Asset managers see biggest price increases in gold

The majority of independent asset managers in Switzerland regard the current bear market as a buying opportunity, as a recent survey by the Aquila Group shows. The experts see the greatest upside potential in gold - due to the geopolitical situation.

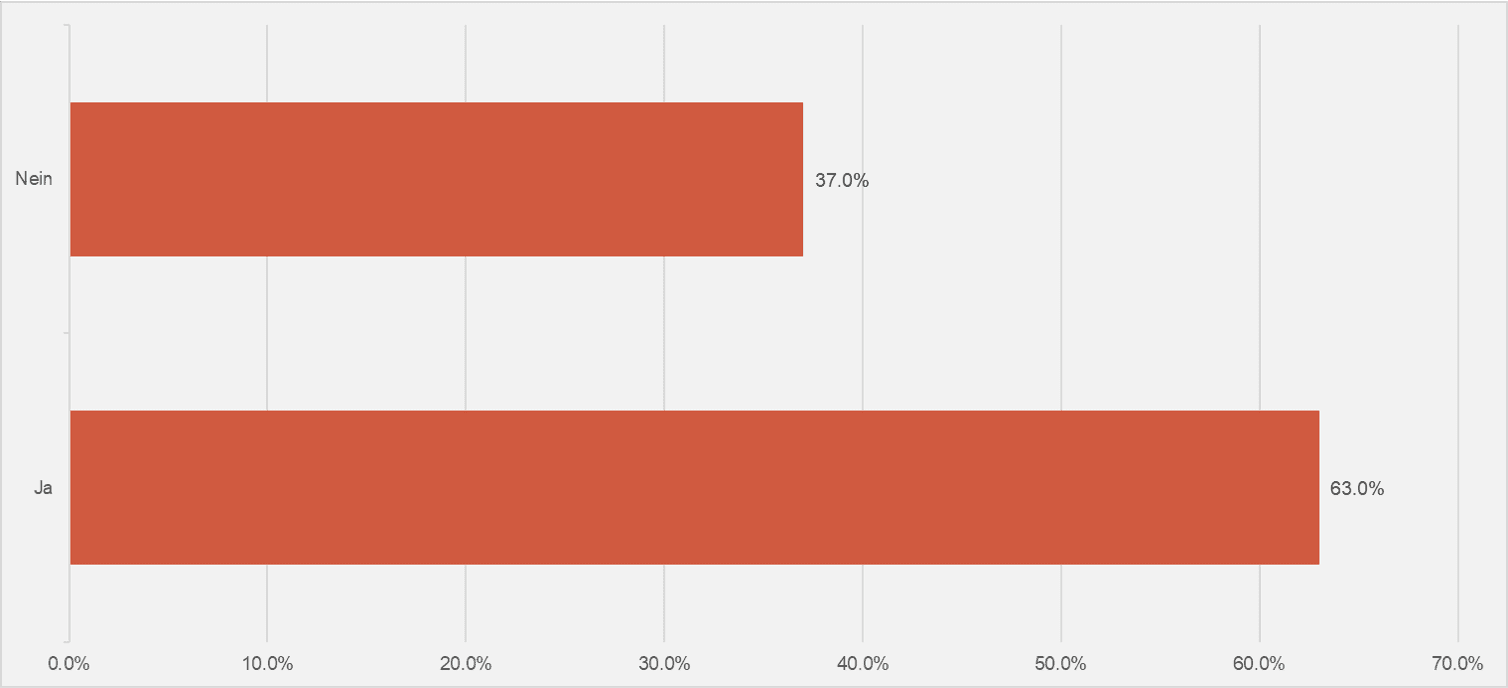

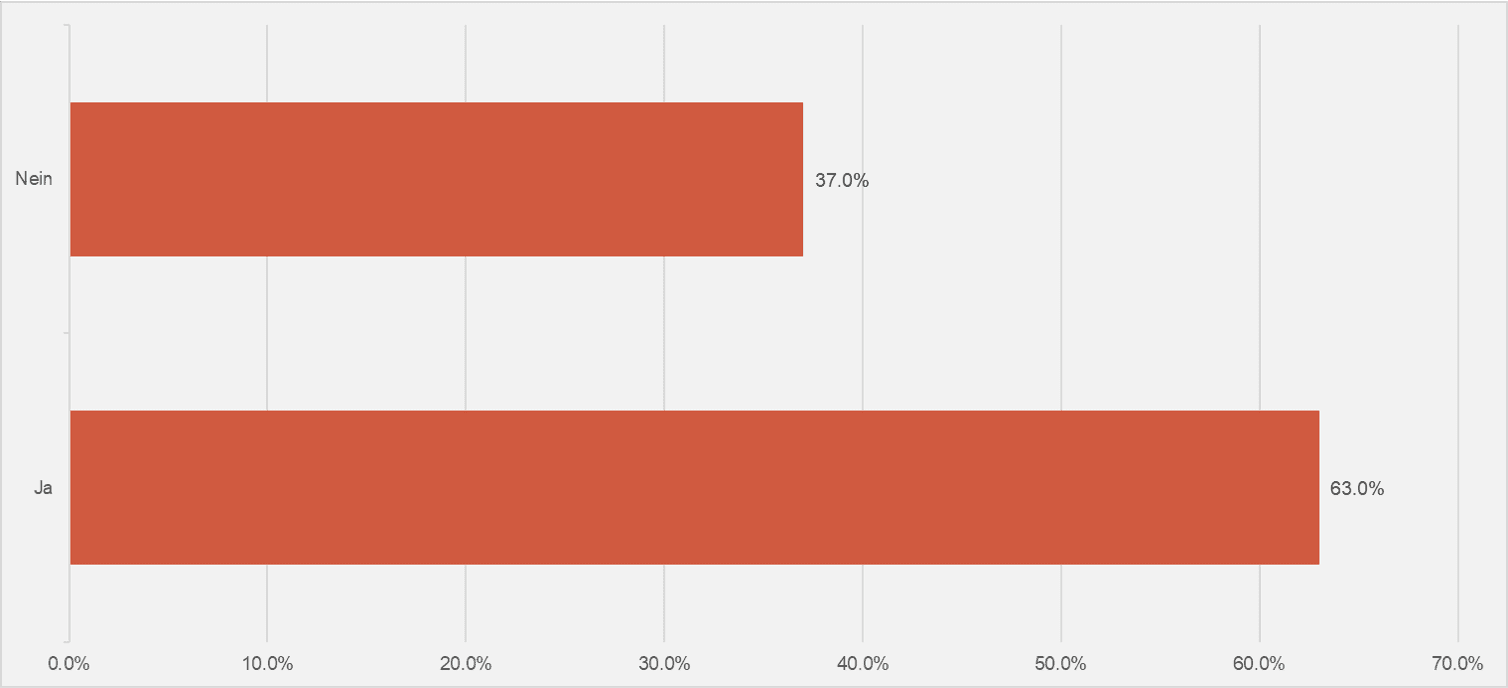

Around two-thirds of independent asset managers (63.0 percent) in Switzerland believe that the current correction on the financial markets is a buying opportunity. By contrast, 37.0 percent of the survey participants expect prices to fall further (see chart below).

The financial experts tend to expect weaker stock markets in the next three months; against the background of the war in Ukraine, the survey participants expect the price of gold to rise sharply by the middle of the year, exceeding the mark of 2,000 dollars per ounce.

Global recession?

This is clear from the Aquila Asset Manager Index (AVI) which is published every three months by the Swiss Aquila Group in cooperation with finews.ch. The index summarizes various forecasts and assessments of independent asset managers in Switzerland. 150 firms participated in the latest survey.

