Asset managers reckon with SPD chancellor

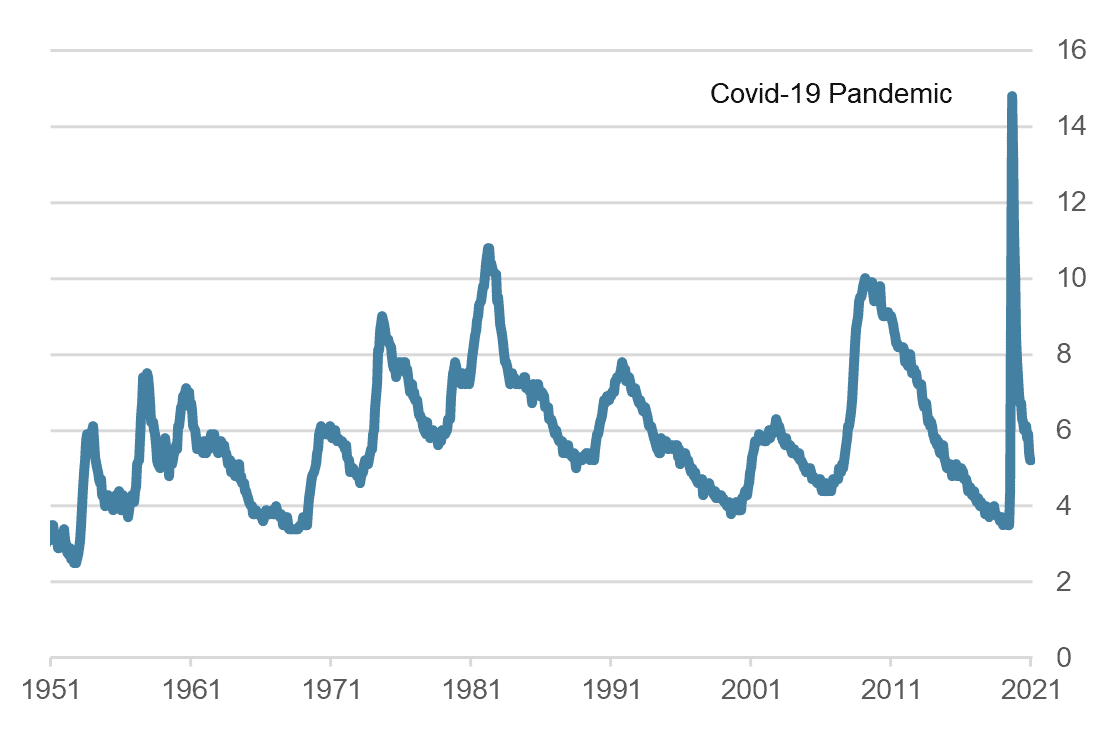

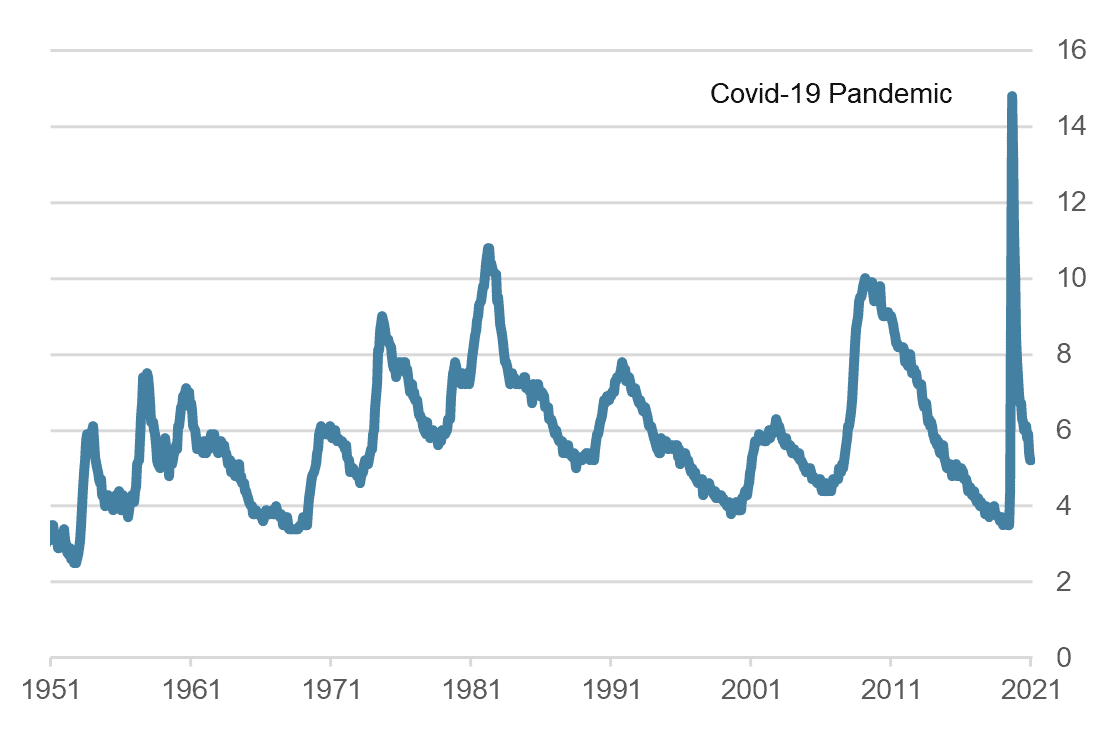

The independent asset managers in Switzerland are facing reality, both with a political turnaround in Germany and with a stock market that, in the face of expected interest rate hikes, will no longer be so exhilarating, as the latest AVI index shows.

Just a few days before the long-awaited elections in Germany, 65 percent of independent asset managers in Switzerland expect a clear victory for the left-wing parties, which are expected to win with Olaf Scholz (SPD) will provide the next German Chancellor.

In contrast, only 33 percent of those surveyed assume that Armin Laschet (CDU) as the future German Chancellor. The Green Party candidate was far behind with 2 percent, Annalena Baerbock (cf. chart below).

Whether this is a good omen for neighborly relations with Switzerland, especially with the Swiss financial sector, remains to be seen.

This is clear from the Aquila Asset Manager Index which is published every three months by the Swiss Aquila Group in cooperation with finews.ch. The index summarizes various forecasts and assessments of independent asset managers in Switzerland. 150 firms participated in the latest survey.

Growth or value stocks?

