Asset managers expect negative interest rates for another two years

Independent asset managers in Switzerland are facing difficult times. They expect negative interest rates to end in the course of 2021 at the earliest.

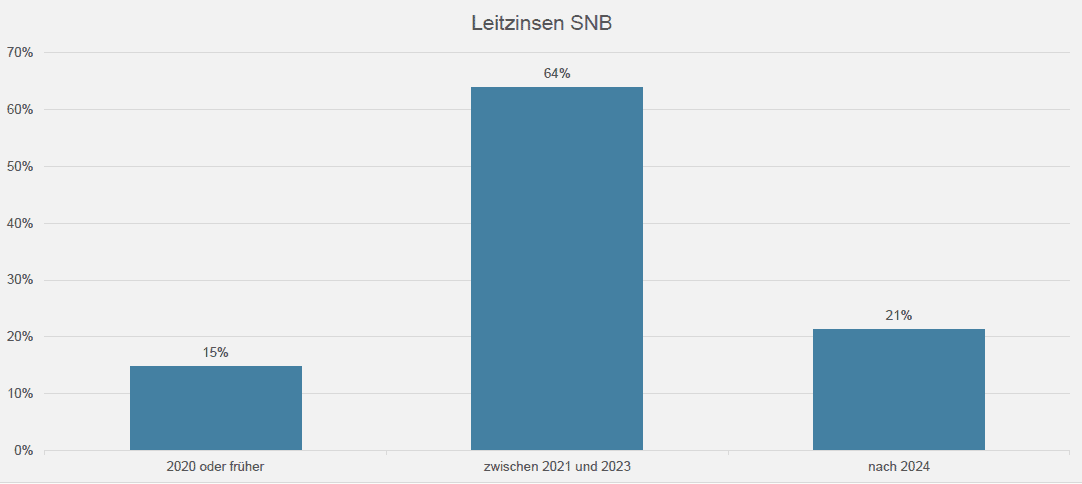

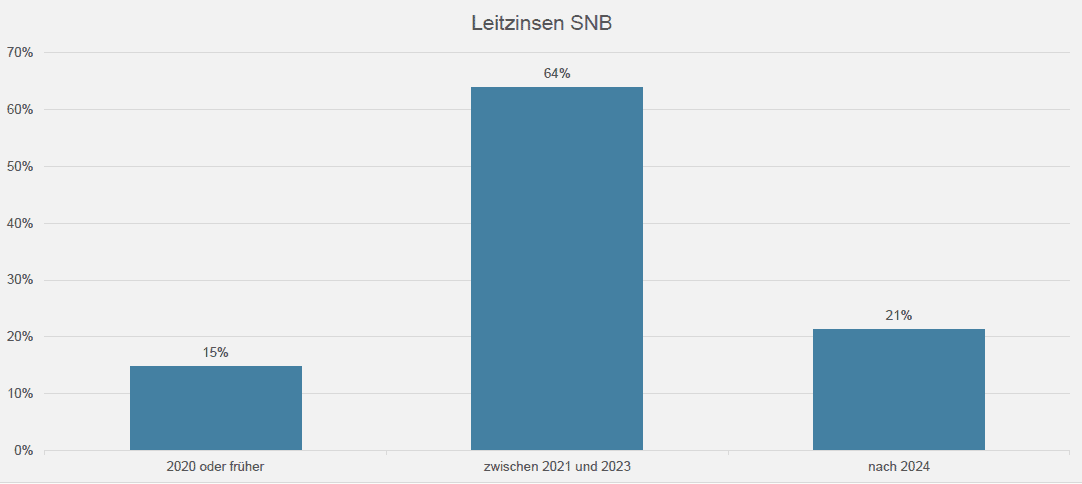

Around two-thirds of independent asset managers (external asset managers, EAMs) are convinced that the Swiss National Bank (SNB) will not lift its negative interest rates until between 2021 and 2023. A good fifth of those surveyed even assume that the "penalty interest rate" will not end until after 2024 (cf. graphic).

This is according to the latest Aquila Asset Managers Index (AVI), published by the Swiss Aquila Group every three months in cooperation with finews.ch published. The index summarizes various forecasts from independent asset managers in Switzerland. A good 140 firms took part in the latest survey.

