Asset managers prepare for difficult times

The far-reaching changes in the monetary policy of some major central banks have not left independent asset managers in Switzerland unscathed. They have significantly lowered their expectations for the next three months.

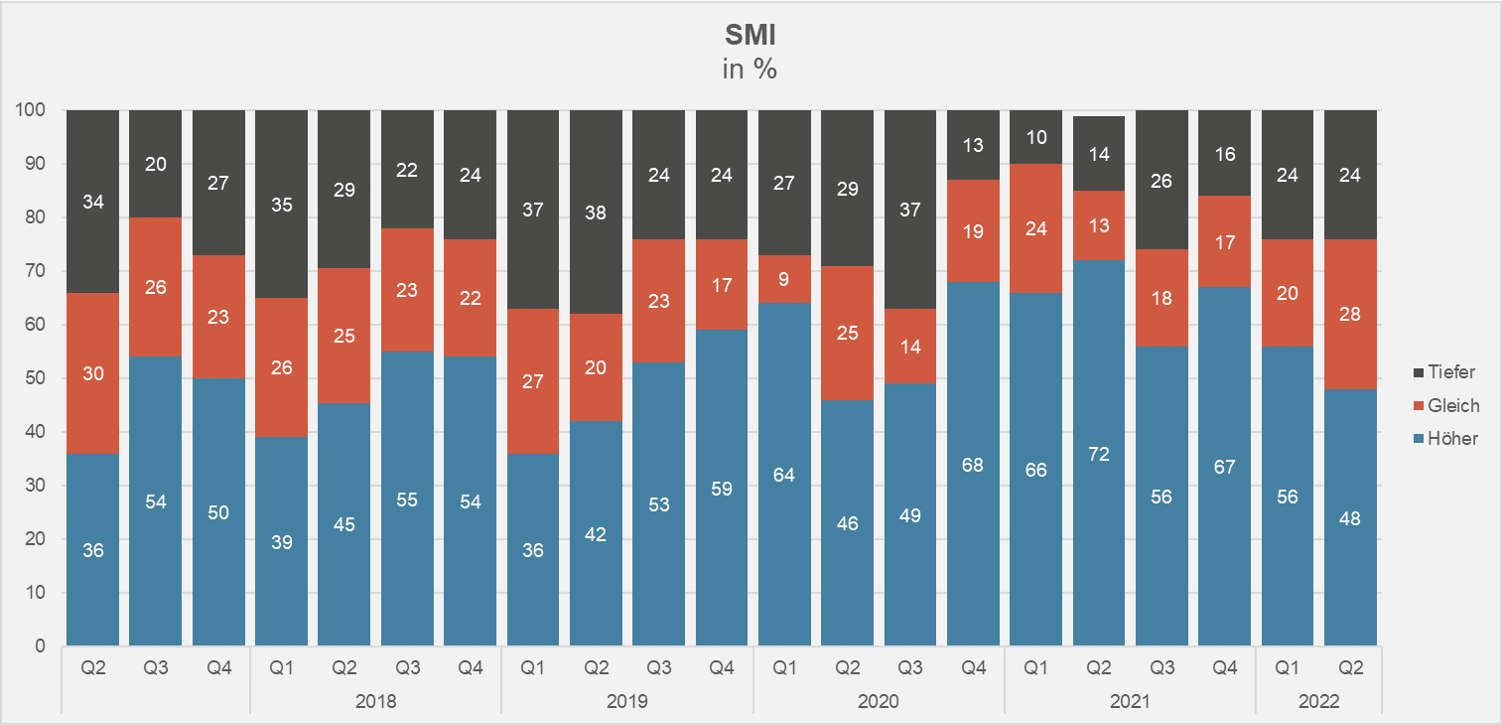

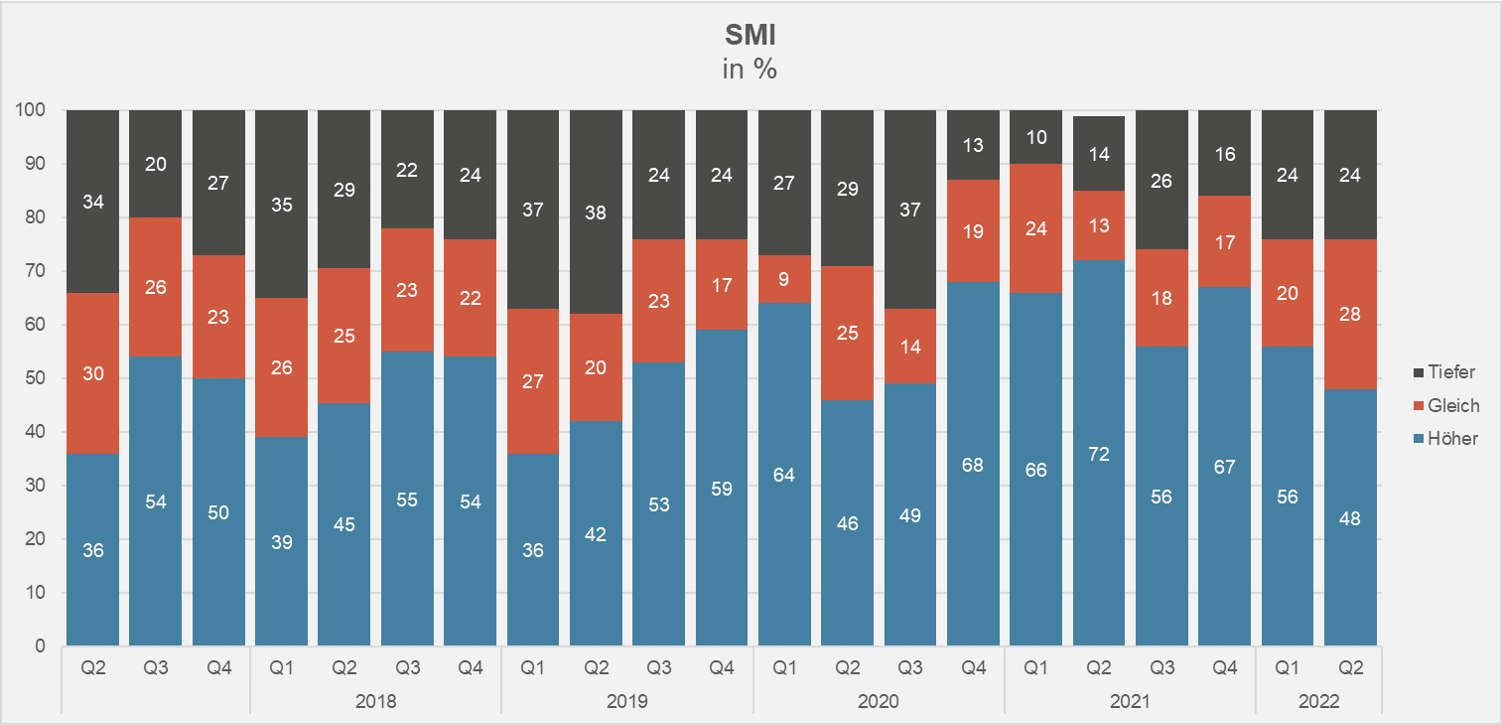

For the time being, independent asset managers in Switzerland do not trust the short-term recovery phases on the stock market. Less than half, or 48 percent, of the players surveyed expect share prices to rise sustainably over the next three months.

The last time this value was this low was two years ago, when the Corona pandemic hit Europe in its first wave (see chart below).

Unchanged, 24 percent of survey participants expect lower prices on the financial markets by the end of September 2022. One important reason for this is that independent asset managers do not trust the recent recovery.

Important index

This is clear from the Aquila Asset Manager Index (AVI) which the Swiss Aquila Group is published every three months in cooperation with finews.ch. The index summarizes various forecasts and assessments by independent asset managers in Switzerland. 150 firms participated in the latest survey.

