Asset managers fear a global recession

Independent asset managers in Switzerland unanimously expect the next three months to be difficult. A majority expects a global recession, but also anticipates a stock market boom.

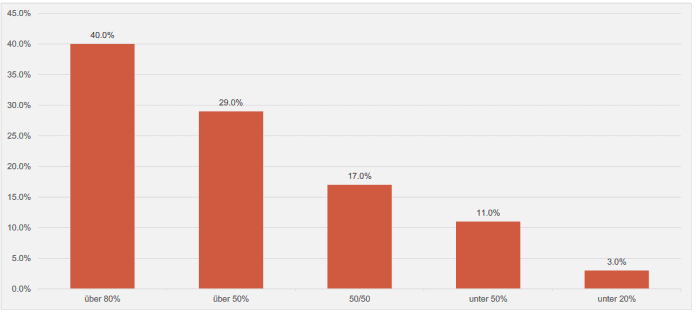

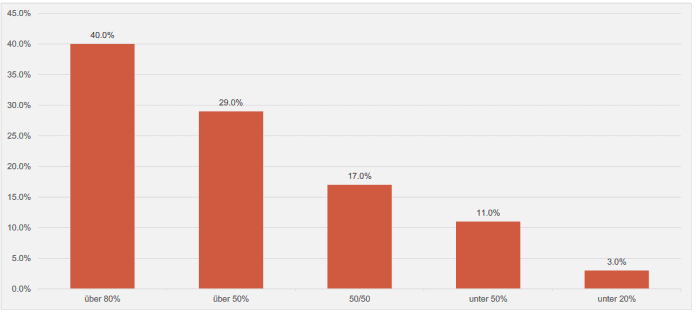

Almost 70 percent of independent asset managers in Switzerland believe that the corona virus will trigger a global recession. Around 40 percent of respondents are strongly convinced, and just under a third of survey participants reckon there is a 50 percent probability of this scenario (cf. graphic).

This is according to the latest Aquila Asset Managers Index (AVI), published by the Swiss Aquila Group every three months in cooperation with finews.ch published. The index summarizes various forecasts from independent asset managers in Switzerland. Almost 160 firms took part in the latest survey.

Click here for the complete overview

Swiss wealth managers also expect most central banks to cut interest rates further over the next three months. Exactly 42 percent of respondents expect the U.S. Federal Reserve to cut rates further but remain above 0 percent, while 35 percent of survey participants expect rates to fall as low as 0, the AVI Index further reveals.

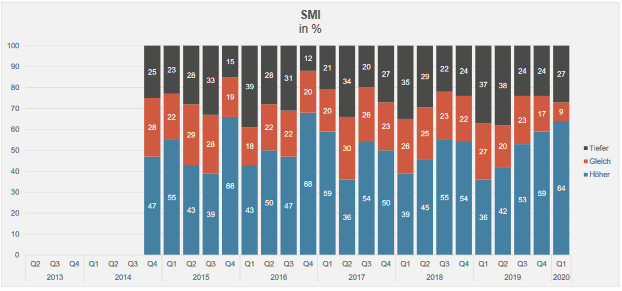

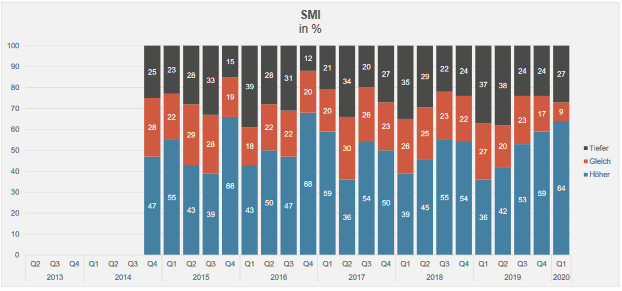

The low interest rates combined with the recent turmoil on the financial markets are the most important arguments for independent asset managers to expect significantly higher share prices in the next twelve months. This applies to all three important indices: the S%P500, the EuroStock50 and the Swiss Market Index (SMI), as shown in the chart below.

"The expectation of a prolonged recession is now priced into the stock markets. Whether this occurs will depend on how quickly the virus can be prevented from spreading further and the mortality rate substantially reduced. The development in China is encouraging and gives hope that the feared economic downturn can be prevented." Markus Straub, Managing Partner of AIB Aquila Invest Basel.

"However, the correction also offers the opportunity to buy quality stocks at bargain prices, the likes of which we haven't seen in a long time. With an investment horizon of two to three years, it should be no mistake to gradually build up positions in defensive, high-dividend food and pharmaceutical stocks and supplement these with badly battered insurance and energy stocks," he adds. Thanks to the now significantly higher volatility, structured products offer additional investment opportunities with an interesting risk/return profile, Straub adds.