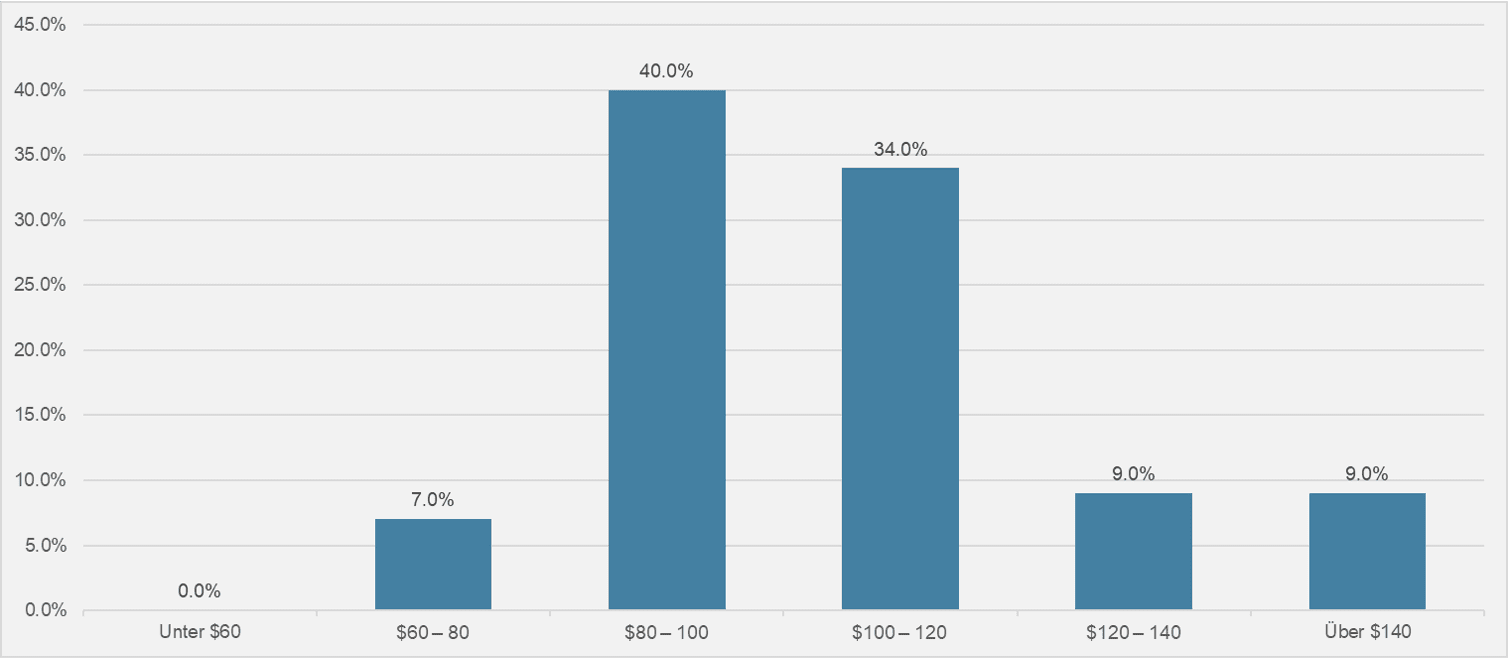

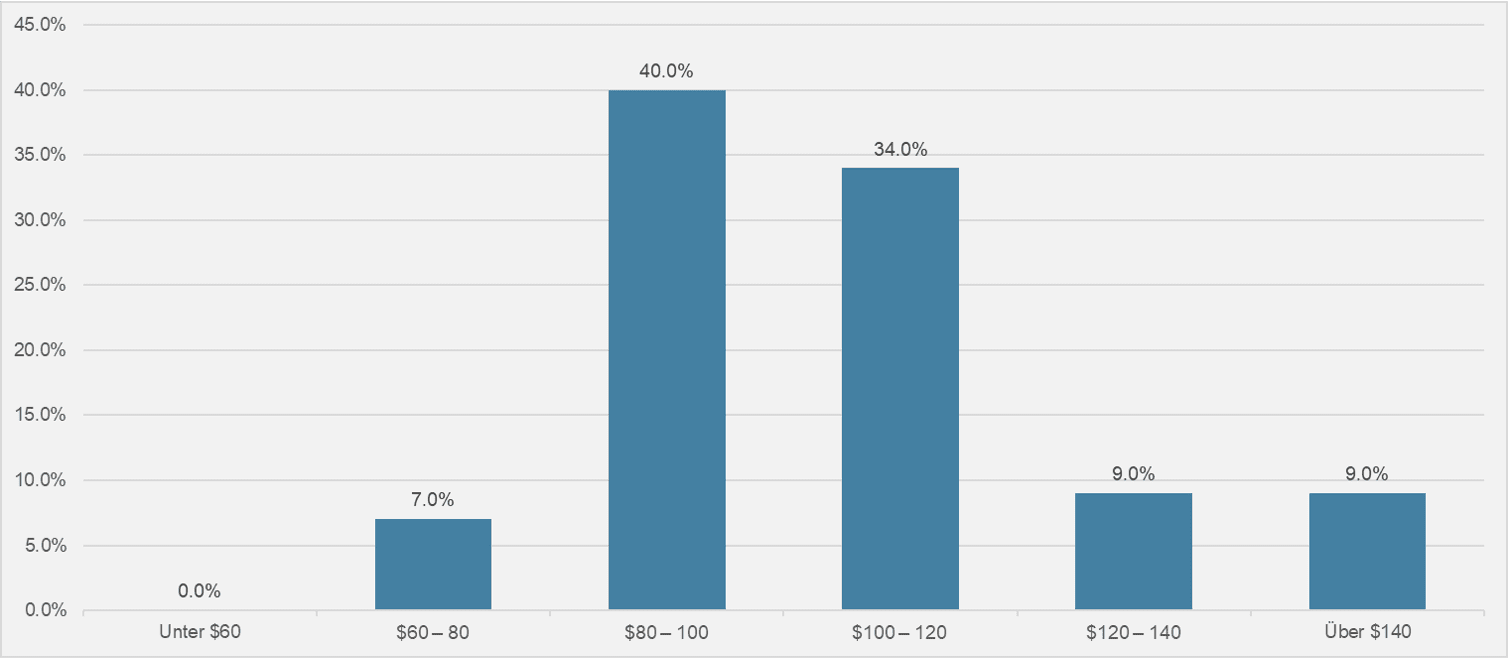

The latest survey also shows that 71.0 percent of independent asset managers do not expect a global recession; 40 percent of respondents see the price of a barrel of WTI (crude oil) at between $80 and $100 by the end of the year, while 34 percent expect it to be between $100 and $120 (see chart above).