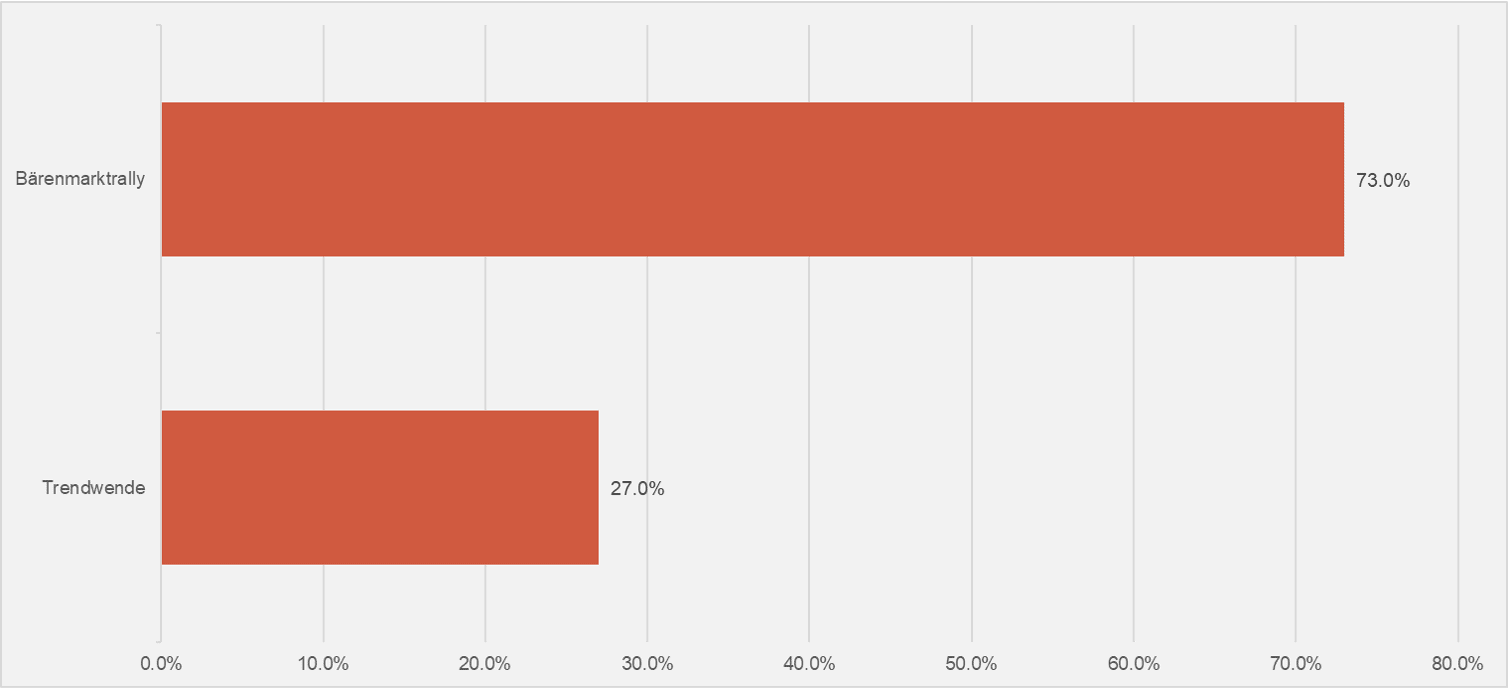

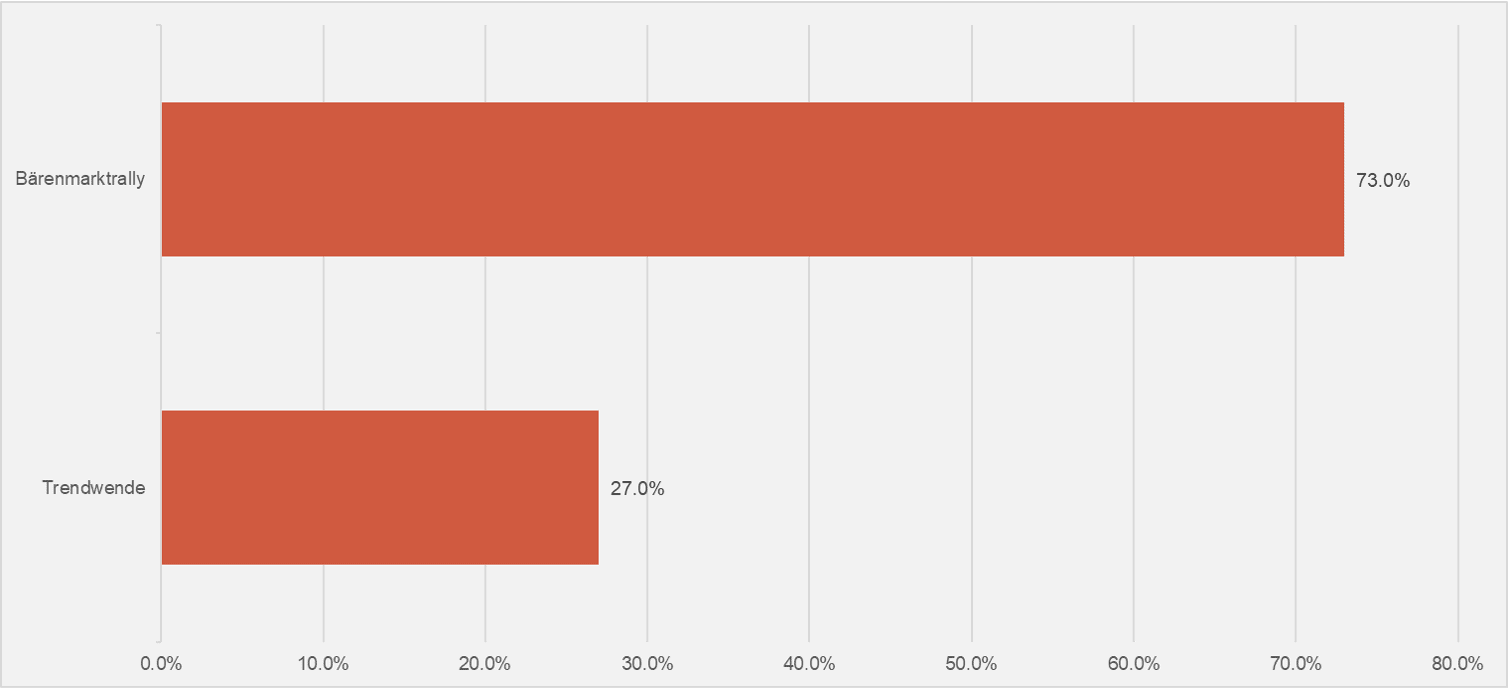

Almost three quarters, or 73 percent, of the players surveyed see the short-term recovery phases as merely a bear market rally, meaning that the price gains are not sustainable for the time being (see chart below).