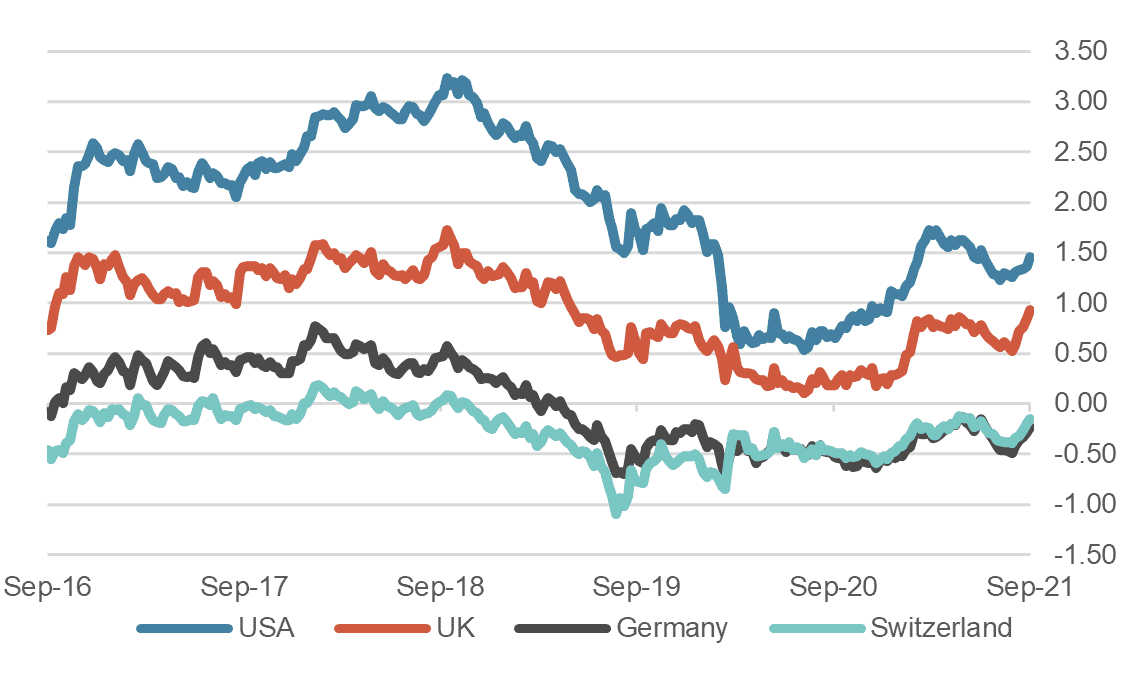

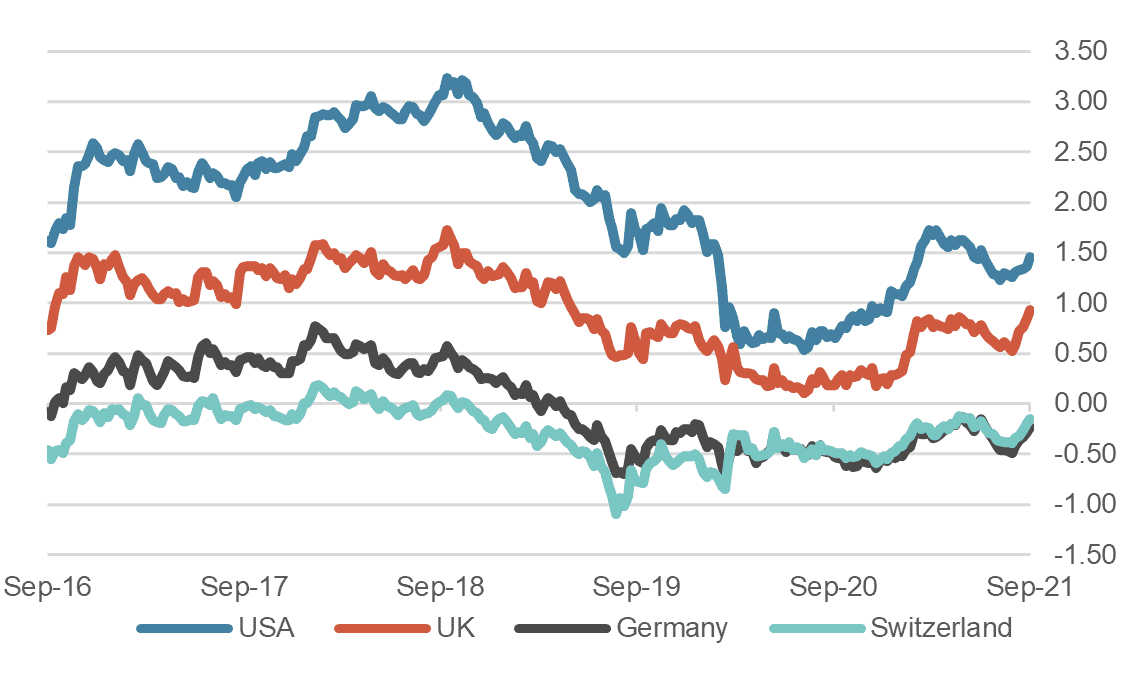

Looking at the U.S., 21 percent of the asset managers surveyed expect the Federal Reserve to raise interest rates this year; the majority, 46 percent, expect a hike in the first half of 2022.

Against this backdrop, 36.0 percent of survey participants believe that it is still too early to rotate from growth to value stocks. However, this trend is not clear-cut. In fact, 33 percent of respondents are convinced that a switch now would be favorable. For 31 percent, there is no reason at all for a rotation.

