Asset managers benefit from money glut

After months of lockdown and limited business opportunities, independent asset managers in Switzerland are experiencing an enormous upswing. New client money is flowing in, and the stock market is doing the rest, as the latest AVI index shows.

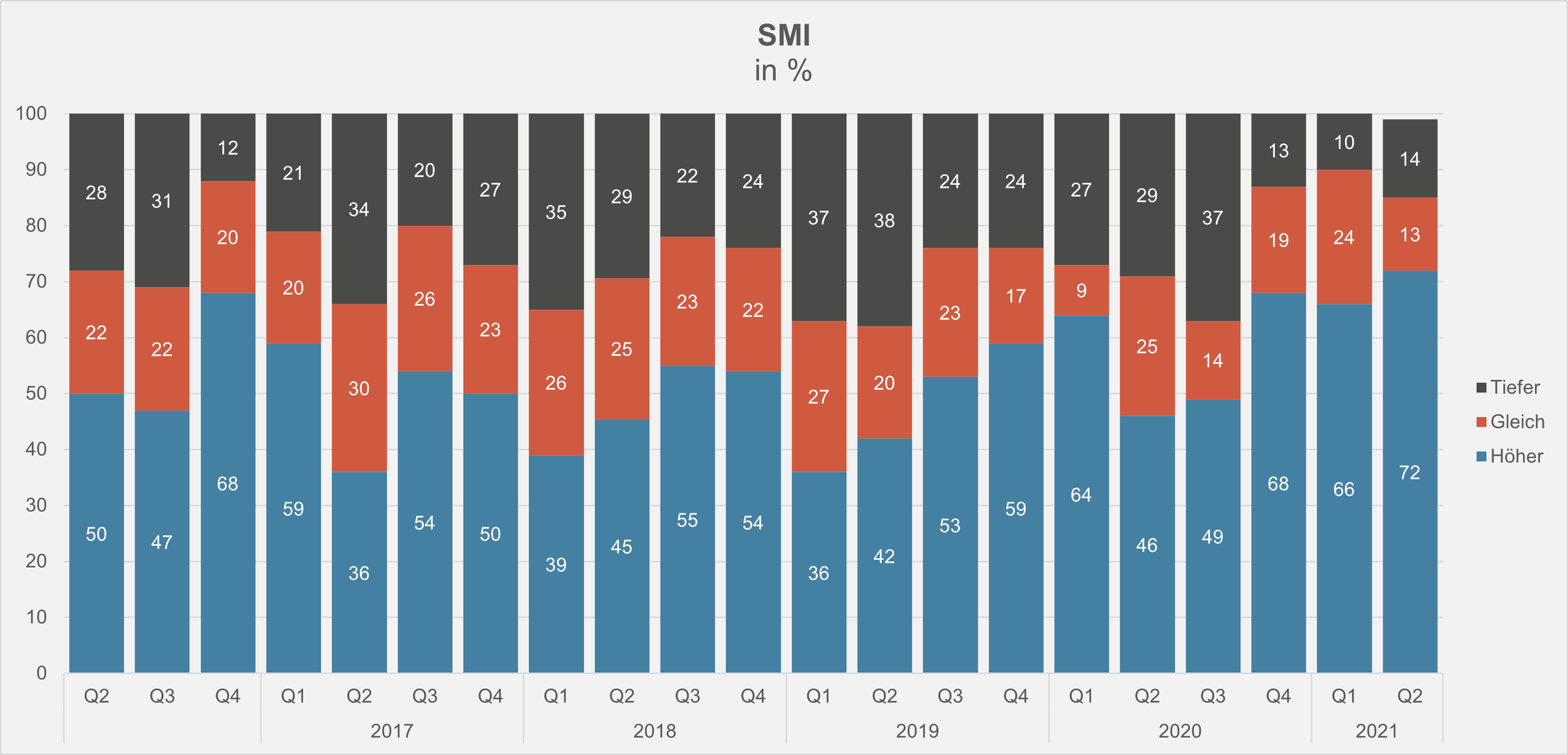

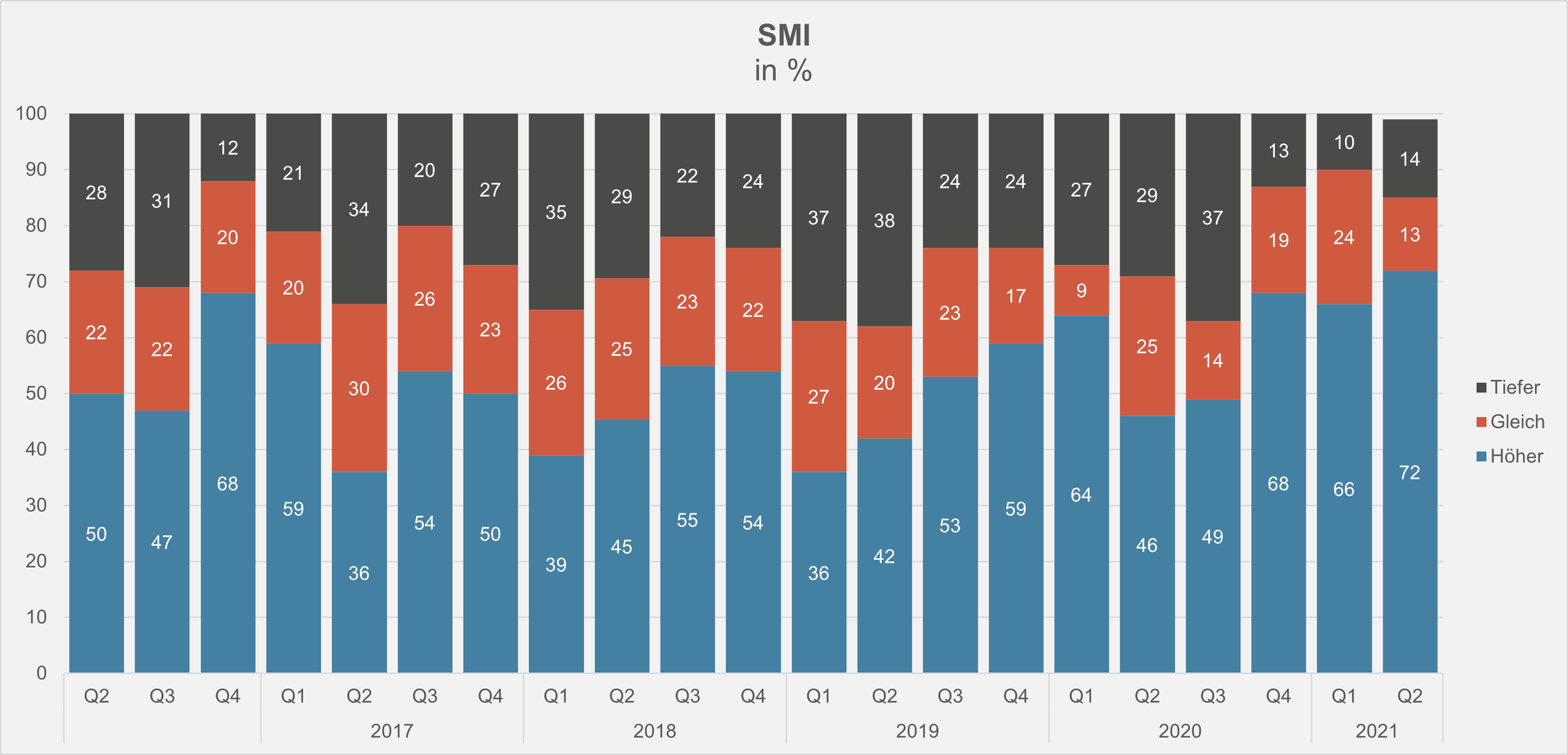

The inexorable rise in share prices on the financial markets is bringing independent asset managers in Switzerland significantly higher client deposits. More than 70 percent of them also expect stock markets to continue to boom (see chart below).

Whereas in the first quarter of 2021 "only" 66 percent of independent asset managers expected share prices to continue rising, this figure has now risen to 72 percent. Only 14 percent expect lower stock markets in the coming months. This is shown by the Aquila Asset Manager Index (AVIwhich is published every three months by the Swiss Aquila Group in cooperation with finews.ch. The index summarizes various forecasts and assessments of independent asset managers in Switzerland. 150 firms participated in the latest survey.

