Asset managers: almost one in three expect a recession

Fewer equities, more gold and caution with artificial intelligence. According to independent asset managers in Switzerland, these are the most important trends for the next three months.

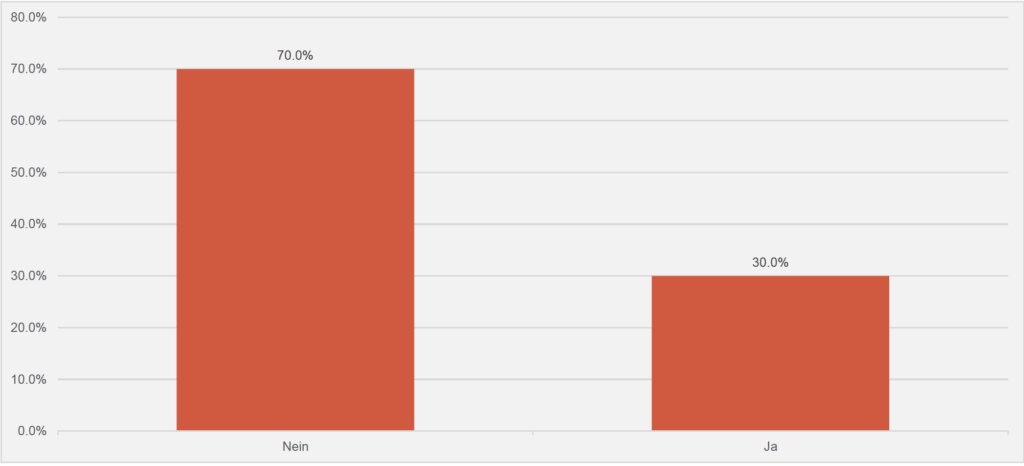

Almost one in three independent asset managers in Switzerland (or exactly 30 percent) anticipates a recession in this country this year (cf. graphic below). And more than half of the companies surveyed are of the opinion that the banking crisis in the US is far from over.

These assessments are based on the latest Aquila Asset Manager Index (AVI), which the Swiss Aquila Group every three months in cooperation with finews.ch is published. The index summarizes various forecasts and assessments by independent asset managers in Switzerland. A total of 150 companies took part in the latest survey.

Declining economic momentum

"We are seeing the final phase of interest rate hikes and a simultaneous decline in economic momentum," says Beat KellerManaging Partner of the Zurich-based asset manager Keller von Arx and Partners. "This development was the declared aim of many central banks in order to counteract the high inflation rates with determination. This cycle will soon continue with weaker share prices."

In this environment, Keller von Arx und Partner positions its client portfolios slightly underweight in equities and slightly overweight in gold. "In all asset classes, we consistently focus on quality and, in the equity sector, on sectors with defensive characteristics," Beat Keller continues.

Artificial intelligence controversial

Against this backdrop, 32% (previous quarter: 30%) of survey participants expect prices on the S&P500 index to fall over the next three months. For the EuroStoxx50, as many as 34 percent (previous quarter: 29 percent) of respondents expect prices to fall. Only for Switzerland are the independent asset managers somewhat more optimistic: only 20 percent (previous quarter: 27 percent) of those surveyed expect prices to fall in the next three months.

The prices of technology stocks, which are particularly strong in the USA, are likely to have a significant influence on the trend.

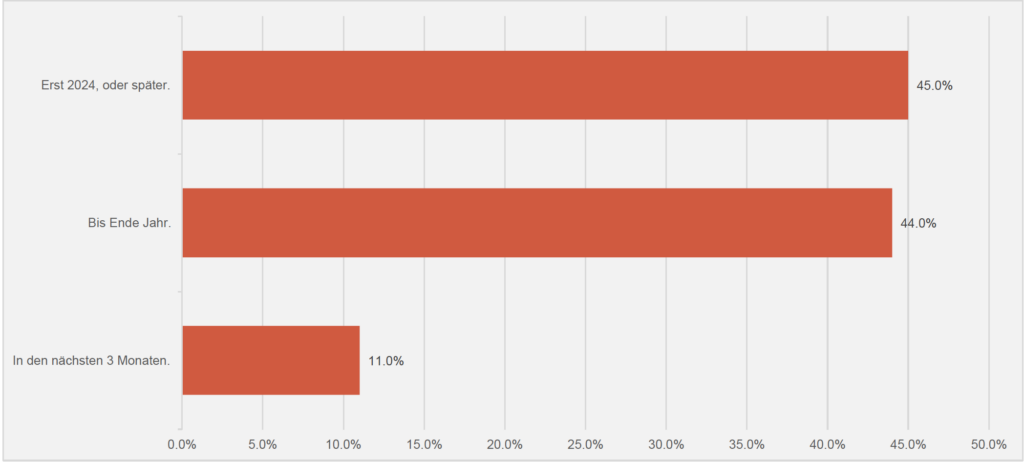

In this respect, however, Swiss asset managers are very cautious - not to say skeptical: 44% of survey participants expect many companies that offer services in the artificial intelligence (AI) sector to correct on the stock market this year. In contrast, 45% assume that the correction will not take place until next year. All in all, skepticism in the AI sector is therefore widespread (cf. graphic below).

Principle of hope in the SMI

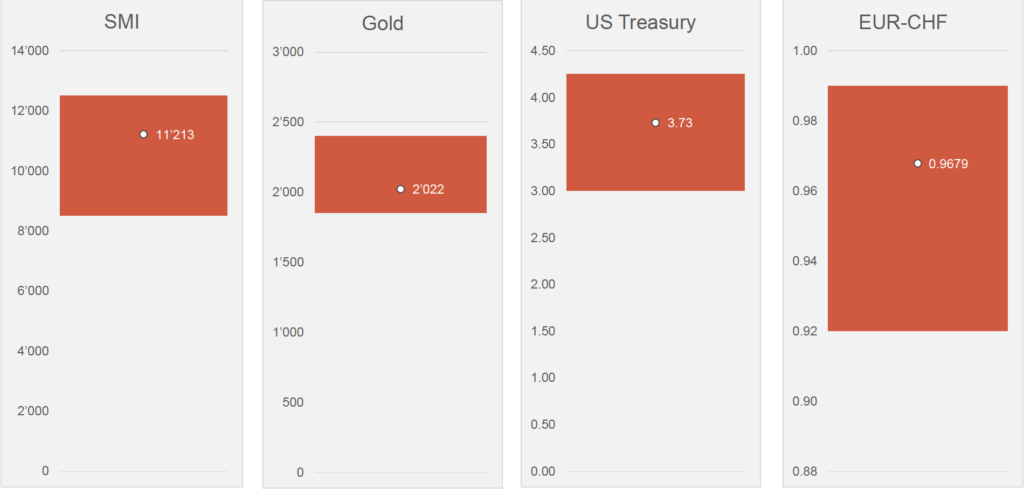

In three months (see chart below), the independent asset managers (cf. graphic below), the Swiss Market Index (SMI) stood at 11,213 (currently: 11,322).

Independent asset managers have new hope for gold, as the expected weakness on the stock markets could give the yellow precious metal a boost.

Gold on the rise again?

By the end of September 2023, respondents expect a price of 2,022 dollars per troy ounce (currently: 1,914 dollars) - i.e. above the 2,000 dollar mark again.

They estimate the yield on the 10-year US Treasury at 3.73% in three months (currently: 3.84%) and the euro-franc exchange rate at 0.9679 (currently: 0.9783). The latter is likely to be related to the looming recession in Germany.

The next AVI Index will be published in October 2023.

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.