Asset managers expect U-shaped recovery - but without Trump

Independent asset managers in Switzerland fear the consequences of a second Corona wave and expect Donald Trump to lose the next US presidential election.

Exactly 44 percent of independent asset managers in Switzerland believe that there will be a U-shaped recovery in the economy. In other words, the potential for new growth is there - albeit associated with numerous imponderables.

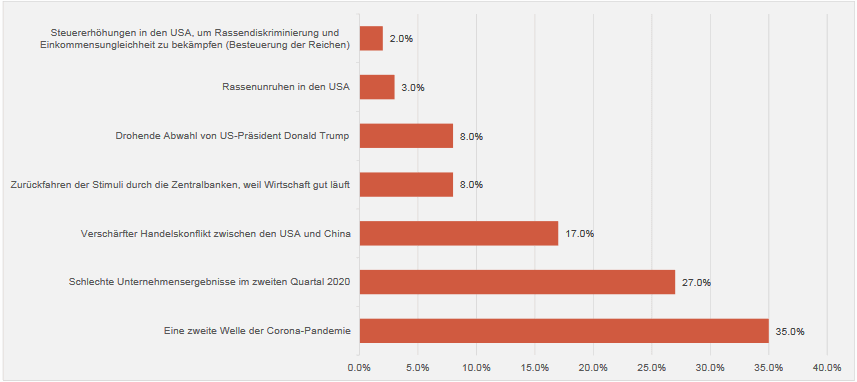

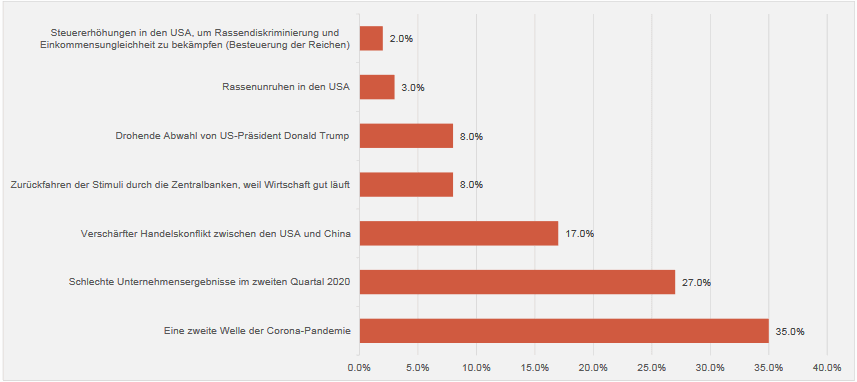

These include a new Corona wave, disappointing corporate results from the second quarter of 2020, and an ongoing trade conflict between the U.S. and China (cf. following graphic).

At the same time, a majority of asset managers (51 percent) now expect US President Donald Trump lose the elections next November and be replaced by his competitor Joe Biden will be replaced. Three months ago, respondents were still assuming that the incumbent would win the election.

This is according to the latest Aquila Asset Managers Index (AVI), published by the Swiss Aquila Group every three months in cooperation with finews.ch published. The index summarizes various forecasts from independent asset managers in Switzerland. A good 140 firms took part in the latest survey.

Click here for the complete overview

Swiss asset managers also expect most central banks to cut interest rates further over the next three months.

Exactly 41 percent of respondents expect the Federal Reserve to continue to cut rates but stay above 0 percent, while 35 percent of survey respondents expect rates to fall as low as 0, the AVI index further shows.