High proportion of shares

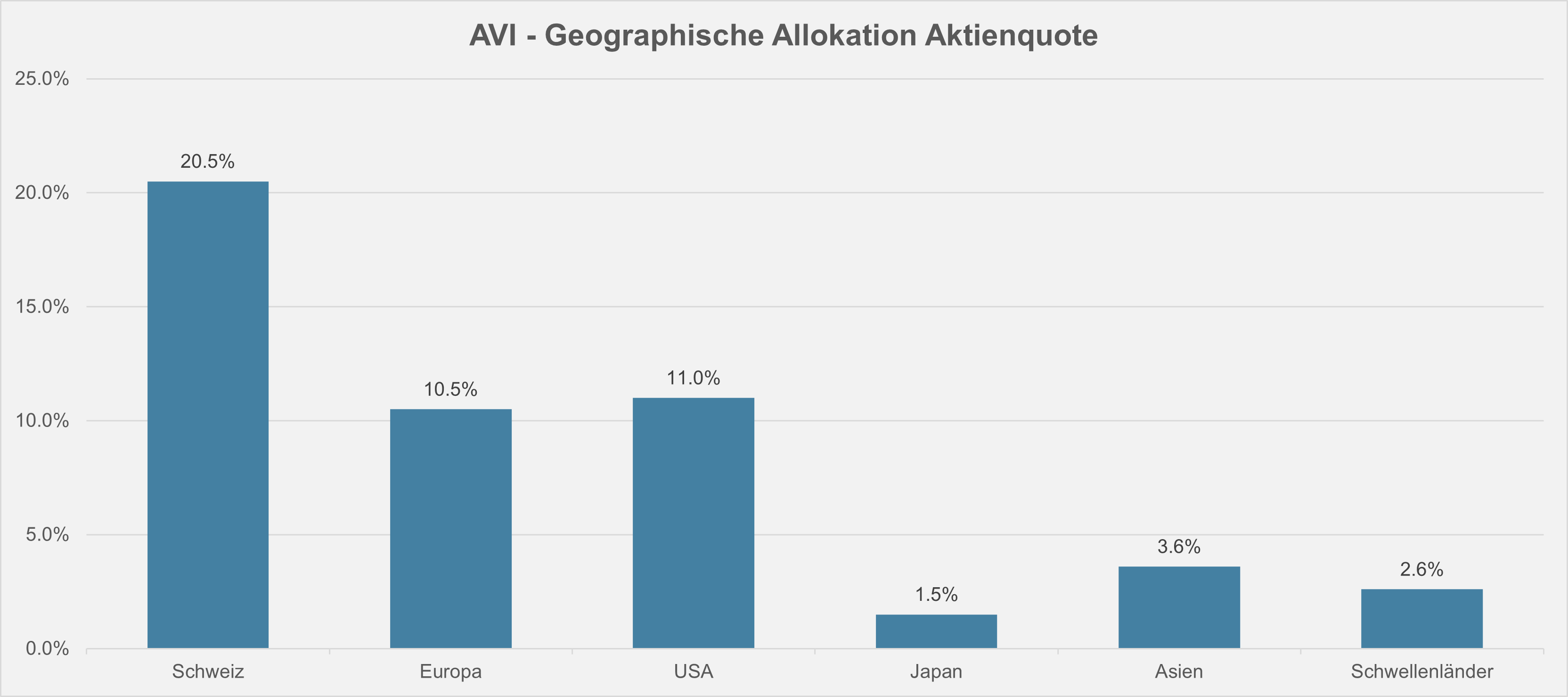

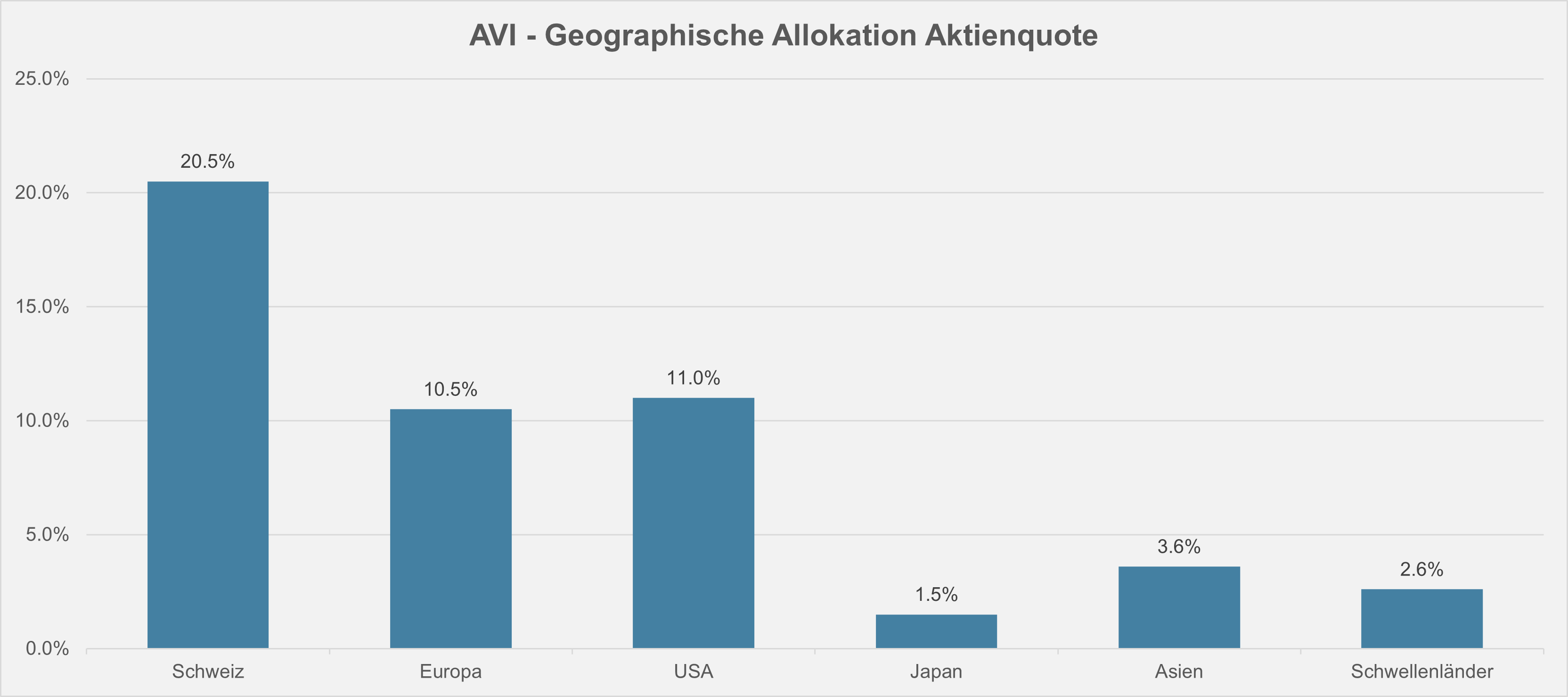

Against the backdrop of these expectations, independent asset managers hold a share of just under 50 percent in equities in their portfolios - of which a good 20 percent is in Swiss equities and around 10 percent each in European and US stocks (see chart below).

"Positive bond returns remain possible even in the current negative interest rate environment. Two factors remain crucial: the main focus remains on portfolio construction as well as on diversification of investment risk, especially at country, sector as well as rating level," said Leon Ernst, Credit Analyst at Aquila Asset Management AG.

On the other hand, it remains crucial to identify and actively exploit opportunities in the market. These can arise both from a sell-off at country level and on an individual security basis, but also from an active comparison of the outstanding bonds of a company or country in different currencies - here, too, price discrepancies can often be found, Ernst continues.

