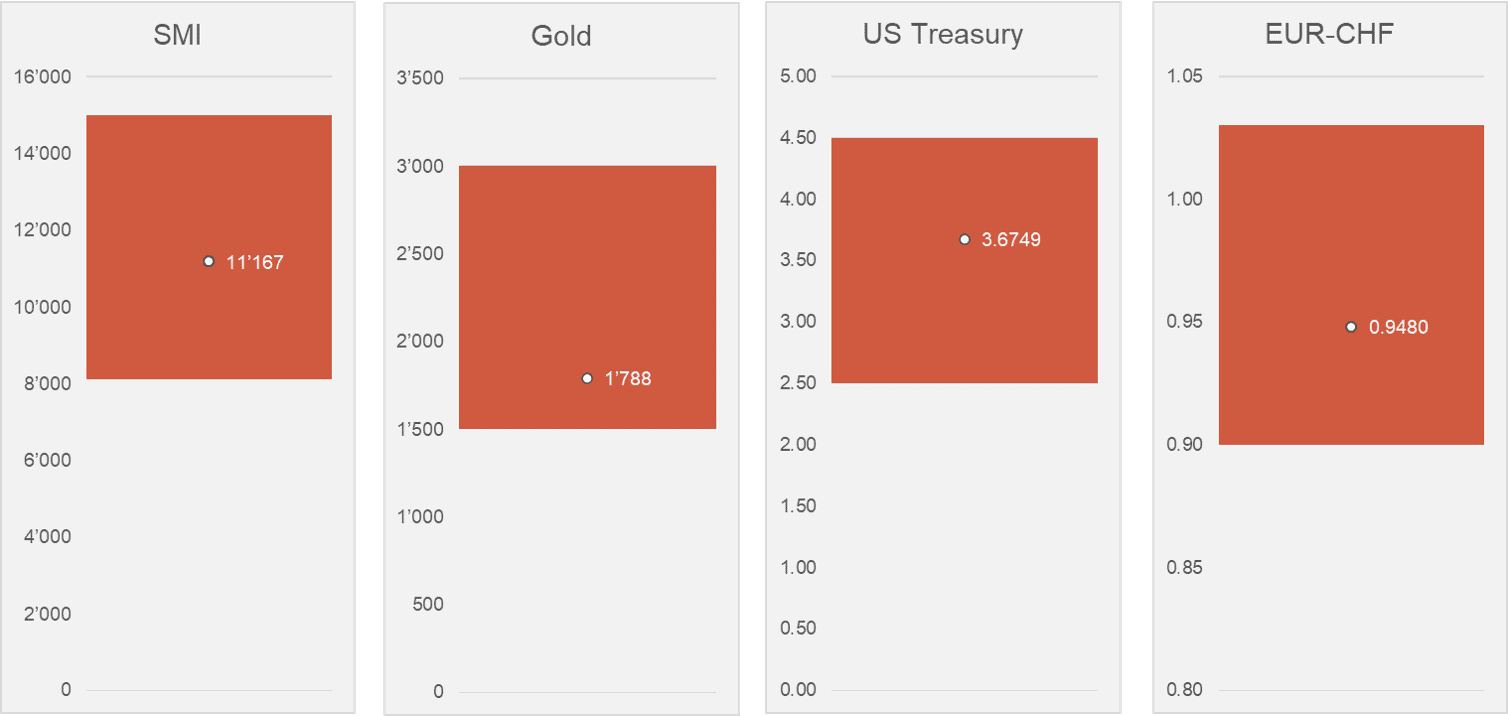

Three months from now (see chart below), the independent asset managers see the Swiss Market Index (SMI) at a level of 10,964 (currently: 11,241).

Independent asset managers are skeptical about gold; recent interest rate hikes by central banks have clouded the outlook for the yellow precious metal.

Gold well below 2,000 dollars

By the end of September 2022, the respondents expect a price of only 1,788 dollars per ounce (currently: 1,707 dollars) - well below the 2,000 dollar mark.

They estimate the yield on the 10-year U.S. Treasury at 3.68 percent in three months (currently: 3.58) and the euro-franc exchange rate at 0.9480 (currently: 0.9763).

The next AVI index will be published in January 2023.

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.