Rare constellation

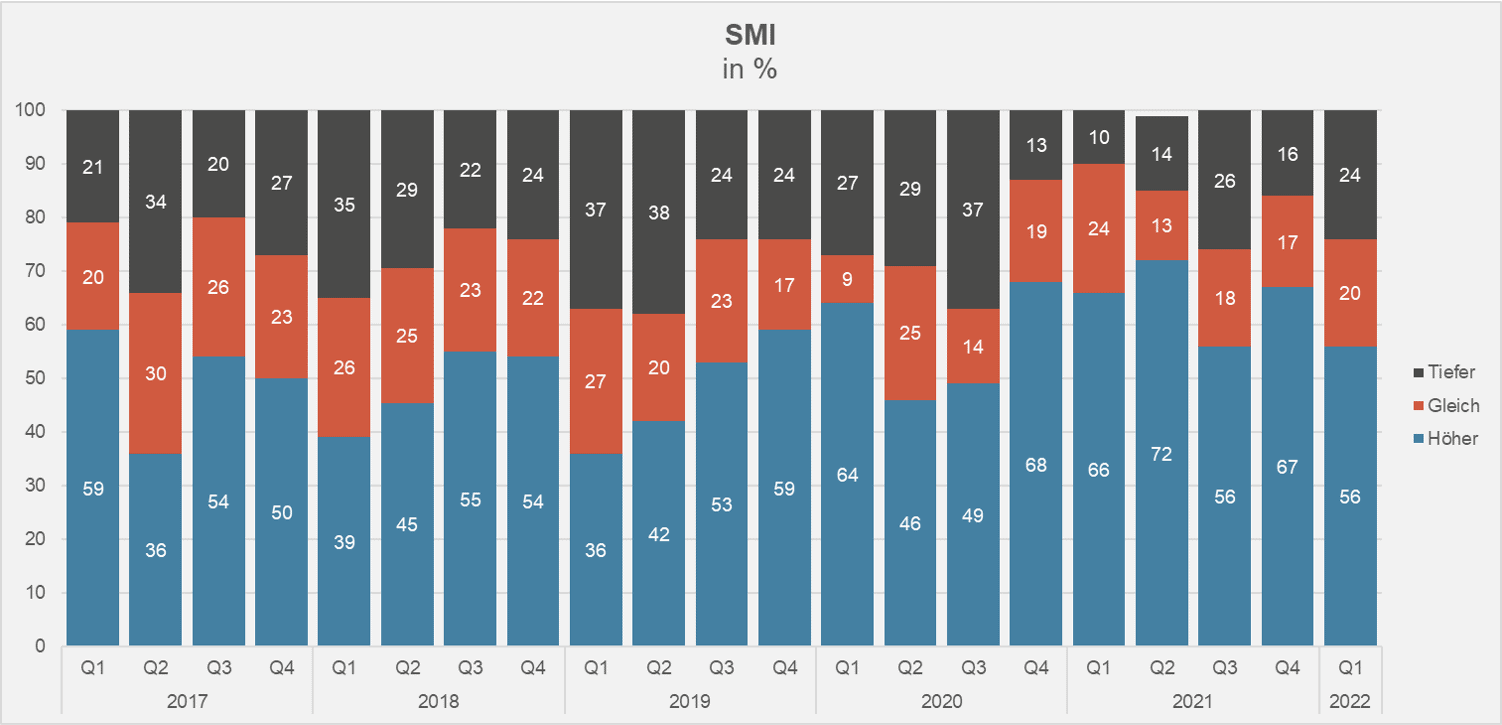

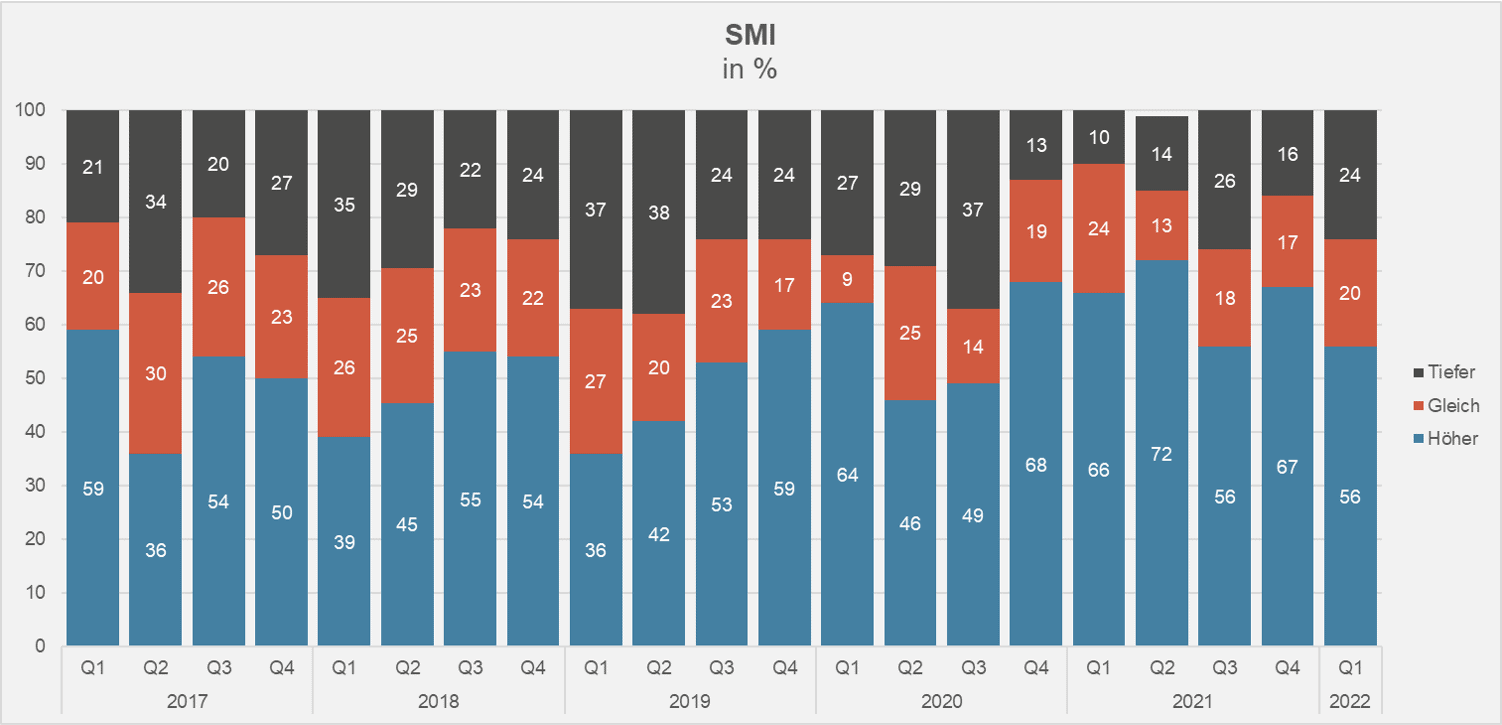

Overall, independent asset managers are rather undecided about the situation in the next three months. Although they do not expect the war in Ukraine to end, they do expect negotiations between the parties to the conflict, which in turn should lead to a certain easing of tensions. Based on these premises, 56 percent of the survey participants still expect stock market prices to rise by mid-year, compared with 67 percent at the beginning of the year (see chart below).