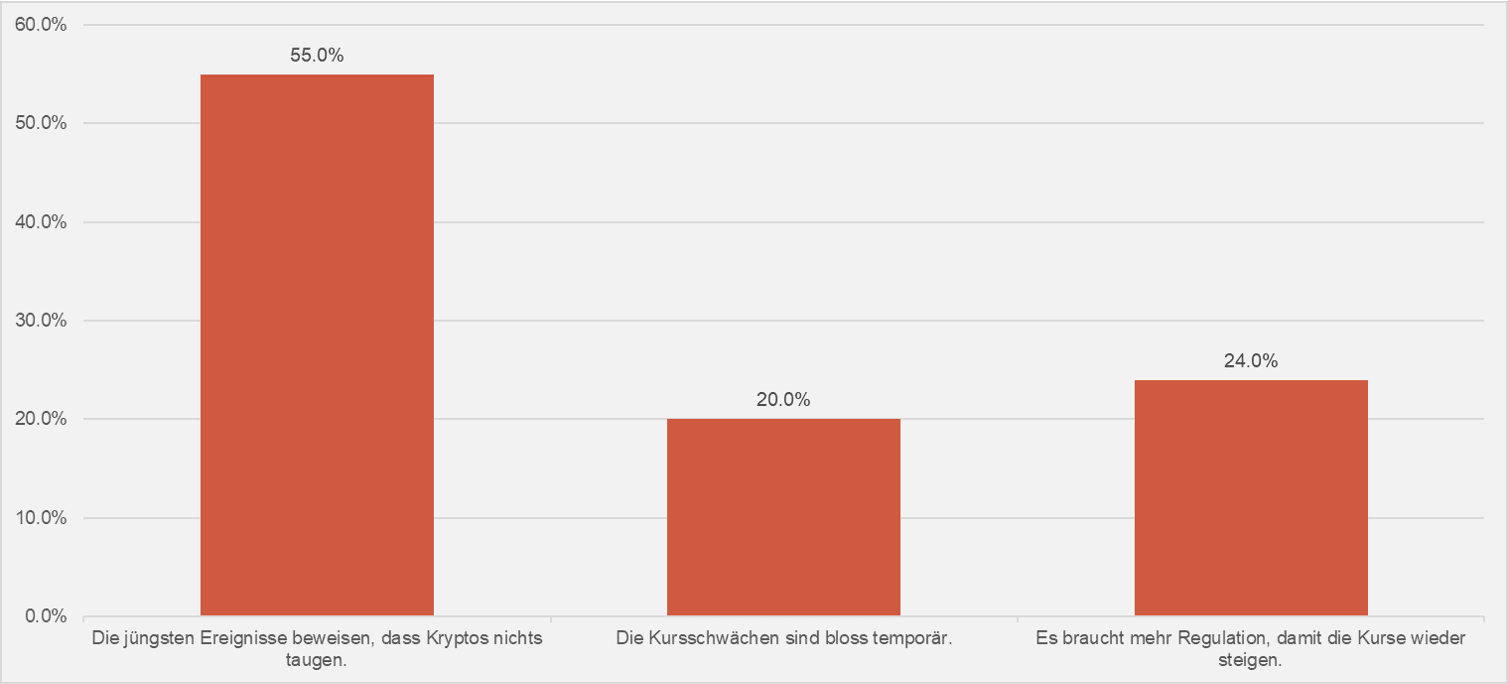

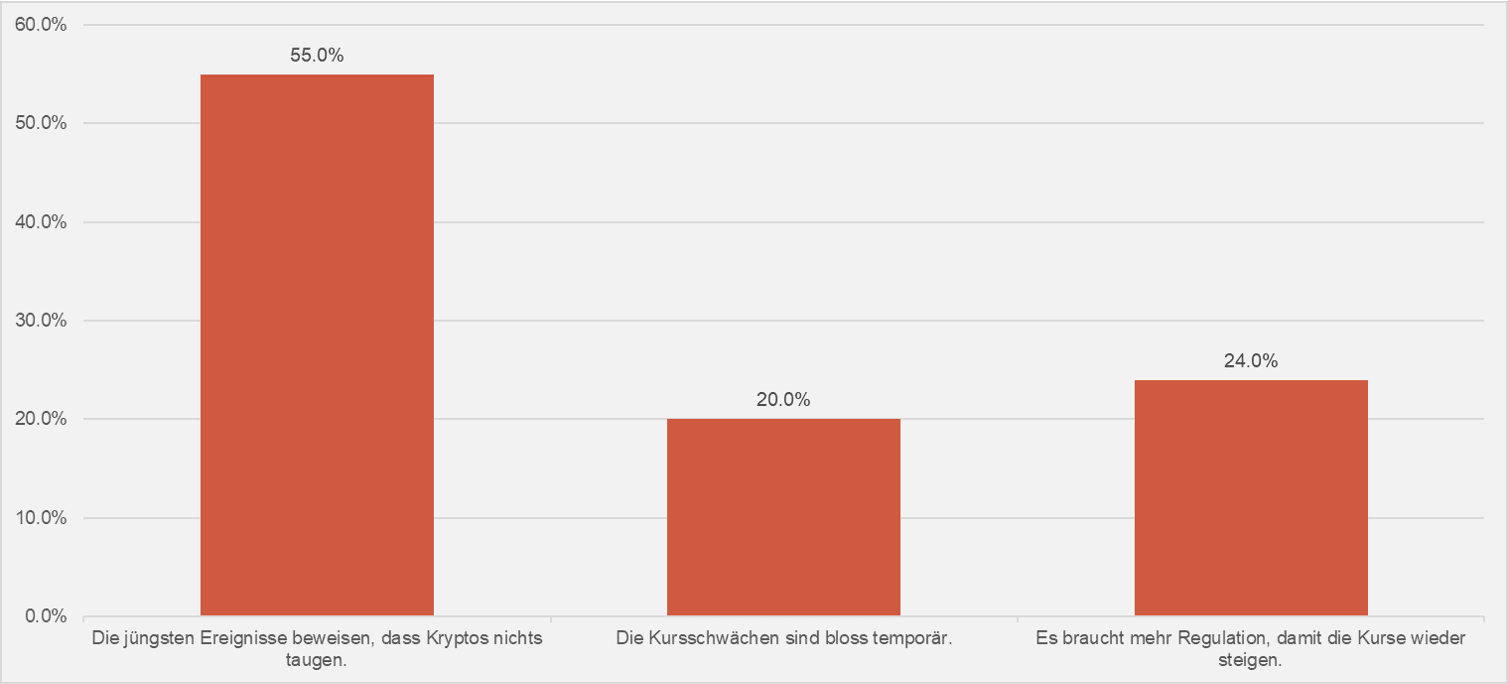

In the recent stock market slump, which has basically been going on since the beginning of the year, independent asset managers see few opportunities to switch to other asset classes, especially since bonds have also been affected following the recent interest rate hikes by various central banks. it has also become particularly dramatic that cryptocurrencies do not represent a counterweight to traditional investment instruments.

