Sentiment in Q1 2018: Swiss asset managers go on the defensive

After the first quarter of 2018, Swiss asset managers have become more cautious. The threat of a trade war between the US and China is clouding the stock market imagination. These are the consequences.

Independent asset managers in Switzerland are bracing themselves for more difficult times ahead. Despite a good start on the stock market three months ago, they expect prices to tend lower over the rest of the year. Accordingly, they have reduced both the equity and the bond quota in their portfolios, in some cases significantly. The looming trade conflict between the U.S. and China and the already impressive stock markets are the two main factors behind the increasingly defensive mood among market participants.

This is according to the latest Aquila Asset Managers Index (AVI), published by the Swiss Aquila Group every three months in cooperation with finews.ch published. The index summarizes various forecasts from independent asset managers in Switzerland. Around 100 people took part in the latest survey.

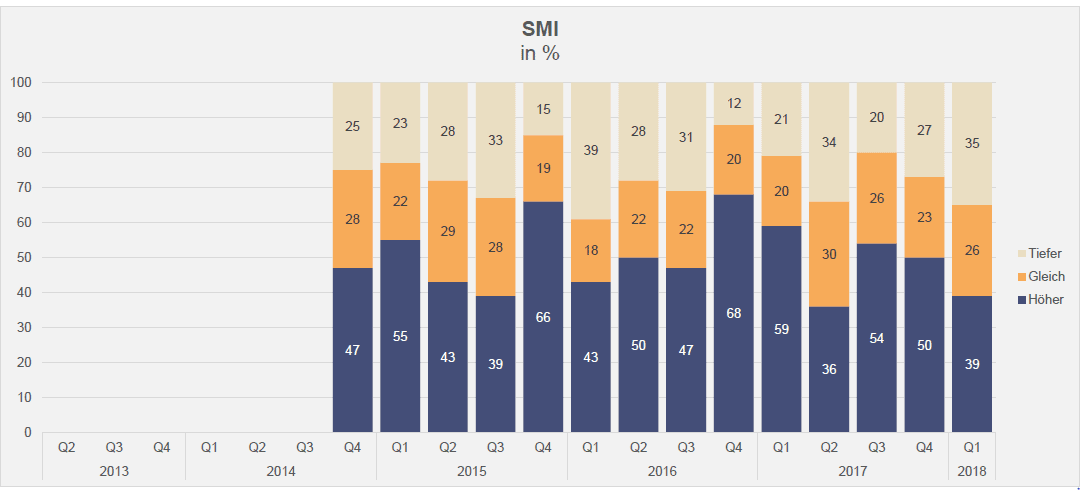

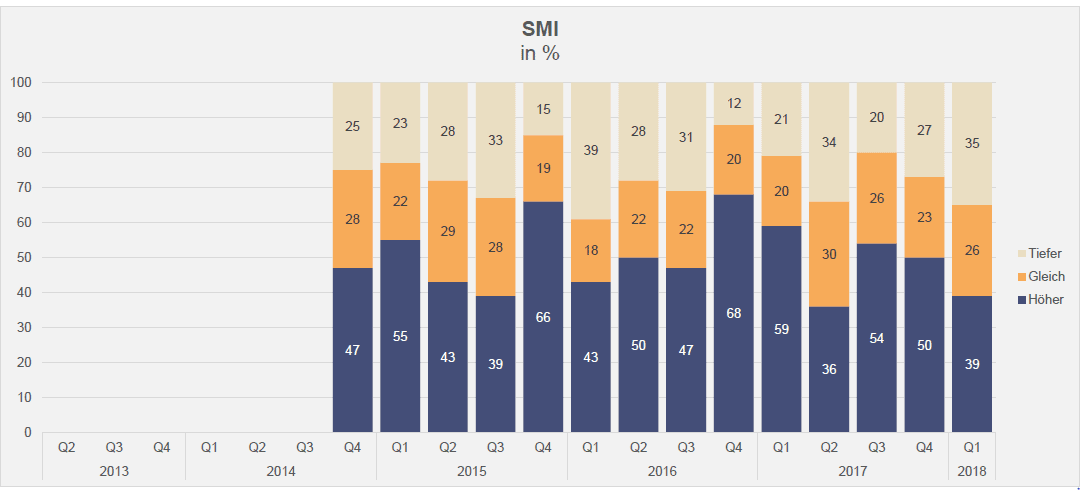

More than a third of the asset managers surveyed (35 percent) expect lower prices in the next three months in the Swiss Market Index (SMI). Three months ago, i.e. at the beginning of January 2018, it had only been 27 percent (cf. graphic).