Currently, 20 percent (three months ago: 17 percent) of independent asset managers expect valuations to stagnate, while 24 percent (three months ago: 18 percent) of specialists expect prices to fall, according to the survey. Expectations for the EuroStoxx50 and the S&P500 also show a similar pattern. The current constellation with globally comparable expectations is rare, but reflects the geopolitical situation, which is largely dominated by the war in Ukraine.

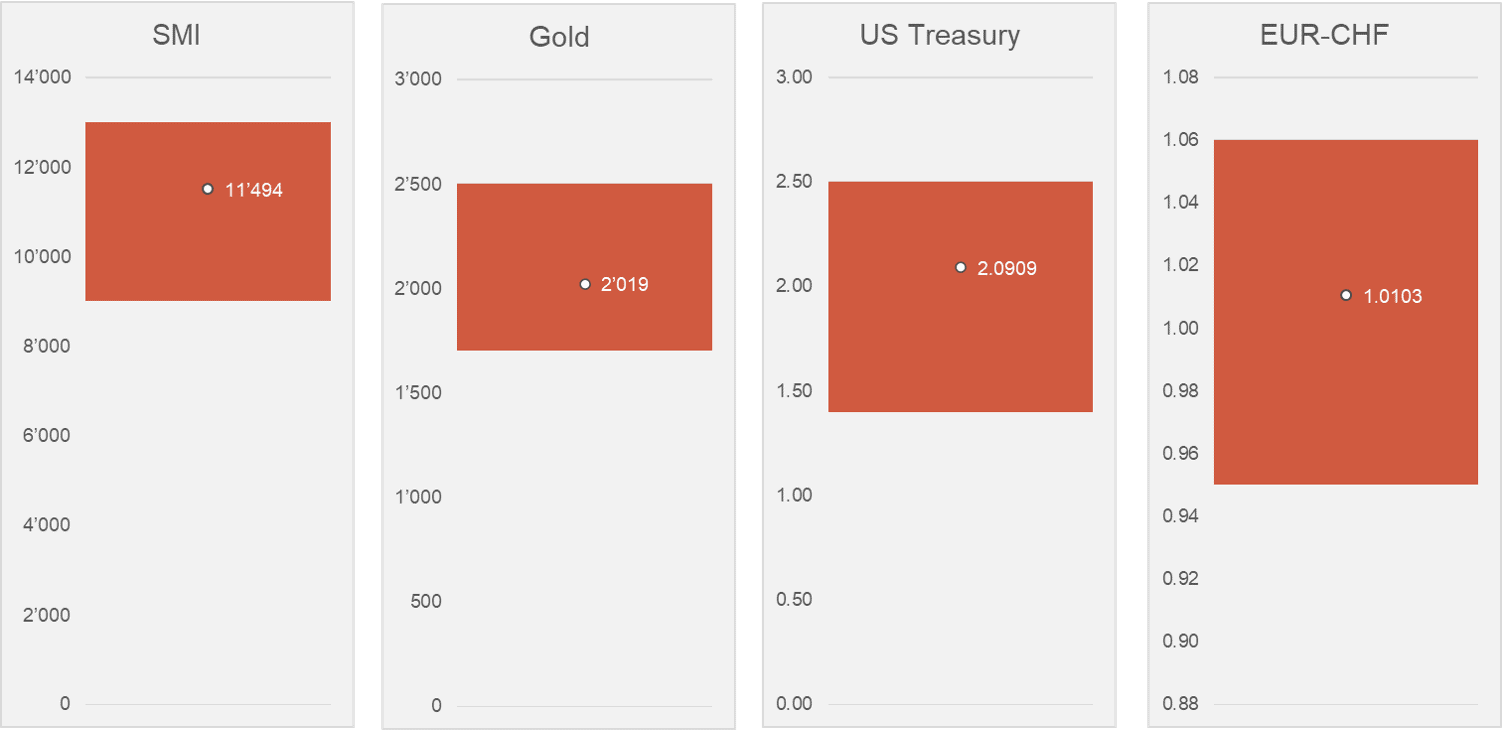