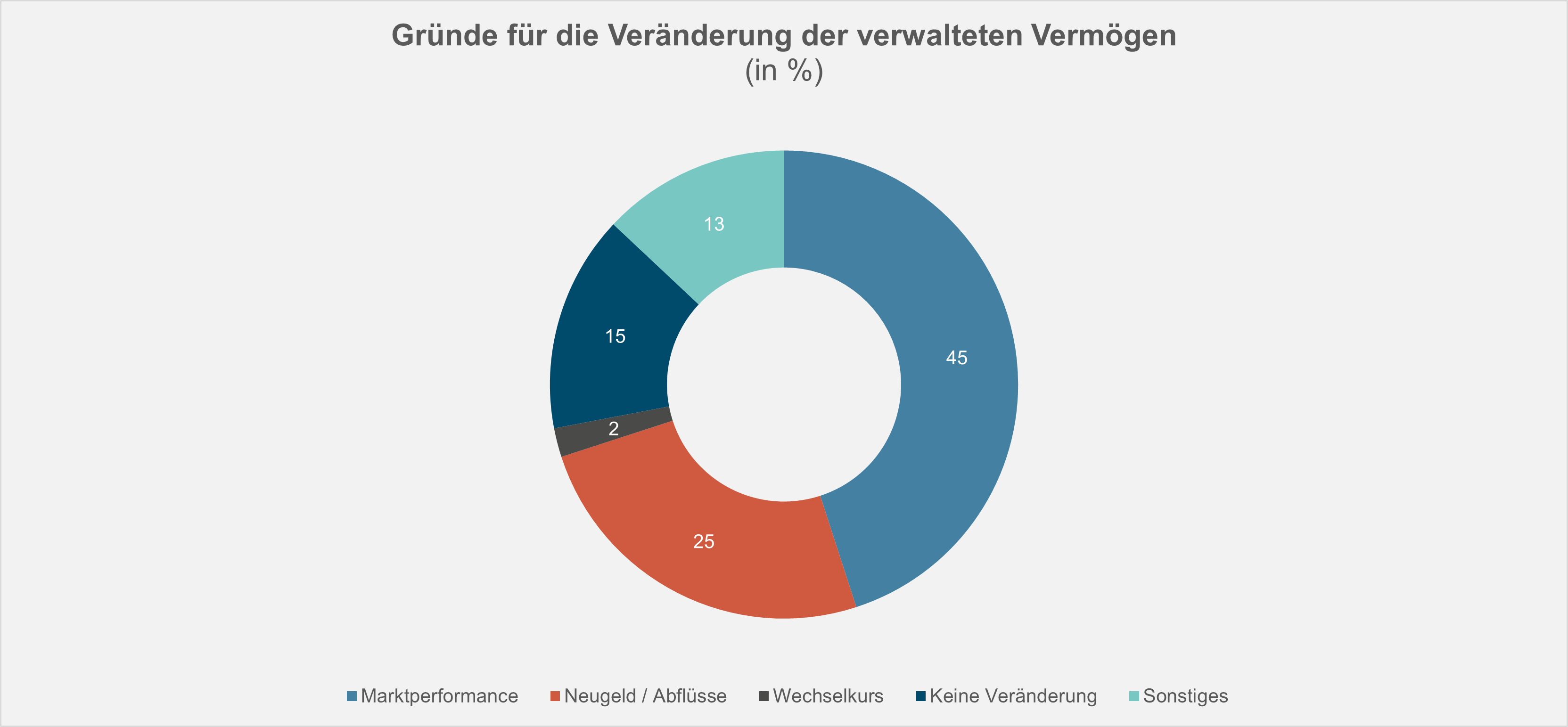

Higher customer deposits

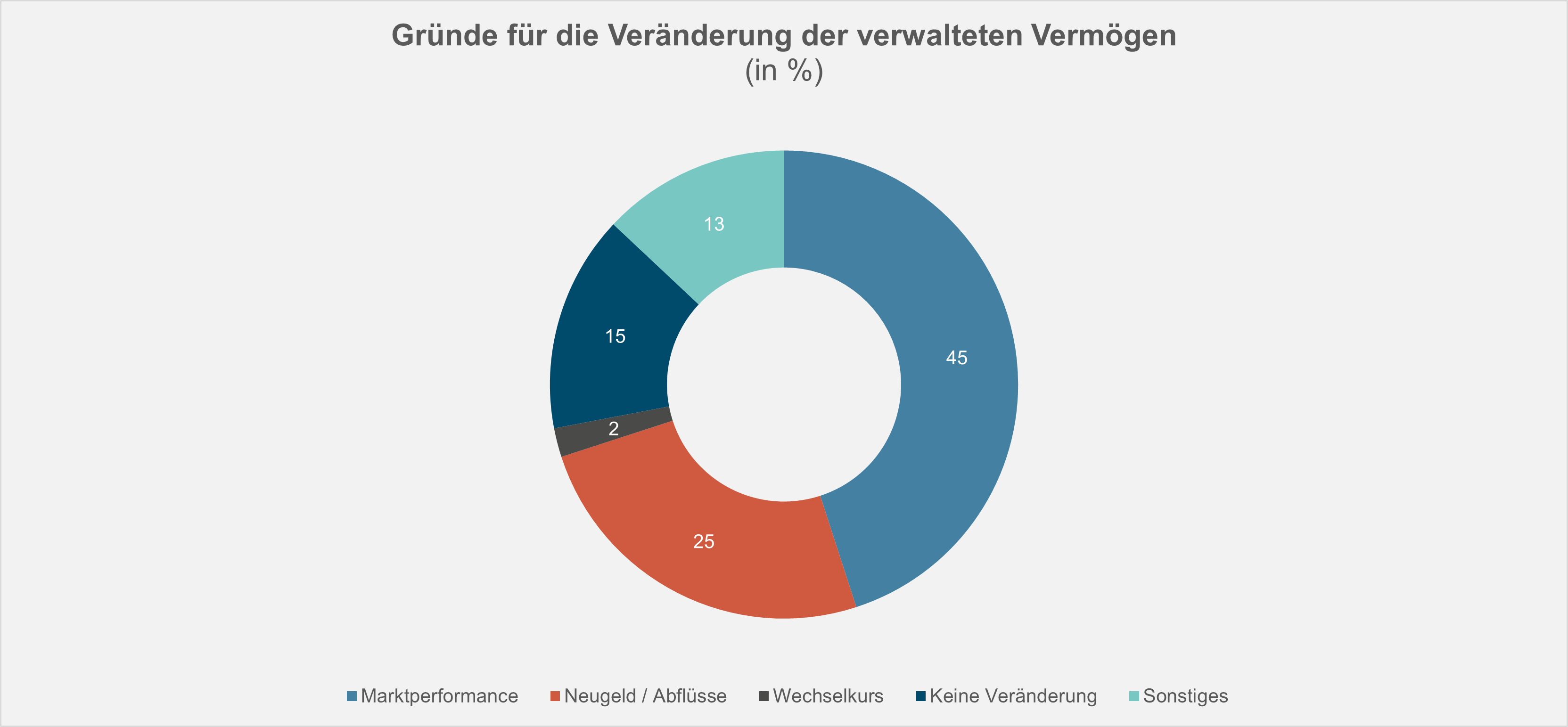

In the second quarter of 2021, 68 percent of the companies surveyed recorded higher customer funds, as the survey further shows. For 45 percent of survey participants, this was due to market performance, and for 25 percent of firms, it was due to new money inflows (see chart below). Various players are likely to benefit from the fact that some customers are turning away from larger banks.