Poor grades for cryptos

The asset managers surveyed are also convinced of this. Exactly 55 percent of them are of the opinion that cryptocurrencies are no good as an asset class. And 24 percent of the respondents are of the opinion that more regulations are needed for prices to rise again (see chart below).

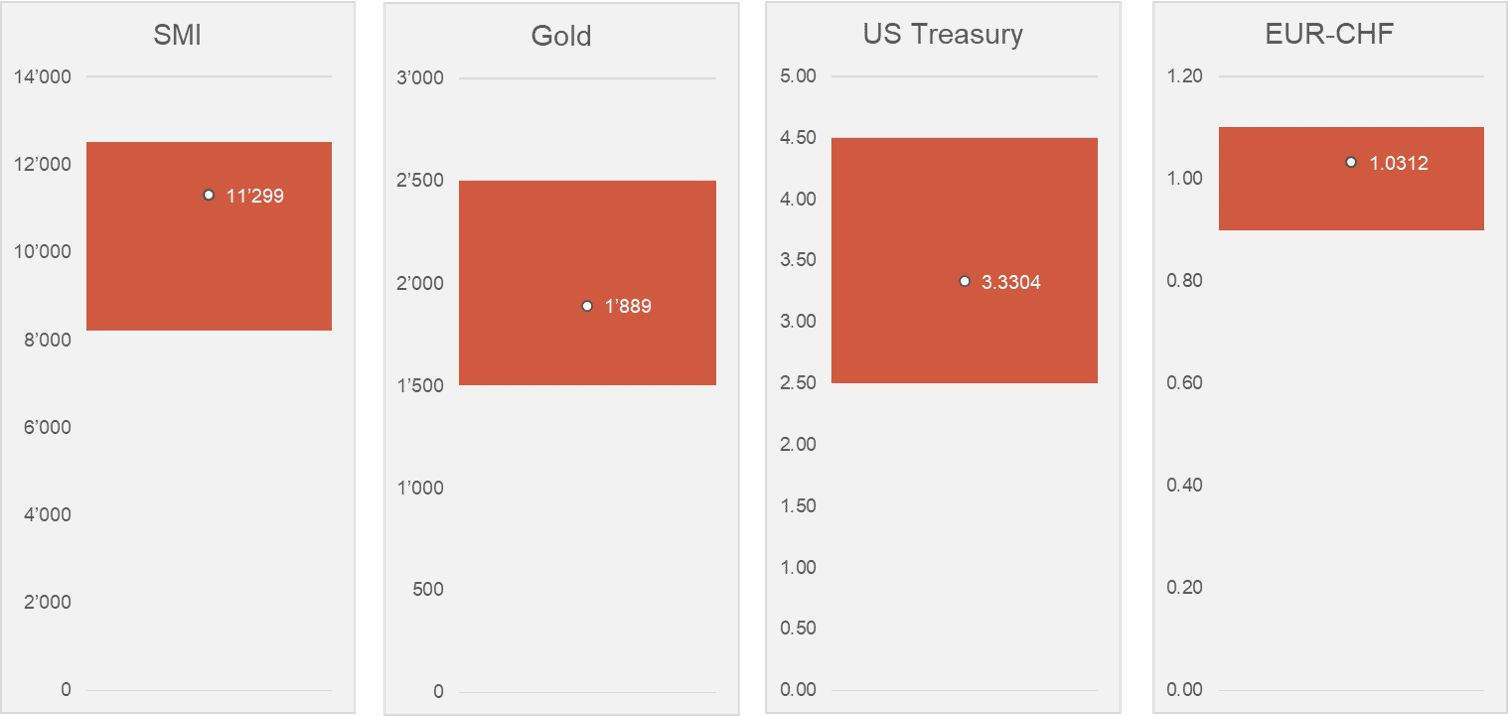

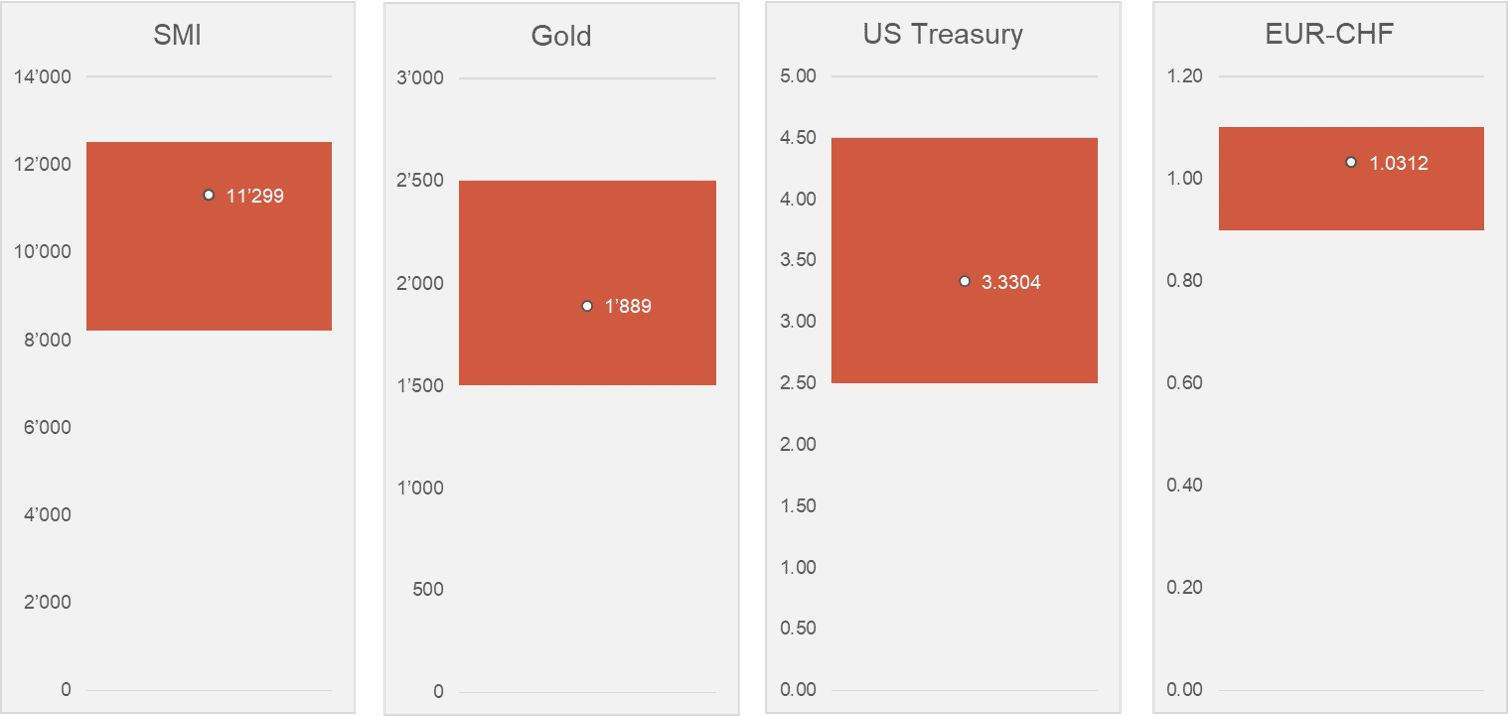

Three months from now (see chart below), the independent asset managers see the Swiss Market Index (SMI) at a level of 10,964 (currently: 11,241).

Independent asset managers are skeptical about gold; recent interest rate hikes by central banks have clouded the outlook for the yellow precious metal.

Gold well below 2,000 dollars

By the end of September 2022, the respondents expect a price of only 1,788 dollars per ounce (currently: 1,707 dollars) - well below the 2,000 dollar mark.

They estimate the yield on the 10-year U.S. Treasury at 3.33 percent in three months (currently: 3.14) and the euro-franc exchange rate at 1.0312 (currently: 1.0115).

The next AVI index will be published in October 2022.

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.