Alternative investments in demand

It is precisely this disagreement about the right timing for rotation that will lead independent asset managers to reduce their equity allocation from the current 49.7 percent to 48.2 percent over the next few months. In return, they intend to increase their bond allocation from 23.3 percent to 24.2 percent.

In view of the unclear interest rate trend, many companies surveyed also increased their share of alternative investments from 6.0 percent to 7.4 percent; well aware that these assets are less liquid but less correlated with the stock market (see chart below).

Disillusionment spreads

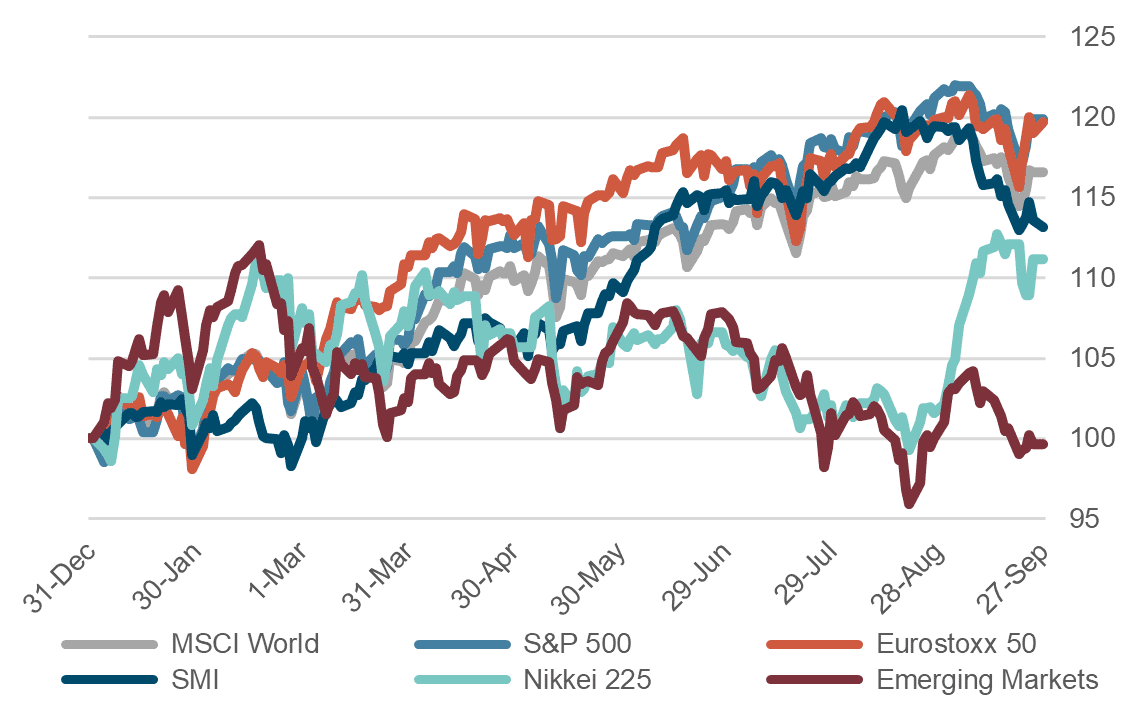

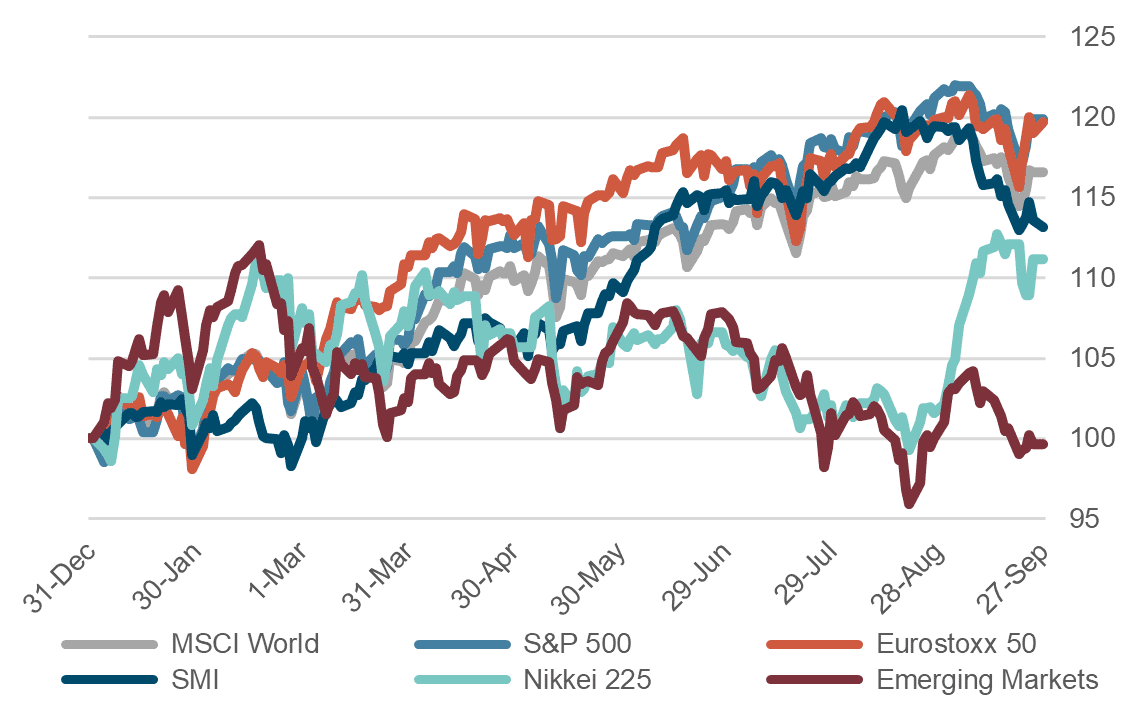

These assessments match the expectations for further developments on the financial markets. A growing proportion of independent asset managers anticipate weaker stock markets. Looking at the Swiss Market Index (SMI), only 14 percent of those surveyed were of this opinion three months ago, but this figure has now risen to 26 percent.

Conversely, 72 percent of respondents in July still expected prices to rise, but this figure has now fallen to just 56 percent. Overall, however, sentiment is still quite stable (see chart below).

These expectations mean that the independent asset managers expect the SMI index to be only slightly higher in three months' time. Whereas they assumed 11,744 in the second quarter of 2021, they forecast a value of 12,292 by the end of 2021. At the same time, they expect a lower price for the ounce of gold. They expect 1,873 francs in three months' time, compared with 1,911 francs last July.