Click here for the complete overview

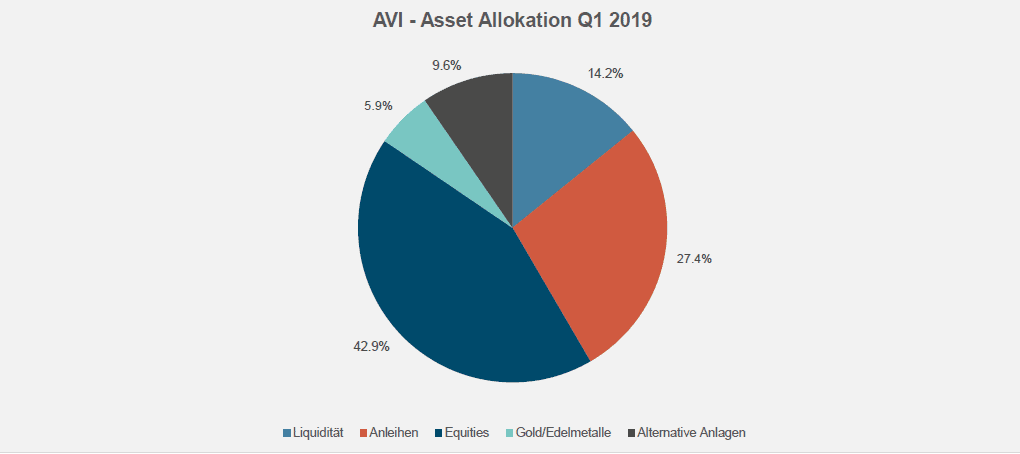

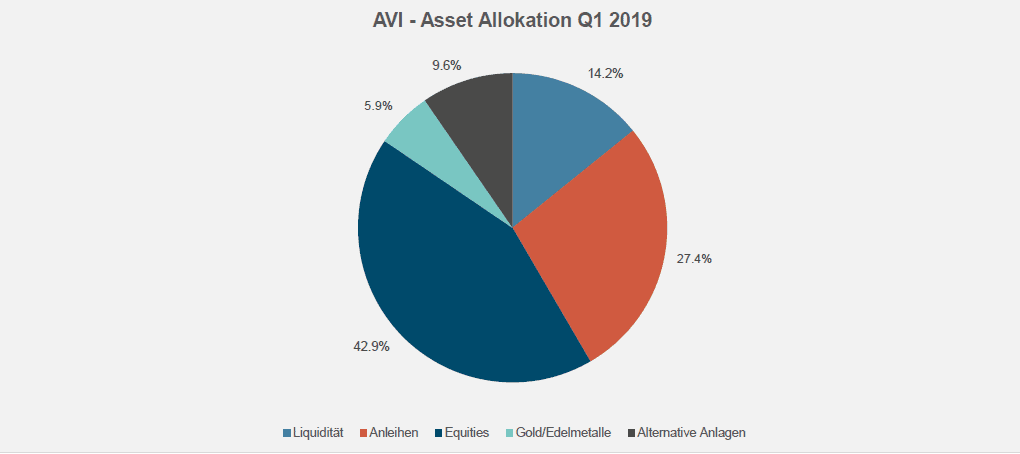

Against the background of this difficult situation, EAM is also realigning its investment strategy. They are increasingly focusing on alternative investments as well as precious metals such as gold. For example, the share of investments in hedge funds, private equity and other private market investments increased to 9.6 percent (8.0 percent in the previous quarter), while the share of gold rose to 5.9 percent (5.79 percent in the previous quarter) (cf. graphic).

This means that the share of investments that do not belong to the classic investment instruments already accounts for more than 15 percent. That is above average. "I forecast interesting movements in the commodity markets over the next three to five years. For gold and silver in particular, I see great development potential and rising prices," says Markus Amstutz, commodity specialist and managing director of the Zurich-based company Future Trade.

Raw materials with potential

"Many investors invest in commodities like they do in stocks. This is a mistake," Amstutz continues, "every market situation holds opportunities to achieve a positive return with an optimal long-short strategy. Therefore, they should not invest in just one commodity, but as broadly as possible to take full advantage of the diversification effect (negative correlation)."

