Asset managers expect second Corona wave

Independent asset managers in Switzerland expect a second Corona wave in the next three months. Against this background, they expect a higher gold price.

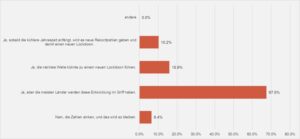

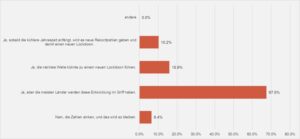

A good two-thirds of independent asset managers in Switzerland (67.5 percent) expect a second wave of Corona to hit by the end of the year. However, the authorities in Europe will have the situation under control, so there will not be another lockdown.

Still, 26.1 percent of respondents expect a lockdown, while 6.4 percent of survey participants expect the numbers to remain the same. (cf. following graphic).

This is according to the latest Aquila Asset Managers Index (AVI), published by the Swiss Aquila Group every three months in cooperation with finews.ch published. The index summarizes various forecasts from independent asset managers in Switzerland. Almost 160 firms took part in the latest survey.

Click here for the complete overview Q3 2020

While independent asset managers no longer expect interest rates to fall further, as some inflationary pressure may well emerge, the time is still good for equity exposure, as the AVI Index continues to show.

Slightly higher share prices in Switzerland

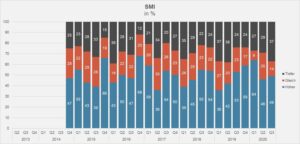

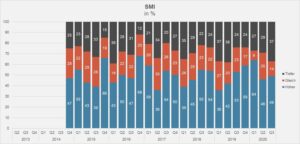

Almost half (49%) of the market participants surveyed expect prices on the Swiss Market Index (SMI) to continue rising, compared with 46% in the previous quarter. Exactly 14 percent (previous quarter: 25 percent) expect prices to remain unchanged, while 37 percent (previous quarter: 29 percent) anticipate lower valuations (cf. following graphic). The assessment of the EuroStoxx 50 and the S&P 500 is less positive.

"The Swiss indices show that both the shares of large and the shares of small and medium-sized companies have coped very differently with the course of the Corona crisis so far. Arguably, the SMI and SPI have almost regained their pre-Corona correction highs, but the indices of exclusively small and mid-cap stocks have more catching up to do," said Paul Vogler, owner of the company Swiss Value Asset Management.

"The fact that the SPI has almost regained its last high is thanks to the performance of the best third of stocks. In the context of the rest of the year, it is therefore important to keep a close eye on prices at the stock level. With stock picking, investors can divest themselves of securities with a poor price trend and favor stocks with a positive price trend," Vogler continues.

Certain confidence

A look at the asset allocation among independent asset managers shows that a certain confidence now dominates again. Most of the survey participants intend to slightly increase their equity allocation over the next three months. Whereas three months ago they held 42.4 percent of their portfolios in equities, this figure has now risen to 45.0 percent.

Alternative investments now account for 7.0 percent, up from 6.7 percent three months ago. The share of gold is now 8.0 percent, compared with a high 9.5 percent in the previous quarter (cf. graphic).

"In recent months, it was primarily the US indices with their extremely high weighting of the technology sector that drove the global equity markets. As the Corona crisis provides a further digitization push, a certain revaluation of this important industry sector is justified, and the persistently low interest rate level also makes a higher valuation of the overall market by historical standards appear quite realistic," said Andreas Schwyn, Chief Investment Officer of the Company Giant Swiss Consulting.

Phases of the reassessment

"However, historically, phases of revaluation were not only more volatile than average, but also tended to overshoot in the short term: A phenomenon that we can also observe today. Despite all our faith in the concentrated power of digitization and the technology sector, it is unrealistic to assume that current growth rates can be maintained at the same pace for years to come. Rather, historical development shows that even phases of higher profit growth are finite and that both margins and profit growth always normalize over time due to increased competition," Schwyn continues.

"All this does not mean that a new bear market is just around the corner. On the contrary, until the U.S. elections, we do not expect any dramatic changes - not even on the downside. What is certain, however, in my opinion, is that the window of opportunity for big price gains has closed again," says Schwyn.

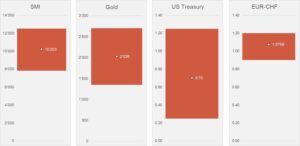

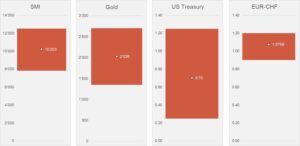

By the end of the year, the asset managers surveyed (cf. graphic above) a SMI to 10,203, a Gold price of $2,026 per ounce, 10-year US government bonds with a yield of 0.70 percent as well as a Euro / Franc exchange rate to 1,076.

The next AVI Index will be published at the beginning of January 2021.

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.