A similar situation is also evident with regard to Europe, where 35 percent (previous quarter: 28 percent) of survey participants expect lower prices in the EuroStoxx50 expect. At S&P500 in the U.S.A., 37 percent (previous quarter: 32 percent) of respondents expect lower prices.

Rising interest rates

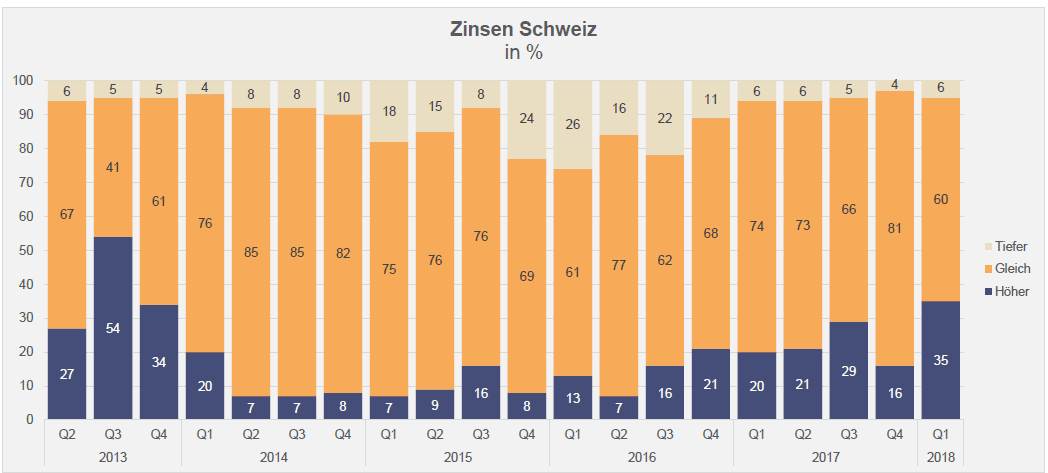

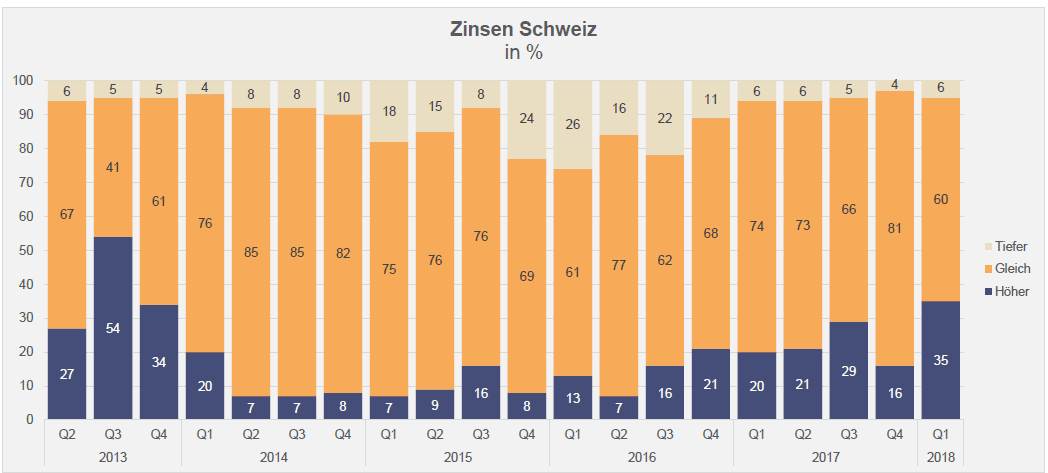

There is also agreement on the development of interest rates: In the Switzerland 35 percent of respondents (previous quarter: 16 percent) expect interest rates to rise for the 10-year government bonds off. In Germany 40 percent (previous quarter: 24 percent), whereas in the USA 35 percent of respondents (previous quarter: 16 percent) expect an interest rate hike in the next three months.

The proportion of market participants who now expect lower interest rates has almost disappeared and is now as low in the U.S. as it was five years ago. (cf. following graphic).