Gold wins

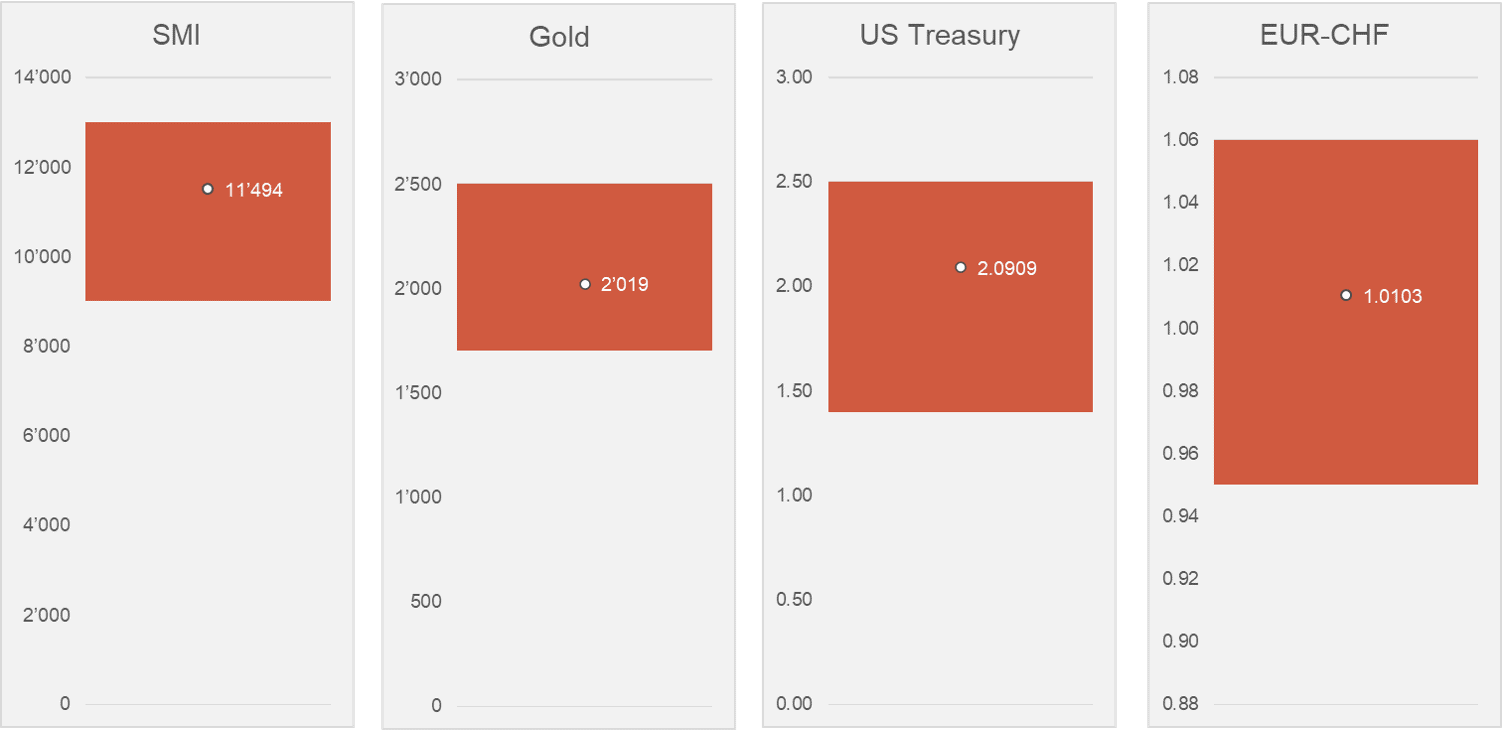

Three months from now (see chart above), the independent asset managers see the Swiss Market Index (SMI) at 11,494 (current: 12,202); the troy ounce of gold at 2,019 dollars (current: 1,792); the yield on the 10-year U.S. Treasury at 2.09 percent (current: 2.39); and the euro-franc exchange rate at 1.0103 (current: 1.0303).

The next AVI index will be published in June 2022.

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.