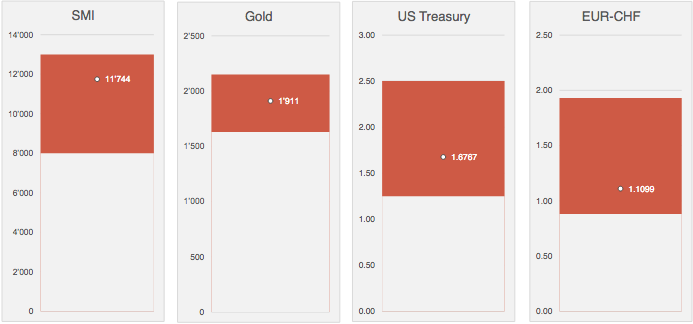

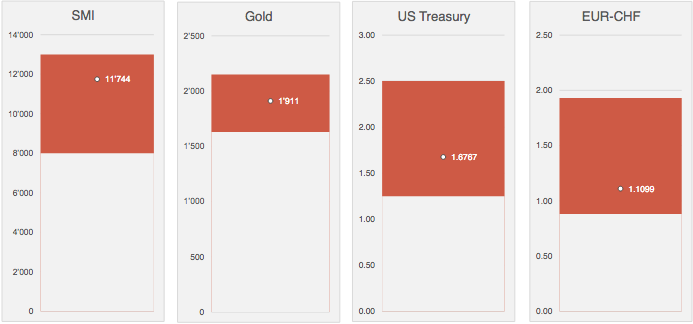

The optimistic expectations also mean that the independent asset managers expect the SMI index to be significantly higher in three months' time. Whereas in the first quarter of 2021 they were expecting 11,082, by the end of September 2021 they are forecasting a value of 11,744. At the same time, they also expect a higher price for an ounce of gold. They expect 1,911 francs in three months' time, compared with 1,777 francs three months ago

They put the yield on 10-year U.S. government bonds at 1.6767 percent at the end of the third quarter of 2021, while assuming a more or less unchanged euro/franc exchange rate of 1.1099 francs.