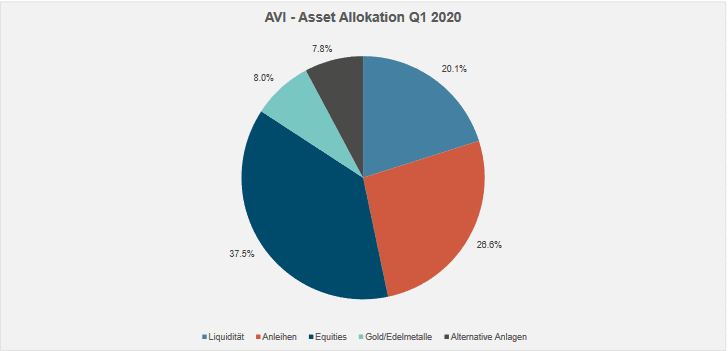

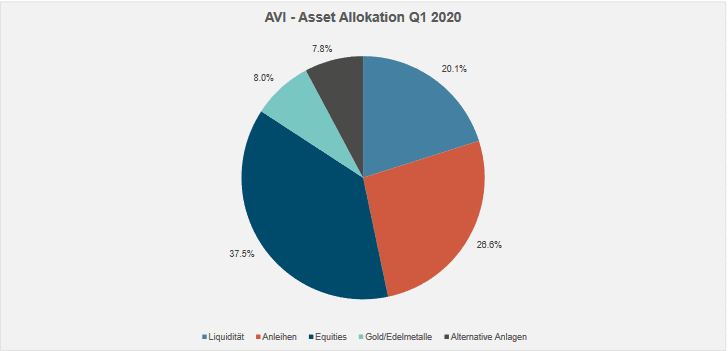

Despite these assessments, a look at the asset allocation among independent asset managers shows that caution now dominates. In particular, most survey participants intend to massively reduce their equity exposure over the next three months. Whereas three months ago they held 46 percent of their portfolios in equities, this figure has now fallen to just 37.5 percent. A good fifth, or 20.1 percent, is now held in cash (liquidity). At the beginning of the year, this share was 13.5 percent (see chart below).

Harbingers failed to materialize

"The capital markets reacted to the crisis with markdowns of historic proportions. Never before in history have stock markets fallen so sharply in such a short period of time. Earlier crises usually developed over months or years. This time, there were no such precursors. This is possibly also the reason for the speed and dynamics of the downward movement," explains Stefan Calefice, director and head of customer service of the company Belvoir Capital in Zurich.

Three pieces of advice

But how should investors position themselves now? Stefan Calefice has three pieces of advice ready:

"First, keep an eye on risk: The quotas in risk positions must fit the investor's personal risk-bearing capacity. Second: Unconditionally focus on quality. Stocks and bonds should be of such high quality that they are very likely to survive the economic crisis. Third: Position for the future. The target ratio for risk capital should be based on the future, not on current market events."

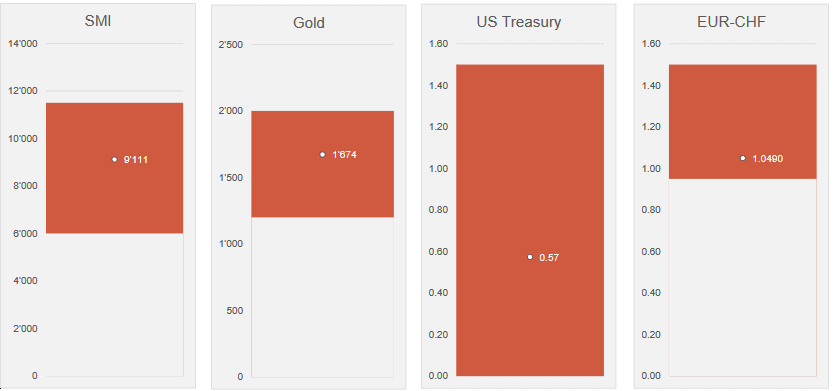

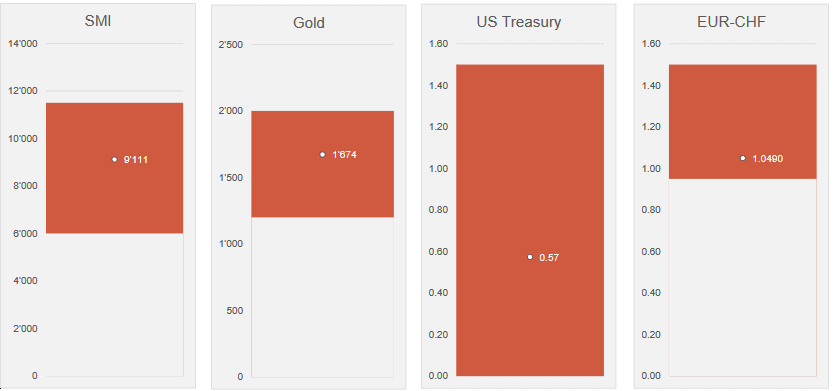

By mid-year, the asset managers surveyed (cf. graphic above) a SMI to 9,111, a Gold price of $1,674 per ounce, 10-year US government bonds with a yield of 0.57 percent as well as a Euro / Franc exchange rate to 1,049.

The next AVI Index will be published in July 2020.

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.