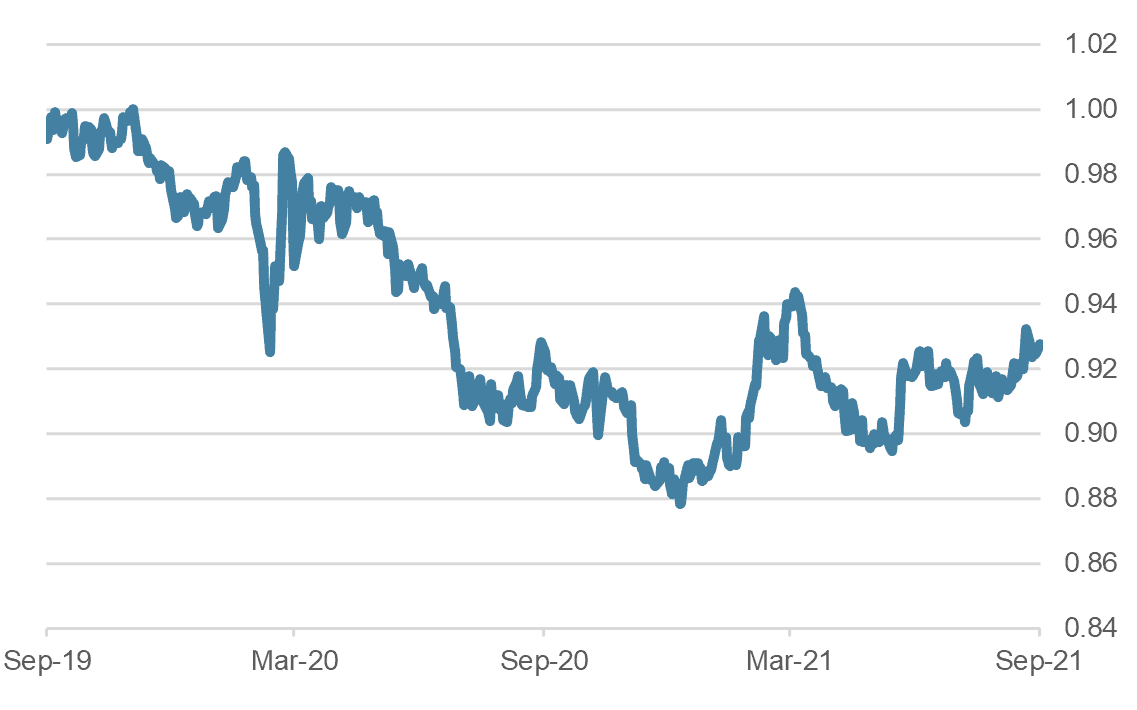

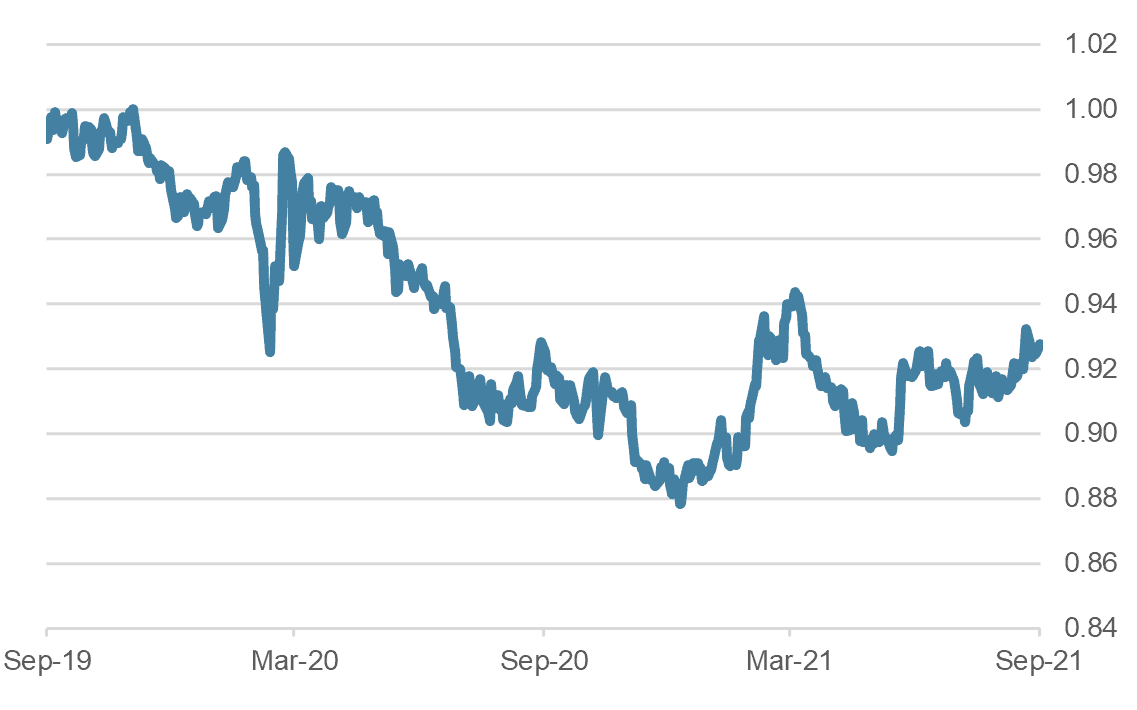

They see the yield on 10-year U.S. Treasury bonds at 1.4089 percent at the end of the fourth quarter of 2021, while they assume a slightly weaker euro/franc exchange rate of 1.0818 francs, down from 1.1099 francs three months ago (see chart below).

The next AVI Index will be published in January 2022.

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.