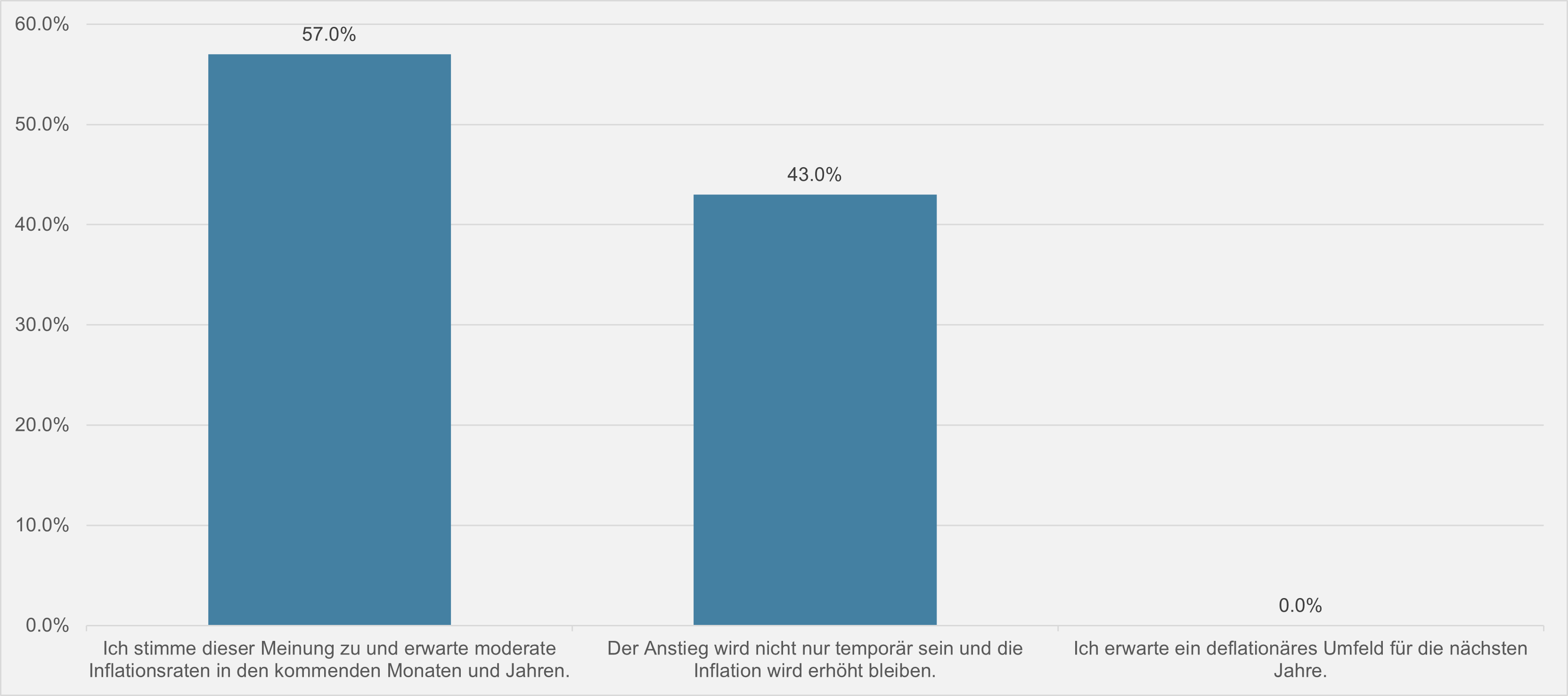

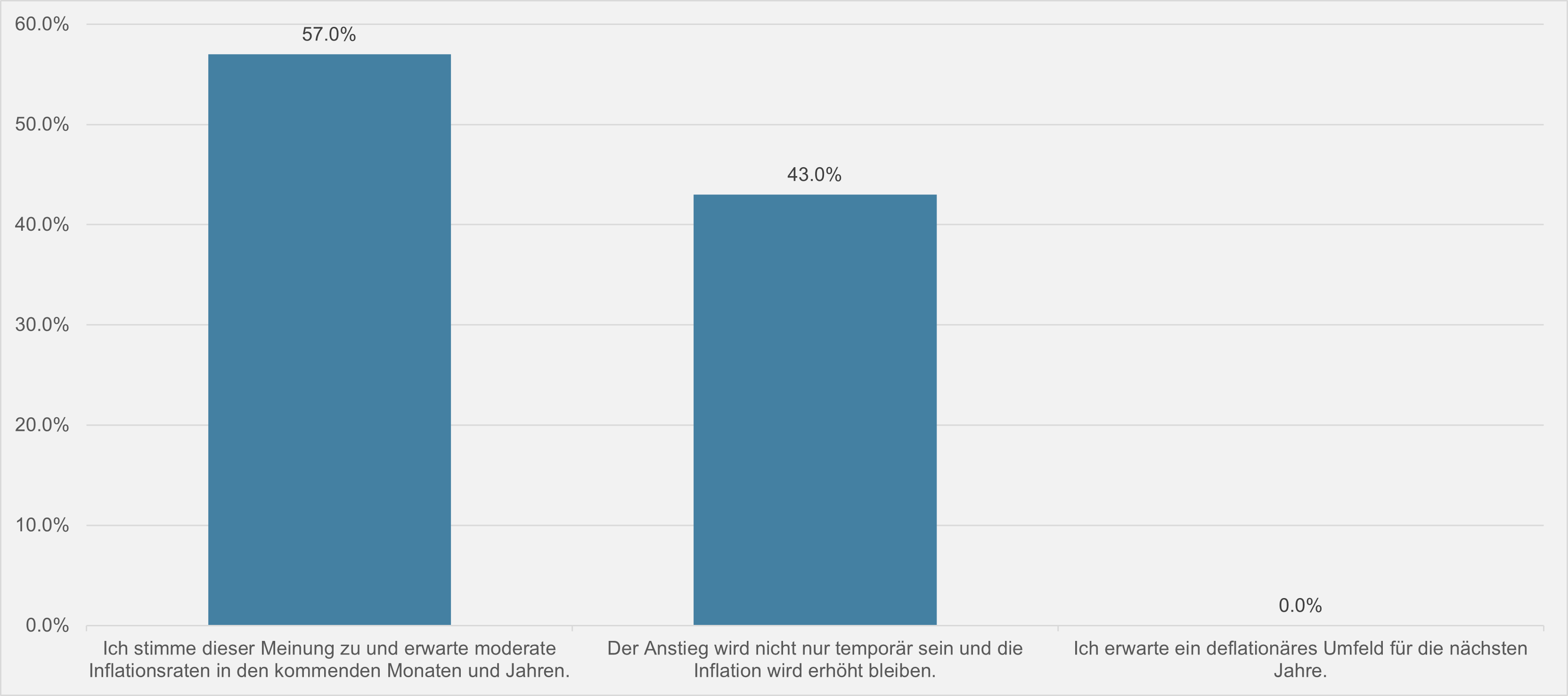

In a recent supplementary question, 57.0 percent of the experts surveyed assess the threat of inflation as a temporary phenomenon at best. By contrast, 43 percent expect inflation to remain elevated (see chart below).

The next AVI Index will be published in October 2021.

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.