Slightly higher share prices

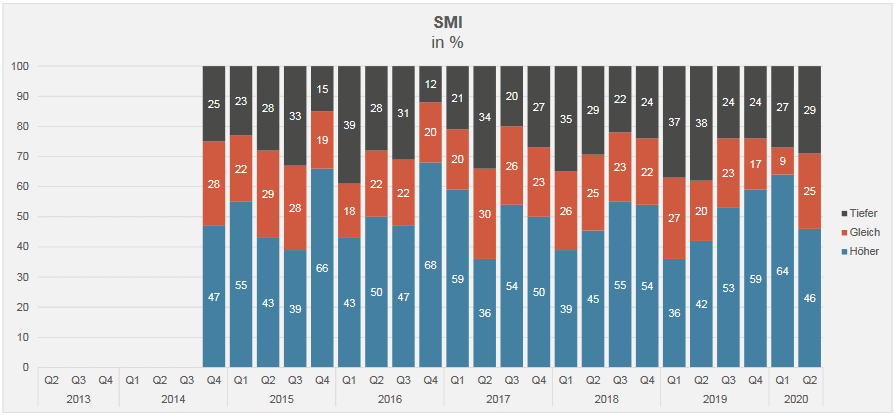

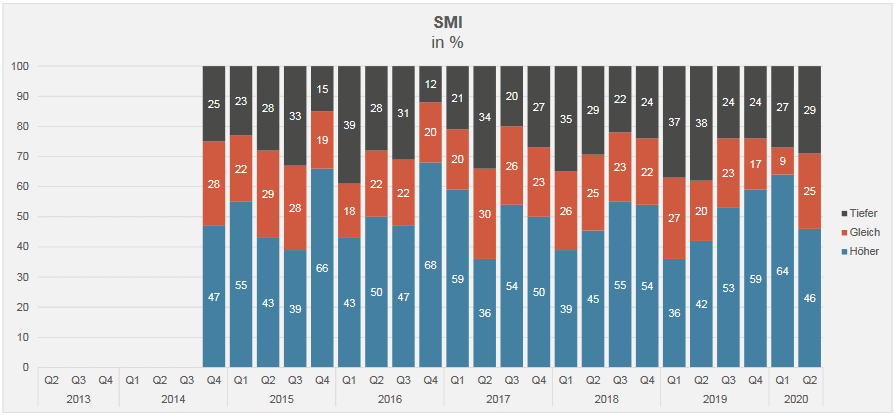

Low interest rates combined with the lack of investment alternatives on the financial markets are therefore the main arguments why independent asset managers expect share prices to rise over the next twelve months. This applies to all three major indices: the S&P 500, the Euro Stoxx 50 and the Swiss Market Index (SMI), as shown in the chart below.

"Price dislocations will continue to be a driving factor in financial markets in the coming months. This opens up short-term opportunities from which investors can profit," says Peter Hegglin, Head Business Development at Alpinum Investment Management

"However, investors face the difficult challenge of finding attractive sources of returns on a sustainable basis, the more interest rates are trading at historically low levels. At the same time, many equity markets have recovered strongly and have high P/E ratios. In this constellation, alternative asset classes will play an increasingly important role," Hegglin continues.

Focus on gold and alternative investments

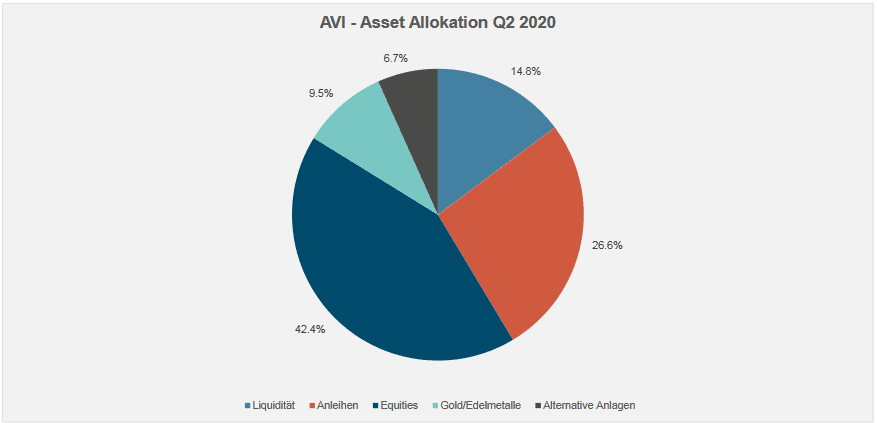

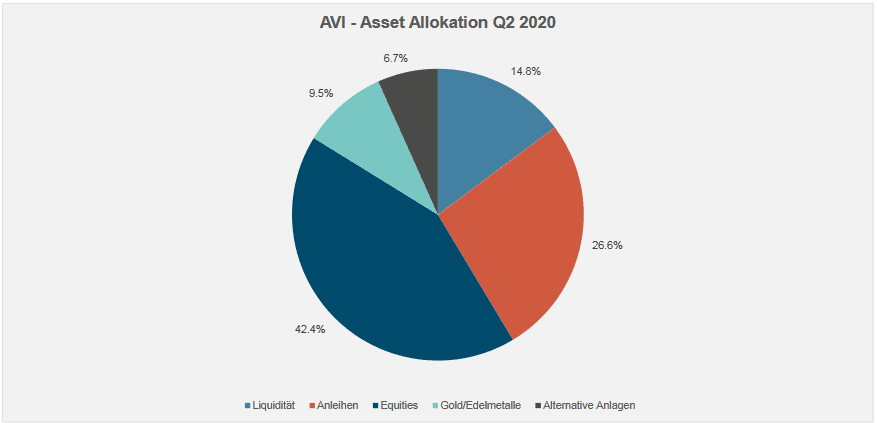

Despite these assessments, a look at the asset allocation among independent asset managers shows that a certain degree of confidence now dominates again. In particular, most survey participants intend to slightly increase their equity allocation over the next three months.