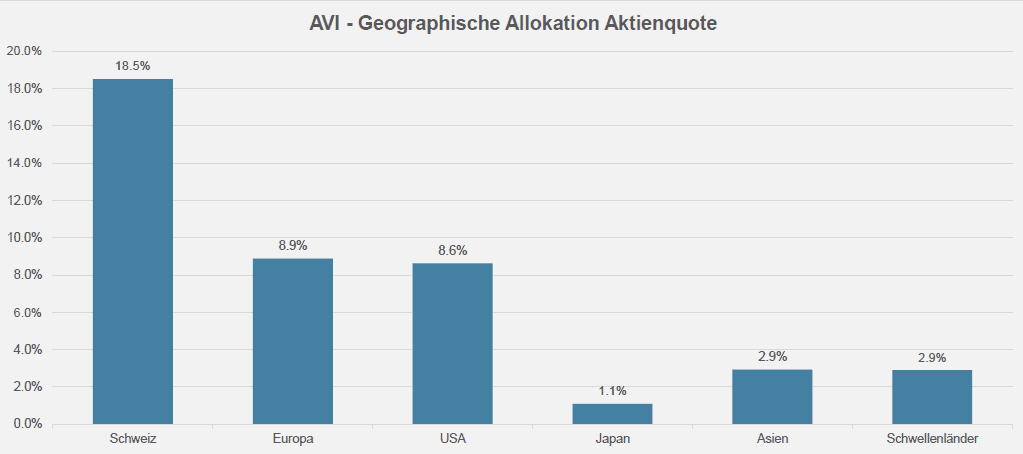

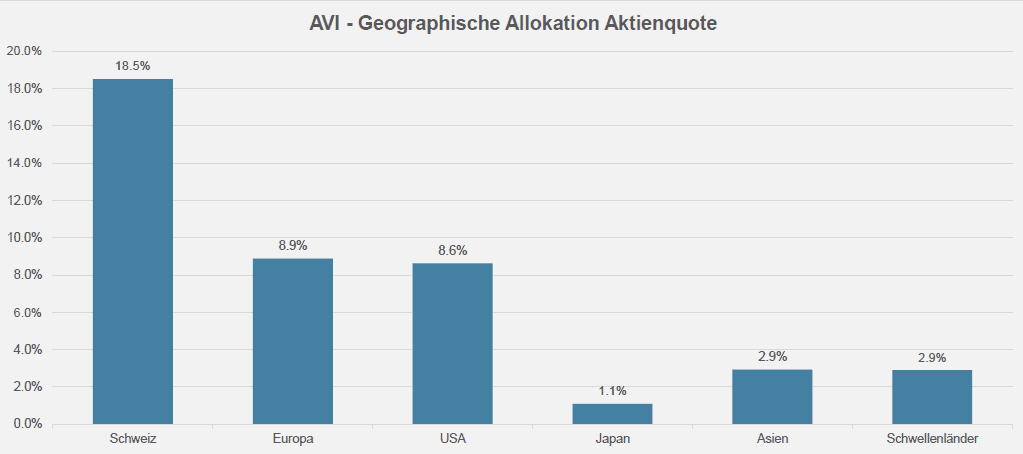

Changes can also be seen in the geographical "asset allocation": The share of investments in Switzerland fell to 18.5 percent (from 19.6 percent in the previous quarter) - in terms of further diversification, this benefited the markets of Europe, the USA, Japan and the rest of Asia - but not the emerging markets (cf. graphic).

A certain caution also put Beat Keller Managing Partner at Zurich-based asset manager Keller von Arx und Partner. "We currently feel comfortable with an above-average cash ratio. Sharp setbacks in individual shares following negative reports show the current susceptibility to corrections and confirm the advanced stage of the economic cycle."

"Our focus is generally on a long-term investment horizon. That's why an important success factor for us is to be patient in waiting for buying opportunities. We then take advantage of these opportunities by investing primarily in medium-sized and small companies that are active in promising business areas with positive earnings momentum," Keller continues.