Dollar weakening expected

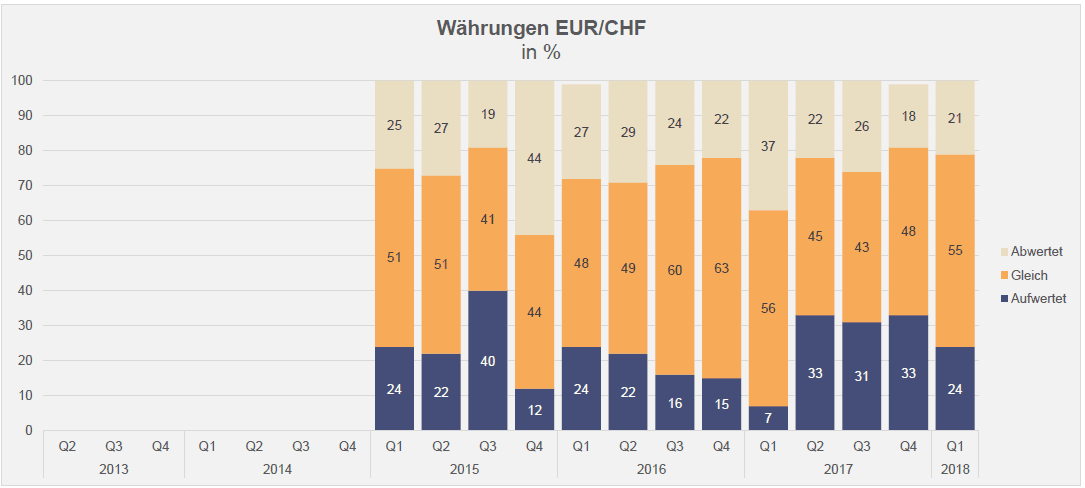

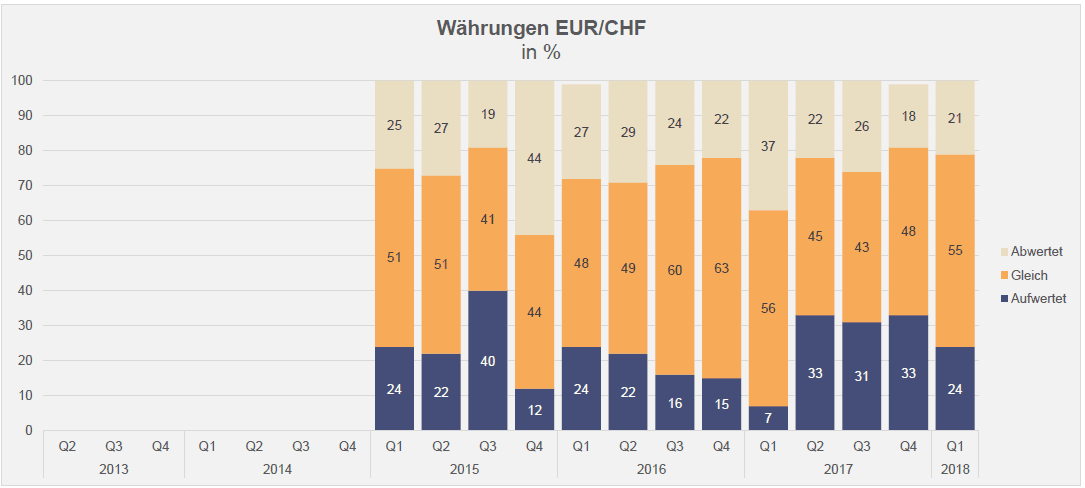

In terms of currencies, Swiss asset managers are assuming a stronger overall alignment between the Euro and the Franconia out: In this context, 55 percent of the freight forwarders surveyed (previous quarter: 48 percent) forecast that the ratio will remain unchanged, while only 24 percent (previous quarter: 33 percent) expect a stronger common currency in Europe.

With a view to the Dollar It is easy to see that the respondents are more or less assuming the status quo compared with the beginning of the year, or are even tending to expect a slight depreciation of the greenback (cf. following graphic).