Whereas three months ago they held 37.5 percent of their portfolios in equities, this figure has now risen to 42.4 percent. Alternative investments now account for 6.7 percent. The share of gold is now as high as 9.5 percent. There are good reasons for this (cf. graphic and explanations below).

Gigantic debt problem

"The 'quantitative easing' that already started in the fall of 2019 is now becoming exponential. But since you can't solve a debt problem with even more debt, the attempt will fail miserably. The world will next see an implosion of the stock market bubble," surmises Egon von Greyerz, founder and managing partner of Matterhorn Asset Management.

"The next bubble after that will be bond markets as central banks lose control of interest rates. Gold has been the best performing asset class this century and will soon rise to a much higher level as a result of the devaluation of all currencies. But physical gold should not be held for capital gain purposes, but as insurance and protection against an extremely fragile financial system," says von Greyerz.

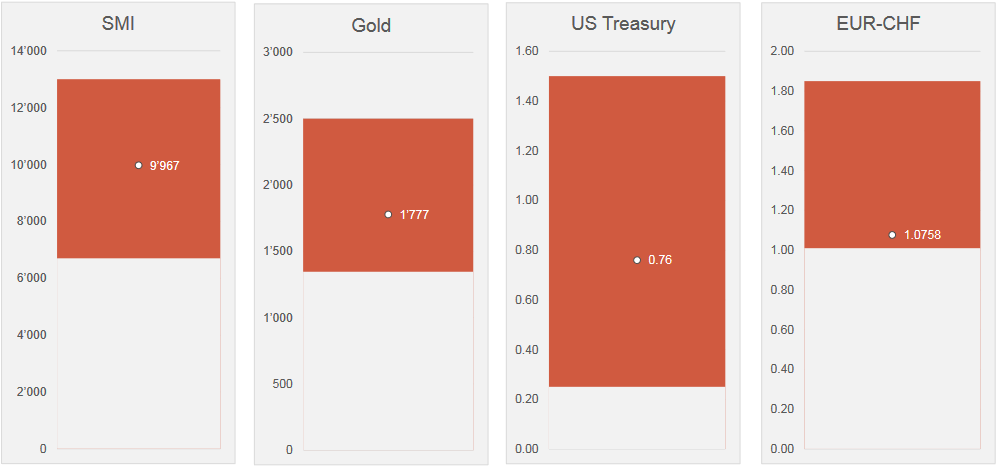

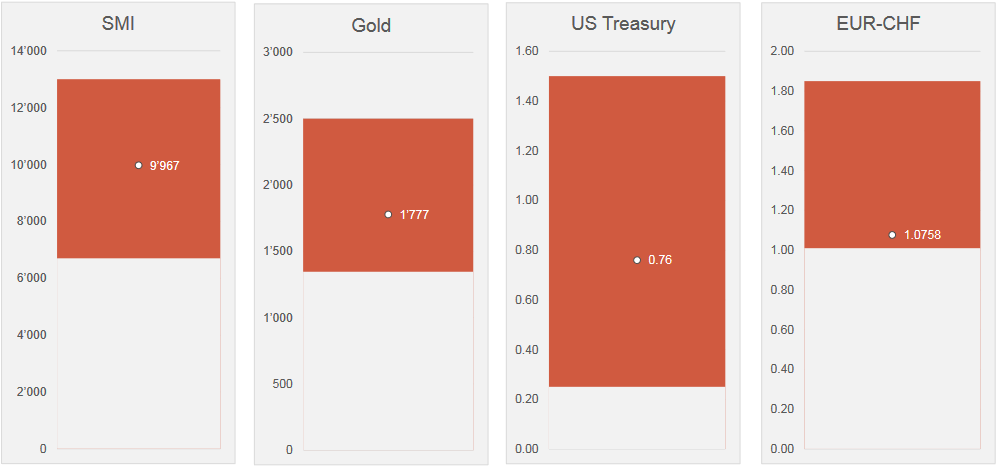

By mid-year, the asset managers surveyed (cf. graphic above) a SMI to 9,967, a Gold price of $1,777 per ounce, 10-year US government bonds with a yield of 0.76 percent as well as a Euro / Franc exchange rate to 1,076.

The next AVI Index will be published at the beginning of October 2020.

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.