More new money

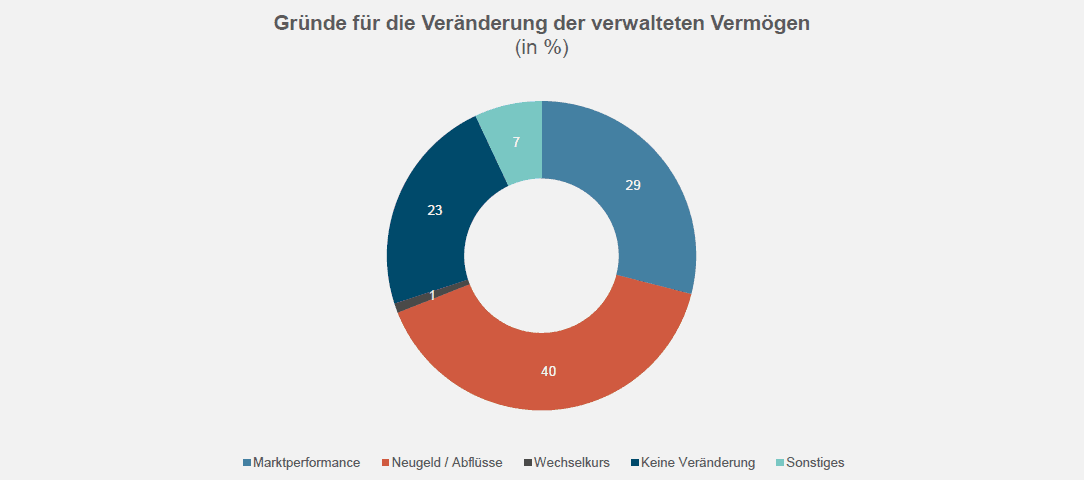

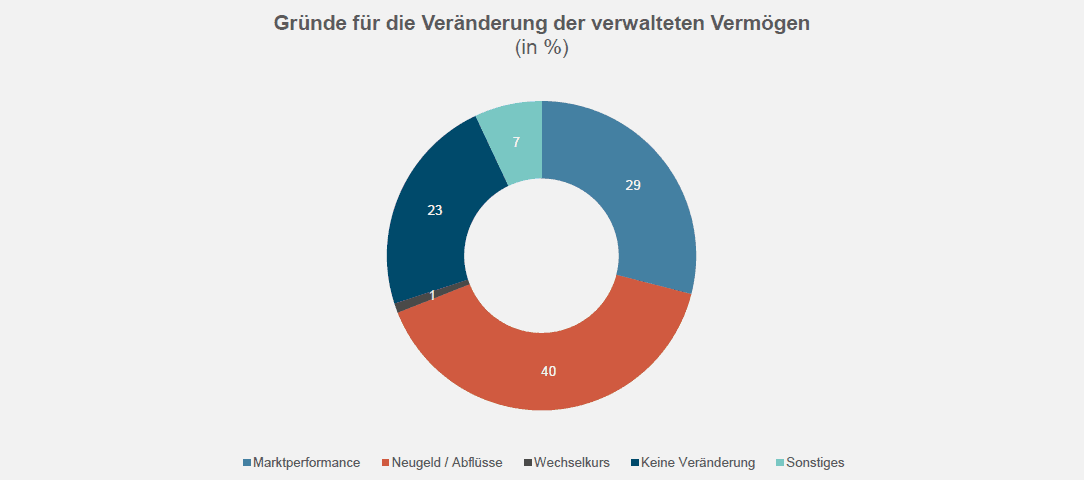

Looking back, the first three months of the current year have left positive marks on the books of independent asset managers. The rising prices between January and March 2019 led not only to an increase in assets under management, but also to a significant increase in new money, as no less than 40 percent of the survey participants stated. At the end of 2018, this figure had been only 32 percent (cf. graphic).

Against this background, it should not come as a complete surprise that many EAMs are still positive about the coming months. Exactly 36 percent (32 percent in the previous quarter) of those surveyed expect business to develop well within the year. And 32 percent (29 percent in the previous quarter) even want to expand their workforce.

In three months, Swiss asset managers see the SMI averaging 9,000, gold at a good 1,380 dollars an ounce, and the euro more or less unchanged at 1.15 francs.

The next AVI Index will be published in July 2019.

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.