Trade war clouds expectations

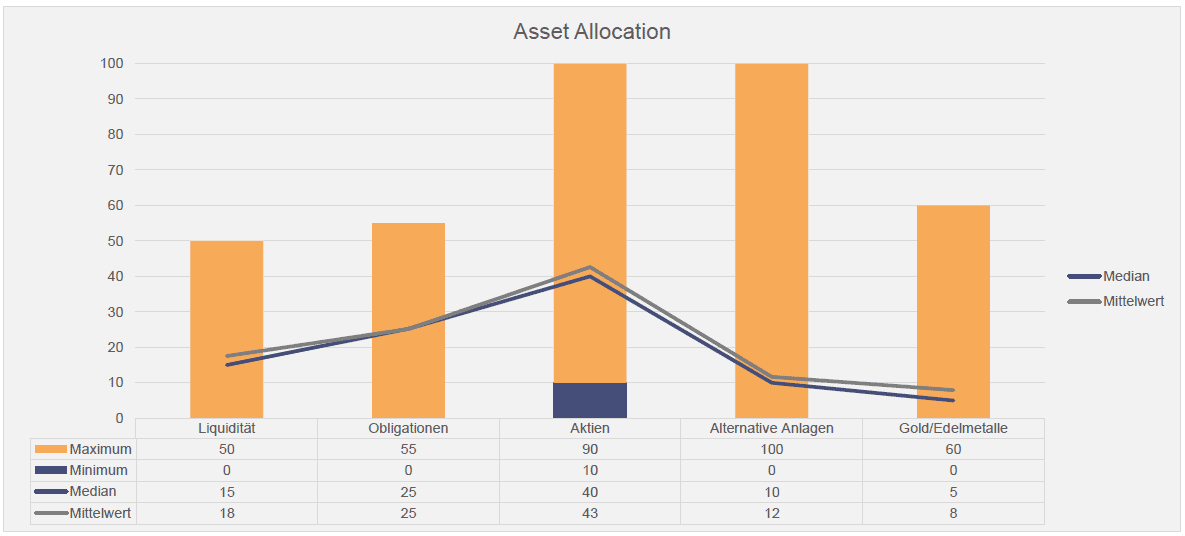

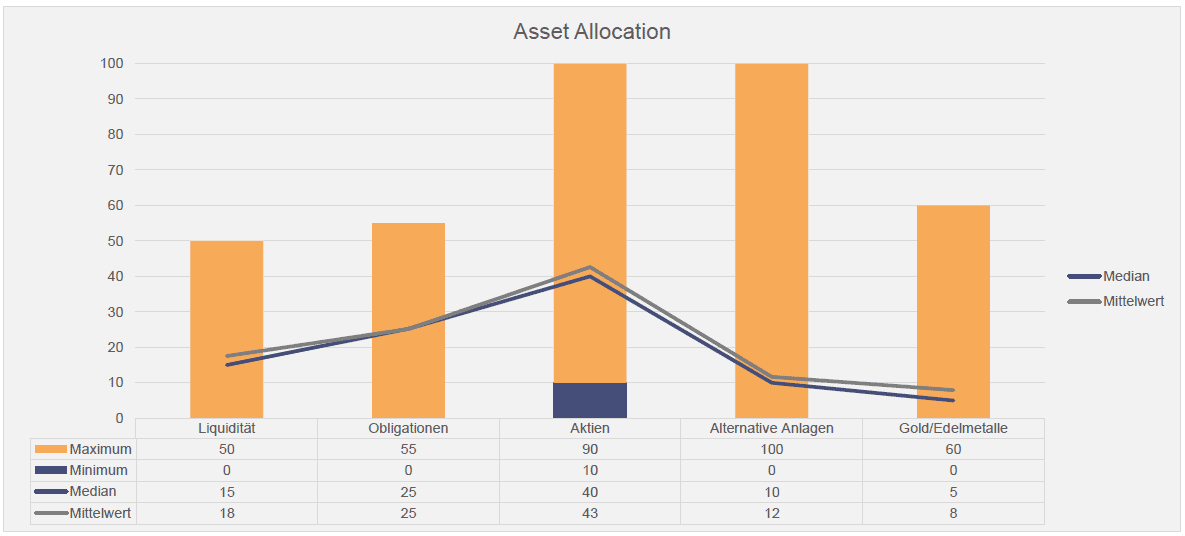

For the second year in a row, many independent asset managers reduced the equity allocation in their portfolios. At the same time, many market participants also reduced their bond allocation. Liquidity in the portfolios increased accordingly.

In other words: After the brilliant start to 2018 on the stock markets, most players have become exceedingly cautious, due not least to the threat of a trade war between the USA and China, which has already noticeably depressed prices on the financial markets (cf. graph below).

Specifically, the composition (Median) as follows: The share of Equities is now 40 percent (previous quarter: 45 percent), that of the Bonds 25 percent (previous quarter: 30 percent), while the Liquidity 15 percent (previous quarter: 10 percent).

Alternative investments remained unchanged at 10 percent, while the proportion of Gold and others Precious metals 5 percent (unchanged), as the AVI survey further indicates.

A good quarter (26 percent) of the asset managers surveyed also want to hire more staff in the next twelve months (see chart below). This is no coincidence. After all, many of them have apparently been able to manage significantly more money in the past six months - on the one hand through new money inflows and on the other thanks to market performance.

Contact: Nicolas Peter, Head Asset ManagementPhone: +41 58 680 60 42Source: Finews AG, Zurich (Link to the article on finews.ch)

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.